Trustee Deed Form New York

Description

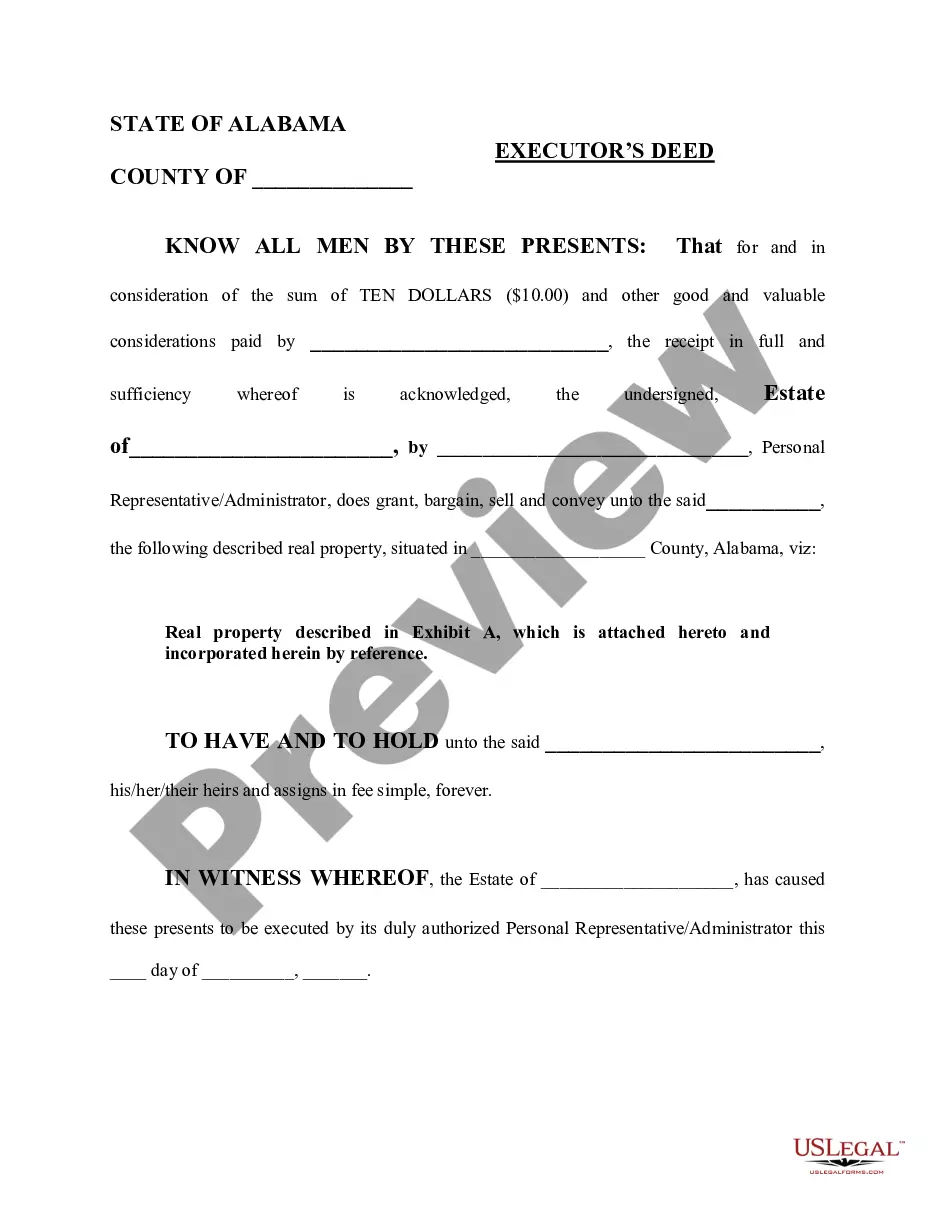

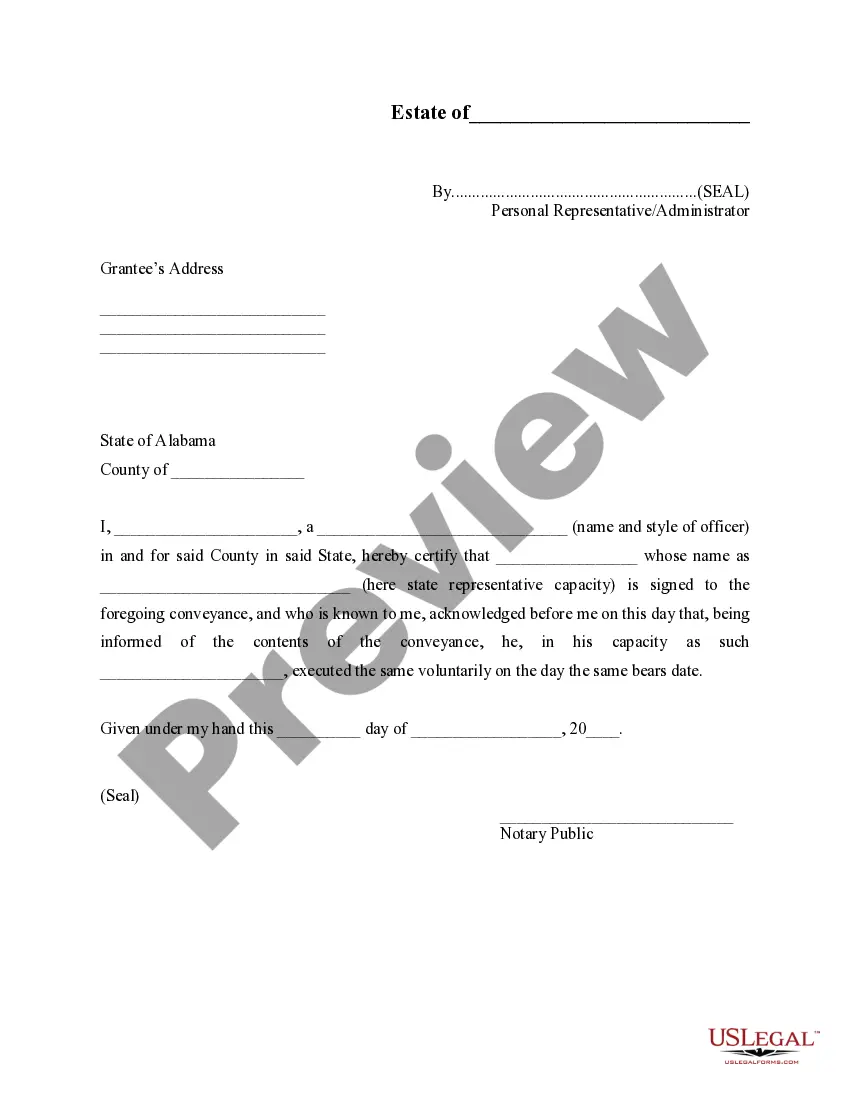

How to fill out Alabama Executor's Deed?

Creating legal documents from the ground up can occasionally be overwhelming.

Some situations may require extensive research and significant financial resources.

If you are searching for a simpler and more cost-effective method of generating the Trustee Deed Form New York or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs.

Before diving straight into downloading the Trustee Deed Form New York, consider the following tips: Review the form preview and descriptions to confirm that you have located the desired form. Ensure the template complies with your state and county regulations. Select the most appropriate subscription plan to acquire the Trustee Deed Form New York. Download the form, then complete, sign, and print it. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and make form completion an easy and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously compiled for you by our legal professionals.

- Utilize our platform whenever you require a dependable and trustworthy service to quickly locate and download the Trustee Deed Form New York.

- If you are already familiar with our site and have an existing account, simply Log In, select the form, and download it, or re-download it anytime later from the My documents section.

- No account? No worries. Registering takes minimal time, allowing you to browse our catalog.

Form popularity

FAQ

How does the IRS know if I give a gift? The IRS finds out if you gave a gift when you file a form 709 as is required if you gift over the annual exclusion. If you fail to file this form, the IRS can find out via an audit.

There is Currently No Tennessee Gift Tax The Tennessee gift tax was repealed in 2012. While every U.S. citizen is subject to the same Federal gift tax rules, the tax laws of the various states do differ. If you gift a property or asset in another state ensure that you are aware of that state's tax policies.

The 2023 gift tax limit is $17,000. For married couples, the limit is $17,000 each, for a total of $34,000. This amount, formally called the annual gift tax exclusion, is the maximum amount you can give a single person without reporting it to the IRS.

Do I have to pay taxes on a $20,000 gift? You do not need to file a gift tax return or pay gift taxes if your gift is under the annual exclusion amount per person ($17,000 in 2023). If you do exceed that amount, you don't necessarily need to pay taxes.

Tennessee also has no gift tax. There is a federal gift tax, though, which has an annual exemption of $17,000 per year for each gift recipient, as of 2023. If you give one person more than $17,000 in a single year, you must report that gift to the IRS.

The basic gift tax exclusion or exemption is the amount you can give each year to one person and not worry about being taxed. The gift tax exclusion limit for 2022 was $16,000, and for 2023 it's $17,000. That means anything you give under that amount is not taxable and does not have to be reported to the IRS.

There is typically a tax-free gift limit to family members until a donation exceeds $15,000 (jumping up to $16,000 in 2022). In these instances, the IRS is usually uninvolved. Even then, it can just result in more paperwork. At the federal level, assets you receive as a gift are usually not taxable income.