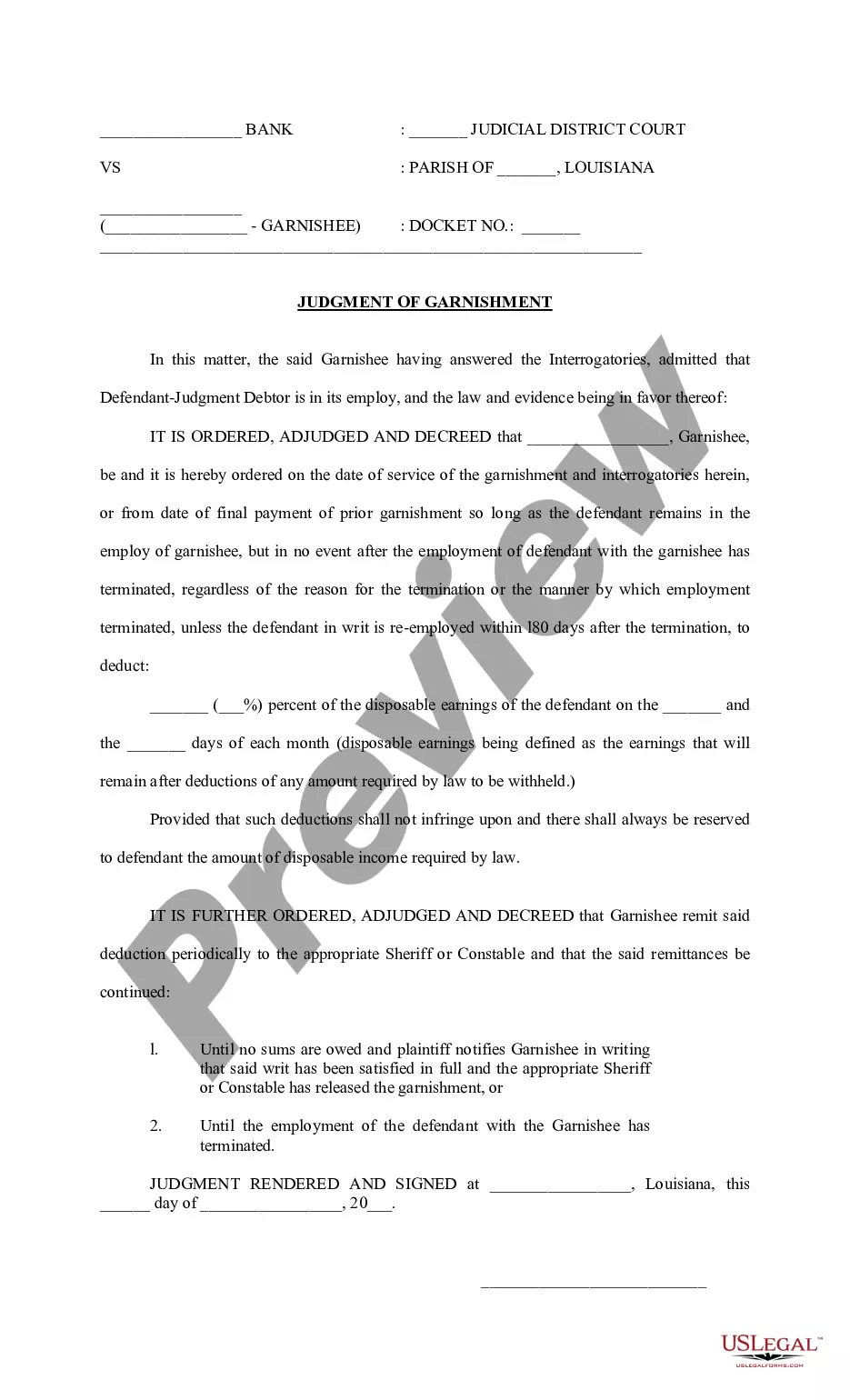

Louisiana Judgment of Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Judgment of Garnishment: A legal process where a court orders a third party to withhold funds, such as wages or bank accounts, from the defendant to satisfy a debt. Common instances include child support payments and unpaid loans. Wage garnishment laws, which vary by state, regulate how much and under what conditions creditors can claim wages. A bank account levy is another form where funds are directly taken from a bank account under court order. Judgment creditor rights describe the legal entitlements creditors possess once a judgment has been made in their favor.

Step-by-Step Guide to Responding to a Judgment of Garnishment

- Review the Garnishment Notice: Understand the details, including the amount and source of garnishment.

- Seek Legal Advice: Consult a debt collection lawyer to explore your legal options.

- Assess Financial Impact: Determine how the garnishment affects your finances, particularly if it involves child support payments or income garnishments details.

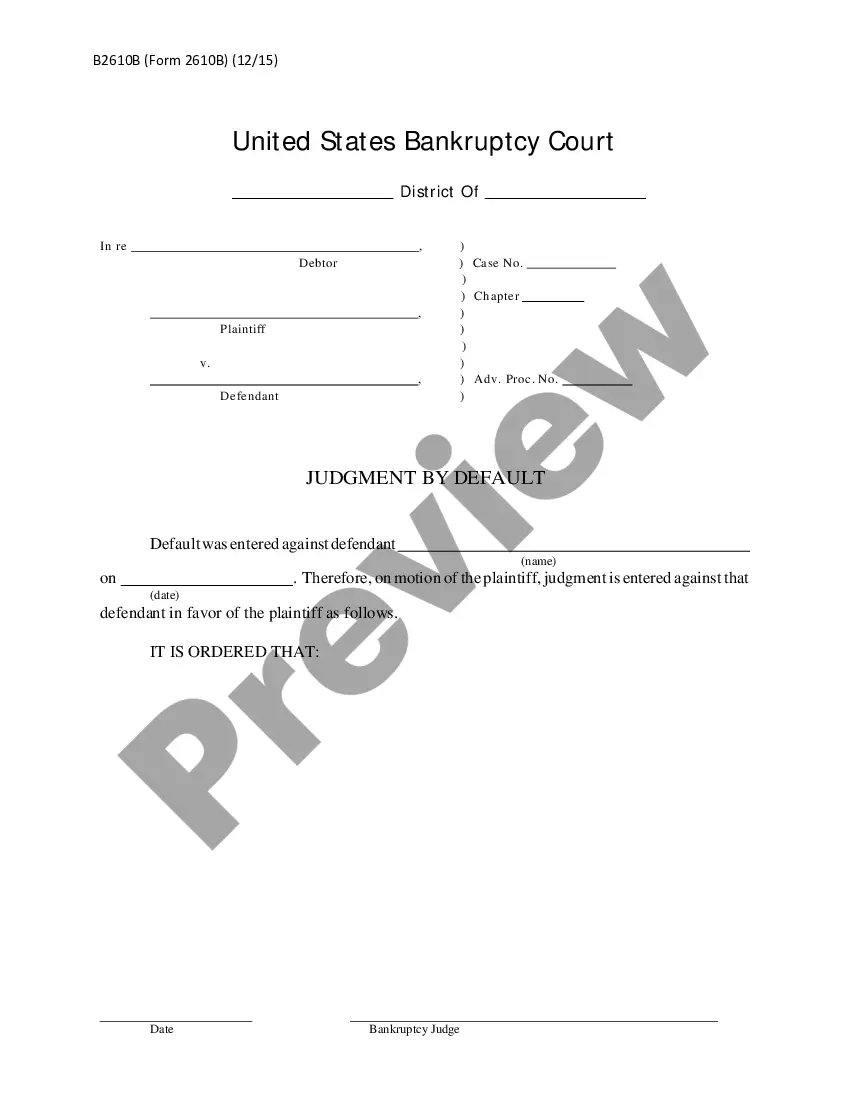

- Filing for Bankruptcy: If appropriate, consider filing for bankruptcy to Invoke bankruptcy protection information.

- Appeal the Garnishment: If you believe the garnishment was wrongly issued, discuss appealing the decision with your lawyer.

Risk Analysis of Garnishment

- Financial Strain: Garnishment can significantly reduce disposable income, impacting daily living and ability to pay other debts.

- Credit Score Impact: Garnishments are recorded and can negatively affect your credit score.

- Employment Concerns: Some employers view garnishment negatively, potentially impacting job security.

- Increased Legal Costs: Fighting a garnishment can involve substantial legal fees and time.

Common Mistakes & How to Avoid Them

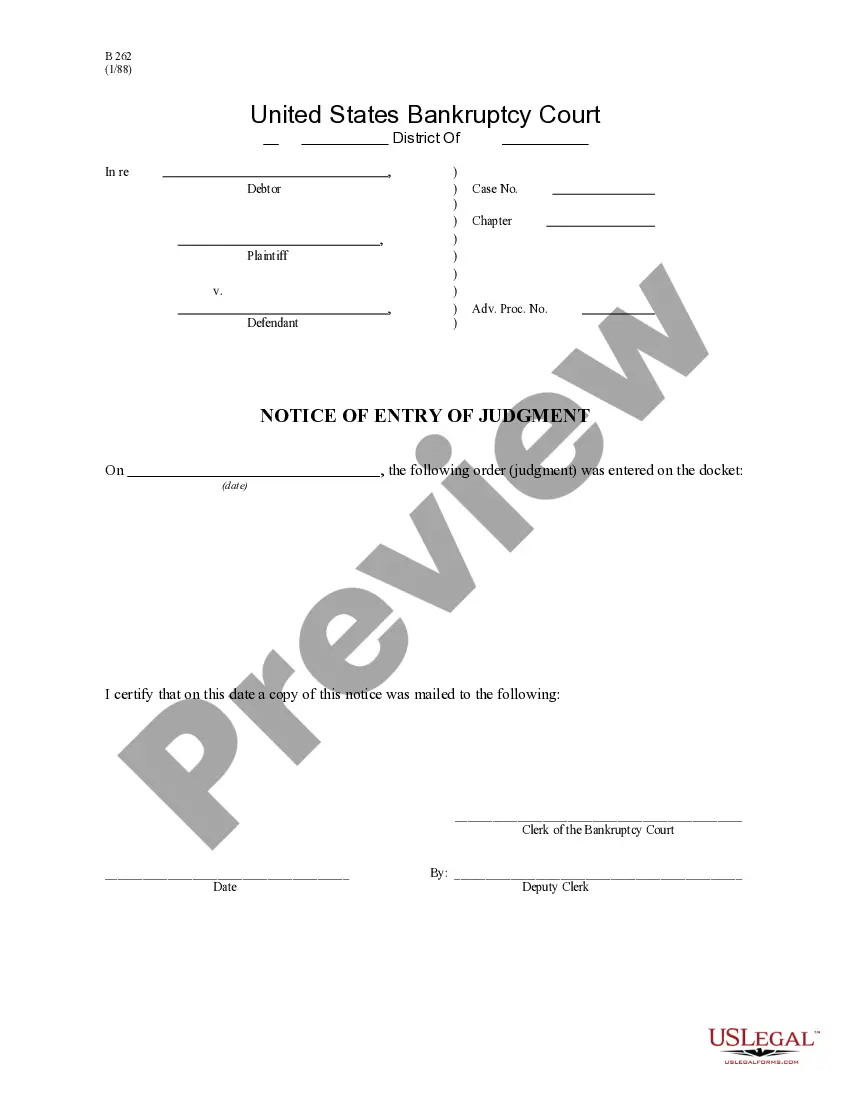

- Ignoring Garnishment Notifications: Always respond promptly to avoid additional penalties or fees.

- Not Updating Court Documents: Keep all records current, especially if your financial situation changes.

- Failing to Secure Personal Information: Employ online security solutions, like a website firewall such as Sucuri, to protect personal financial information from data breaches.

- Omitting Professional Help: Consider hiring a debt collection lawyer early in the process to navigate the complexities of garnishment laws and creditor rights effectively.

How to fill out Louisiana Judgment Of Garnishment?

Searching for a Louisiana Judgment of Garnishment example and filling it out can pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms to quickly locate the appropriate sample specifically for your state.

Our attorneys prepare each document, so all you need to do is complete them. It is truly simple.

Select your payment method on the pricing page, either by credit card or PayPal. Download the form in your preferred format. You can print the Louisiana Judgment of Garnishment template or fill it out using any online editor. There's no need to worry about typos because your template can be used and submitted, and printed as many times as you wish. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's webpage to save the sample.

- Your saved templates are kept in My documents and are always accessible for future use.

- If you haven't subscribed yet, you must register.

- Follow our comprehensive instructions on obtaining your Louisiana Judgment of Garnishment template in just a few minutes.

- Verify the example's applicability for your state.

- Examine the sample using the Preview function (if available).

- If a description exists, read it to discover the details.

- Click on the Buy Now button if you have found what you seek.

Form popularity

FAQ

In Louisiana, the statute of limitations on a judgment is ten years from the date of the judgment. This means you have a decade to enforce the Louisiana Judgment of Garnishment before it expires. After this period, you may lose your ability to collect. For clear guidance on preserving your judgment rights, consider the resources available through platforms like USLegalForms.

In Louisiana, a judgment creditor can seize various types of personal property through a Louisiana Judgment of Garnishment. This includes bank accounts, vehicles, and certain personal items that are not exempt under state law. It's essential to understand which assets can be targeted to protect your finances effectively. Consulting with a legal expert can provide clarity on your specific situation.

This current liability account reports the amount a company must remit to a court or other agencies for amounts withheld from its employees' salaries and wages.

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

Go to Employees, then choose the Employee's name. In the Deductions and Contributions section, select Edit. Select Add a Garnishment. Select a garnishment type, then enter the required information. Field. Select Save, then OK.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Wage Garnishments Only Apply to the Employment Relationship In most situations, the creditor must first file a lawsuit, overcome any defenses the debtor may assert (many debtors simply default), and then obtain a Monetary Judgment in the exact amount of the debt due plus interest (both past and ongoing).

You do this by filing a Claim of Exemption with the court and mailing it to the judgment creditor, the sheriff or constable who served the collection paperwork, and any third party involved (such as your employer or bank). f063 Fill out the Claim of Exemption form completely.

In many situations, one of the best ways to collect a judgment after winning a case is to put a lien on the debtor's property. This gives you a claim to the property and, in some cases, the property will be sold at public auction in order to satisfy the debt that is owed.

There is no wage garnishment tax deduction that can automatically reduce your income tax if you have wages garnished. However, if your wages are being garnished to pay a tax-deductible expense, like medical debt, you may be able to deduct those payments.