Foreclosure For Not Paying Property Taxes

Description

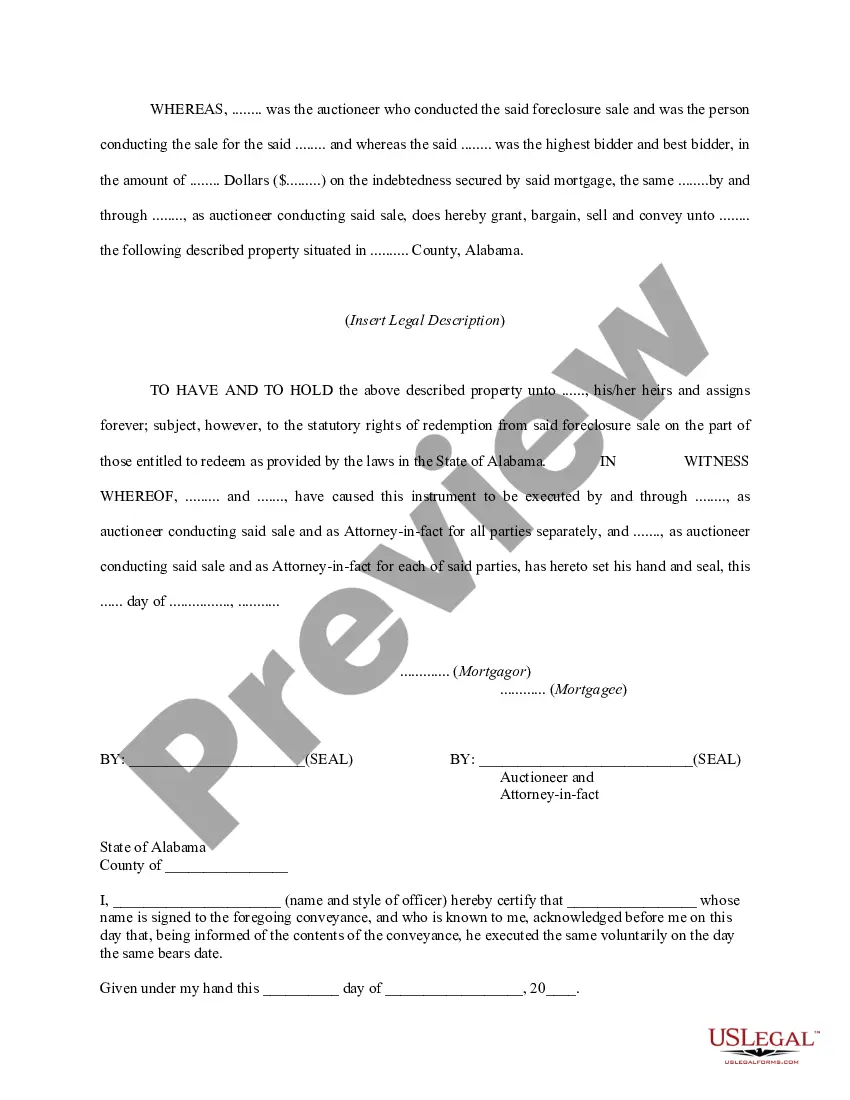

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- If you’re already a US Legal Forms user, log into your account and download your desired form template by selecting the Download button. Confirm your subscription is active and renew if necessary.

- For new users, begin by checking the Preview mode and form description to verify you have selected the right document that aligns with your local jurisdiction.

- If discrepancies arise, utilize the Search tab to find an alternative template that meets your needs.

- Once you find the correct document, click the Buy Now button and select your preferred subscription plan. You’ll need to create an account to access the forms.

- Complete your purchase by providing your payment information either through credit card or PayPal.

- Finally, download your form to save it on your device, and access it later in the My Forms section of your profile.

Utilizing US Legal Forms empowers you to generate legal documents swiftly and accurately. With competitive costs and an extensive collection, it's the smart choice for anyone facing foreclosure due to unpaid property taxes.

Ready to get started? Visit US Legal Forms today to explore the vast library and secure the documents you need!

Form popularity

FAQ

Foreclosure can lead to significant financial and personal consequences, including damage to your credit score and potential loss of your home. Additionally, the stress and difficulty of finding new housing can be overwhelming. Understanding the gravity of foreclosure for not paying property taxes can motivate timely action to avoid such outcomes.

In general, foreclosure fees are not tax deductible. However, if you make payments related to the sale of a foreclosed property, those expenses might be deductible. It's wise to consult a tax professional to navigate the specifics of tax deductions related to foreclosure for not paying property taxes.

If your property undergoes foreclosure, you must report it on your tax return by including any cancellation of debt income. Be sure to gather all documentation related to the foreclosure for accurate reporting. Using platforms like USLegalForms can provide valuable guidance on how to properly handle this situation.

In New York, you can typically go unpaid for one year before facing serious consequences like foreclosure for not paying property taxes. After this period, the municipality may start foreclosure proceedings, which can result in losing your property. It’s essential to address tax bills promptly to avoid complications.

Paying back taxes does not automatically give you ownership of a property; however, it can be part of the process in some jurisdictions. If a property is in tax foreclosure, you may have an opportunity to bid on it at auction after paying the outstanding taxes. Understanding the local laws governing tax sales is crucial. Services like uslegalforms can assist you in navigating these complex situations effectively.

In Florida, the timeframe for delinquency on property taxes is typically two years. After this period, the government can begin foreclosure proceedings for not paying property taxes, which can ultimately result in losing your property. Staying on top of your payment schedule is vital. If you are struggling, resources like uslegalforms can help you navigate your tax responsibilities.

In Colorado, you can have property taxes go unpaid for up to three years. After this period, the local government can initiate a foreclosure for not paying property taxes, and you may lose your property. Staying informed about your property tax deadlines can help prevent adverse outcomes. Consider using platforms like uslegalforms to manage your property tax obligations effectively.

Tax lien investing carries several risks that you should consider. First, if the property owner does not repay the tax lien, you may end up with a property subject to foreclosure for not paying property taxes. Additionally, the process can be complex, and it may take time to see returns on your investment. Always conduct thorough research before engaging in tax lien investing to understand these challenges.

Paying property taxes contributes to local services such as schools, roads, and emergency services, benefiting the community. Regular payment helps you avoid potential foreclosure for not paying property taxes, thereby protecting your ownership rights. Additionally, timely payments can enhance your property’s marketability and stability. Utilizing resources from US Legal Forms can simplify the understanding of tax obligations and support your homeownership journey.

Paying property taxes does not grant ownership but is often a requirement for maintaining it. Ownership is recognized through the title deed, whereas taxes support local services and infrastructure. If unpaid, property taxes can lead to foreclosure for not paying property taxes, thus jeopardizing your ownership rights. Therefore, staying current on your tax payments is essential for your property security.