Foreclosure With Equity

Description

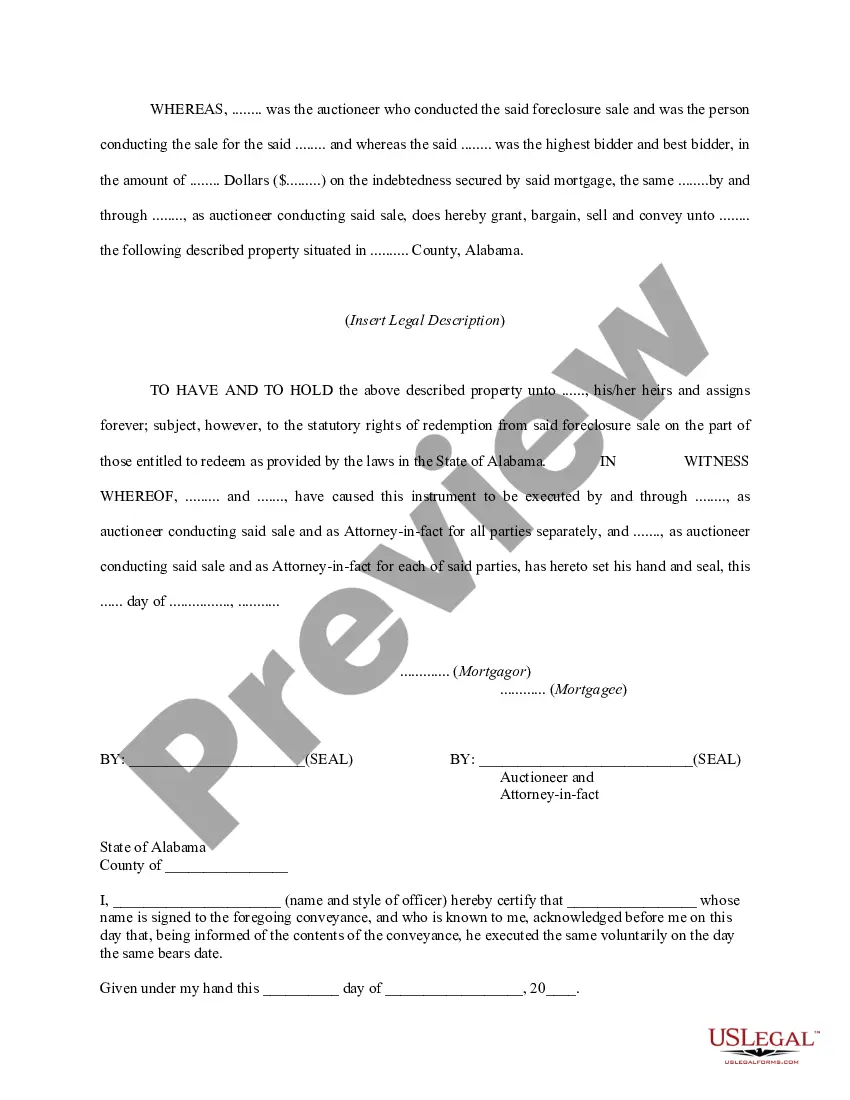

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- If you are a returning user, log in to your account and download the necessary form template by clicking the Download button. Verify that your subscription is valid, and renew it if necessary.

- For new users, start by checking the Preview mode and form description. Ensure that the document you choose fits your needs and aligns with local jurisdiction requirements.

- If you require a different template, use the Search tab to find one that suits you. If you identify any inconsistencies, repeat this step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account to access the resources.

- Complete the payment process by providing your credit card information or using your PayPal account to complete the purchase.

- Once purchased, download your form and save it on your device. You can access it anytime through the My documents section in your profile.

With US Legal Forms, you gain the advantage of a robust collection of forms that often outnumbers competitors at similar costs. Plus, you have access to premium experts who can assist you in completing forms accurately and effectively.

Take the first step towards securing your foreclosure documents today. Explore our library and start your journey with US Legal Forms!

Form popularity

FAQ

The 120-day rule for foreclosure mandates that a lender cannot initiate foreclosure proceedings until the homeowner is over 120 days delinquent on mortgage payments. This rule offers a grace period for homeowners to explore alternatives to foreclosure. Knowing about this rule can help you leverage your options effectively in the midst of financial hardship.

During a foreclosure, the owner’s equity is at risk, as it represents the difference between the property value and the outstanding mortgage balance. If your home sells for less than what you owe, you may lose your equity. If you have equity at the time of foreclosure, you might have options to recover some value before the process completes.

Certain exceptions to the 120-day foreclosure rule include cases of abandoned properties and certain types of mortgages. Additionally, properties secured by high-risk loans or fraud cases may also be excluded. Understanding these exceptions is crucial for homeowners navigating the complexities of foreclosure with equity, allowing them to protect their valuable assets.

In foreclosure with equity, the homeowner typically retains the right to any equity built up in the property until the foreclosure process is finalized. If the sale of the home covers the amount owed to the lender, any remaining equity may revert back to the homeowner. However, if the sale does not cover the mortgage balance, the equity may not be realized.

The new foreclosure law in California introduces several consumer protections aimed at homeowners. It emphasizes the importance of communication between lenders and borrowers, especially for those facing foreclosure with equity. This law ensures that homeowners have access to resources and processes to explore alternatives, thereby preserving their rights to their property's equity.

The 120-day rule mainly applies to residential mortgage contracts and certain secured loans. This rule is designed to protect homeowners facing foreclosure with equity by providing them a grace period to rectify their financial situations. It allows homeowners to take necessary steps to maintain control over their property and avoid losing valuable equity.

Yes, you can foreclose on an equitable mortgage, as it provides the lender specific rights regarding the property. However, the process may differ compared to a traditional mortgage. Understanding the specifics of equitable mortgages can be complex, so consulting with professionals or utilizing resources like US Legal Forms can help clarify your rights and obligations.