Transfer On Death Deed Form Alabama With Signature

Description

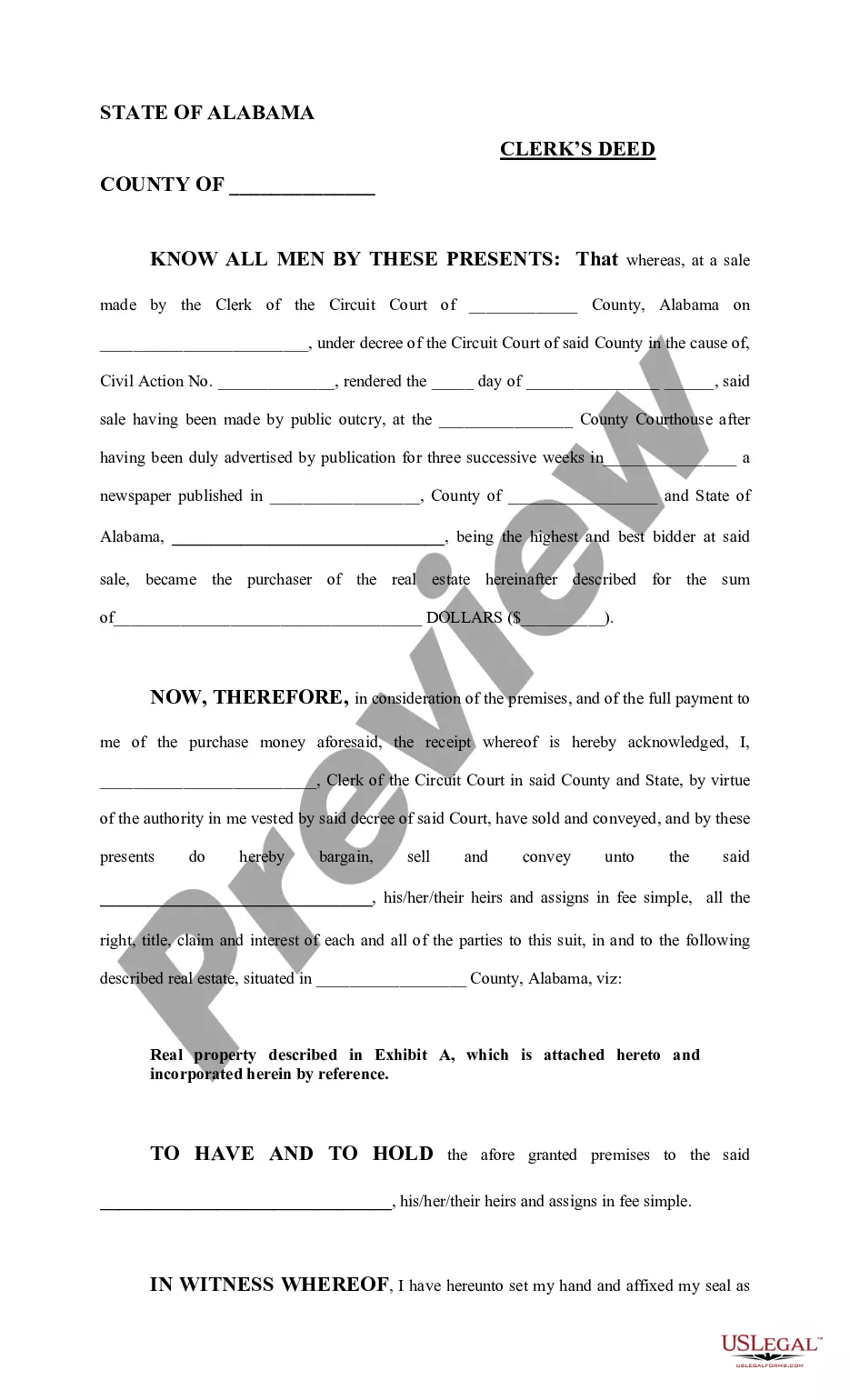

How to fill out Alabama Clerk's Deed?

The Transfer On Death Deed Form Alabama With Signature you see on this page is a reusable formal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Transfer On Death Deed Form Alabama With Signature will take you only a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to ensure it fits your requirements. If it does not, use the search option to find the right one. Click Buy Now once you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Choose the format you want for your Transfer On Death Deed Form Alabama With Signature (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your papers one more time. Use the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

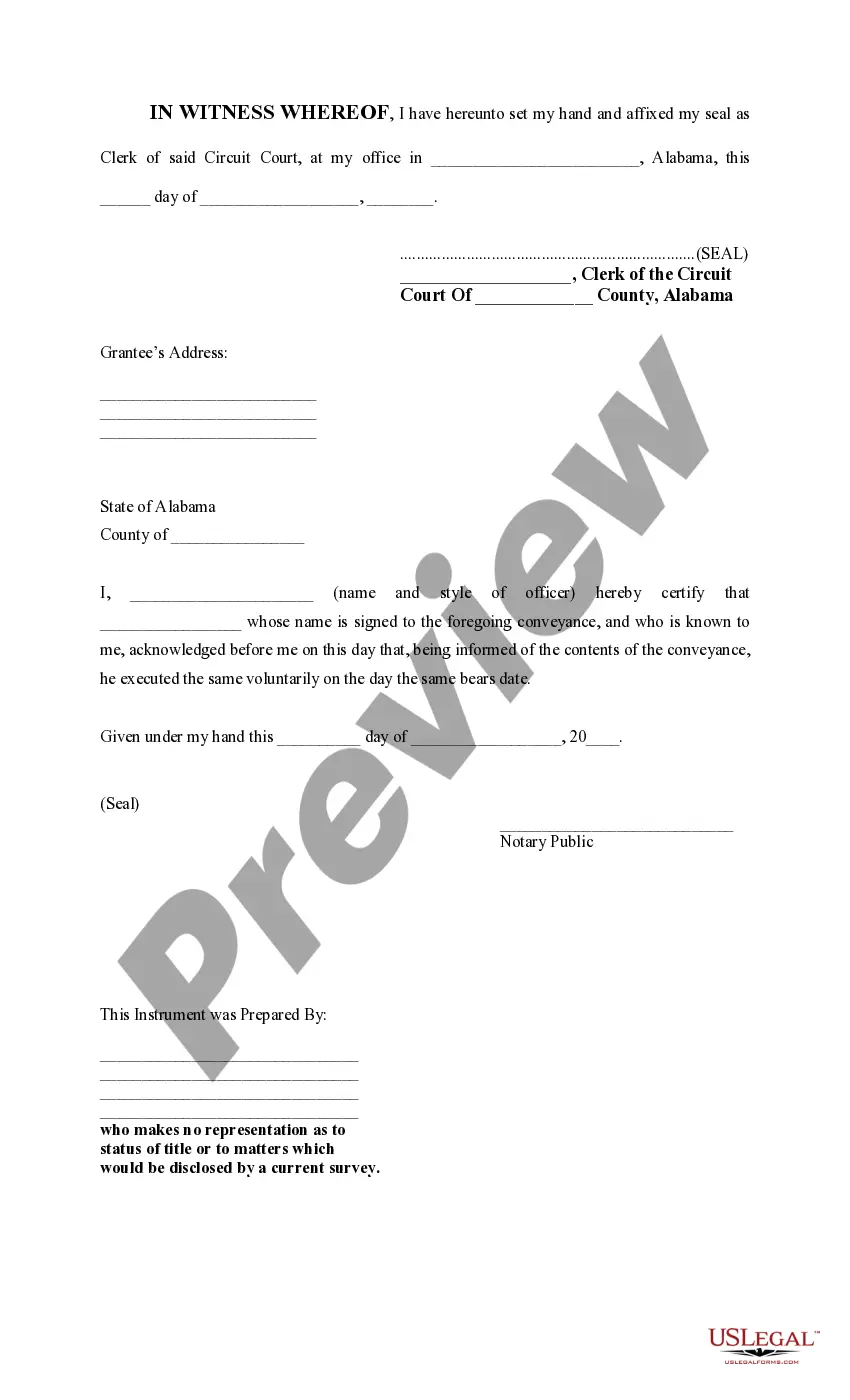

FAQ

All deeds filed in Alabama must be met with the Grantor(s) signing in front of a notary public or one (1) witness along with the Real Estate Sales Validation (Form RT-1) to be completed when filing with the Probate County Judge's Office.

To transfer ownership from the deceased owner, the surviving owner must bring in the original title and original death certificate of deceased owner for transfer of title. If the names are joined on the title with ?and? or nothing separating the names, it is presumed by the state to be ?AND?.

Attorney Involvement All legal documents must be drafted by an attorney licensed to practice in the State of Alabama. Parties to a transaction can draft their own documents if they are doing so on behalf of themselves.

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.