- US Legal Forms

-

Indiana Transfer on Death Deed - TOD from Individual to Two...

Indiana Transfer on Death Deed - TOD from Individual to Two Individuals

What this document covers

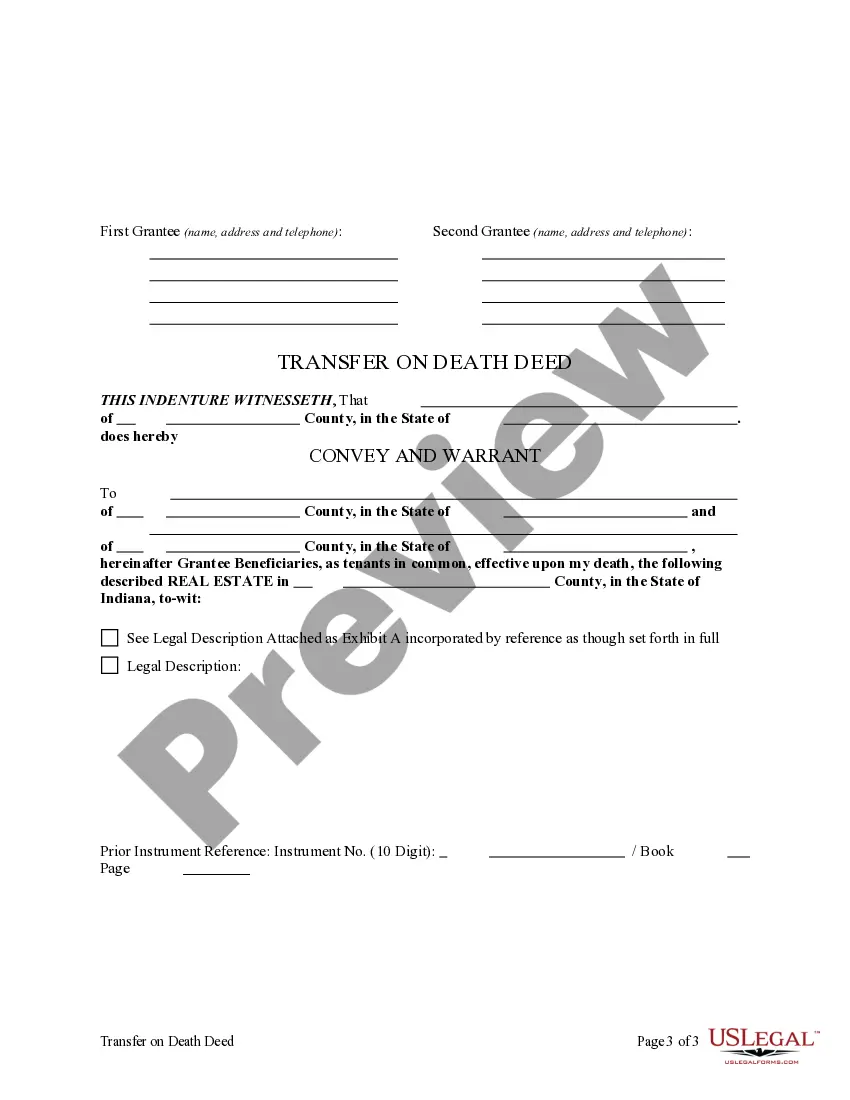

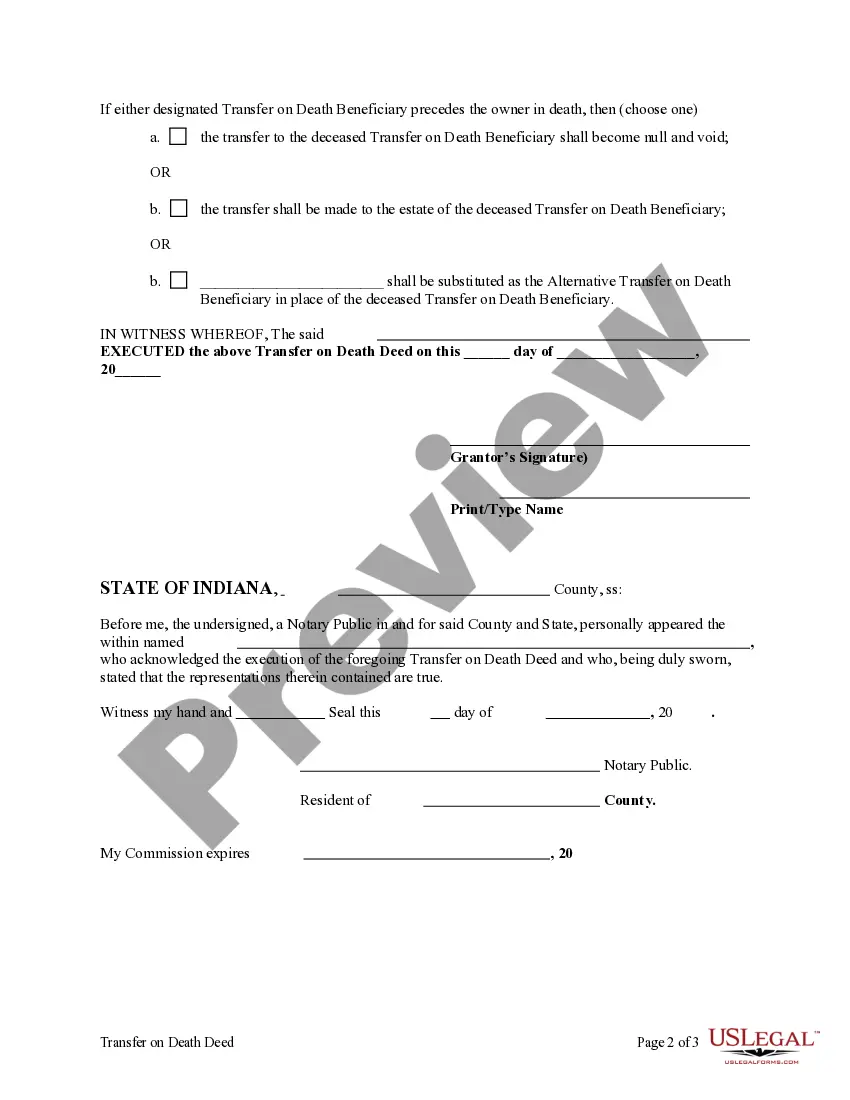

The Transfer on Death Deed (TOD) allows an individual to transfer property to two designated beneficiaries upon their death. This form outlines the title transfer process similar to a will but operates outside of probate, providing a streamlined way to convey real estate. One distinctive feature of this TOD is the provision for contingent beneficiaries, serving as a backup if one of the primary beneficiaries passes away before the property owner. If all beneficiaries are deceased prior to the owner's death, the deed is rendered null and void.

Main sections of this form

- Identification of the property being transferred.

- Names and details of the two primary beneficiaries.

- Option to name an alternate beneficiary in case one of the primary beneficiaries predeceases the owner.

- A clause stating that the deed becomes void if all named beneficiaries die before the owner.

- Revocation provisions allowing the owner to change beneficiaries at any time.

Related forms

Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property

Deed of Gift of Real Property

Declaration of Trust with Trustor as Life Beneficiary

Owner's - Seller's - Affidavit

Joint Venture Agreement - Joint Venture Agreements for Two Parties Owning Property as Tenants in Common

Common use cases

This Transfer on Death Deed should be used when an individual wishes to designate two beneficiaries to inherit property automatically upon their death. It is particularly useful for individuals who want to avoid the lengthy and potentially costly probate process and who have clear intentions regarding property distribution. It is also applicable when the owner wants to ensure a seamless transfer of real estate to their loved ones after their passing.

Intended users of this form

- Individuals seeking to transfer real estate to two beneficiaries upon death.

- Property owners looking to avoid probate for their real estate assets.

- Those wanting to appoint contingent beneficiaries as a backup plan.

- Anyone considering changing their estate plan or beneficiaries without the involvement of an attorney.

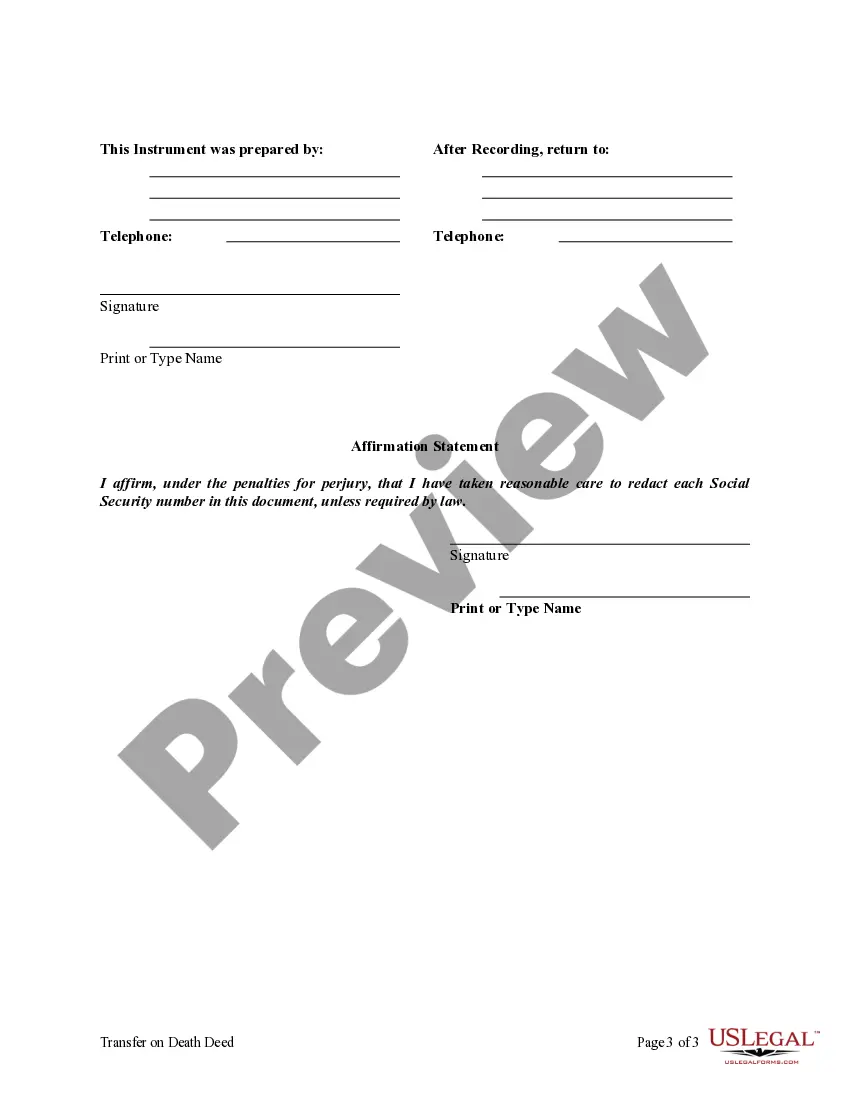

How to prepare this document

- Identify the property you are transferring and provide its description.

- Enter the names and addresses of the two primary beneficiaries clearly.

- If desired, name an alternate beneficiary who would inherit if a primary beneficiary predeceases you.

- Sign and date the deed in presence of the required witnesses according to state law.

- Record the completed deed with the appropriate county office to make it legally effective.

Is notarization required?

This form does not typically require notarization unless specified by local law. However, signing the deed in the presence of a notary can enhance its legality and ensure clarity in the execution process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not providing a clear and specific description of the property.

- Failing to include an alternate beneficiary, which could lead to complications.

- Not following state-specific requirements for signing and witnessing.

- Neglecting to record the deed, rendering it ineffective.

Benefits of completing this form online

- Convenience of completing the form at your own pace.

- Editability allows you to make changes before finalizing.

- Access to legal templates drafted by licensed attorneys for assurance.

- Reduce the risk of errors with user-friendly interfaces that guide you through completion.

Looking for another form?

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Guam

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Puerto Rico

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virgin Islands

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Viewed forms

Consumer Oriented Web Site Development Agreement

Sample Letter for Opt-Out - Telemarketing Lists

Credit Application

Personal Property Inventory

Release of Lis Pendens

Form - Content Provider Oriented Webcasting and Radio Broadcast Agreement

Stock Certificate Package

Bid Proposal form for Construction of Building

Personal Loan Agreement Document Package

Technical Support Help Bulletin

Form popularity

FAQ

When considering whether a transfer on death deed is better than a traditional beneficiary designation, it often comes down to your specific needs. A TOD gives you control over the property while you are alive and avoids probate for your beneficiaries. In contrast, naming a beneficiary for accounts or insurance policies may not provide the same level of asset control or ease of transition for real estate. Ultimately, the best option depends on your individual circumstances.

The amount that's in a TOD account at the time of your death is not taxable under federal law to the person who receives the account, although it may be taxable to your estate. If your beneficiary or the account are in a state with an inheritance tax, he may have to pay that.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

When someone dies and their property transfers to their beneficiaries, the federal government impose an estate tax on the value of all that property. Since the transfer on death account is not a trust, it does not help you avoid or minimize estate taxes.

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.

POST DATE: 8.9. 19. A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.

Indiana Transfer on Death Deed - TOD from Individual to Two Individuals Related Searches

-

Indiana transfer on death deed tod from individual to two individuals form

-

Problems with transfer on death deeds in Indiana

-

Problems with transfer on death deeds in Indiana pdf

-

Indiana Transfer on Death deed form

-

Transfer on Death deed Indiana free

-

Indiana Transfer on Death deed PDF

-

Transfer on Death deed Indiana cost

-

Indiana transfer on death deed statute

Explore more forms

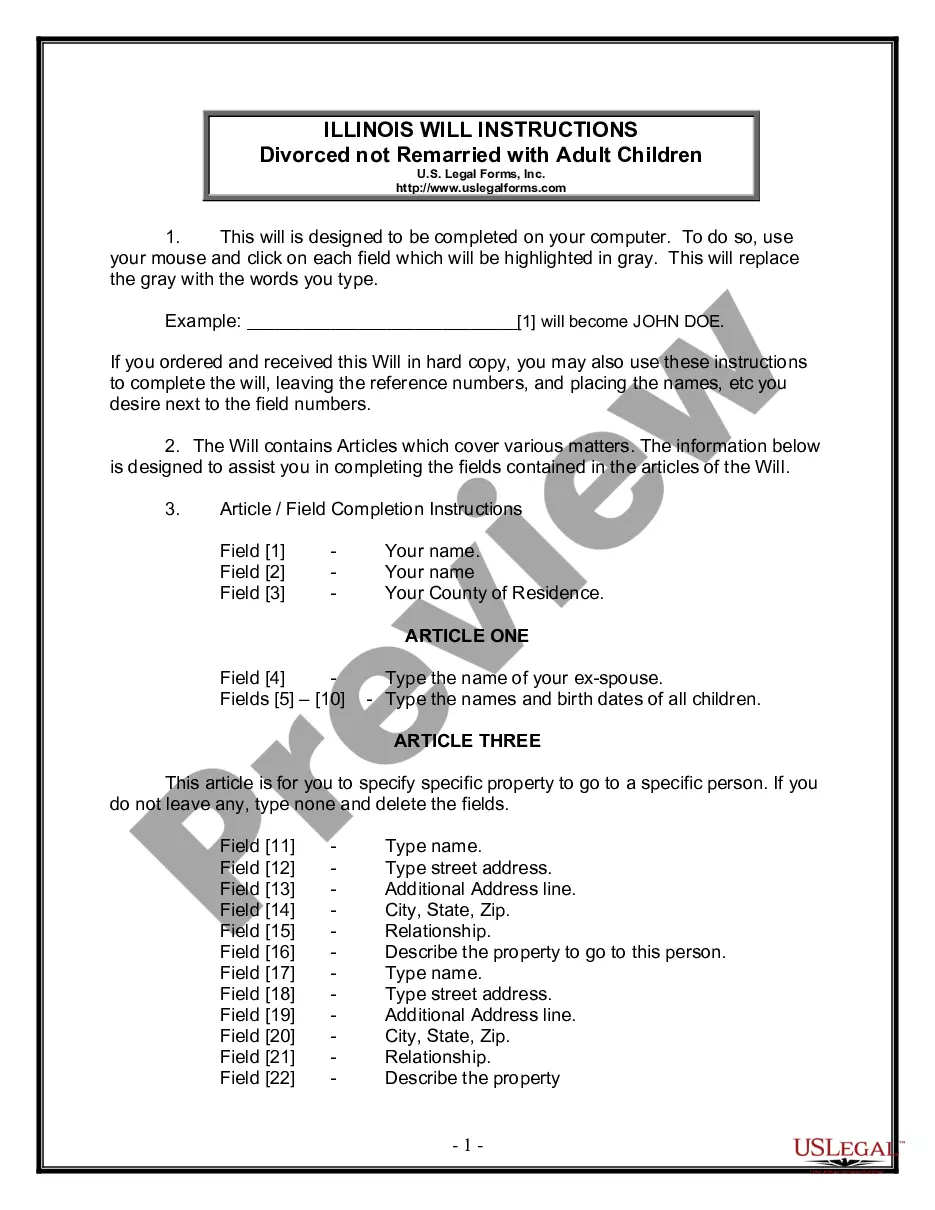

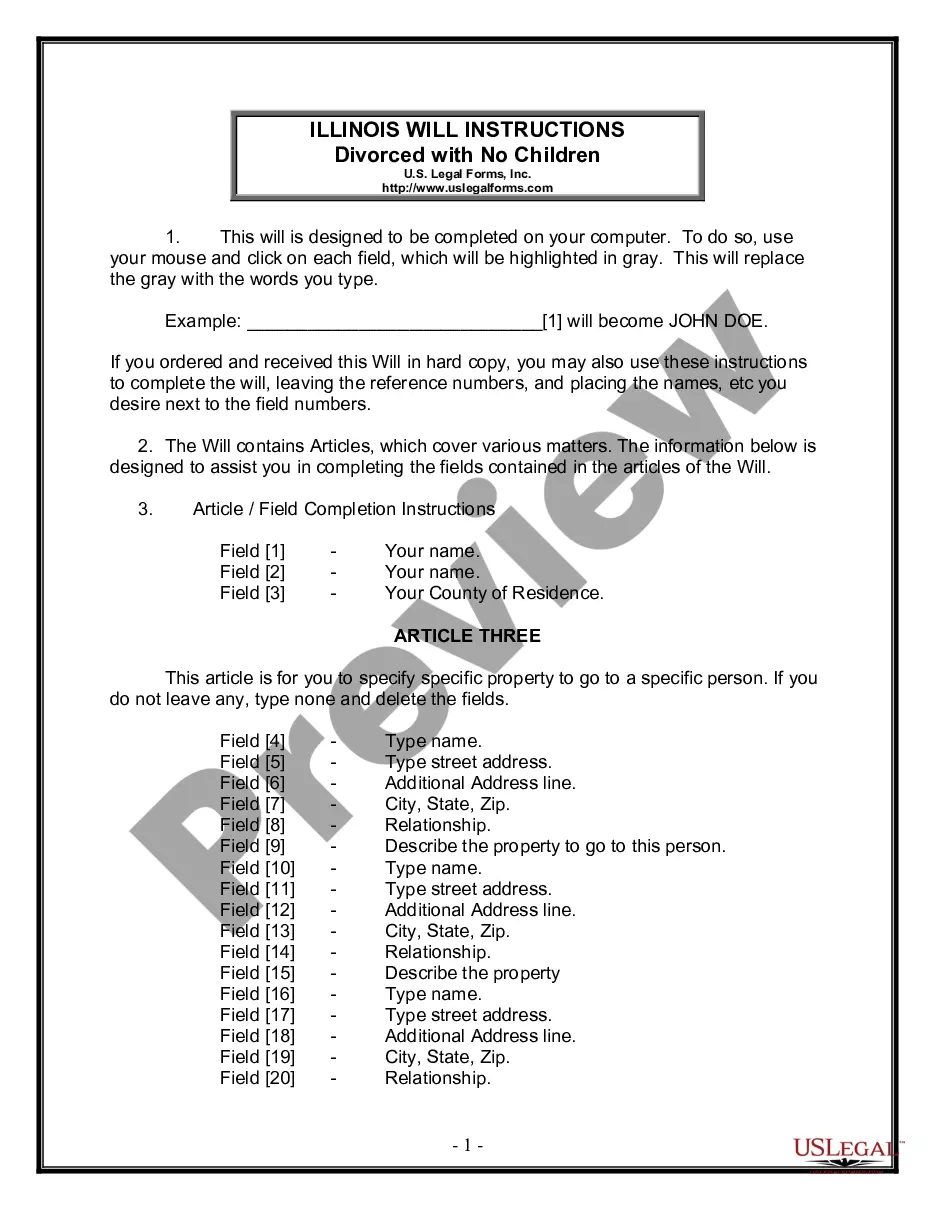

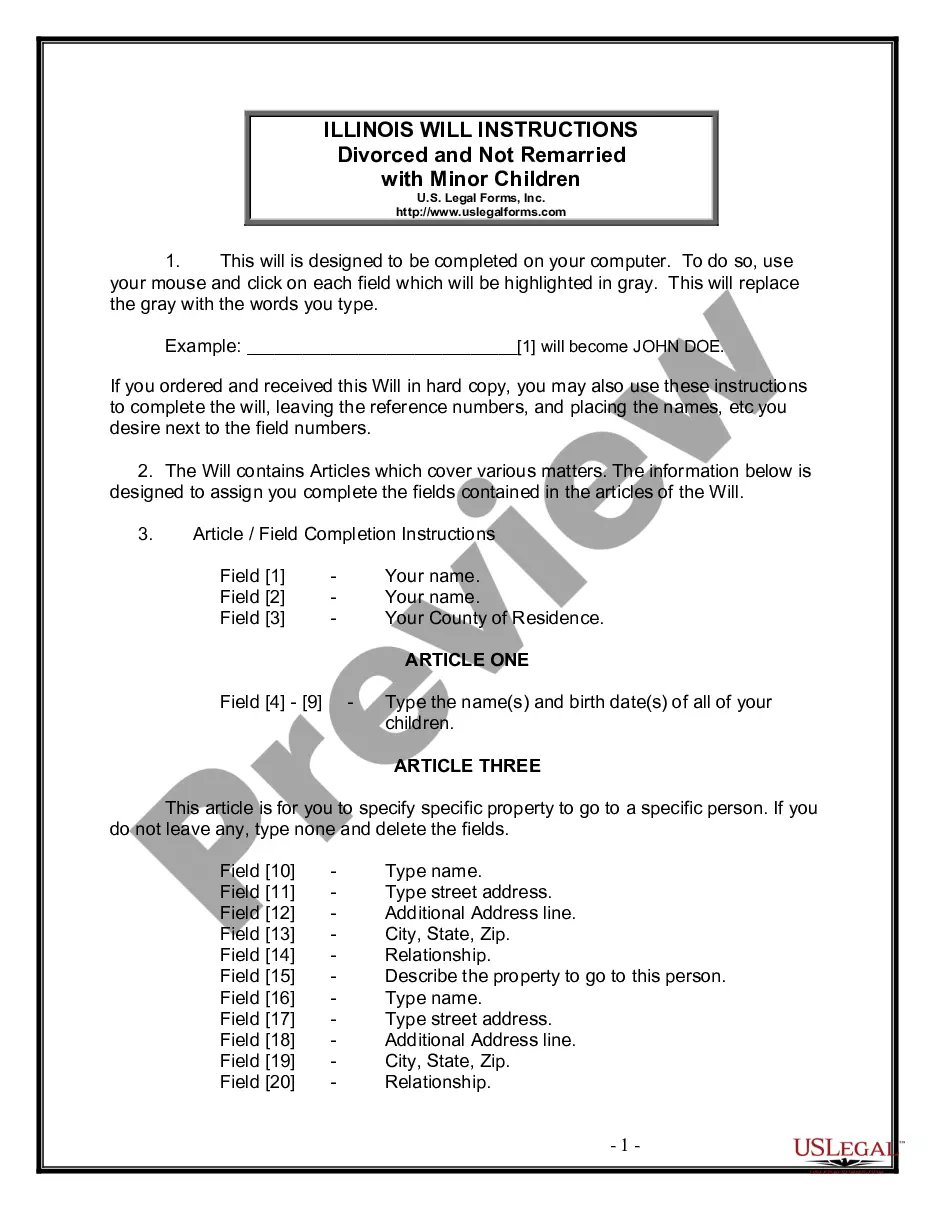

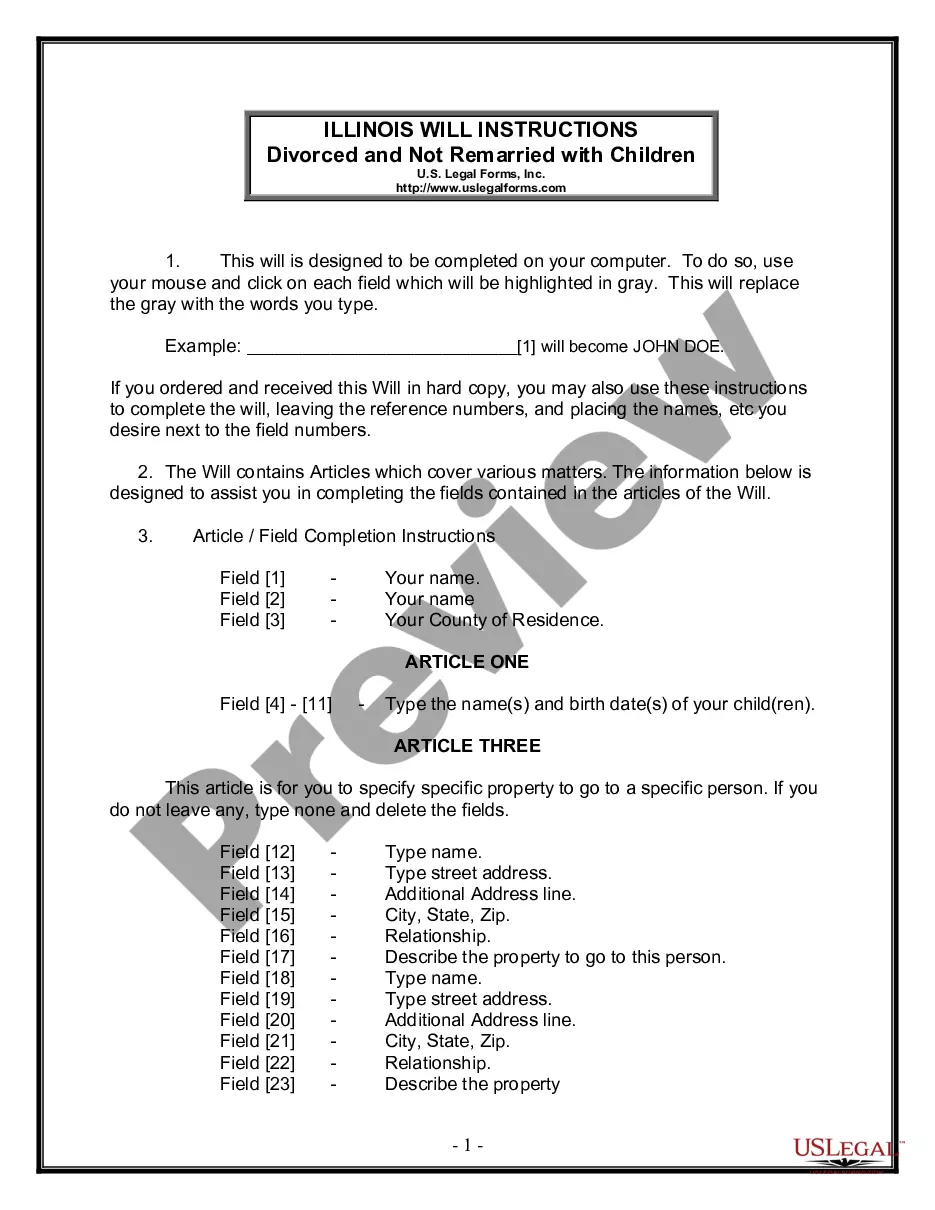

Last Will and Testament for Divorced person not Remarried with Adult Children

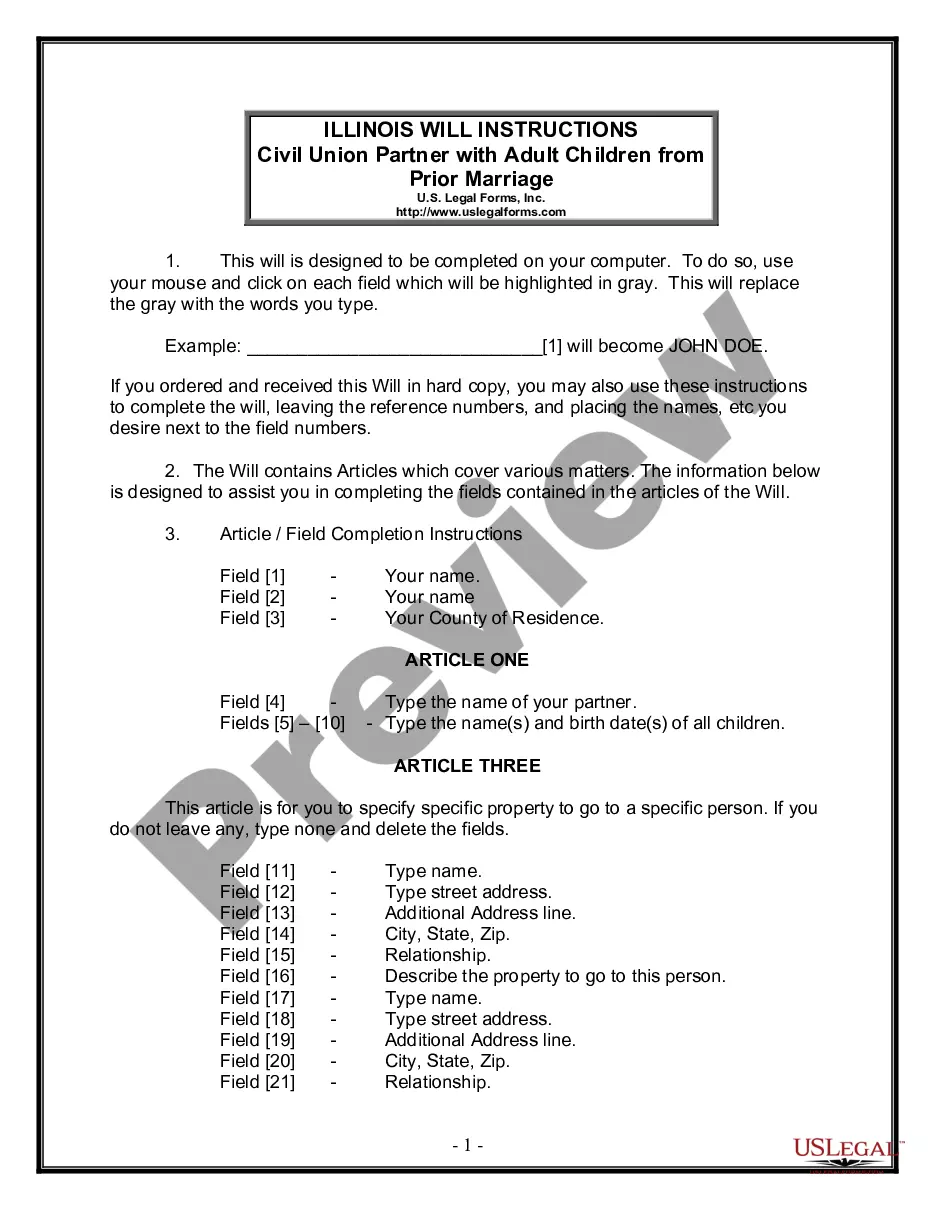

Last Will and Testament for Civil Union Partner with Adult Children from Prior Marriage

Last Will and Testament for Divorced Person Not Remarried with No Children

Last Will and Testament for Divorced person not Remarried with Minor Children

Last Will and Testament for Divorced Person Not Remarried with Adult and Minor Children

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Indiana

-

Alabama

-

Alaska

-

Arkansas

-

California

-

Florida

-

Georgia

-

Hawaii

-

Illinois

-

Iowa

-

Kansas

-

Maryland

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

New Hampshire

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

Tennessee

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

Indiana Code

Title 32. Property

Article 17. Interests in Property

Chapter 14. Transfer on Death Property Act

IC 32-17-14-0.2. The addition of IC 32-4-1.6 ("Uniform Act on Transfer.... **Update Notice: This section has been added by P.L. 220-2011

[EDITORS' NOTE: SECTION ADDED BY CURRENT LEGISLATION. PLEASE FOLLOW THE LINK ABOVE TO VIEW THE ACT.]

IC 32-17-14-1 This chapter may be cited as the Transfer on Death....

This chapter may be cited as the Transfer on Death Property Act.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-2 (a) Except as provided elsewhere in this chapter, this....

(a) Except as provided elsewhere in this chapter, this chapter applies to a transfer on death security, transfer on death securities account, and pay on death account created before July 1, 2009, unless the application of this chapter would:

(1) adversely affect a right given to an owner or beneficiary;

(2) give a right to any owner or beneficiary that the owner or beneficiary was not intended to have when the transfer on death security, transfer on death securities account, or pay on death account was created;

(3) impose a duty or liability on any person that was not intended to be imposed when the transfer on death security, transfer on death securities account, or pay on death account was created; or

(4) relieve any person from any duty or liability imposed:

(A) by the terms of the transfer on death security, transfer on death securities account, or pay on death account; or

(B) under prior law.

(b) Subject to section 32 of this chapter, this chapter applies to a transfer on death transfer if at the time the owner designated the beneficiary:

(1) the owner was a resident of Indiana;

(2) the property subject to the beneficiary designation was situated in Indiana;

(3) the obligation to pay or deliver arose in Indiana;

(4) the transferring entity was a resident of Indiana or had a place of business in Indiana; or

(5) the transferring entity's obligation to make the transfer was accepted in Indiana.

(c) This chapter does not apply to property, money, or benefits paid or transferred at death under a life or accidental death insurance policy, annuity, contract, plan, or other product sold or issued by a life insurance company unless the provisions of this chapter are incorporated into the policy or beneficiary designation in whole or in part by express reference.

(d) This chapter does not apply to a transfer on death transfer if the beneficiary designation or an applicable law expressly provides that this chapter does not apply to the transfer.

(e) Subject to IC 9-17-3-9(h) and IC 9-31-2-30(h), this chapter applies to a beneficiary designation for the transfer on death of a motor vehicle or a watercraft.

(f) The provisions of:

(1) section 22 of this chapter; and

(2) section 26(b)(9) of this chapter; relating to distributions to lineal descendants per stirpes apply to a transfer on death or payable on death transfer created before July 1, 2009.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 25.]

IC 32-17-14-2.5 This chapter does not apply to property, money, or benefits.... **Update Notice: This section has been added by P.L. 36-2011

[EDITORS' NOTE: SECTION ADDED BY CURRENT LEGISLATION. PLEASE FOLLOW THE LINK ABOVE TO VIEW THE ACT.]

IC 32-17-14-3 The following definitions apply throughout this chapter: **Update Notice: This section has been amended by P.L. 36-2011

The following definitions apply throughout this chapter:

(1) "Beneficiary" means a person designated or entitled to receive property because of another person's death under a transfer on death transfer.

(2) "Beneficiary designation" means a written instrument other than a will or trust that designates the beneficiary of a transfer on death transfer.

(3) "Governing instrument" refers to a written instrument agreed to by an owner that establishes the terms and conditions of an ownership in beneficiary form.

(4) "Joint owners" refers to persons who hold property as joint tenants with a right of survivorship. However, the term does not include a husband and wife who hold property as tenants by the entirety.

(5) "LDPS" means an abbreviation of lineal descendants per stirpes, which may be used in a beneficiary designation to designate a substitute beneficiary as provided in section 22 of this chapter.

(6) "Owner" refers to a person or persons who have a right to designate the beneficiary of a transfer on death transfer.

(7) "Ownership in beneficiary form" means holding property under a registration in beneficiary form or other written instrument that:

(A) names the owner of the property;

(B) directs ownership of the property to be transferred upon the death of the owner to the designated beneficiary; and

(C) designates the beneficiary.

(8) "Person" means an individual, a sole proprietorship, a partnership, an association, a fiduciary, a trustee, a corporation, a limited liability company, or any other business entity.

(9) "Proof of death" means a death certificate or a record or report that is prima facie proof or evidence of an individual's death.

(10) "Property" means any present or future interest in real property, intangible personal property (as defined in IC 6-4.1-1-5), or tangible personal property (as defined in IC 6-4.1-1-13). The term includes:

(A) a right to direct or receive payment of a debt;

(B) a right to direct or receive payment of money or other benefits due under a contract, account agreement, deposit agreement, employment contract, compensation plan, pension plan, individual retirement plan, employee benefit plan, or trust or by operation of law;

(C) a right to receive performance remaining due under a contract;

(D) a right to receive payment under a promissory note or a debt maintained in a written account record;

(E) rights under a certificated or uncertificated security;

(F) rights under an instrument evidencing ownership of property issued by a governmental agency; and

(G) rights under a document of title (as defined in IC 26-1-1-201).

(11) "Registration in beneficiary form" means titling of an account record, certificate, or other written instrument that:

(A) provides evidence of ownership of property in the name of the owner;

(B) directs ownership of the property to be transferred upon the death of the owner to the designated beneficiary; and

(C) designates the beneficiary.

(12) "Security" means a share, participation, or other interest in property, in a business, or in an obligation of an enterprise or other issuer. The term includes a certificated security, an uncertificated security, and a security account.

(13) "Transfer on death deed" means a deed that conveys an interest in real property to a grantee by beneficiary designation.

(14) "Transfer on death transfer" refers to a transfer of property that takes effect upon the death of the owner under a beneficiary designation made under this chapter.

(15) "Transferring entity" means a person who:

(A) owes a debt or is obligated to pay money or benefits;

(B) renders contract performance;

(C) delivers or conveys property; or

(D) changes the record of ownership of property on the books, records, and accounts of an enterprise or on a certificate or document of title that evidences property rights.

The term includes a governmental agency, business entity, or transfer agent that issues certificates of ownership or title to property and a person acting as a custodial agent for an owner's property. However, the term does not include a governmental office charged with endorsing, entering, or recording the transfer of real property in the public records.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 26.]

IC 32-17-14-4 (a) The following transfers of ownership are not....

(a) The following transfers of ownership are not considered transfer on death transfers for purposes of this chapter:

(1) Transfers by rights of survivorship in property held as joint tenants or tenants by the entirety.

(2) A transfer to a remainderman on the termination of a life tenancy.

(3) An inter vivos or a testamentary transfer under a trust established by an individual.

(4) A transfer made under the exercise or nonexercise of a power of appointment.

(5) A transfer made on the death of a person who did not have the right to designate the person's estate as the beneficiary of the transfer.

(b) A beneficiary designation made under this chapter must do the following:

(1) Designate the beneficiary of a transfer on death transfer.

(2) Make the transfer effective upon the death of the owner of the property being transferred.

(3) Comply with this chapter, the conditions of any governing instrument, and any other applicable law.

(c) For purposes of construing this chapter or a beneficiary designation made under this chapter, the death of the last surviving owner of property held by joint owners is considered the death of the owner.

(d) Except as otherwise provided in this chapter, a transfer on death direction is accomplished in a form substantially similar to the following:

(1) Insert Name of the Owner or Owners.

(2) Insert "Transfer on death to" or "TOD" or "Pay on death to" or "POD".

(3) Insert the Name of the Beneficiary or Beneficiaries.

(e) An owner may revoke or change a beneficiary designation at any time before the owner's death.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-5 A transfer on death transfer:

A transfer on death transfer:

(1) is effective with or without consideration;

(2) is not considered testamentary;

(3) is not subject to the requirements for a will or for probating a will under IC 29-1; and

(4) may be subject to an agreement between the owner and a transferring entity to carry out the owner's intent to transfer the property under this chapter.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-6 For the purpose of discharging its duties under this....

For the purpose of discharging its duties under this chapter, the authority of a transferring entity acting as agent for an owner of property subject to a transfer on death transfer does not cease at the death of the owner. The transferring entity shall transfer the property to the designated beneficiary in accordance with the beneficiary designation and this chapter.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-7 (a) If any of the following are required by the transferring....

(a) If any of the following are required by the transferring entity, an agreement between the owner and the transferring entity is necessary to carry out a transfer on death transfer, which may be made in accordance with the rules, terms, and conditions set forth in the agreement:

(1) The submission to the transferring entity of a beneficiary designation under a governing instrument.

(2) Registration by a transferring entity of a transfer on death direction on any certificate or record evidencing ownership of property.

(3) Consent of a contract obligor for a transfer of performance due under the contract.

(4) Consent of a financial institution for a transfer of an obligation of the financial institution.

(5) Consent of a transferring entity for a transfer of an interest in the transferring entity.

(b) When subsection (a) applies, a transferring entity is not required to accept an owner's request to assist the owner in carrying out a transfer on death transfer.

(c) If a beneficiary designation, revocation, or change is subject to acceptance by a transferring entity, the transferring entity's acceptance of the beneficiary designation, revocation, or change relates back to and is effective as of the time the request was received by the transferring entity.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 27.]

IC 32-17-14-8 (a) If a transferring entity accepts a beneficiary designation....

(a) If a transferring entity accepts a beneficiary designation or beneficiary assignment or registers property in beneficiary form, the acceptance or registration constitutes the agreement of the owner and the transferring entity that, subject to this section, the owner's property will be transferred to and placed in the name and control of the beneficiary in accordance with the beneficiary designation or transfer on death direction, the agreement between the parties, and this chapter.

(b) An agreement described in subsection (a) is subject to the owner's power to revoke or change a beneficiary designation before the owner's death.

(c) A transferring entity's duties under an agreement described in subsection (a) are subject to the following:

(1) Receiving proof of the owner's death.

(2) Complying with the transferring entity's requirements for proof that the beneficiary is entitled to receive the property.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-9 (a) Except as provided in subsection (c), a beneficiary....

(a) Except as provided in subsection (c), a beneficiary designation that satisfies the requirements of subsection (b):

(1) authorizes a transfer of property under this chapter;

(2) is effective on the death of the owner of the property; and

(3) transfers the right to receive the property to the designated beneficiary who survives the death of the owner.

(b) A beneficiary designation is effective under subsection (a) if the beneficiary designation is:

(1) executed; and

(2) delivered; to the transferring entity before the death of the owner.

(c) A transferring entity shall make a transfer described in subsection (a)(3) unless there is clear and convincing evidence of the owner's different intention at the time the beneficiary designation was created.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 28.]

IC 32-17-14-10 (a) A written assignment of a contract right that:

(a) A written assignment of a contract right that:

(1) assigns the right to receive any performance remaining due under the contract to an assignee designated by the owner; and

(2) expressly states that the assignment does not take effect until the death of the owner;

transfers the right to receive performance due under the contract to the designated assignee beneficiary if the assignment satisfies the requirements of subsection (b).

(b) A written assignment described in subsection (a) is effective upon the death of the owner if the assignment is:

(1) executed; and

(2) delivered; to the contract obligor before the death of the owner.

(c) A beneficiary assignment described in this section is not required to be supported by consideration or delivered to the assignee beneficiary.

(d) This section does not preclude other methods of assignment that are permitted by law and have the effect of postponing the enjoyment of the contract right until after the death of the owner.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 29.]

IC 32-17-14-11 (a) A transfer on death deed transfers the interest.... **Update Notice: This section has been amended by P.L. 36-2011

(a) A transfer on death deed transfers the interest provided to the beneficiary if the transfer on death deed is:

(1) executed by the owner or owner's legal representative; and

(2) recorded with the recorder of deeds in the county in which the real property is situated before the death of the owner.

(b) A transfer on death deed is void if it is not recorded with the recorder of deeds in the county in which the real property is situated before the death of the owner.

(c) A transfer on death deed is not required to be supported by consideration or delivered to the grantee beneficiary.

(d) A transfer on death deed may be used to transfer an interest in real property to either a revocable or an irrevocable trust.

(e) If the owner records a transfer on death deed, the effect of the recording the transfer on death deed is determined as follows:

(1) If the owner's interest in the real property is as a tenant by the entirety, the conveyance is inoperable and void unless the other spouse joins in the conveyance.

(2) If the owner's interest in the real property is as a joint tenant with rights of survivorship, the conveyance severs the joint tenancy and the cotenancy becomes a tenancy in common.

(3) If the owner's interest in the real property is as a joint tenant with rights of survivorship and the property is subject to a beneficiary designation, a conveyance of any joint owner's interest has no effect on the original beneficiary designation for the nonsevering joint tenant.

(4) If the owner's interest is as a tenant in common, the owner's interest passes to the beneficiary as a transfer on death transfer.

(5) If the owner's interest is a life estate determined by the owner's life, the conveyance is inoperable and void.

(6) If the owner's interest is any other interest, the interest passes in accordance with this chapter and the terms and conditions of the conveyance establishing the interest. If a conflict exists between the conveyance establishing the interest and this chapter, the terms and conditions of the conveyance establishing the interest prevail.

(f) A beneficiary designation in a transfer on death deed may be worded in substance as "(insert owner's name) conveys and warrants (or quitclaims) to (insert owner's name), TOD to (insert beneficiary's name)". This example is not intended to be exhaustive.

(g) A transfer on death deed using the phrase "pay on death to" or the abbreviation "POD" may not be construed to require the liquidation of the real property being transferred.

(h) This section does not preclude other methods of conveying real property that are permitted by law and have the effect of postponing enjoyment of an interest in real property until after the death of the owner. This section applies only to transfer on death deeds and does not invalidate any deed that is otherwise effective by law to convey title to the interest and estates provided in the deed.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 30.]

IC 32-17-14-12 (a) A deed of gift, bill of sale, or other writing intended....

(a) A deed of gift, bill of sale, or other writing intended to transfer an interest in tangible personal property is effective on the death of the owner and transfers ownership to the designated transferee beneficiary if the document:

(1) expressly creates ownership in beneficiary form;

(2) is in other respects sufficient to transfer the type of property involved; and

(3) is executed by the owner and acknowledged before a notary public or other person authorized to administer oaths.

(b) A beneficiary transfer document described in this section is not required to be supported by consideration or delivered to the transferee beneficiary.

(c) This section does not preclude other methods of transferring ownership of tangible personal property that are permitted by law and have the effect of postponing enjoyment of the property until after the death of the owner.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-13 (a) A transferor of property, with or without....

(a) A transferor of property, with or without consideration, may execute a written instrument directly transferring the property to a transferee to hold as owner in beneficiary form.

(b) A transferee under an instrument described in subsection (a) is considered the owner of the property for all purposes and has all the rights to the property provided by law to the owner of the property, including the right to revoke or change the beneficiary designation.

(c) A direct transfer of property to a transferee to hold as owner in beneficiary form is effective when the written instrument perfecting the transfer becomes effective to make the transferee the owner.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-14 (a) Property may be held or registered in beneficiary form....

(a) Property may be held or registered in beneficiary form by including in the name in which the property is held or registered a direction to transfer the property on the death of the owner to a beneficiary designated by the owner.

(b) Property is registered in beneficiary form by showing on the account record, security certificate, or instrument evidencing ownership of the property:

(1) the name of the owner and, if applicable, the estate by which two (2) or more joint owners hold the property; and

(2) an instruction substantially similar in form to "transfer on death to (insert name of beneficiary)".

An instruction to "pay on death to (insert name of the beneficiary)" and the use of the abbreviations "TOD" and "POD" are also permitted by this section.

(c) Only a transferring entity or a person authorized by the transferring entity may place a transfer on death direction described by this section on an account record, a security certificate, or an instrument evidencing ownership of property.

(d) A transfer on death direction described by this section is effective on the death of the owner and transfers the owner's interest in the property to the designated beneficiary if:

(1) the property is registered in beneficiary form before the death of the owner; or

(2) the transfer on death direction is delivered to the transferring entity before the owner's death.

(e) An account record, security certificate, or instrument evidencing ownership of property that contains a transfer on death direction written as part of the name in which the property is held or registered is conclusive evidence, in the absence of fraud, duress, undue influence, lack of capacity, or mistake, that the direction was:

(1) regularly made by the owner;

(2) accepted by the transferring entity; and

(3) not revoked or changed before the owner's death.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 31.]

IC 32-17-14-15 (a) Before the death of the owner, a beneficiary has no....

(a) Before the death of the owner, a beneficiary has no rights in the property because of the beneficiary designation. The signature or agreement of the beneficiary is not required for any transaction relating to property transferred under this chapter. If a lienholder takes action to enforce a lien, by foreclosure or otherwise through a court proceeding, it is not necessary to join the beneficiary as a party defendant in the action unless the beneficiary has another interest in the real property that has vested.

(b) On the death of one (1) of two (2) or more joint owners, property with respect to which a beneficiary designation has been made belongs to the surviving joint owner or owners. If at least two (2) joint owners survive, the right of survivorship continues as between the surviving owners.

(c) On the death of a tenant by the entireties, property with respect to which a beneficiary designation has been made belongs to the surviving tenant.

(d) On the death of the owner, property with respect to which a beneficiary designation has been made passes by operation of law to the beneficiary.

(e) If two (2) or more beneficiaries survive, there is no right of survivorship among the beneficiaries when the death of a beneficiary occurs after the death of the owner unless the beneficiary designation expressly provides for survivorship among the beneficiaries. Except as expressly provided otherwise, the surviving beneficiaries hold their separate interest in the property as tenants in common. The share of any beneficiary who dies after the owner dies belongs to the deceased beneficiary's estate.

(f) If no beneficiary survives the owner, the property belongs to the estate of the owner unless the beneficiary designation directs the transfer to a substitute beneficiary in the manner required by section 22 of this chapter.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-16 (a) A beneficiary designation may be revoked or changed....

(a) A beneficiary designation may be revoked or changed during the lifetime of the owner.

(b) A revocation or change of a beneficiary designation involving property owned as tenants by the entirety must be made with the agreement of both tenants for so long as both tenants are alive. After an individual dies owning as a tenant by the entirety property that is subject to a beneficiary designation, the individual's surviving spouse may revoke or change the beneficiary designation.

(c) A revocation or change of a beneficiary designation involving property owned in a form of ownership (other than as tenants by the entirety) that restricts conveyance of the interest unless another person joins in the conveyance must be made with the agreement of each living owner required to join in a conveyance.

(d) A revocation or change of a beneficiary designation involving property owned by joint owners with a right of survivorship must be made with the agreement of each living owner.

(e) A subsequent beneficiary designation revokes a prior beneficiary designation unless the subsequent beneficiary designation expressly provides otherwise.

(f) A revocation or change in a beneficiary designation must comply with the terms of any governing instrument, this chapter, and any other applicable law.

(g) A beneficiary designation may not be revoked or changed by a will or trust unless the beneficiary designation expressly grants the owner the right to revoke or change the beneficiary designation by a will or trust.

(h) A transfer during the owner's lifetime of the owner's interest in the property, with or without consideration, terminates the beneficiary designation with respect to the property transferred.

(i) The effective date of a revocation or change in a beneficiary designation is determined in the same manner as the effective date of a beneficiary designation.

(j) An owner may revoke a beneficiary designation made in a transfer on death deed by executing and recording before the death of the owner with the recorder of deeds in the county in which the real property is situated either:

(1) a subsequent deed of conveyance revoking, omitting, or changing the beneficiary designation; or

(2) an affidavit acknowledged or proved under IC 32-21-2-3 that revokes or changes the beneficiary designation.

(k) A physical act, such as a written modification on or the destruction of a transfer on death deed after the transfer on death deed has been recorded, has no effect on the beneficiary designation.

(l) A transfer on death deed may not be revoked or modified by will or trust.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 32.]

IC 32-17-14-17 (a) An attorney in fact, guardian, conservator, or other....

(a) An attorney in fact, guardian, conservator, or other agent acting on the behalf of the owner of property may make, revoke, or change a beneficiary designation if:

(1) the action complies with the terms of this chapter and any other applicable law; and

(2) the action is not expressly forbidden by the document establishing the agent's right to act on behalf of the owner.

(b) An attorney in fact, guardian, conservator, or other agent may withdraw, sell, pledge, or otherwise transfer property that is subject to a beneficiary designation notwithstanding the fact that the effect of the transaction may be to extinguish a beneficiary's right to receive a transfer of the property at the death of the owner.

(c) The rights of a beneficiary to any part of property that is subject to a beneficiary designation after the death of the owner are determined under IC 29-3-8-6.5 if:

(1) a guardian or conservator takes possession of the property;

(2) the guardian sells, transfers, encumbers, or consumes the property during the protected person's lifetime; and

(3) the owner subsequently dies.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-18 If property subject to a beneficiary designation is lost,....

If property subject to a beneficiary designation is lost, destroyed, damaged, or involuntarily converted during the owner's lifetime, the beneficiary succeeds to any right with respect to the loss, destruction, damage, or involuntary conversion that the owner would have had if the owner had survived. However, the beneficiary has no interest in any payment or substitute property received by the owner during the owner's lifetime.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-19 (a) A beneficiary of a transfer on death transfer takes the....

(a) A beneficiary of a transfer on death transfer takes the owner's interest in the property at the death of the owner subject to all conveyances, assignments, contracts, set offs, licenses, easements, liens, and security interests made by the owner or to which the owner was subject during the owner's lifetime.

(b) A beneficiary of a transfer on death transfer of an account with a bank, savings and loan association, credit union, broker, or mutual fund takes the owner's interest in the property at the death of the owner subject to all requests for payment of money issued by the owner before the owner's death, whether paid by the transferring entity before or after the owner's death, or unpaid. The beneficiary is liable to the payee of an unsatisfied request for payment to the extent that the request represents an obligation that was enforceable against the owner during the owner's lifetime.

(c) Each beneficiary's liability with respect to an unsatisfied request for payment is limited to the same proportionate share of the request for payment as the beneficiary's proportionate share of the account under the beneficiary designation. Each beneficiary has the right of contribution from the other beneficiaries with respect to a request for payment that is satisfied after the owner's death, to the extent that the request for payment would have been enforceable by the payee during the owner's lifetime.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-20 An individual who is a beneficiary of a transfer on death....

An individual who is a beneficiary of a transfer on death transfer is not entitled to a transfer unless the individual:

(1) survives the owner; and

c (2) survives the owner by the time, if any, required by the terms of the beneficiary designation.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-21 (a) A trustee of a trust may be a designated beneficiary....

(a) A trustee of a trust may be a designated beneficiary regardless of whether the trust is amendable, revocable, irrevocable, funded, unfunded, or amended after the designation is made.

(b) Unless a beneficiary designation provides otherwise, a trust that is revoked or terminated before the death of the owner is considered nonexistent at the owner's death.

(c) Unless a beneficiary designation provides otherwise, a legal entity or trust that does not:

(1) exist; or

(2) come into existence effective as of the owner's death; is considered nonexistent at the owner's death.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-22 (a) Notwithstanding sections 9 and 20 of this chapter, a....

(a) Notwithstanding sections 9 and 20 of this chapter, a designated beneficiary's rights under this chapter are not extinguished when the designated beneficiary does not survive the owner if:

(1) subsection (b) applies in the case of a designated beneficiary who is a lineal descendant of the owner; or

(2) subsection (d) applies in the case of a designated beneficiary who is not a lineal descendant of the owner.

(b) If a designated beneficiary who is a lineal descendant of the owner:

(1) is deceased at the time the beneficiary designation is made;

(2) does not survive the owner; or

(3) is treated as not surviving the owner; the beneficiary's right to a transfer on death transfer belongs to the beneficiary's lineal descendants per stirpes who survive the owner unless the owner provides otherwise under subsection (c).

(c) An owner may execute a beneficiary designation to which subsection (b) does not apply by:

(1) making the notation "No LDPS" after a beneficiary's name; or

(2) including other words negating an intention to direct the transfer to the lineal descendant substitutes of the nonsurviving beneficiary.

(d) An owner may execute a beneficiary designation that provides that the right to a transfer on death transfer belonging to a beneficiary who is not a lineal descendant of the owner and does not survive the owner belongs to the beneficiary's lineal descendants per stirpes who survive the owner. An owner's intent to direct the transfer to the nonsurviving beneficiary's lineal descendants must be shown by either of the following on the beneficiary designation after the name of the beneficiary:

(1) The words "and lineal descendants per stirpes".

(2) The notation "LDPS".

(e) When two (2) or more individuals receive a transfer on death transfer as substitute beneficiaries under subsection (b) or (d), the individuals are entitled to equal shares of the property if they are of the same degree of kinship to the nonsurviving beneficiary. If the substitute beneficiaries are of unequal degrees of kinship, an individual of a more remote degree is entitled by representation to the share that would otherwise belong to the individual's parent.

(f) If:

(1) a designated beneficiary of a transfer on death transfer does not survive the owner;

(2) either subsection (b) or (d) applies; and

(3) no lineal descendant of the designated beneficiary survives the owner;

the right to receive the property transferred belongs to the other surviving beneficiaries. If no other beneficiary survives the owner, the property belongs to the owner's estate.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-23 (a) If, after an owner makes a beneficiary designation, the.... **Update Notice: This section has been amended by P.L. 36-2011

(a) If, after an owner makes a beneficiary designation, the owner's marriage is dissolved or annulled, any provision of the beneficiary designation in favor of the owner's former spouse is revoked on the date the marriage is dissolved or annulled. Revocation under this subsection is effective regardless of whether the beneficiary designation refers to the owner's marital status. The beneficiary designation is given effect as if the former spouse had not survived the owner.

(b) Subsection (a) does not apply to a provision of a beneficiary designation that:

(1) has been made irrevocable, or revocable only with the spouse's consent;

(2) is made after the marriage is dissolved or annulled; or

(3) expressly states that the dissolution or annulment of the marriage does not affect the designation of a spouse or a relative of the spouse as a beneficiary.

(c) A provision of a beneficiary designation that is revoked solely by subsection (a) is revived by the owner's remarriage to the former spouse or by a nullification of the dissolution or annulment of the marriage.

(d) This section does not apply to any employee benefit plan governed by the Employee Retirement Income Security Act of 1974.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-24 (a) A beneficiary designation or a revocation of a....

(a) A beneficiary designation or a revocation of a beneficiary designation that is procured by fraud, duress, undue influence, or mistake or because the owner lacked capacity is void.

(b) A beneficiary designation made under this chapter is subject to IC 29-1-2-12.1.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-25 (a) An election under IC 29-1-3-1 does not apply to a.... **Update Notice: This section has been amended by P.L. 36-2011

(a) An election under IC 29-1-3-1 does not apply to a valid transfer on death transfer. In accordance with IC 32-17-13, a transfer on death transfer may be subject to the payment of the surviving spouse and family allowances under IC 29-1-4-1.

(b) A beneficiary designation designating the children of the owner or children of any other person as a class and not by name includes all children of the person regardless of whether the child is born or adopted before or after the beneficiary designation is made.

(c) Except as provided in subsection (d), a child of the owner born or adopted after the owner makes a beneficiary designation that names another child of the owner as the beneficiary is entitled to receive a fractional share of the property that would otherwise be transferred to the named beneficiary. The share of the property to which each child of the owner is entitled to receive is expressed as a fraction in which the numerator is one (1) and the denominator is the total number of the owner's children.

(d) A beneficiary designation or a governing instrument may provide that subsection (c) does not apply to an owner's beneficiary designation. In addition, a transferring entity is not obligated to apply subsection (c) to property registered in beneficiary form.

(e) If a beneficiary designation does not name any child of the owner as the designated beneficiary with respect to a particular property interest, a child of the owner born or adopted after the owner makes the beneficiary designation is not entitled to any share of the property interest subject to the designation.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 33.]

IC 32-17-14-26 (a) If an agreement between the owner and a transferring.... **Update Notice: This section has been amended by P.L. 36-2011

(a) If an agreement between the owner and a transferring entity is required to carry out a transfer on death transfer as described in section 7 of this chapter, a transferring entity may not adopt rules for the making, execution, acceptance, and revocation of a beneficiary designation that are inconsistent with this chapter. A transferring entity may adopt the rules imposed by subsection (b) in whole or in part by incorporation by reference.

(b) Except as otherwise provided in a beneficiary designation, a governing instrument, or any other applicable law, the following rules apply to a beneficiary designation:

(1) A beneficiary designation or a request for registration of property in beneficiary form must be made in writing, signed by the owner, dated, and, in the case of a transfer on death deed, compliant with all requirements for the recording of deeds.

(2) A security that is not registered in the name of the owner may be registered in beneficiary form on instructions given by a broker or person delivering the security.

(3) A beneficiary designation may designate one (1) or more primary beneficiaries and one (1) or more contingent beneficiaries.

(4) On property registered in beneficiary form, a primary beneficiary is the person shown immediately following the transfer on death direction. Words indicating that the person is a primary beneficiary are not required. The name of a contingent beneficiary in the registration must have the words "contingent beneficiary" or words of similar meaning to indicate the contingent nature of the interest being transferred.

(5) Multiple surviving beneficiaries share equally in the property being transferred unless a different percentage or fractional share is stated for each beneficiary. If a percentage or fractional share is designated for multiple beneficiaries, the surviving beneficiaries share in the proportion that their designated shares bear to each other.

(6) A transfer of unequal shares to multiple beneficiaries for property registered in beneficiary form may be expressed in numerical form following the name of the beneficiary in the registration.

(7) A transfer on death transfer of property also transfers any interest, rent, royalties, earnings, dividends, or credits earned or declared on the property but not paid or credited before the owner's death.

(8) If a distribution by a transferring entity under a transfer on death transfer results in fractional shares in a security or other property that is not divisible, the transferring entity may distribute the fractional shares in the name of all beneficiaries as tenants in common or as the beneficiaries may direct, or the transferring entity may sell the property that is not divisible and distribute the proceeds to the beneficiaries in the proportions to which they are entitled.

(9) On the death of the owner, the property, minus all amounts and charges owed by the owner to the transferring entity, belongs to the surviving beneficiaries and, in the case of substitute beneficiaries permitted under section 22 of this chapter, the lineal descendants of designated beneficiaries who did not survive the owner are entitled to the property as follows:

(A) If there are multiple primary beneficiaries and a primary beneficiary does not survive the owner and does not have a substitute under section 22 of this chapter, the share of the nonsurviving beneficiary is allocated among the surviving beneficiaries in the proportion that their shares bear to each other.

(B) If there are no surviving primary beneficiaries and there are no substitutes for the nonsurviving primary beneficiaries under section 22 of this chapter, the property belongs to the surviving contingent beneficiaries in equal shares or according to the percentages or fractional shares stated in the registration.

(C) If there are multiple contingent beneficiaries and a contingent beneficiary does not survive the owner and does not have a substitute under section 22 of this chapter, the share of the nonsurviving contingent beneficiary is allocated among the surviving contingent beneficiaries in the proportion that their shares bear to each other.

(10) If a trustee designated as a beneficiary:

(A) does not survive the owner;

(B) resigns; or

(C) is unable or unwilling to execute the trust as trustee and no successor trustee is appointed in the twelve (12) months following the owner's death;

the transferring entity may make the distribution as if the trust did not survive the owner.

(11) If a trustee is designated as a beneficiary and no affidavit of certification of trust or probated will creating an express trust is presented to the transferring entity within the twelve (12) months after the owner's death, the transferring entity may make the distribution as if the trust did not survive the owner.

(12) If the transferring entity is not presented evidence during the twelve (12) months after the owner's death that there are lineal descendants of a nonsurviving beneficiary for whom LDPS distribution applies who survived the owner, the transferring entity may make the transfer as if the nonsurviving beneficiary's descendants also failed to survive the owner.

(13) If a beneficiary cannot be located at the time the transfer is made to located beneficiaries, the transferring entity shall hold the missing beneficiary's share. If the missing beneficiary's share is not claimed by the beneficiary or by the beneficiary's personal representative or successor during the twelve (12) months after the owner's death, the transferring entity shall transfer the share as if the beneficiary did not survive the owner.

(14) A transferring entity has no obligation to attempt to locate a missing beneficiary, to pay interest on the share held for a missing beneficiary, or to invest the share in any different property.

(15) Cash, interest, rent, royalties, earnings, or dividends payable to a missing beneficiary may be held by the transferring entity at interest or reinvested by the transferring entity in the account or in a dividend reinvestment account associated with a security held for the missing beneficiary.

(16) If a transferring entity is required to make a transfer on death transfer to a minor or an incapacitated adult, the transfer may be made under the Indiana Uniform Transfers to Minors Act, the Indiana Uniform Custodial Trust Act, or a similar law of another state.

(17) A written request for the execution of a transfer on death transfer may be made by any beneficiary, a beneficiary's legal representative or attorney in fact, or the owner's personal representative.

(18) A transfer under a transfer on death deed occurs automatically upon the owner's death subject to the requirements of subdivision (20) and does not require a request for the execution of the transfer.

(19) A written request for the execution of a transfer on death transfer must be accompanied by the following:

(A) A certificate or instrument evidencing ownership of the contract, account, security, or property.

(B) Proof of the deaths of the owner and any nonsurviving beneficiary.

(C) An inheritance tax waiver from states that require it.

(D) In the case of a request by a legal representative, a copy of the instrument creating the legal authority or a certified copy of the court order appointing the legal representative.

(E) Any other proof of the person's entitlement that the transferring entity may require.

(20) On the death of an owner whose transfer on death deed has been recorded, the beneficiary shall file an affidavit in the office of the recorder of the county in which the real property is located. The affidavit must contain the following:

(A) The legal description of the property.

(B) A certified copy of the death certificate certifying the owner's death.

(C) The name and address of each designated beneficiary who survives the owner or is in existence on the date of the owner's death.

(D) The name of each designated beneficiary who has not survived the owner's death or is not in existence on the date of the owner's death.

(E) A cross-reference to the recorded transfer on death deed.

(c) A beneficiary designation is presumed to be valid. A party may rely on the presumption of validity unless the party has actual knowledge that the beneficiary designation was not validly executed. A person who acts in good faith reliance on a transfer on death deed is immune from liability to the same extent as if the person had dealt directly with the named owner and the named owner had been competent and not incapacitated.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 34.]

IC 32-17-14-27 (a) An owner who makes arrangements for a transfer on....

(a) An owner who makes arrangements for a transfer on death transfer under this chapter gives to the transferring entity the protections provided in this section for executing the owner's beneficiary designation.

(b) A transferring entity may execute a transfer on death transfer with or without a written request for execution.

(c) A transferring entity may rely and act on:

(1) a certified or authenticated copy of a death certificate issued by an official or an agency of the place where the death occurred as showing the fact, place, date, and time of death and the identity of the decedent; and

(2) a certified or authenticated copy of a report or record of any governmental agency that a person is missing, detained, dead, or alive, and the dates, circumstances, and places disclosed by the record or report.

(d) A transferring entity has no duty to verify the information contained within a written request for the execution of a beneficiary designation. The transferring entity may rely and act on a request made by a beneficiary or a beneficiary's attorney in fact, guardian, conservator, or other agent.

(e) A transferring entity has no duty to:

(1) except as provided in subsection (g), give notice to any person of the date, manner, and persons to whom a transfer will be made under beneficiary designation;

(2) attempt to locate any beneficiary or lineal descendant substitute;

(3) determine whether a nonsurviving beneficiary or descendant had a lineal descendant who survived the owner;

(4) locate a trustee or custodian;

(5) obtain the appointment of a successor trustee or custodian;

(6) discover the existence of a trust instrument or will that creates an express trust; or

(7) determine any fact or law that would:

(A) cause the beneficiary designation to be revoked in whole or in part as to any person because of a change in marital status or other reason; or

(B) cause a variation in the distribution provided in the beneficiary designation.

(f) A transferring entity has no duty to withhold making a transfer based on knowledge of any fact or claim adverse to the transfer to be made unless before making the transfer the transferring entity receives a written notice that:

(1) in manner, place, and time affords a reasonable opportunity to act on the notice before making the transfer; and

(2) does the following:

(A) Asserts a claim of beneficial interest in the transfer adverse to the transfer to be made.

(B) Gives the name of the claimant and an address for communications directed to the claimant.

(C) Identifies the deceased owner.

(D) States the nature of the claim as it affects the transfer.

(g) If a transferring entity receives a timely notice meeting the requirements of subsection (f), the transferring entity may discharge any duty to the claimant by sending a notice by certified mail to the claimant at the address provided by the claimant's notice of claim. The notice must advise the claimant that a transfer to the claimant's asserted claim will be made at least forty-five (45) days after the date of the mailing unless the transfer is restrained by a court order. If the transferring entity mails the notice described by this subsection to the claimant, the transferring entity shall withhold making the transfer for at least forty-five (45) days after the date of the mailing. Unless the transfer is restrained by court order, the transferring entity may make the transfer at least forty-five (45) days after the date of the mailing.

(h) Neither notice that does not comply with the requirements of subsection (f) nor any other information shown to have been available to a transferring entity, its transfer agent, or its employees affects the transferring entity's right to the protections provided by this chapter.

(i) A transferring entity is not responsible for the application or use of property transferred to a fiduciary entitled to receive the property.

(j) Notwithstanding the protections provided a transferring entity by this chapter, a transferring entity may require parties engaged in a dispute over the propriety of a transfer to:

(1) adjudicate their respective rights; or

(2) furnish an indemnity bond protecting the transferring entity.

(k) A transfer by a transferring entity made in accordance with this chapter and under the beneficiary designation in good faith and reliance on information the transferring entity reasonably believes to be accurate discharges the transferring entity from all claims for the amounts paid and the property transferred.

(l) All protections provided by this chapter to a transferring entity are in addition to the protections provided by any other applicable Indiana law.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-28 (a) The protections provided to a transferring entity or to....

(a) The protections provided to a transferring entity or to a purchaser or lender for value by this chapter do not affect the rights of beneficiaries or others involved in disputes that:

(1) are with parties other than a transferring entity or purchaser or lender for value; and

(2) concern the ownership of property transferred under this chapter.

(b) Unless the payment or transfer can no longer be challenged because of adjudication, estoppel, or limitations, a transferee of money or property under a transfer on death transfer that was improperly distributed or paid is liable for:

(1) the return of the money or property, including income earned on the money or property, to the transferring entity; or

(2) the delivery of the money or property, including income earned on the money or property, to the rightful transferee.

In addition, the transferee is liable for the amount of attorney's fees and costs incurred by the rightful transferee in bringing the action in court.

(c) If a transferee of money or property under a transfer on death transfer that was improperly distributed or paid does not have the property, the transferee is liable for an amount equal to the sum of:

(1) the value of the property as of the date of the disposition;

(2) the income and gain that the transferee received from the property and its proceeds; and

(3) the amount of attorney's fees and costs incurred by the rightful transferee in bringing the action in court.

(d) If a transferee of money or property under a transfer on death transfer that was improperly distributed or paid encumbers the property, the transferee:

(1) shall satisfy the debt incurred in an amount sufficient to release any security interest, lien, or other encumbrance on the property; and

(2) is liable for the amount of attorney's fees and costs incurred by the rightful transferee in bringing the action in court.

(e) A purchaser for value of property or a lender who acquires a security interest in the property from a beneficiary of a transfer on death transfer:

(1) in good faith; or

(2) without actual knowledge that:

(A) the transfer was improper; or

(B) information in an affidavit provided under section 26(b)(20) of this chapter was not true;

takes the property free of any claims of or liability to the owner's estate, creditors of the owner's estate, persons claiming rights as beneficiaries of the transfer on death transfer, or heirs of the owner's estate. A purchaser or lender for value has no duty to verify sworn information relating to the transfer on death transfer.

(f) The protection provided by subsection (e) applies to information that relates to the beneficiary's ownership interest in the property and the beneficiary's right to sell, encumber, and transfer good title to a purchaser or lender but does not relieve a purchaser or lender from the notice provided by instruments of record with respect to the property.

(g) A transfer on death transfer that is improper under section 22, 23, 24, or 25 of this chapter imposes no liability on the transferring entity if the transfer is made in good faith. The remedy of a rightful transferee must be obtained in an action against the improper transferee.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 35.]

IC 32-17-14-29 (a) This chapter does not limit the rights of an owner's....

(a) This chapter does not limit the rights of an owner's creditors against beneficiaries and other transferees that may be available under any other applicable Indiana law.

(b) The liability of a beneficiary for creditor claims and statutory allowances is determined under IC 32-17-13.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-30 Except as otherwise provided by law, a transfer on death....

Except as otherwise provided by law, a transfer on death transfer and the obligation of a transferring entity to execute the transfer on death transfer that are subject to this chapter under section 2(b) of this chapter remain subject to this chapter notwithstanding a change in the:

(1) beneficiary designation;

(2) residency of the owner;

(3) residency or place of business of the transferring entity; or

(4) location of the property.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-31 (a) The probate court shall hear and determine questions....

(a) The probate court shall hear and determine questions and issue appropriate orders concerning the determination of the beneficiary who is entitled to receive a transfer on death transfer and the proper share of each beneficiary.

(b) The probate court shall hear and determine questions and issue appropriate orders concerning any action to:

(1) obtain the distribution of any money or property from a transferring entity; or

(2) with respect to money or property that was improperly distributed to any person, obtain the return of:

(A) any money or property and income earned on the money or property; or

(B) an amount equal to the sum of the value of the money or property plus income and gain realized from the money or property.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-32 (a) Except for transfer on death deeds, a beneficiary....

(a) Except for transfer on death deeds, a beneficiary designation that purports to have been made and is valid under:

(1) the Uniform Probate Code as enacted by another state;

(2) the Uniform TOD Security Registration Law as enacted by another state; or

(3) a similar law of another state; is governed by the law of that state.

(b) A transfer on death transfer subject to a law described in subsection (a) may be executed and enforced in Indiana.

(c) Except for transfer on death deeds, the meaning and legal effect of a transfer on death transfer is determined by the law of the state selected in a governing instrument or beneficiary designation.

[As added by P.L. 143-2009, SEC. 41.]

Indiana Code

Title 32. Property

Article 17. Interests in Property

Chapter 14. Transfer on Death Property Act

IC 32-17-14-0.2. The addition of IC 32-4-1.6 ("Uniform Act on Transfer.... **Update Notice: This section has been added by P.L. 220-2011

[EDITORS' NOTE: SECTION ADDED BY CURRENT LEGISLATION. PLEASE FOLLOW THE LINK ABOVE TO VIEW THE ACT.]

IC 32-17-14-1 This chapter may be cited as the Transfer on Death....

This chapter may be cited as the Transfer on Death Property Act.

[As added by P.L. 143-2009, SEC. 41.]

IC 32-17-14-2 (a) Except as provided elsewhere in this chapter, this....

(a) Except as provided elsewhere in this chapter, this chapter applies to a transfer on death security, transfer on death securities account, and pay on death account created before July 1, 2009, unless the application of this chapter would:

(1) adversely affect a right given to an owner or beneficiary;

(2) give a right to any owner or beneficiary that the owner or beneficiary was not intended to have when the transfer on death security, transfer on death securities account, or pay on death account was created;

(3) impose a duty or liability on any person that was not intended to be imposed when the transfer on death security, transfer on death securities account, or pay on death account was created; or

(4) relieve any person from any duty or liability imposed:

(A) by the terms of the transfer on death security, transfer on death securities account, or pay on death account; or

(B) under prior law.

(b) Subject to section 32 of this chapter, this chapter applies to a transfer on death transfer if at the time the owner designated the beneficiary:

(1) the owner was a resident of Indiana;

(2) the property subject to the beneficiary designation was situated in Indiana;

(3) the obligation to pay or deliver arose in Indiana;

(4) the transferring entity was a resident of Indiana or had a place of business in Indiana; or

(5) the transferring entity's obligation to make the transfer was accepted in Indiana.

(c) This chapter does not apply to property, money, or benefits paid or transferred at death under a life or accidental death insurance policy, annuity, contract, plan, or other product sold or issued by a life insurance company unless the provisions of this chapter are incorporated into the policy or beneficiary designation in whole or in part by express reference.

(d) This chapter does not apply to a transfer on death transfer if the beneficiary designation or an applicable law expressly provides that this chapter does not apply to the transfer.

(e) Subject to IC 9-17-3-9(h) and IC 9-31-2-30(h), this chapter applies to a beneficiary designation for the transfer on death of a motor vehicle or a watercraft.

(f) The provisions of:

(1) section 22 of this chapter; and

(2) section 26(b)(9) of this chapter; relating to distributions to lineal descendants per stirpes apply to a transfer on death or payable on death transfer created before July 1, 2009.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 25.]

IC 32-17-14-2.5 This chapter does not apply to property, money, or benefits.... **Update Notice: This section has been added by P.L. 36-2011

[EDITORS' NOTE: SECTION ADDED BY CURRENT LEGISLATION. PLEASE FOLLOW THE LINK ABOVE TO VIEW THE ACT.]

IC 32-17-14-3 The following definitions apply throughout this chapter: **Update Notice: This section has been amended by P.L. 36-2011

The following definitions apply throughout this chapter:

(1) "Beneficiary" means a person designated or entitled to receive property because of another person's death under a transfer on death transfer.

(2) "Beneficiary designation" means a written instrument other than a will or trust that designates the beneficiary of a transfer on death transfer.

(3) "Governing instrument" refers to a written instrument agreed to by an owner that establishes the terms and conditions of an ownership in beneficiary form.

(4) "Joint owners" refers to persons who hold property as joint tenants with a right of survivorship. However, the term does not include a husband and wife who hold property as tenants by the entirety.

(5) "LDPS" means an abbreviation of lineal descendants per stirpes, which may be used in a beneficiary designation to designate a substitute beneficiary as provided in section 22 of this chapter.

(6) "Owner" refers to a person or persons who have a right to designate the beneficiary of a transfer on death transfer.

(7) "Ownership in beneficiary form" means holding property under a registration in beneficiary form or other written instrument that:

(A) names the owner of the property;

(B) directs ownership of the property to be transferred upon the death of the owner to the designated beneficiary; and

(C) designates the beneficiary.

(8) "Person" means an individual, a sole proprietorship, a partnership, an association, a fiduciary, a trustee, a corporation, a limited liability company, or any other business entity.

(9) "Proof of death" means a death certificate or a record or report that is prima facie proof or evidence of an individual's death.

(10) "Property" means any present or future interest in real property, intangible personal property (as defined in IC 6-4.1-1-5), or tangible personal property (as defined in IC 6-4.1-1-13). The term includes:

(A) a right to direct or receive payment of a debt;

(B) a right to direct or receive payment of money or other benefits due under a contract, account agreement, deposit agreement, employment contract, compensation plan, pension plan, individual retirement plan, employee benefit plan, or trust or by operation of law;

(C) a right to receive performance remaining due under a contract;

(D) a right to receive payment under a promissory note or a debt maintained in a written account record;

(E) rights under a certificated or uncertificated security;

(F) rights under an instrument evidencing ownership of property issued by a governmental agency; and

(G) rights under a document of title (as defined in IC 26-1-1-201).

(11) "Registration in beneficiary form" means titling of an account record, certificate, or other written instrument that:

(A) provides evidence of ownership of property in the name of the owner;

(B) directs ownership of the property to be transferred upon the death of the owner to the designated beneficiary; and

(C) designates the beneficiary.

(12) "Security" means a share, participation, or other interest in property, in a business, or in an obligation of an enterprise or other issuer. The term includes a certificated security, an uncertificated security, and a security account.

(13) "Transfer on death deed" means a deed that conveys an interest in real property to a grantee by beneficiary designation.

(14) "Transfer on death transfer" refers to a transfer of property that takes effect upon the death of the owner under a beneficiary designation made under this chapter.

(15) "Transferring entity" means a person who:

(A) owes a debt or is obligated to pay money or benefits;

(B) renders contract performance;

(C) delivers or conveys property; or

(D) changes the record of ownership of property on the books, records, and accounts of an enterprise or on a certificate or document of title that evidences property rights.

The term includes a governmental agency, business entity, or transfer agent that issues certificates of ownership or title to property and a person acting as a custodial agent for an owner's property. However, the term does not include a governmental office charged with endorsing, entering, or recording the transfer of real property in the public records.

[As added by P.L. 143-2009, SEC. 41. Amended by P.L. 6-2010, SEC. 26.]

IC 32-17-14-4 (a) The following transfers of ownership are not....

(a) The following transfers of ownership are not considered transfer on death transfers for purposes of this chapter:

(1) Transfers by rights of survivorship in property held as joint tenants or tenants by the entirety.

(2) A transfer to a remainderman on the termination of a life tenancy.

(3) An inter vivos or a testamentary transfer under a trust established by an individual.

(4) A transfer made under the exercise or nonexercise of a power of appointment.

(5) A transfer made on the death of a person who did not have the right to designate the person's estate as the beneficiary of the transfer.

(b) A beneficiary designation made under this chapter must do the following:

(1) Designate the beneficiary of a transfer on death transfer.

(2) Make the transfer effective upon the death of the owner of the property being transferred.

(3) Comply with this chapter, the conditions of any governing instrument, and any other applicable law.