Foreclosure

Description

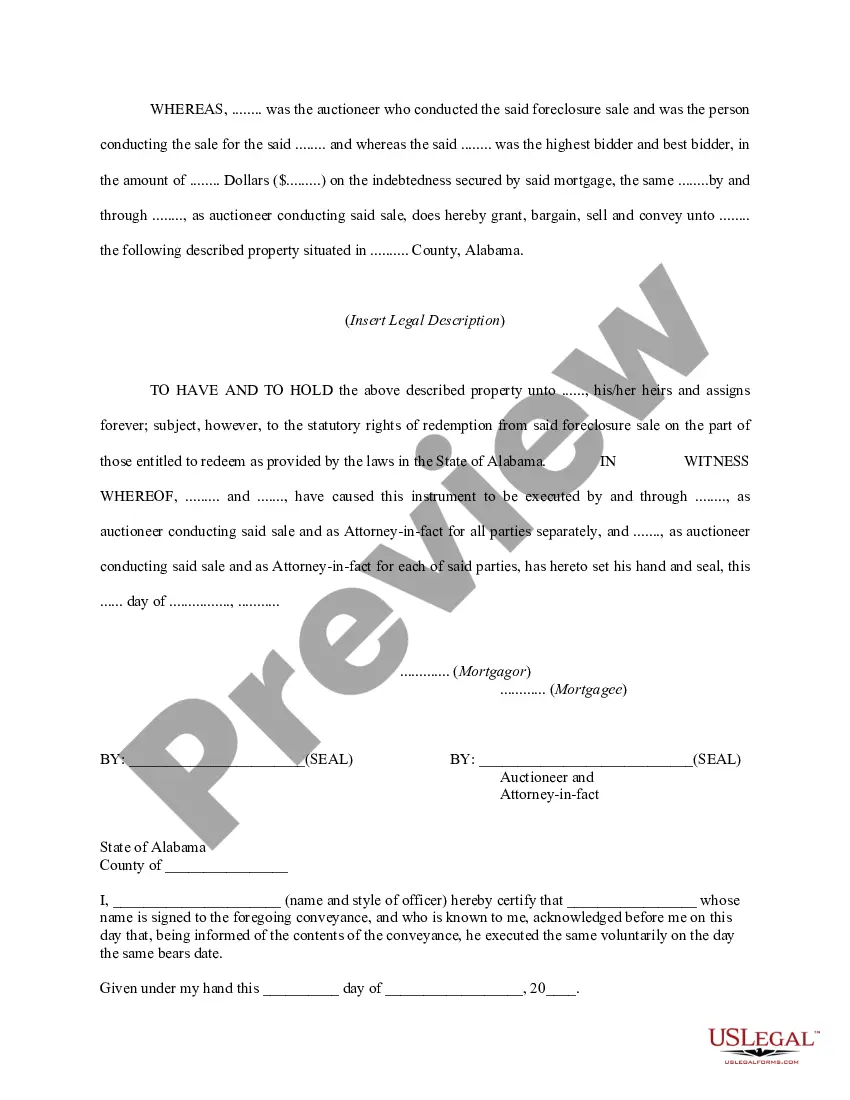

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- If you’re a returning user, log in to your account at US Legal Forms and select the needed foreclosure form. Ensure your subscription is active; renew if necessary.

- For new users, begin by exploring the platform's extensive library. Use the Preview mode to inspect the form you need and verify it adheres to your jurisdiction’s requirements.

- If you don’t find the right form, utilize the Search tab to locate alternative templates that match your criteria.

- Once you've identified the correct document, click on the Buy Now button to choose a suitable subscription plan. You’ll need to create an account for full access.

- Proceed to payment by entering your credit card details or opting for PayPal to complete your purchase.

- After payment, download your form to your device and save it for completion. You can also access it later in the My Forms section of your account.

Successfully navigating the foreclosure process means having the right documents on hand. US Legal Forms not only provides a comprehensive selection but also supports users with expert assistance for precision in legal matters.

Start your journey today by visiting US Legal Forms and find the documents you need for a smooth foreclosure process!

Form popularity

FAQ

In Arizona, foreclosure typically follows a non-judicial process, allowing lenders to sell homes without court involvement due to missed payments. After a borrower defaults, a notice of trustee's sale is recorded, providing a timeline for when the property will go to auction. Borrowers have a chance to remedy their situation before the sale. Understanding this foreclosure process can aid homeowners in finding solutions and protecting their rights.

The six phases of foreclosure generally include pre-foreclosure, initiation, filing, sale, and post-sale. First, the lender sends a notice default, signifying that the borrower has missed payments. Next, the foreclosure is filed in court, leading to a scheduled sale date. If sold, the new owner must be aware that previous obligations might still persist, making it vital to understand foreclosure dynamics throughout each phase.

In North Carolina, foreclosure typically occurs through a process known as a power of sale. When a borrower fails to make mortgage payments, the lender can initiate the foreclosure process. This usually involves filing a notice and allowing a period for the borrower to address the default. If the borrower does not settle the account, the property may be sold at a public auction to recover the owed amount, making understanding foreclosure crucial for property owners.

To request foreclosure, you generally need to contact your lender directly and submit a formal request. Be sure to include necessary documentation that supports your financial situation. Understanding the requirements can help ease the process for homeowners facing foreclosure.

The foreclosure process in Georgia involves several key steps, beginning with a 30-day notice of default. After this notice, if the debt remains unpaid, the lender can schedule a foreclosure sale. Homeowners should be aware of their rights throughout this process.

In Tennessee, foreclosures primarily occur through a non-judicial process. This means that lenders can foreclose without going to court, provided they follow specific procedures. Being familiar with these steps can help homeowners navigate their options more effectively.

In West Virginia, the foreclosure process typically lasts between three to six months. Factors such as court schedules and borrower responses may influence this timeline. Understanding this process can help you prepare for what lies ahead.

A foreclosure statement should follow a formal business letter format. Include your contact information at the top, followed by the date, and the lender's information. Clearly state the subject, detail your situation, and close with a professional sign-off.

When writing a letter of explanation for foreclosure, address the lender directly and explain the circumstances leading to the missed payments. Be honest about your situation and include any steps you have taken to resolve it. This can foster understanding and potentially facilitate a resolution.

Creating a foreclosure letter requires clear communication. Start with your name and address, state the purpose of the letter, and outline the reasons for foreclosure. Ensure you include relevant details about the mortgage and express your request or response appropriately.