Foreclosure Of A Dream

Description

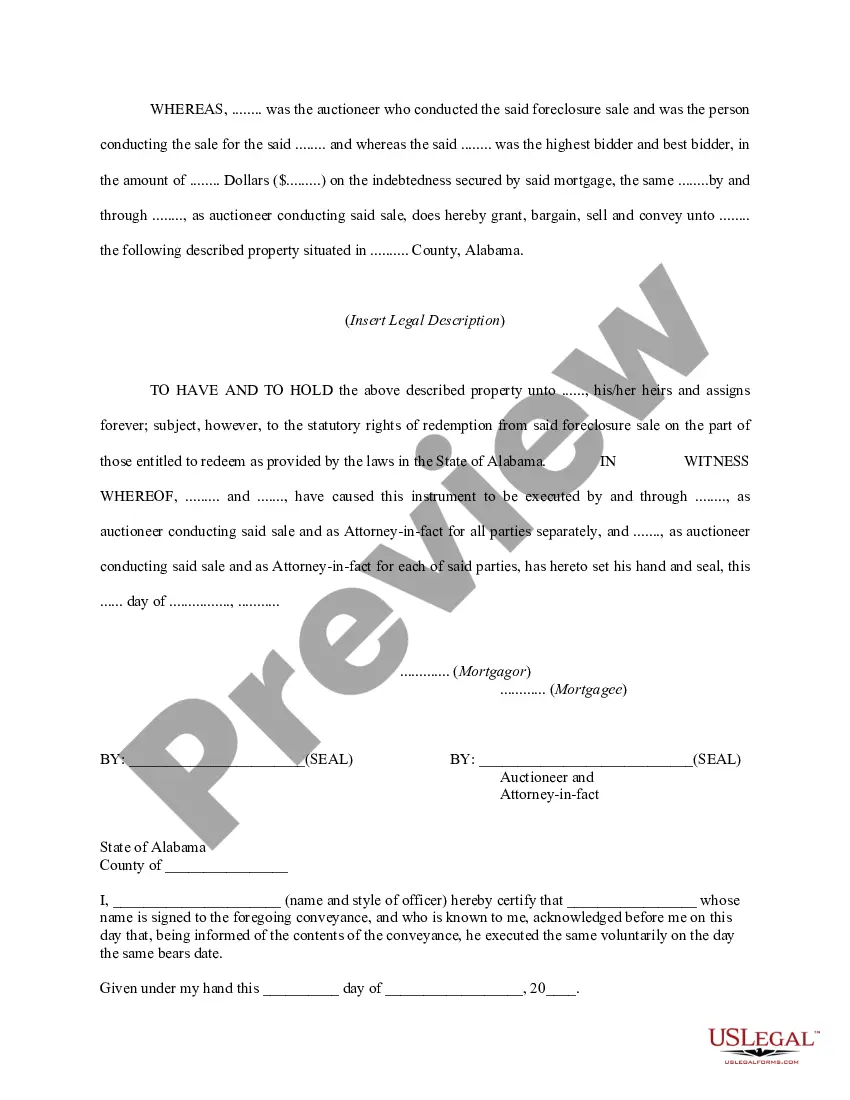

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Log into your existing US Legal Forms account or create a new one if you are a first-time user.

- Use the Preview mode to review the form description, ensuring it aligns with your local jurisdiction's requirements.

- If the current template does not meet your needs, utilize the Search tab to find the appropriate alternative.

- Select the correct document and click on the Buy Now button to choose your preferred subscription plan.

- Complete the purchase by providing your payment details, either with a credit card or through PayPal.

- Once payment is confirmed, download the legal form to your device for completion, and access it anytime via the My Forms menu in your profile.

In conclusion, US Legal Forms streamlines the process of acquiring legal documents crucial to your situation. By leveraging their extensive library of over 85,000 forms and access to expert assistance, you can create legally sound documents tailored to your needs.

Don't let the foreclosure of a dream overwhelm you; take the first step towards resolution and visit US Legal Forms today.

Form popularity

FAQ

While opinions may vary, many consider 'Eruption' by Van Halen to be one of the hardest guitar songs to play. Its fast-paced finger tapping and complex techniques resonate with the struggles of tackling life's challenges, similar to facing a foreclosure of a dream. Musicians often strive to conquer this piece, finding great satisfaction in its mastery. By dedicating time to practice and refine your skills, you can rise to the occasion just as you would in overcoming obstacles.

Comparing the difficulty of Megadeth songs to those of Metallica is subjective and depends on individual skill levels. However, Megadeth often incorporates intricate patterns and complex solos, especially in songs like 'Hangar 18,' which can echo the complexities of a foreclosure of a dream. Guitarists may find themselves challenged by both bands, as each has its unique demands. Ultimately, your personal experience will shape your perspective on this comparison.

Many guitarists believe that 'Tornado of Souls' is the hardest Megadeth song to play. Its intricate solos and complex rhythms make it a true test for musicians tackling the theme of foreclosure of a dream. Aspiring players find satisfaction in overcoming its challenges, just as individuals navigate the stressful process of foreclosure. Mastering this song can boost your skills and confidence on the guitar.

The fastest Megadeth song is often considered to be 'Holy Wars... The Punishment Due.' The track showcases lightning-fast guitar riffs and rapid drumming, mirroring the urgency of a foreclosure of a dream. Fans appreciate its high tempo, which adds intensity to the listening experience. If you want to explore songs that reflect the speed and passion of life's challenges, this track stands out.

Tennessee has specific rules governing foreclosure, including the requirement for lenders to provide homeowners with a notice of default. Additionally, lenders must wait at least 120 days before starting the foreclosure process. These regulations aim to protect homeowners and ensure due process. Knowing these rules can empower you on your journey toward the foreclosure of a dream.

Foreclosures in Tennessee usually start when a homeowner defaults on mortgage payments. The lender will then file a notice of default, leading to a public auction where the property is sold to recover losses. Using our platform, uslegalforms, can simplify your understanding of this process. With the right resources, you can confidently navigate through the foreclosure of a dream.

In Tennessee, the foreclosure process typically takes around one to three months after the lender files a notice of default. The timeline can vary based on factors such as the lender's actions and any homeowner disputes. Being proactive can shorten this timeline, allowing you to make informed decisions during the foreclosure of a dream. Understanding this process brings clarity and readiness.

Yes, a voluntary foreclosure allows homeowners to surrender their property to the lender without the formal foreclosure process. This option may enable quicker resolution, helping you avoid the lengthy legal procedures associated with a traditional foreclosure. However, this can still impact your credit score. It’s wise to consult resources regarding the foreclosure of a dream for further assistance.

The 120-day rule pertains to the timeline for lenders to initiate foreclosure proceedings after a borrower misses payments. In Tennessee, lenders must wait 120 days before starting foreclosure to give homeowners a chance to catch up on missed payments. This rule emphasizes the importance of communication between borrowers and lenders. Understanding this can help someone navigate the challenging journey of the foreclosure of a dream.

The fastest way to stop a foreclosure is to act quickly and explore immediate options. You can communicate directly with your lender to negotiate a temporary forbearance or seek legal assistance to file for bankruptcy. Additionally, US Legal Forms offers helpful resources to streamline this process, putting you on the path to protect your foreclosure of a dream.