Sample Letter for Stock Purchase

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Sample Letter For Stock Purchase?

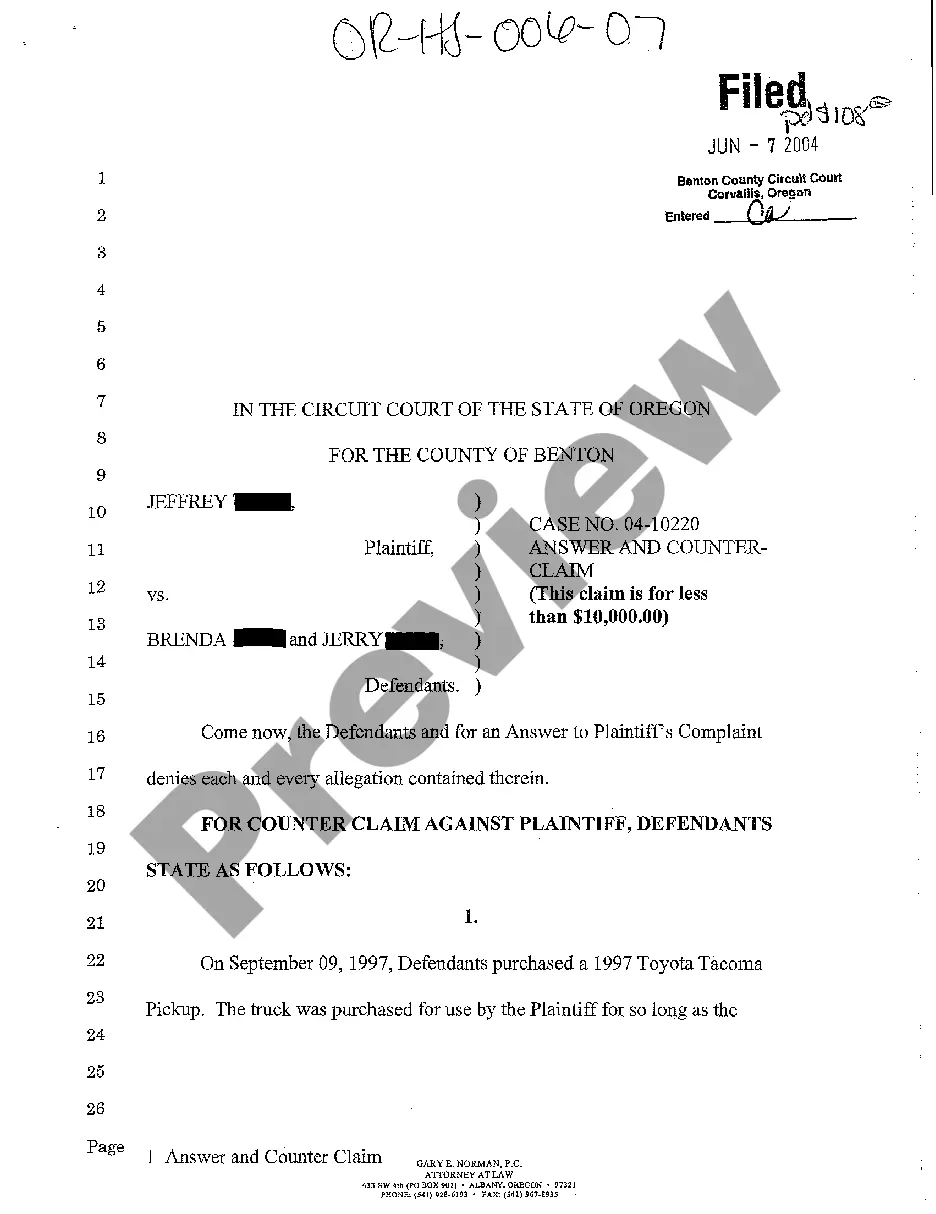

Use US Legal Forms to get a printable Sample Letter for Stock Purchase. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms library on the internet and provides reasonably priced and accurate samples for consumers and lawyers, and SMBs. The templates are grouped into state-based categories and some of them can be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Sample Letter for Stock Purchase:

- Check to ensure that you get the right template with regards to the state it’s needed in.

- Review the document by reading the description and using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Stock Purchase. Over three million users have utilized our service successfully. Select your subscription plan and obtain high-quality documents in a few clicks.

Form popularity

FAQ

Flatter first. Your offer to purchase letter is an emotional pitch. Get to the point. You may have 10 great ideas that you'd like to tell the seller. Paint a picture. Don't remodel the house. Show stability. Show humility. Don't whine. Close your offer to purchase letter with clarity.

Sell the shares back to the company. Sell the shares to another investor. Sell the shares on a private-securities market. Get your company to do an IPO.

A letter of intent (LOI) is a document that someone uses in order to declare their intent to do something, such as make a purchase, apply for a job or education program, or to clarify points in a business transaction. They are written in letter format, and signed by one party (the party writing it).

The full names of the buyer and the seller. The complete address of the property. The agreed-upon purchase price. The agreed-upon earnest deposit. The date of signing the SPA. The terms and conditions that surround the earnest deposit.

A purchase letter of intent is the written intention to purchase products or services from a vendor. The customer will make use of this letter to demonstrate their seriousness as a buyer and their motivation to transact business in the future.

Identify your letter as a letter of intent to sell shares. Define the company and who is meant by "seller" and "buyer." Include contact information for all the parties. Include the postal and registered address of the company, if they're different. Name every shareholder involved in the sale.

Salutation. Begin with a professional salutation. Body Paragraph 1: Introduction. Body Paragraph 2: Highlight Relevant Skills. Body Paragraph 3: Call to Action. Closing. Use the appropriate format. When sending an email, include a clear subject line. Research the company.

You can redeem your mutual fund shares or transfer securities to another financial institution using a letter of instruction. This letter gives your financial institution the authority to sell or transfer shares on your behalf.