An Assignment of Mortgage is a legal document used to transfer the rights and obligations of a mortgage from one party to another. This document is used when a borrower sells the property securing the loan to a third party, and the original lender must be repaid. It is also used when a lender sells or transfers a loan to another lender. An Assignment of Mortgage is often referred to as a “mortgage transfer” or “mortgage assignment.” The document assigns the mortgage from the current lender to the new lender. It also includes all the terms and conditions of the mortgage loan, such as the interest rate, principal amount, and due date. It also specifies the legal rights and obligations of both parties as they relate to the mortgage loan. There are two types of Assignment of Mortgage: a voluntary assignment and an involuntary assignment. A voluntary assignment of mortgage occurs when the current lender agrees to transfer the loan to a new lender. An involuntary assignment of mortgage occurs when the current lender is forced to transfer the loan to a new lender due to the borrower’s default.

Assignment of Mortgage

Description

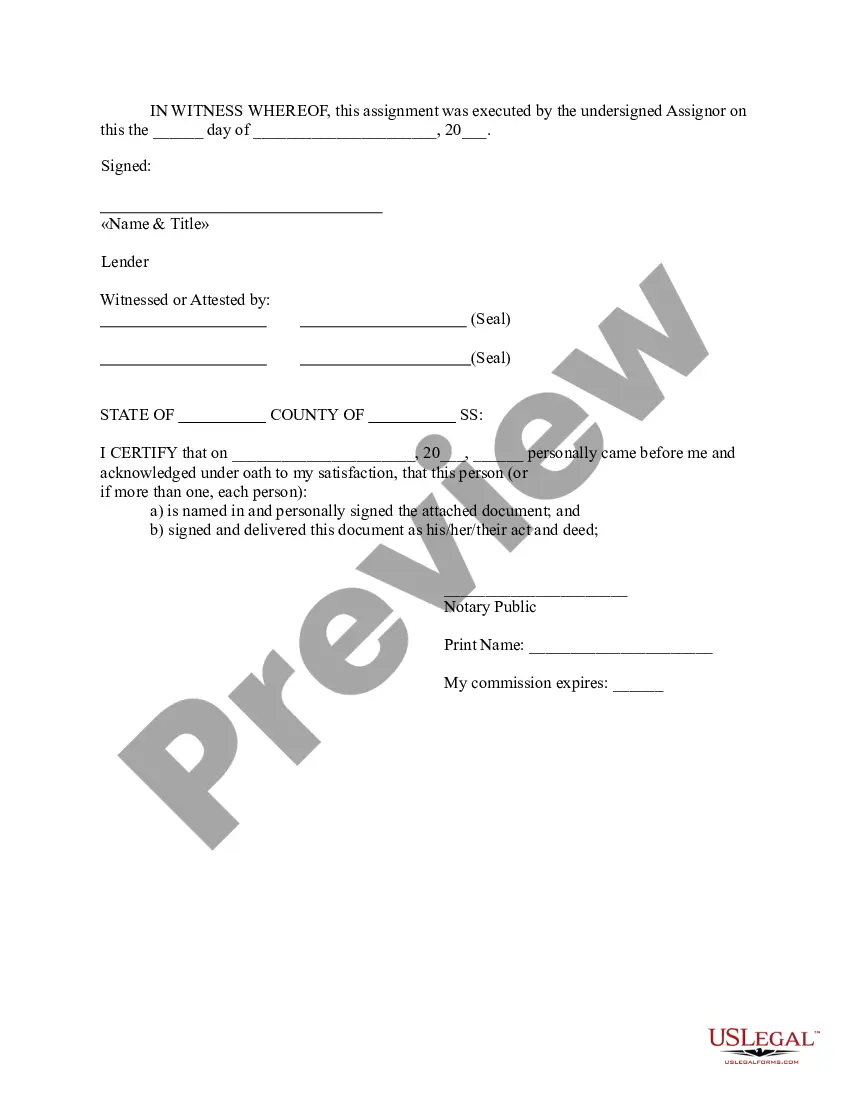

How to fill out Assignment Of Mortgage?

How much time and resources do you normally spend on composing formal documentation? There’s a greater opportunity to get such forms than hiring legal specialists or spending hours browsing the web for an appropriate blank. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, like the Assignment of Mortgage.

To obtain and prepare a suitable Assignment of Mortgage blank, follow these simple instructions:

- Look through the form content to make sure it meets your state requirements. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Assignment of Mortgage. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally safe for that.

- Download your Assignment of Mortgage on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us now!

Form popularity

FAQ

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

If the mortgagee fails to execute and record a Satisfaction of Mortgage within the 60-day period afforded by statute, the mortgagor (property owner) may file suit and seek a court order directing the mortgagee to execute a satisfaction of mortgage or an order extinguishing the lien against the property.

Assignment of Mortgage ? The Basics. When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

Once a loan has been assigned to MERS, it can be bought and sold any number of times later without recording assignments. Don't be surprised if you find out that your mortgage was assigned to MERS at some point. In most cases, the loan will have to be assigned out of MERS' name before a foreclosure can begin.