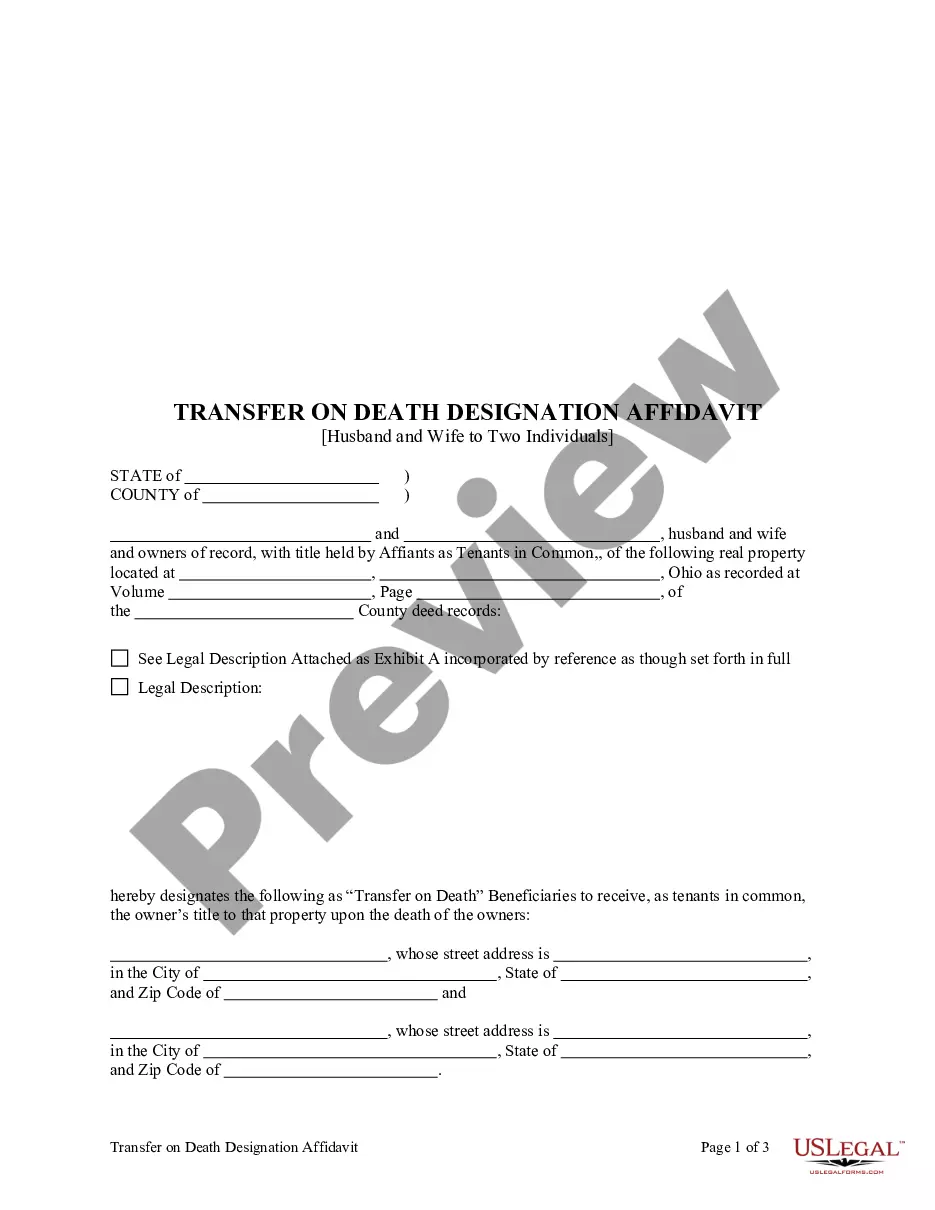

This form is a Transfer on Death Designation Affidavit where the affiants are husband and wife and the beneficiaries are two individuals. This affidavit of designation is revocable by affiants/grantors until afiant's death and effective only upon the death of the affiants. The beneficiaries take the property as tenants in common. Is a beneficiary fails to survive the grantors, their interest goes to their heirs per stirpes. This deed complies with all state statutory laws.

Ohio Transfer on Death Designation Affidavit - TOD - Husband and Wfie to Two Individuals Beneficiaries

Description

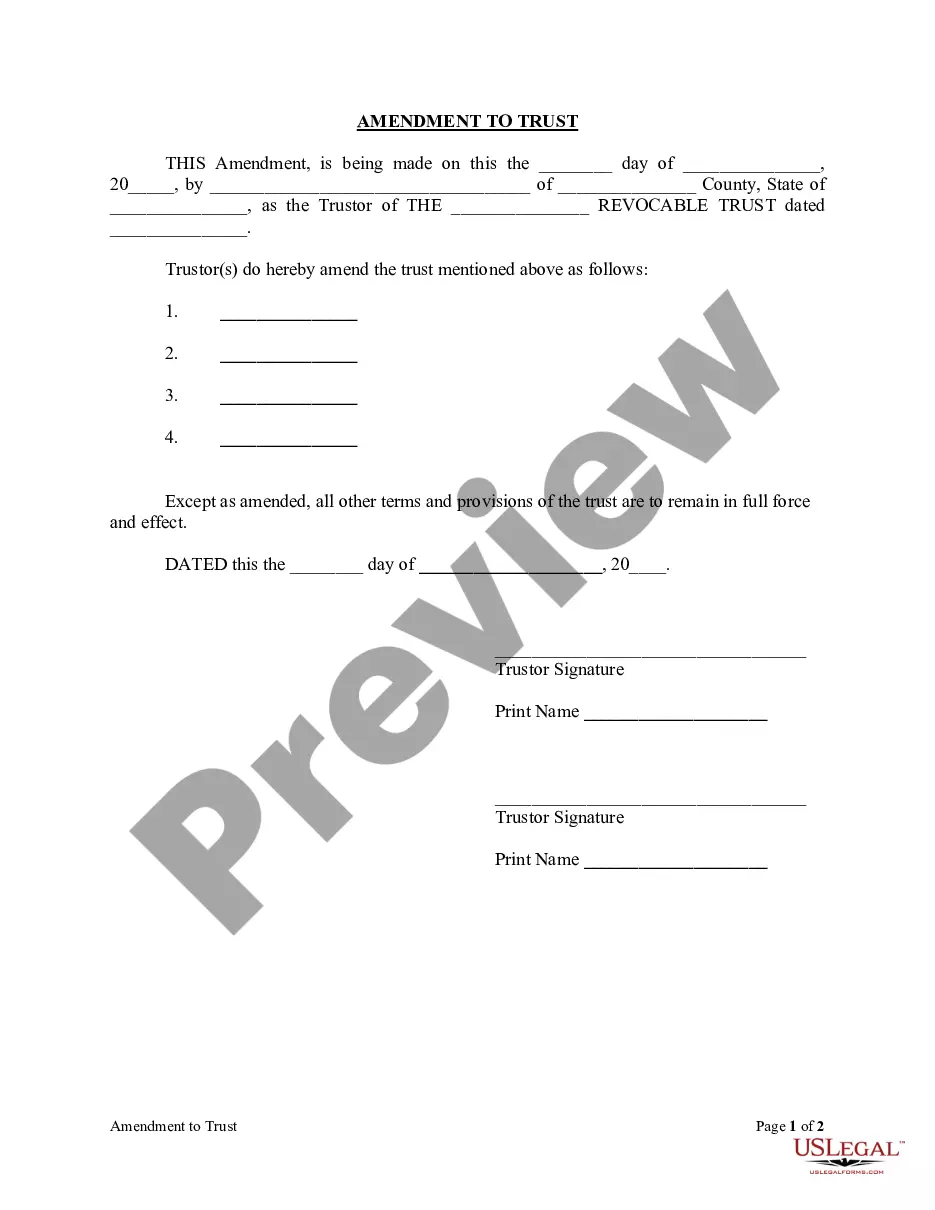

How to fill out Ohio Transfer On Death Designation Affidavit - TOD - Husband And Wfie To Two Individuals Beneficiaries?

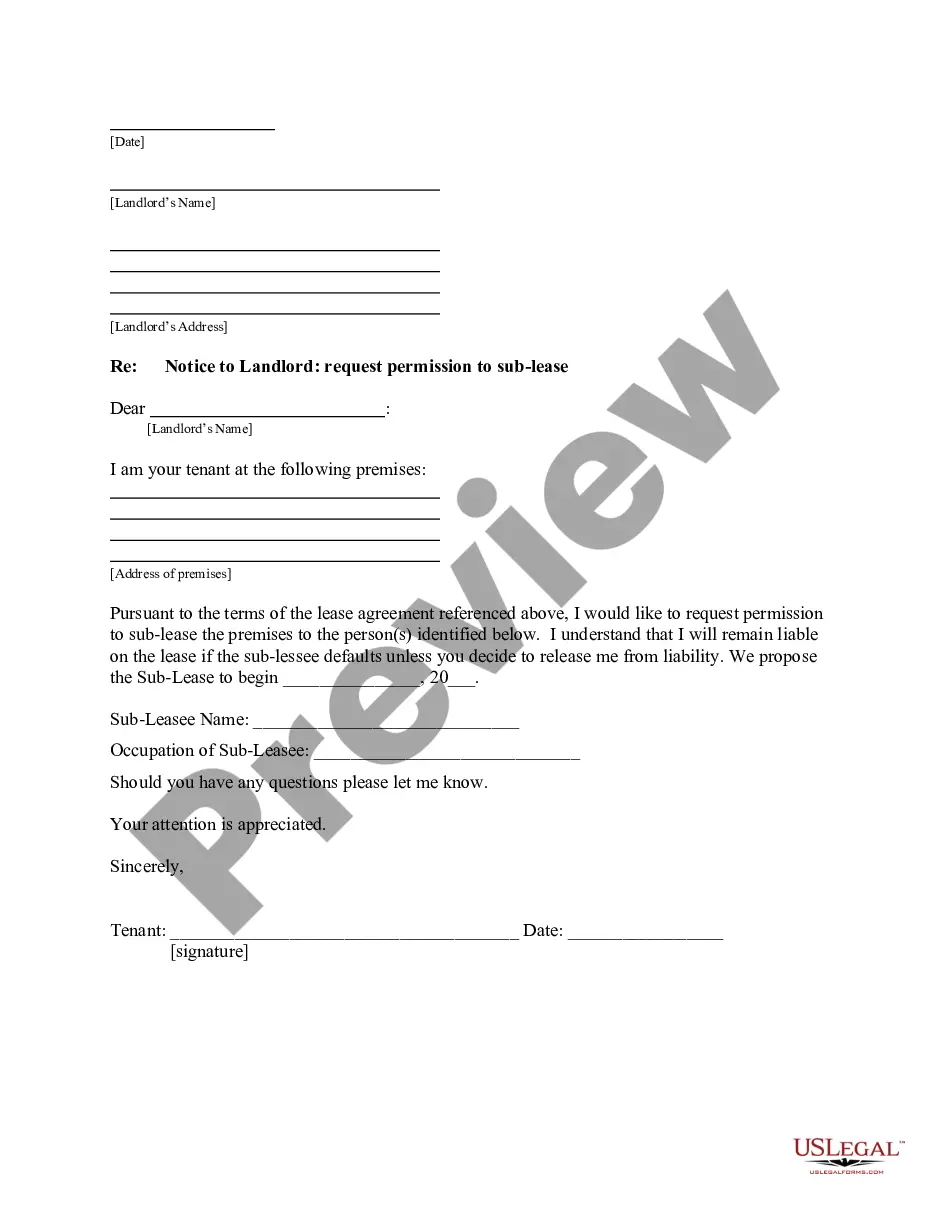

When it comes to submitting Ohio Transfer on Death Designation Affidavit - TOD - Husband and Wfie to Two Individuals Beneficiaries, you almost certainly visualize a long process that requires choosing a perfect form among numerous very similar ones then being forced to pay out legal counsel to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific template within just clicks.

For those who have a subscription, just log in and click on Download button to get the Ohio Transfer on Death Designation Affidavit - TOD - Husband and Wfie to Two Individuals Beneficiaries template.

In the event you don’t have an account yet but need one, stick to the step-by-step guide below:

- Make sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do this by looking at the form’s description and by clicking the Preview function (if available) to view the form’s content.

- Click on Buy Now button.

- Pick the proper plan for your budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Skilled attorneys draw up our samples so that after downloading, you don't need to worry about modifying content outside of your individual details or your business’s information. Sign up for US Legal Forms and get your Ohio Transfer on Death Designation Affidavit - TOD - Husband and Wfie to Two Individuals Beneficiaries document now.

Form popularity

FAQ

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

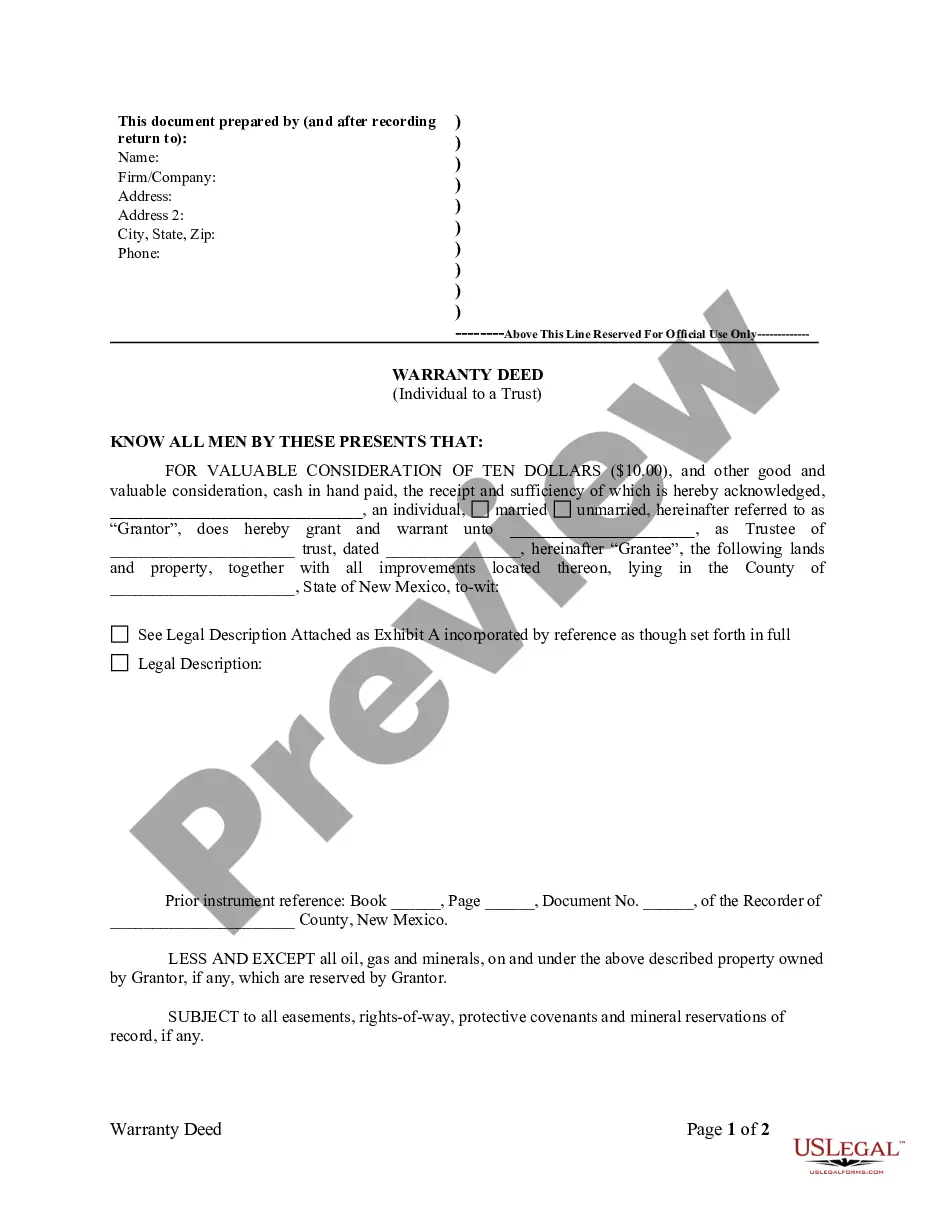

Survivorship Deeds contain special language that enables the property to transfer to the surviving owner(s) upon the deceased owner's death.A Transfer-On-Death Designation Affidavit allows the owner of Ohio real estate to designate one or more beneficiaries of the property.

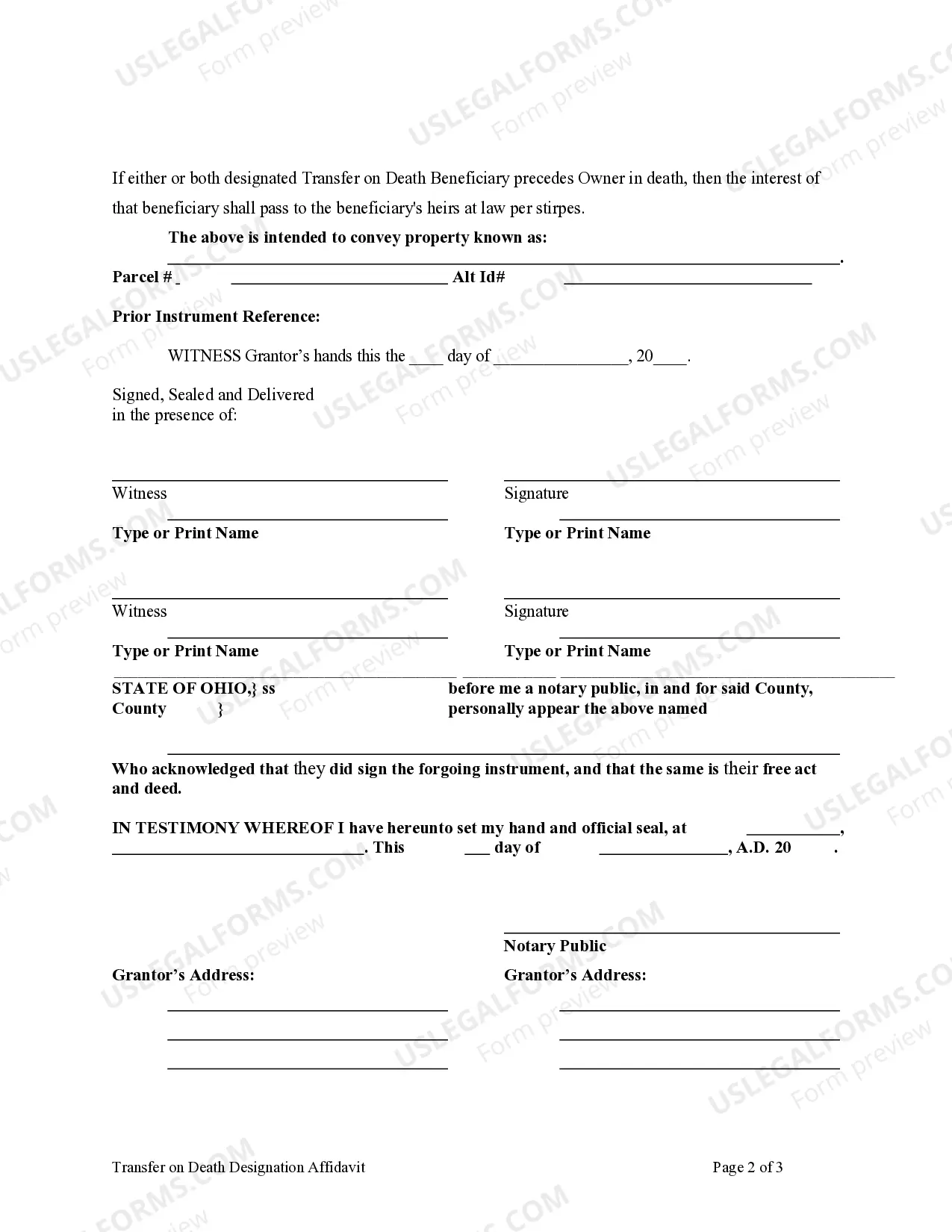

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.

If the deeds to the property are unregistered, it is possible to place a death certificate with the deeds, but it's advisable to register the title with the Land Registry at this point. Once this has been done, the property will then be registered in the name of the surviving joint owner.