Foreclosure Sale On Property

Description

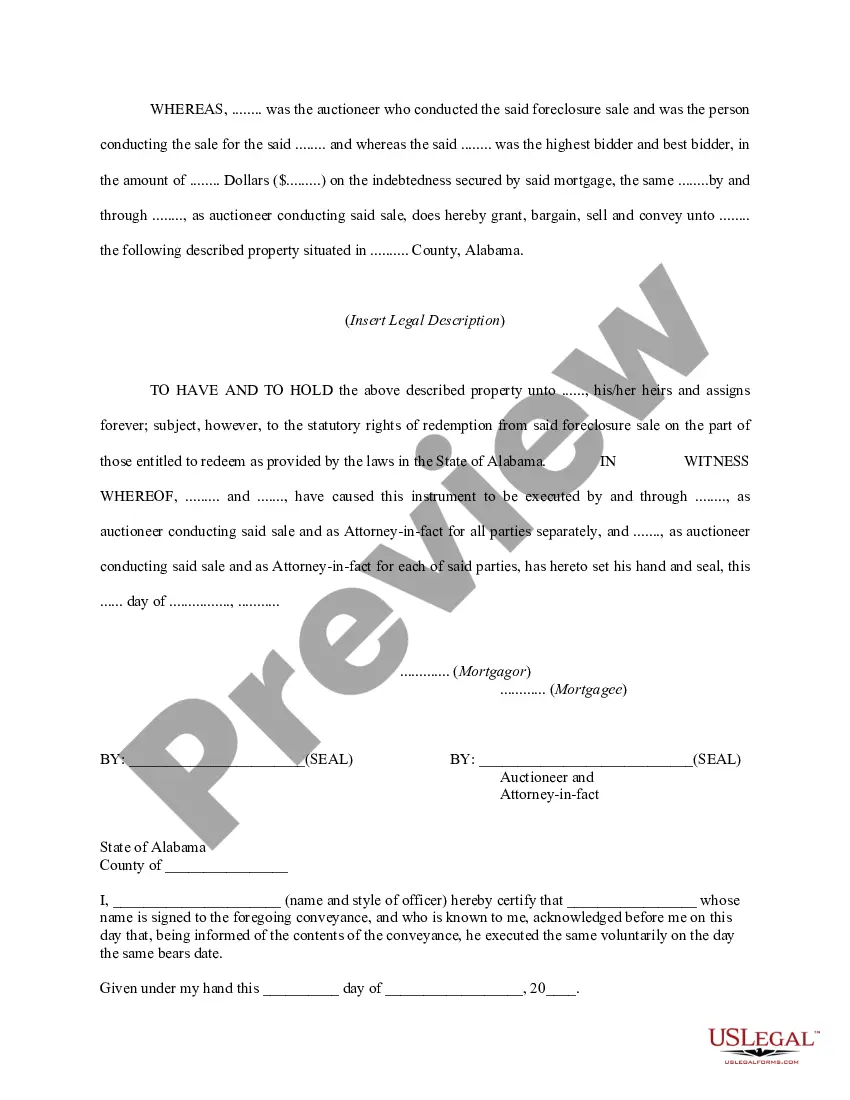

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Access the US Legal Forms website and log in to your account if you are an existing user. Ensure your subscription is active; renew it if needed.

- Browse the library to find the specific form related to your foreclosure sale on property. Use the Preview mode for insights into its relevance and jurisdiction compliance.

- If the suggested form isn't suitable, conduct a search using the provided search bar to find the correct template.

- Once you locate the proper document, click the 'Buy Now' button and select your desired subscription plan to gain access.

- Complete your purchase by entering your credit card or PayPal information.

- Download the document directly to your device, and access it anytime through the 'My Forms' section of your profile.

With these simple steps, obtaining your foreclosure sale on property document becomes efficient and hassle-free. US Legal Forms not only offers a vast collection of forms but also provides access to premium experts for further assistance.

If you're ready to streamline your legal documentation process, visit US Legal Forms today and transform your experience!

Form popularity

FAQ

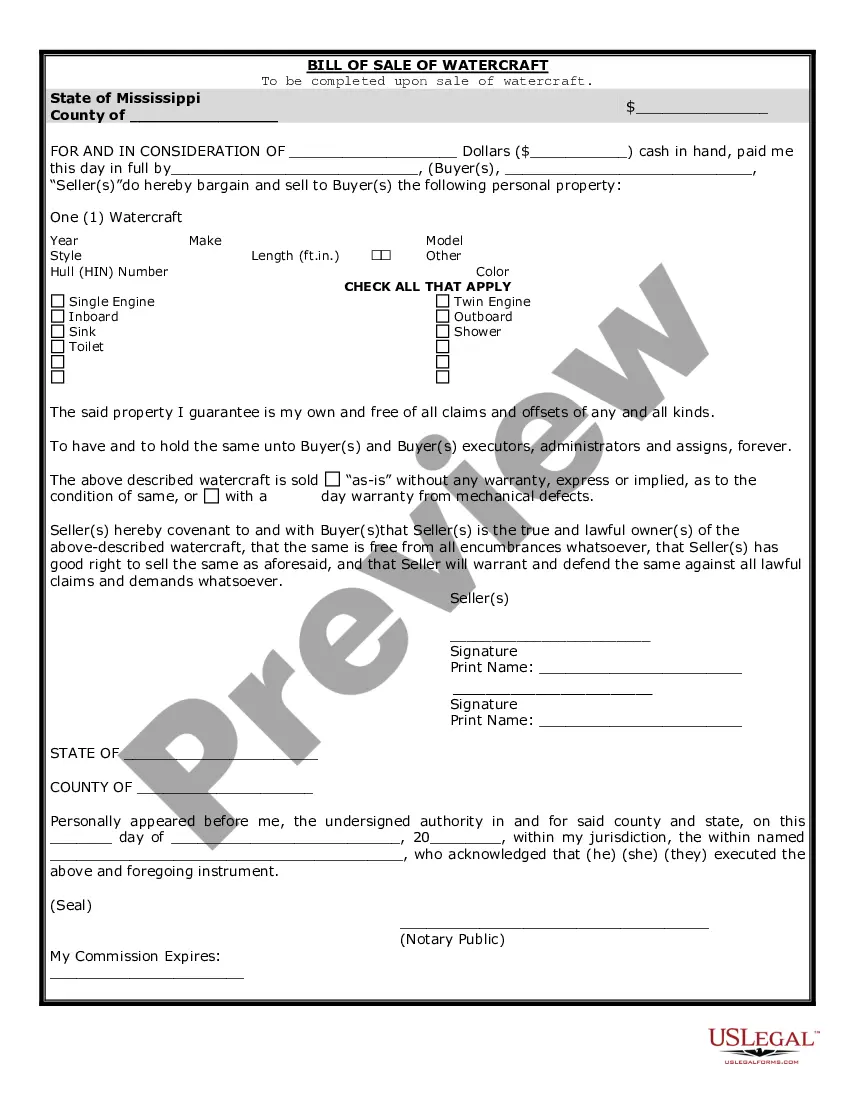

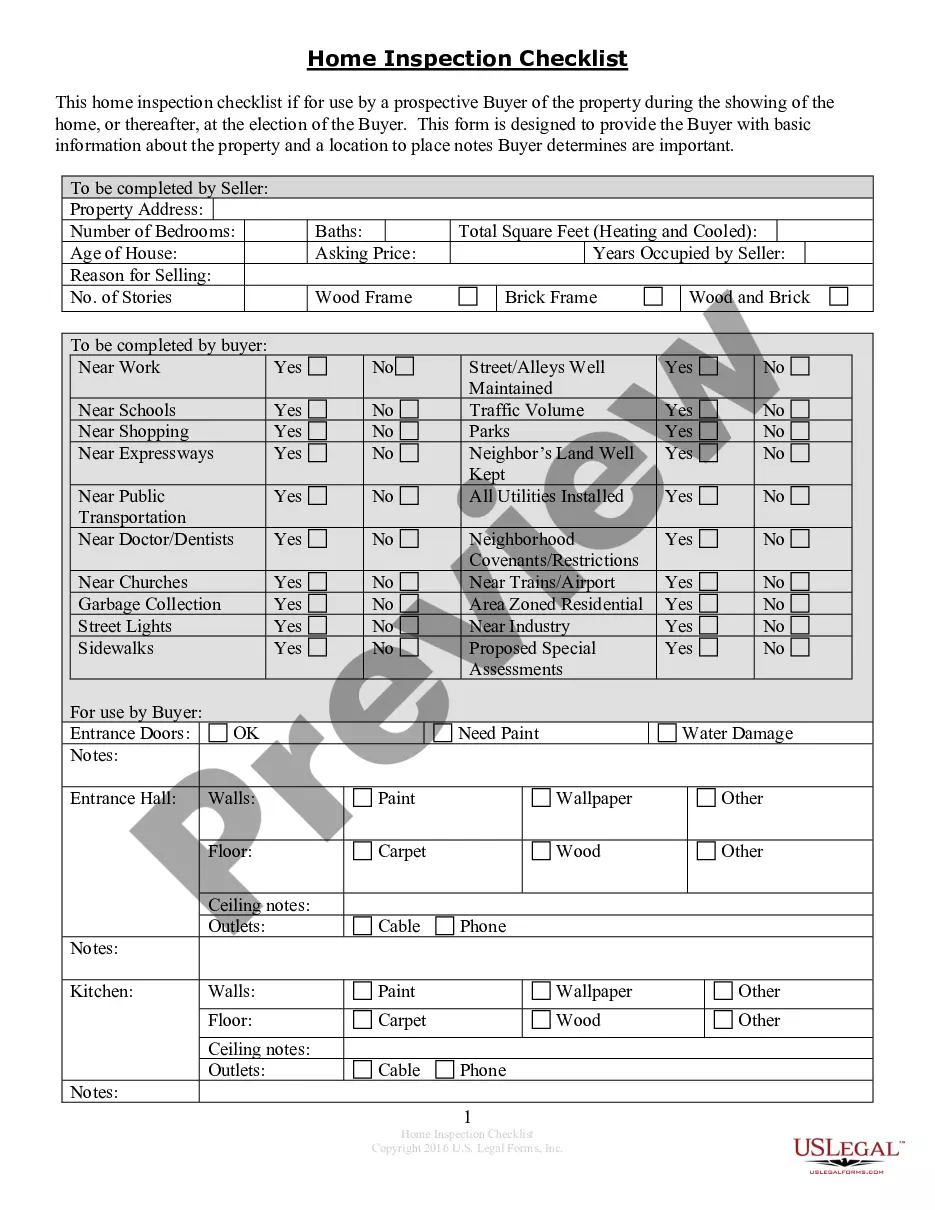

The catch with buying a foreclosed home is that these properties often come with maintenance issues or may require extensive repairs. Buyers should conduct thorough inspections to understand what they are getting into. Moreover, while a foreclosure sale on property may seem like a great deal, understanding the potential risks is crucial to making an informed decision.

In Florida, foreclosure laws allow lenders to initiate foreclosure after a borrower has defaulted on their mortgage payments. The process typically involves a court proceeding, and homeowners must be notified of the proceedings. Understanding these laws is crucial if you are facing a foreclosure sale on property, as they provide specific rights and timelines for borrowers.

The downside of a foreclosure includes the loss of your home and any equity you built over time. This kind of sale often attracts investors looking for bargains, which can quickly decrease the property's value. Furthermore, going through a foreclosure can complicate your financial situation, making it essential to understand your options.

The 120-day foreclosure rule is a mandate that requires lenders to wait for at least 120 days after a borrower is in default before initiating foreclosure proceedings. This rule aims to give homeowners a fair chance to rectify their financial situation. Knowing this timeline can be critical for anyone involved in the foreclosure sale on property.

The downside of buying a foreclosure includes potential hidden repair costs and the risk of competing with multiple buyers at auctions. Additionally, properties may come with liens or other legal issues that complicate the sale. Understanding these risks can prepare you for the reality of the foreclosure sale on property.

To access foreclosed properties, consider connecting with real estate agents who specialize in these types of sales or exploring online listings. Local county websites often have information on upcoming foreclosure sale on property events. Networking with professionals can also provide valuable insights into available options and streamline your search.

The foreclosure process in Florida starts when the lender files a lawsuit against the homeowner. Once the court rules in favor of the lender, a foreclosure sale on property is scheduled to auction the home. Homeowners usually have a chance to redeem their property before the sale, making it crucial to act swiftly if you're facing foreclosure.

In Florida, foreclosures are judicial, meaning the process involves court intervention. A lender must file a lawsuit to obtain a final judgment on the foreclosure sale on property. Once the court grants this judgment, the home is sold at a public auction. Understanding the state’s regulations can empower you to navigate this complex system.

In Washington, the foreclosure process typically takes about 6 to 12 months. This timeframe includes the various legal steps involved in a foreclosure sale on property. Homeowners have the right to address their debts during this period, potentially delaying the process. Engaging with professionals can help you understand your options and navigate this timeline.

Buying a house that was foreclosed on can be a wise investment, as these properties often sell for below market value. However, there are risks, such as potential damage or unresolved liens, which means buyers should conduct thorough inspections. By leveraging platforms like US Legal Forms, buyers can access important legal documents and resources to navigate the complexities of a foreclosure sale on property.