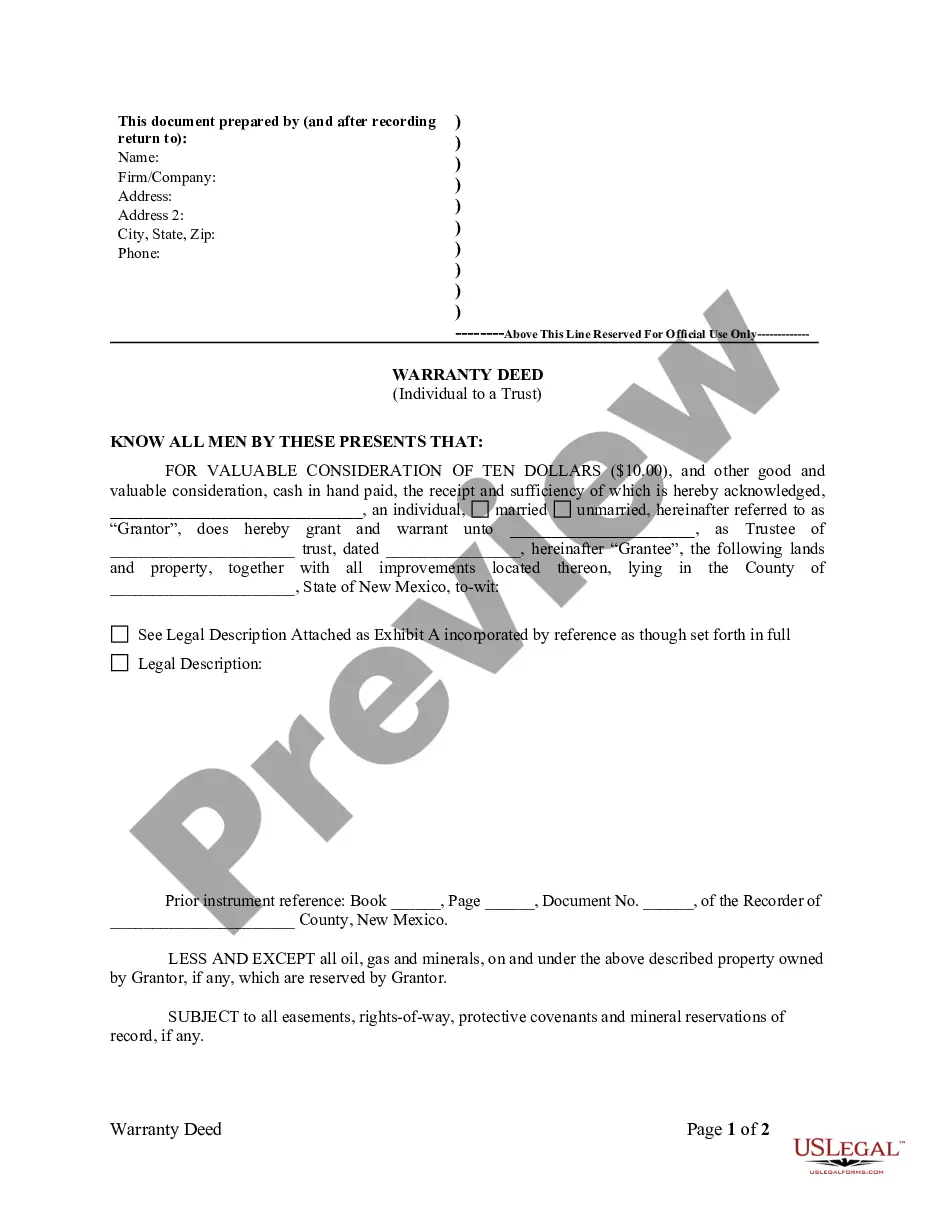

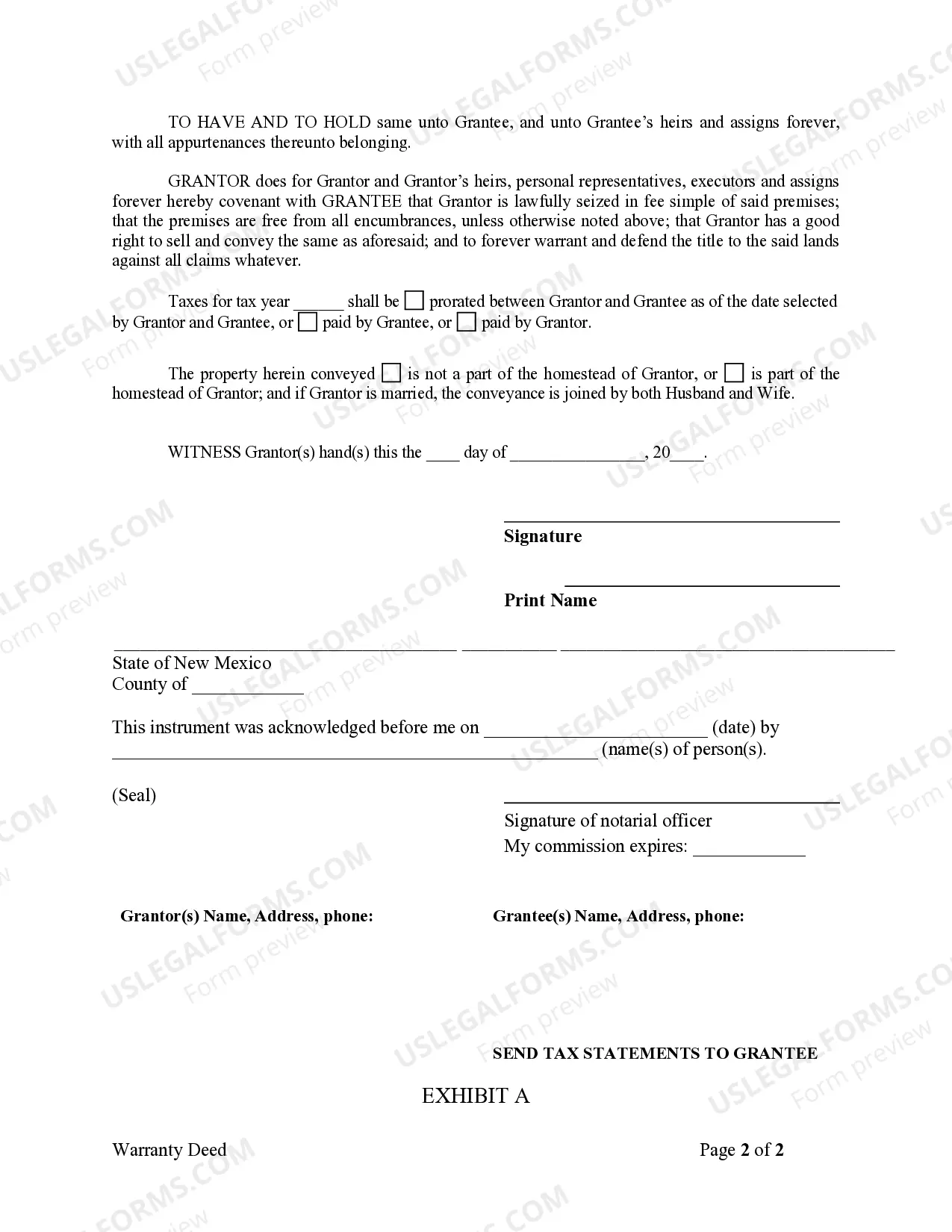

New Mexico Warranty Deed from Individual to a Trust

What is this form?

A Warranty Deed from Individual to a Trust is a legal document that transfers ownership of property from an individual (the grantor) to a trust (the grantee). This form ensures that the title to the property is conveyed securely, while also reserving any mineral rights to the grantor. It differs from other types of deeds, such as quitclaim or grant deeds, by providing a higher level of warranty to the grantee regarding the ownership and the absence of encumbrances on the property.

Main sections of this form

- Identification of the Grantor and Grantee, including their full names and addresses.

- A legal description of the property being conveyed, often included as an exhibit.

- Specific reservations by the grantor, such as mineral rights, if applicable.

- Covenants by the grantor ensuring clear title and freedom from encumbrances.

- Provisions for prorating property taxes between the parties.

- Space for signatures and dates, including a witness if necessary.

When to use this document

This form is typically used when an individual wishes to transfer property into a trust for estate planning purposes. It is also relevant when a property owner wants to secure the trust with clear title and high warranty against claims. This can happen during asset protection planning, when setting up a living trust, or as part of transferring wealth to beneficiaries in a controlled manner.

Who needs this form

- Individuals seeking to transfer property ownership to a trust.

- Trustees managing a trust that is receiving property transfers.

- Property owners looking to protect their assets and ensure smooth transitions for heirs.

How to prepare this document

- Identify the parties involved, including the grantor's name and the trustee's name.

- Provide a detailed legal description of the property, attaching as an exhibit if necessary.

- Specify any reservations of rights by the grantor, particularly regarding minerals or other resources.

- Enter the agreed-upon terms regarding property taxes and any relevant additional notes.

- Have all necessary parties sign and date the document, and include any required witnesses.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Typical mistakes to avoid

- Failing to accurately complete the legal description of the property.

- Not specifying any mineral rights being reserved by the grantor.

- Neglecting to prepare for tax prorations or leaving it ambiguous.

- Forgetting signatures from all necessary parties, including witnesses if required.

Benefits of using this form online

- Convenience of immediate access to the form for download.

- Ability to customize the form as needed before finalizing.

- Reliability from being drafted and vetted by licensed attorneys.

State law considerations

This Warranty Deed complies with all state statutory laws. Ensure that you understand any additional requirements that may apply in your specific jurisdiction, particularly concerning witness requirements or local filing procedures.

Form popularity

FAQ

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

A deed conveys ownership; a deed of trust secures a loan.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

A trustee deed offers no such warranties about the title.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.