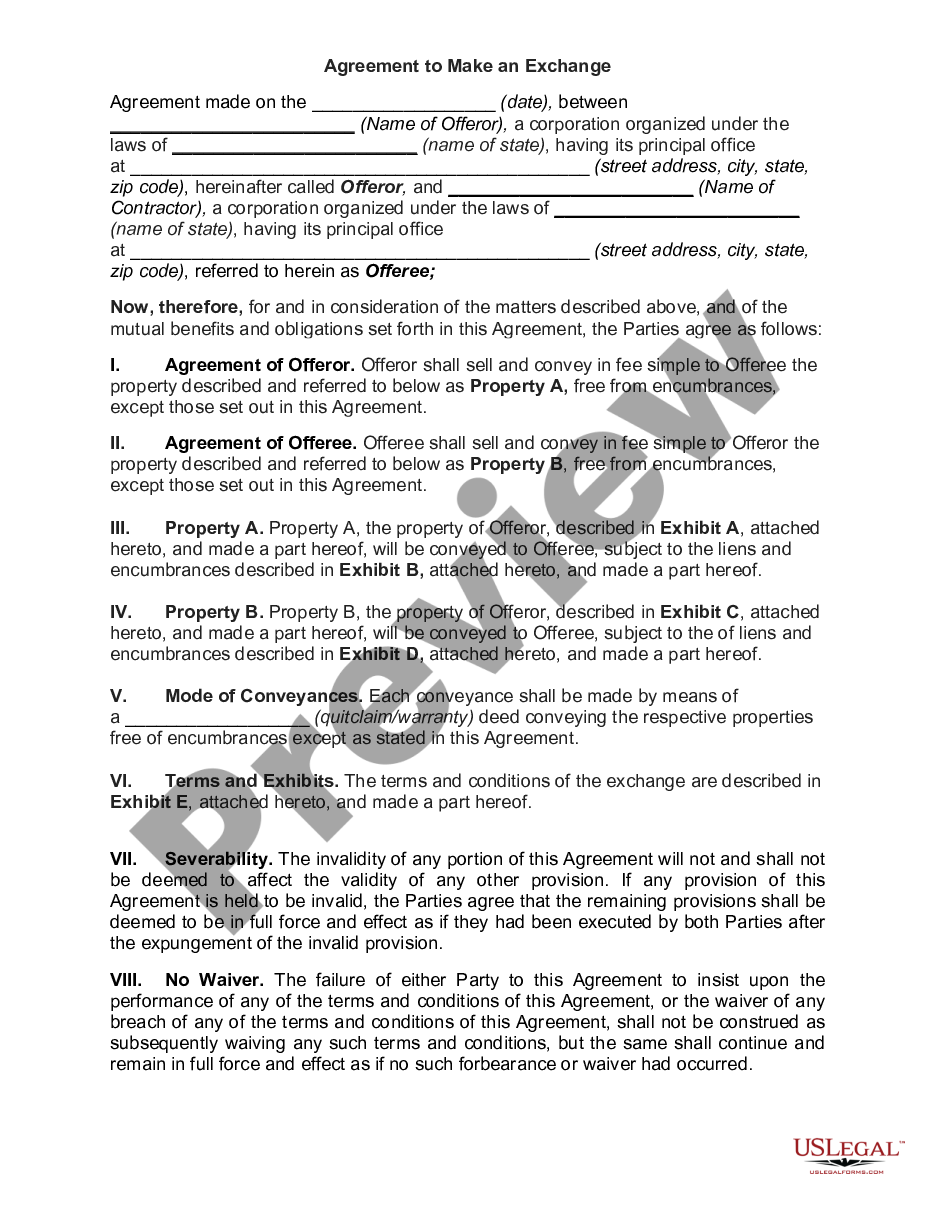

Like Kind Exchange Clauses: Contract for Real Property are contractual clauses which allow for the exchange of real property between two parties without any immediate tax liability. This type of exchange is commonly referred to as a 1031 Exchange, in reference to the section of the Internal Revenue Code that governs it. Like Kind Exchange Clauses: Contract for Real Property can be found in sales contracts, leases, and other agreements that involve the transfer of real property. The clause typically states that the parties agree to exchange the real property in a like-kind exchange, meaning that the properties must be of the same type, such as land, office space, or multifamily dwellings. The clause also typically states that any taxes associated with the exchange must be the responsibility of the parties, and that the exchange must be in compliance with all applicable federal, state, and local laws. There are two main types of Like Kind Exchange Clauses: Contract for Real Property: Simple Exchange and Reverse Exchange. A Simple Exchange is the most common type of 1031 exchange and involves the exchange of real property between two parties. A Reverse Exchange is a more complex form of 1031 exchange that involves the use of a qualified intermediary to facilitate the exchange.

Like Kind Exchange Clauses: Contract for Real Property

Description

How to fill out Like Kind Exchange Clauses: Contract For Real Property?

If you’re searching for a way to properly prepare the Like Kind Exchange Clauses: Contract for Real Property without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every private and business scenario. Every piece of paperwork you find on our web service is created in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Follow these simple guidelines on how to acquire the ready-to-use Like Kind Exchange Clauses: Contract for Real Property:

- Ensure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and select your state from the list to find an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Like Kind Exchange Clauses: Contract for Real Property and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Any real estate, except for one's own personal residence, is considered like-kind to any other real estate. Generally, any real estate property held for productive use in the trade or business or for investment qualifies for a like-kind exchange.

What Properties Are Not Considered Like-Kind? A Primary or Secondary Residence: An Exchanger's primary or secondary residence is not considered like kind and does not qualify for a 1031 exchange.

Property used primarily for personal use, like a primary residence or a second home or vacation home, does not qualify for like-kind exchange treatment. Both properties must be similar enough to qualify as "like-kind." Like-kind property is property of the same nature, character or class.

Securities, stocks, bonds, partnership interests, and other financial assets are excluded from the definition of like-kind property.

The Regulations allow identifying multiple properties. A Taxpayer may identify as many as 3 alternate properties of any value. If more than 3 properties are identified, the value of the 3 cannot exceed 200% of the value of the Relinquished Property unless 95% of the properties identified are acquired.

Under the Tax Cuts and Jobs Act, Section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. An exchange of real property held primarily for sale still does not qualify as a like-kind exchange.

Property used primarily for personal use, like a primary residence or a second home or vacation home, does not qualify for like-kind exchange treatment. Both properties must be similar enough to qualify as "like-kind." Like-kind property is property of the same nature, character or class.

Like-kind exchanges -- when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or ?like-kind? -- have long been permitted under the Internal Revenue Code.