This form is a General Warranty Deed where the grantor is an individual and the grantees are three individuals with the right of survivorship.

Texas General Warranty Deed for Individual to Three (3) Individuals as Joint Tenants with Rights of Survivorship

Description

Key Concepts & Definitions

General Warranty Deed: A legal document used in real estate transactions that guarantees the seller holds clear title to the property and has the right to sell it. The document promises the buyer protection against future claims to the property. Quitclaim Deed: Transfers whatever interest the owner has in the property without any warranties. It is often used between known parties, such as family members. Homestead Exemption: A state law, notably in Texas, that protects the value of a home from property taxes and creditors.

Step-by-Step Guide: Transferring Ownership Through a General Warranty Deed

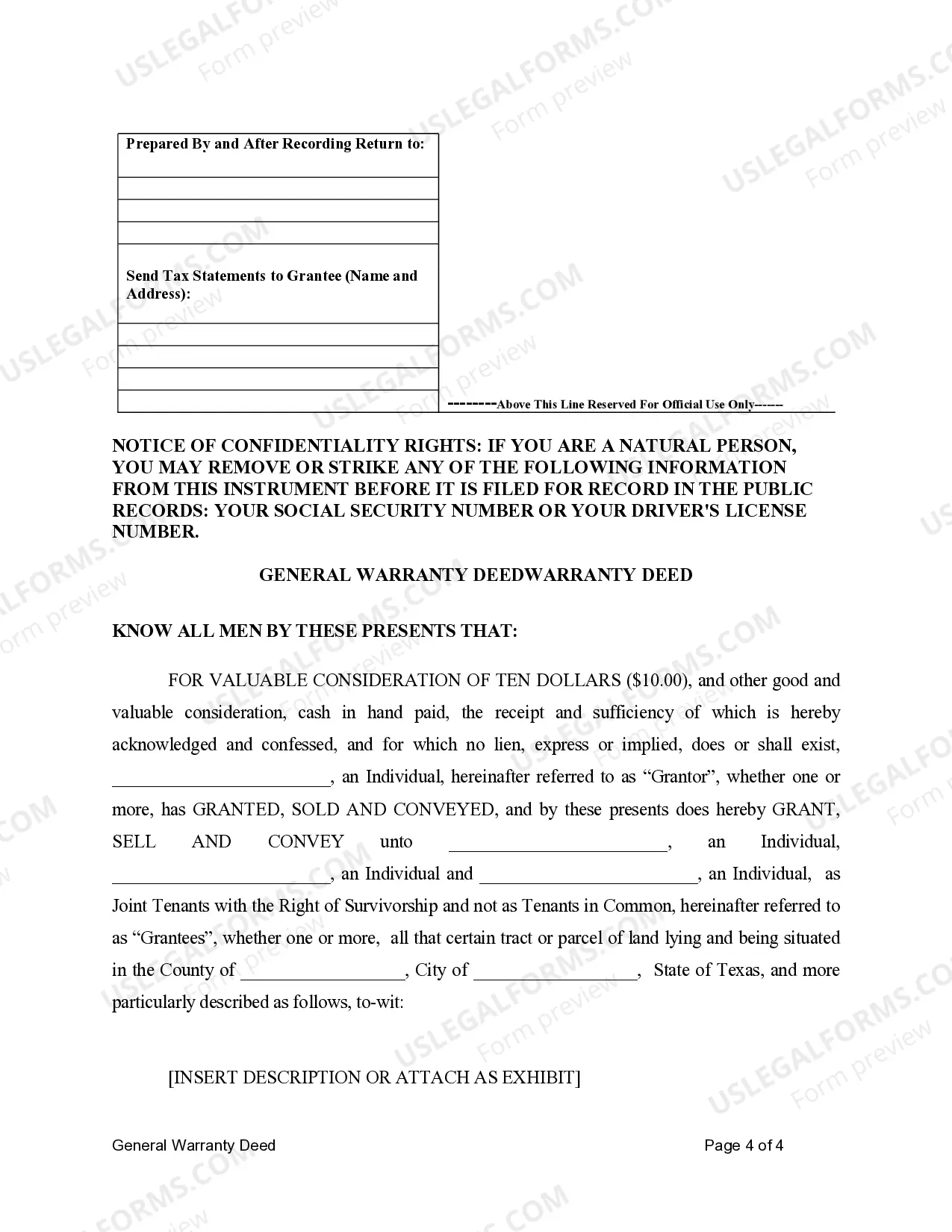

- Identify the Parties: Gather personal information of both the grantor (seller) and the grantees (buyers).

- Prepare the Deed: Engage a real estate lawyer to draft the general warranty deed ensuring it conveys to three individuals effectively.

- Review Financial Considerations: Check if all buyers meet credit score requirements and align with financial planning resources.

- Execution and Notarization: Both parties must sign the deed before a notary public to validate the transfer.

- Record the Deed: File the deed at the local county recorders office to make the transfer public and protect the buyers interests.

Risk Analysis in Real Estate Deeds

- Title Issues: General warranty deeds should ideally protect from future title disputes, but miscommunications or undisclosed liens can pose risks.

- Error in Documentation: Incorrect details can invalidate the deed. Always double-check information and get free legal advice if uncertain.

- Varying State Laws: Understanding warranty deeds requires knowledge of state-specific laws, like homestead exemptions in Texas which can impact the deed's implications.

Comparison Table: General Warranty Deed vs. Quitclaim Deed

| Feature | General Warranty Deed | Quitclaim Deed |

|---|---|---|

| Level of Protection | High - guarantees clear title | None - no warranties provided |

| Usage Scenario | Formal sales, mostly where a clear title needs assurance | Transferring between family or known parties |

| Legal Support | Generally requires a real estate lawyer | Simpler, can sometimes be done without legal help |

Best Practices in Using General Warranty Deeds

- Always consult with a qualified real estate lawyer to avoid common pitfalls and quitclaim deed issues.

- Utilize financial planning resources beforehand to ensure all parties are financially prepared for real estate ownership responsibilities.

- Conduct a thorough title search and possibly purchase title insurance for additional security.

FAQ

What credit score is required to engage in a real estate transaction with a general warranty deed? While there's no fixed credit score to buy real estate, buyers often need good credit (640+) to secure favorable mortgage terms. Can a general warranty deed be challenged? Yes, though rare, if there are undisclosed liens or disputes about boundary lines, it can be challenged.

How to fill out Texas General Warranty Deed For Individual To Three (3) Individuals As Joint Tenants With Rights Of Survivorship?

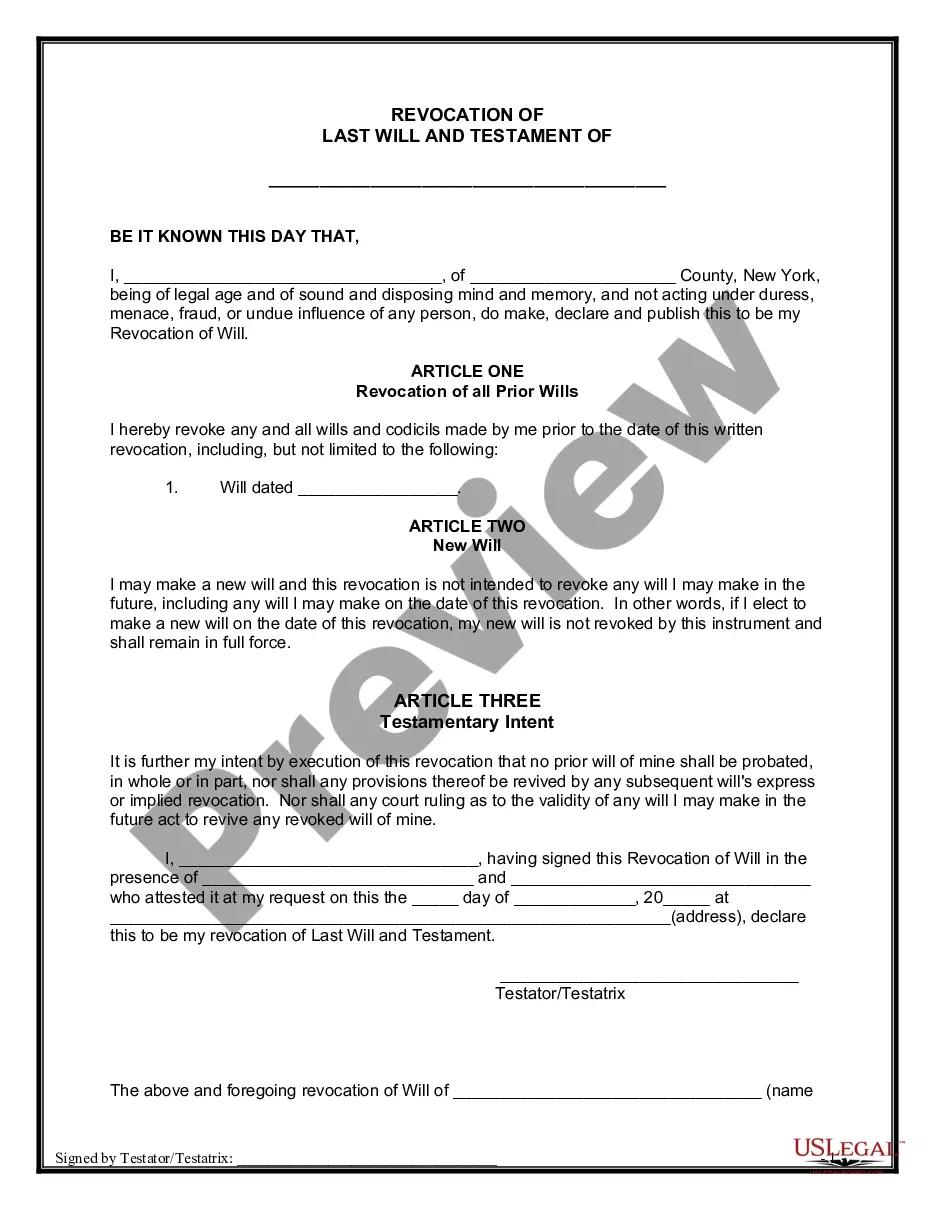

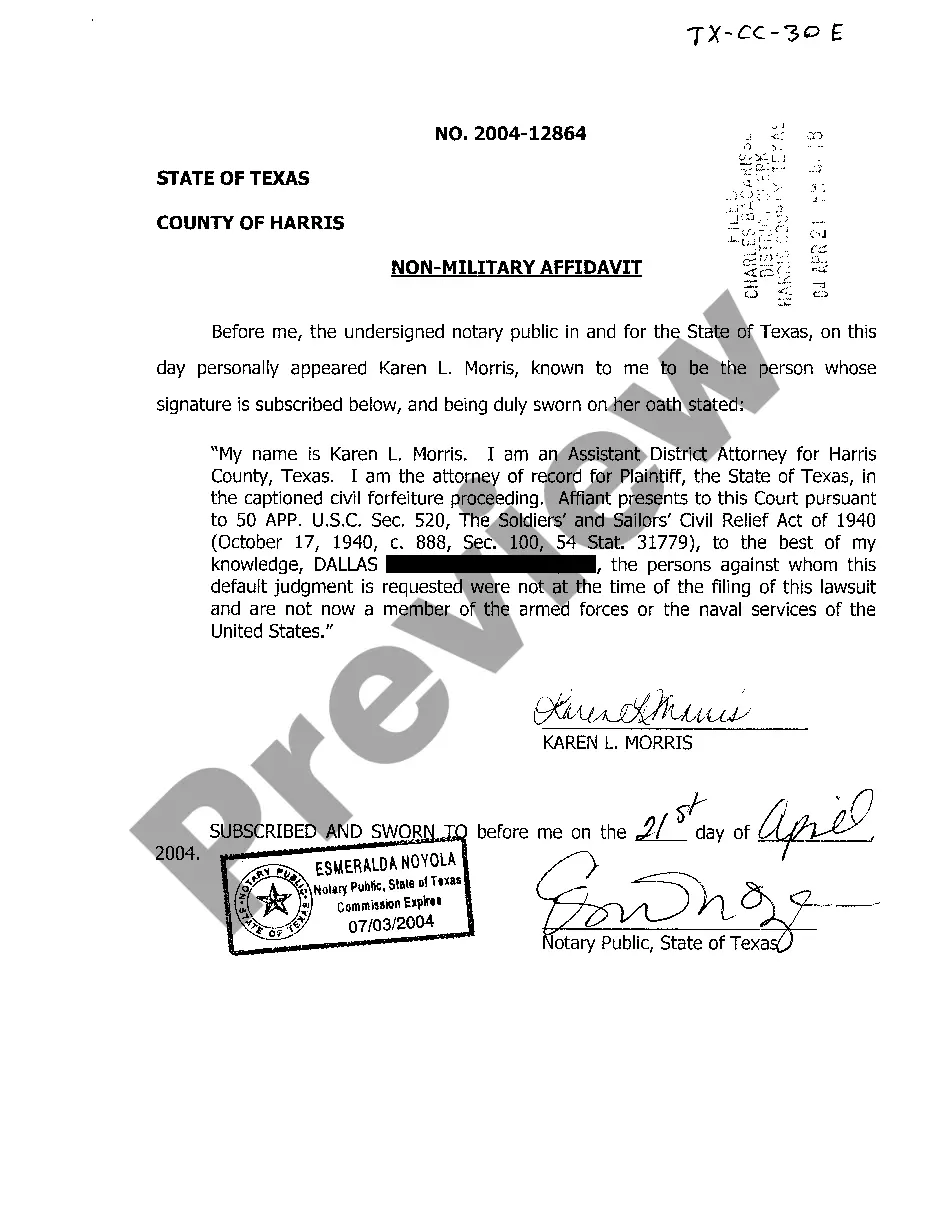

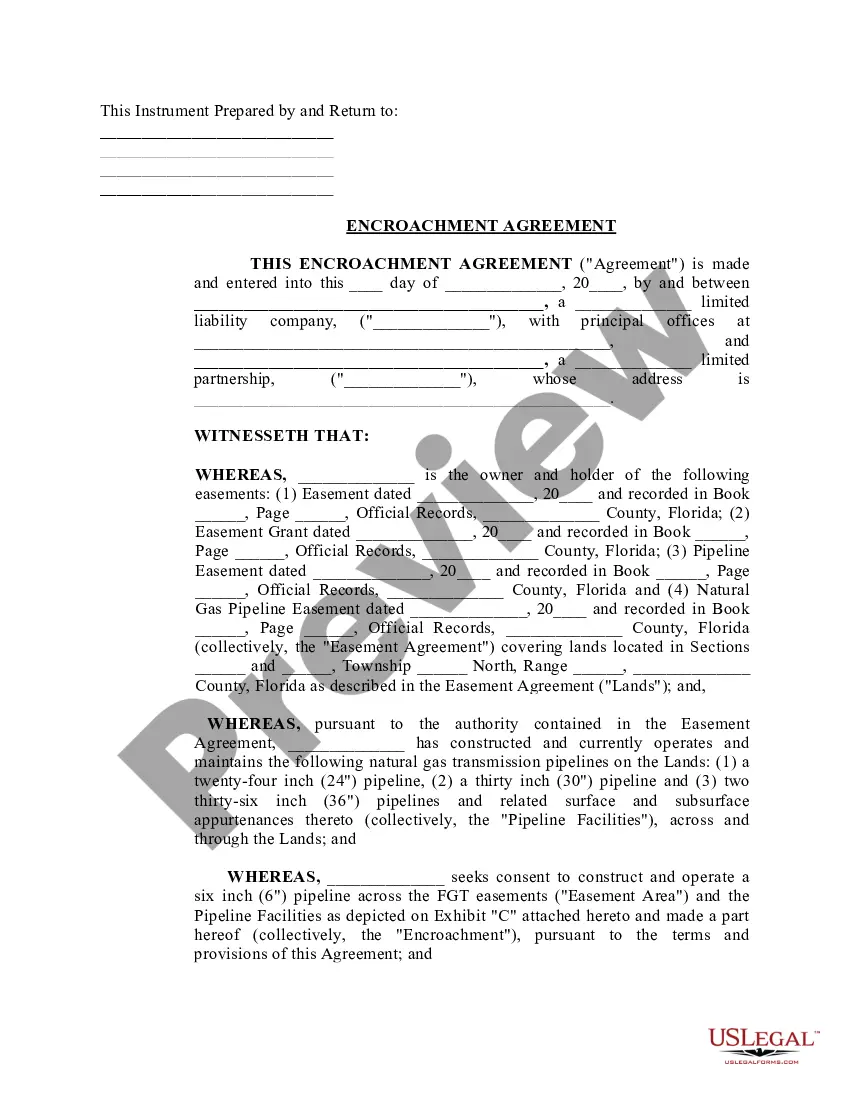

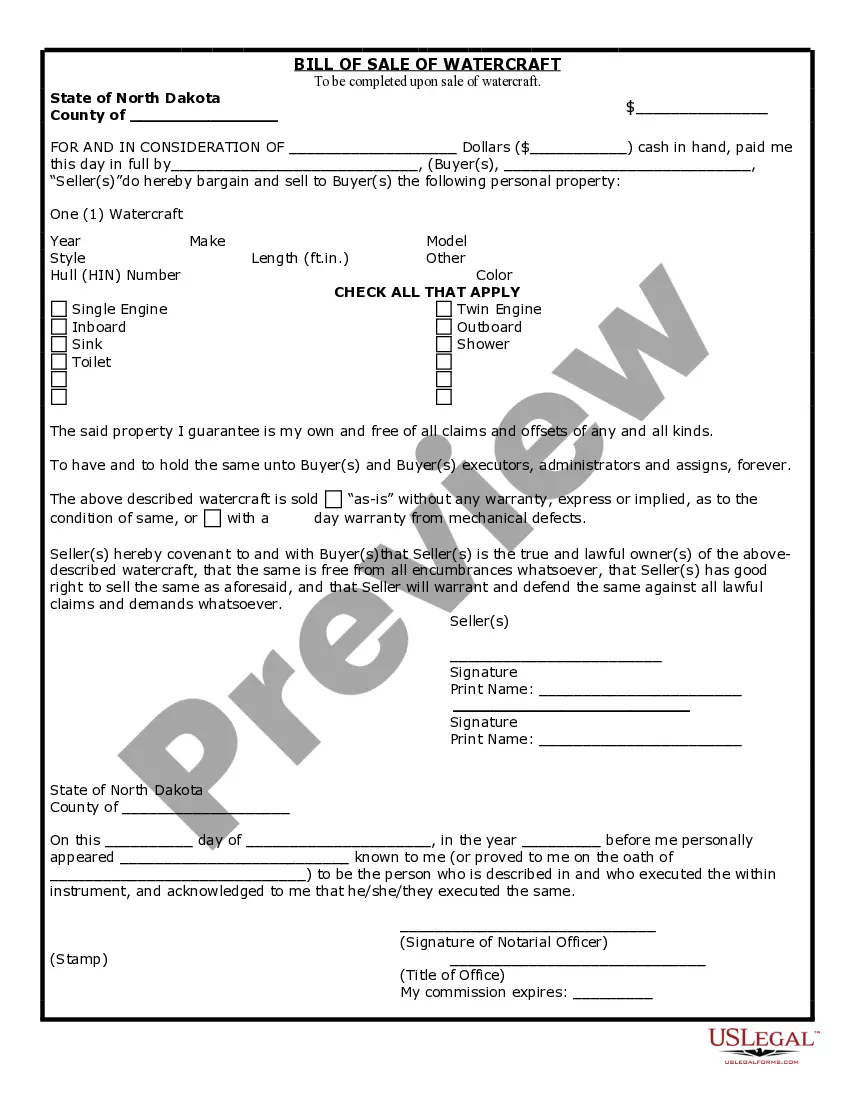

Among numerous paid and free samples that you find on the web, you can't be sure about their accuracy. For example, who created them or if they’re competent enough to take care of what you require these people to. Keep calm and use US Legal Forms! Find Texas General Warranty Deed for Individual to Three (3) Individuals as Joint Tenants with Rights of Survivorship samples created by skilled lawyers and prevent the expensive and time-consuming process of looking for an lawyer or attorney and then having to pay them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you’re looking for. You'll also be able to access all your earlier downloaded files in the My Forms menu.

If you’re utilizing our website the very first time, follow the instructions listed below to get your Texas General Warranty Deed for Individual to Three (3) Individuals as Joint Tenants with Rights of Survivorship easily:

- Ensure that the file you discover applies in the state where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or look for another example using the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you have signed up and bought your subscription, you can use your Texas General Warranty Deed for Individual to Three (3) Individuals as Joint Tenants with Rights of Survivorship as many times as you need or for as long as it remains active where you live. Revise it with your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Property held in joint tenancy, tenancy by the entirety, or community property with right of survivorship automatically passes to the survivor when one of the original owners dies. Real estate, bank accounts, vehicles, and investments can all pass this way. No probate is necessary to transfer ownership of the property.

In Texas, two forms of joint ownership have the right of survivorship: Joint tenancy. Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. (The survivor must, however, live at least 120 hours longer than the deceased co-owner.

Joint tenancy has what is called right of survivorship, where, if one owner dies, the surviving owner takes all of the property, immediately upon the other owner's death. No court action is necessary for the surviving owner to take the property.X gives property to A & B as joint tenants with right of survivorship.

Joint Tenancy With Right of Survivorship Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies.

Right of survivorship refers to the right of the surviving party (usually a husband or wife) to take over their deceased partner's interest in a property that they owned equal interest in without having to go through probate.An exception in a Survivorship Deed means anything that may limit the title of property.

Joint tenancy can only be created if the four people obtain their interest at the same time. In other words, if three people own a building, they cannot add a fourth person to the deed and create a joint tenancy.

Survivorship rights take precedence over any contrary terms in a person's will because property subject to rights of survivorship is not legally part of their estate at death and so cannot be distributed through a will.

Unlike most states Texas does not automatically recognize joint tenancies as having a right of survivorship. Instead the parties must agree, in writing, to include a right of survivorship.

As with the tenancy-in-common, a joint tenancy can exist in three or more people. Obviously, each party must have an interest that is equal to one divided by the total number of joint tenants. If one of the joint tenants dies, the others share his or her interest and they remain joint tenants with each other.