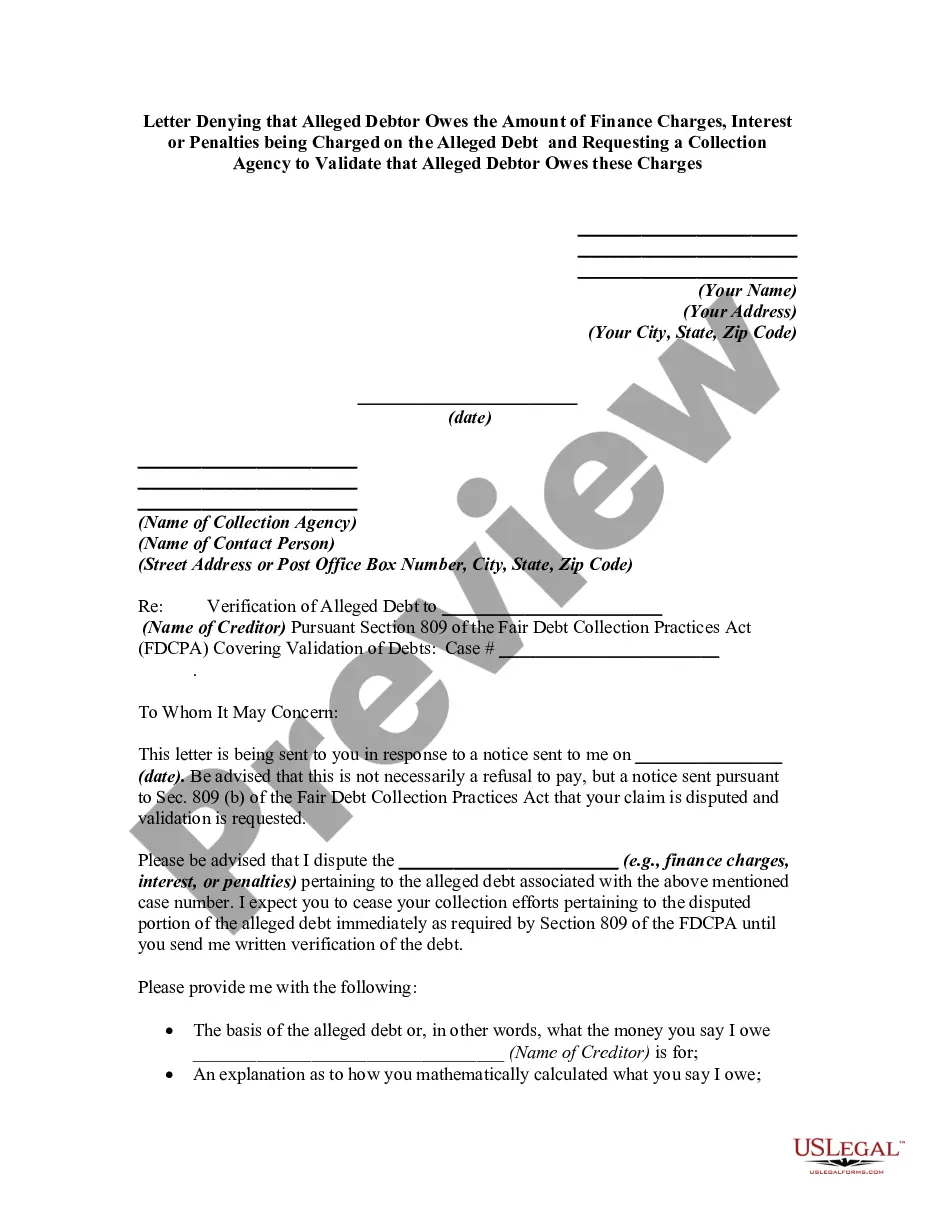

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

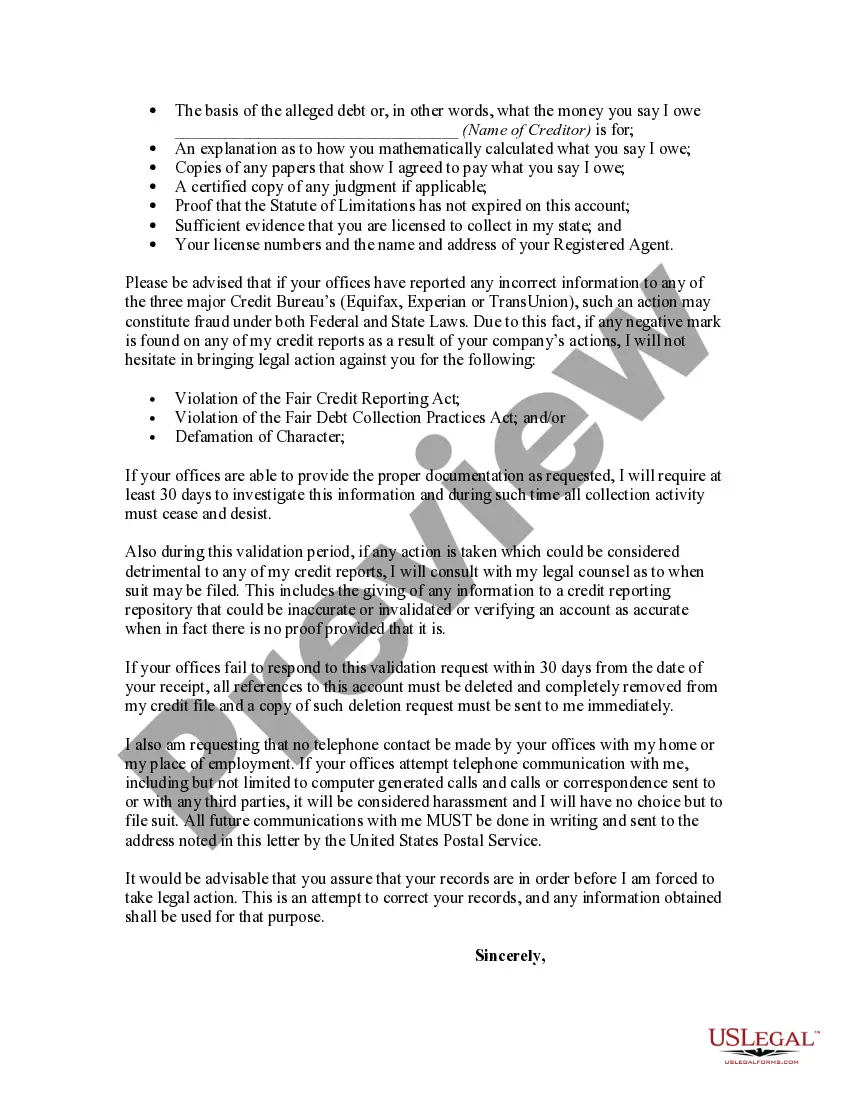

Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges

Description

How to fill out Letter Denying That Alleged Debtor Owes The Amount Of Finance Charges, Interest Or Penalties Being Charged On The Alleged Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes These Charges?

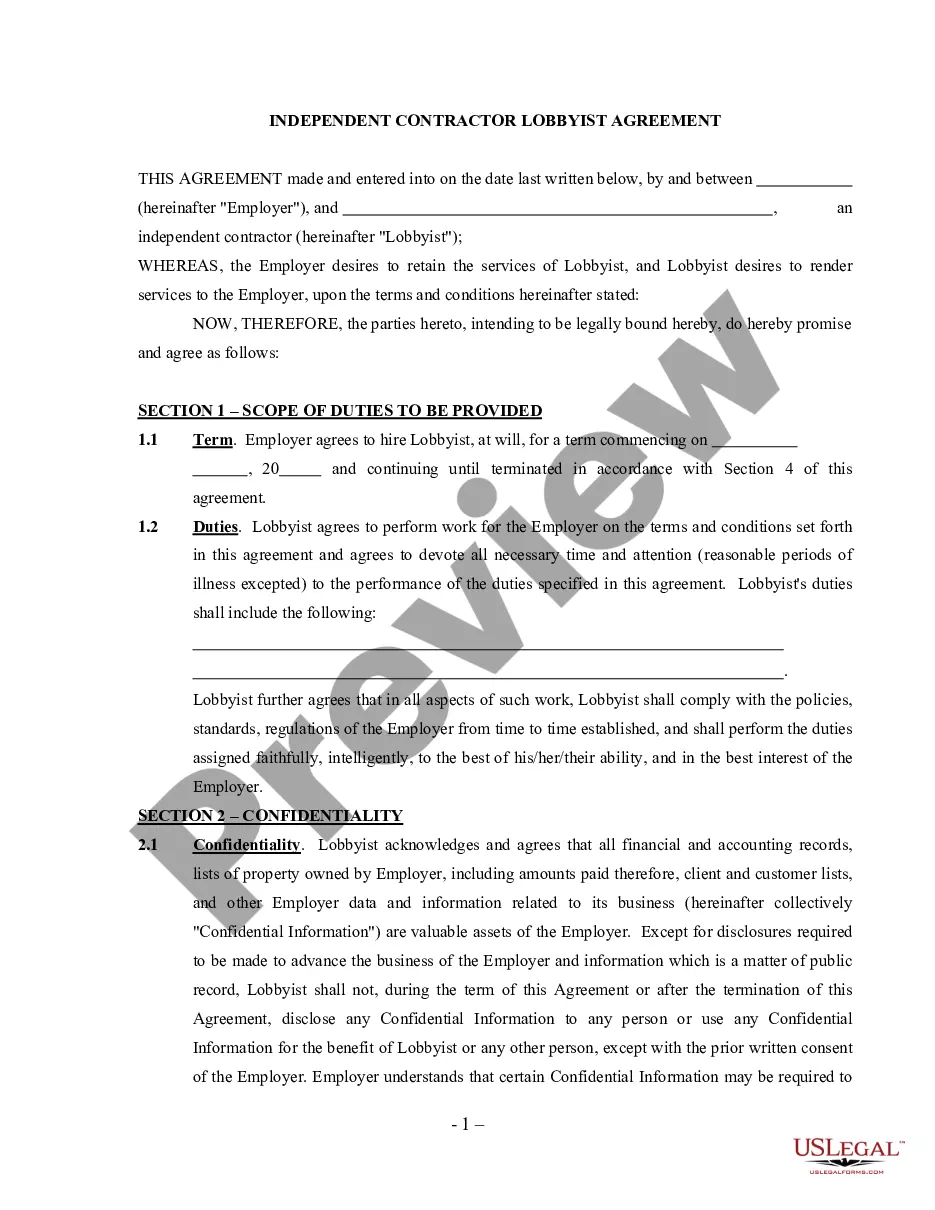

When it comes to drafting a legal form, it’s easier to leave it to the professionals. However, that doesn't mean you yourself can not get a template to utilize. That doesn't mean you yourself can’t find a template to use, nevertheless. Download Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges from the US Legal Forms web site. It offers a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. As soon as you are signed up with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges fast:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges is downloaded you are able to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

This is important: You have just 30 days to respond to a debt validation letter. If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can send a dispute after 30 days.

Documentation that you owed the debt at some point, such as a contract you signed. How much you owe and the last outstanding action on the debt, which can be shown by documents such as the last statement or bill.

In other words, you only have the right to request verification of your debt from companies or law firms collecting the debt or which have purchased the debt from the original creditor. A collector's duty to verify a debt only kicks in if you send a specific, written request for verification.

That if you dispute the debt in writing within 30 days the debt collector will provide verification of the debt. That if you request the name and address of the original creditor within 30 days, if different from the current creditor, the debt collector will provide you that information.

The amount of debt owed. The name of the creditor to whom the debt is owed. A statement of notice that the debt will be considered valid by the debt collector unless the consumer disputes it within 30 days of notice.

It's a violation of the collection practices act for a debt collector to refuse to send a validation notice or fail to respond to your verification letter. If you encounter such behavior, you can file a complaint with the Consumer Financial Protection Bureau.

You have the right to force the debt collector to prove you owe the money. Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

A debt validation letter can be an effective tool for dealing with debt collectors.