New York Sample Letter for Refinancing of Loan

Description

How to fill out Sample Letter For Refinancing Of Loan?

Are you currently in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but it can be challenging to find reliable ones.

US Legal Forms provides thousands of templates, including the New York Sample Letter for Loan Refinancing, designed to comply with state and federal regulations.

When you locate the right form, simply click Get now.

Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New York Sample Letter for Loan Refinancing template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for your specific city/region.

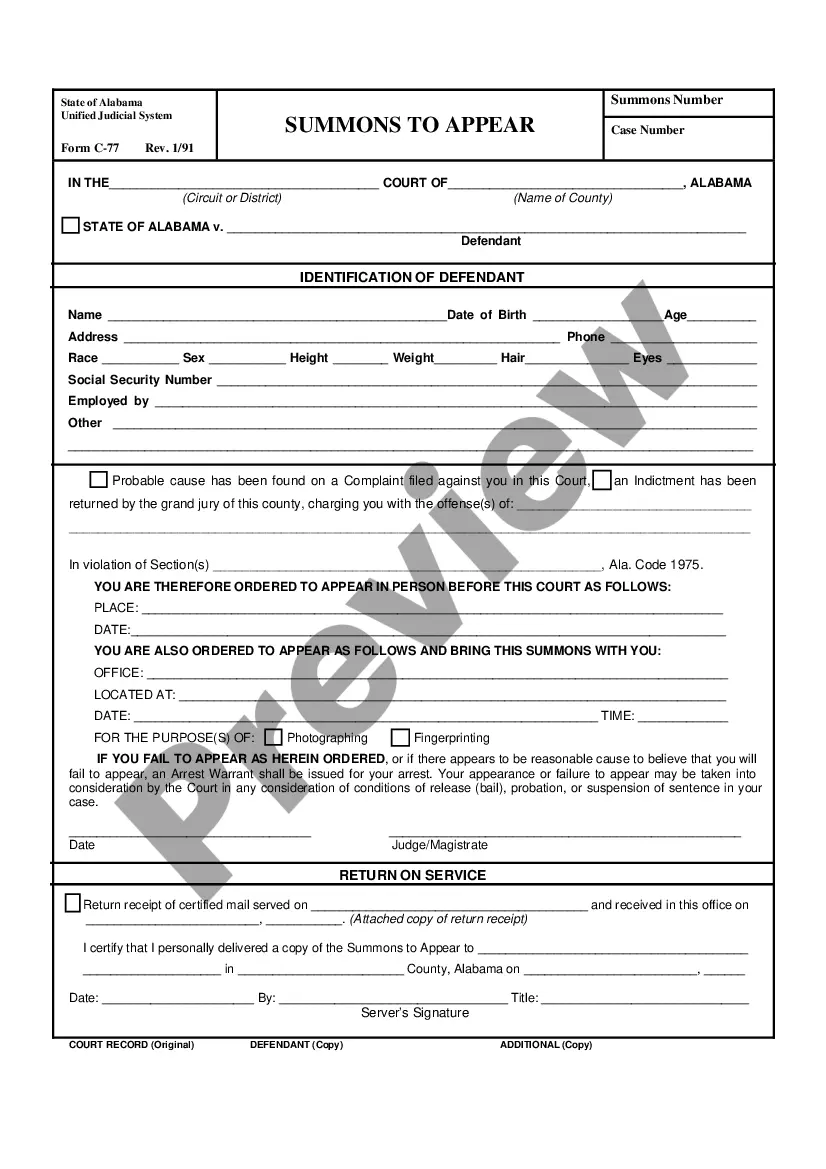

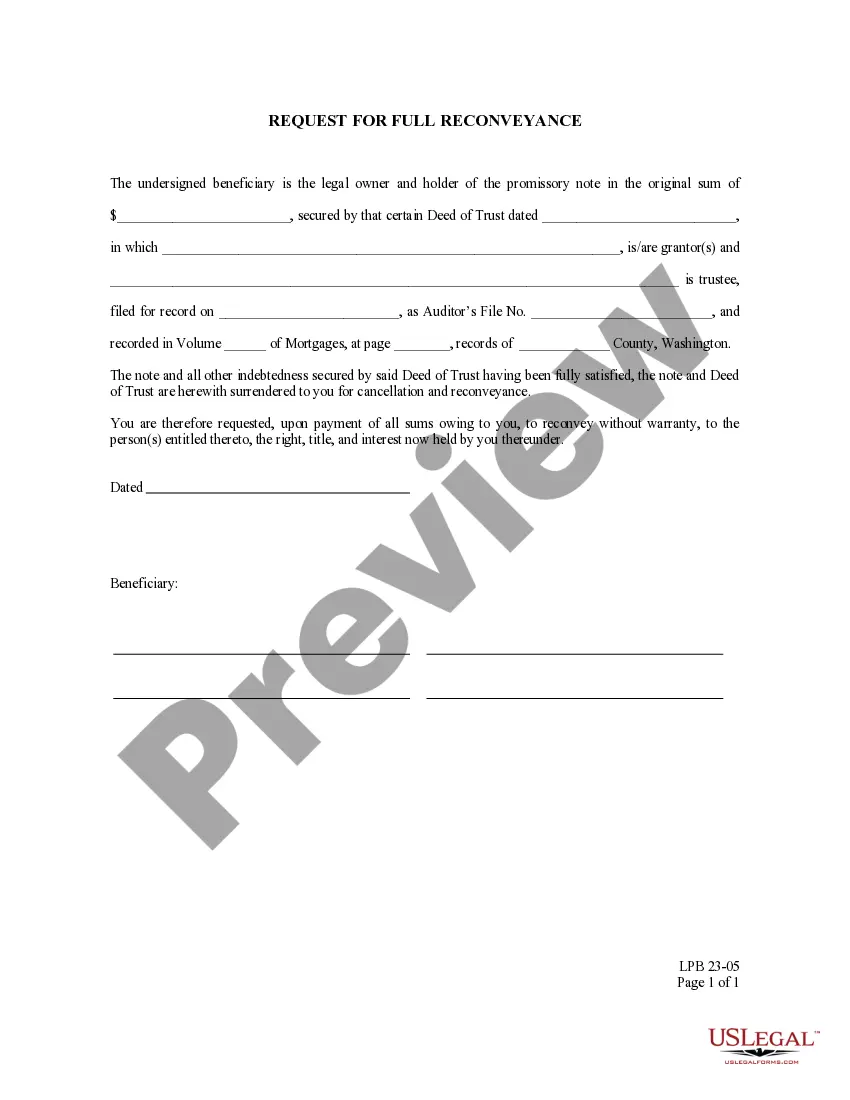

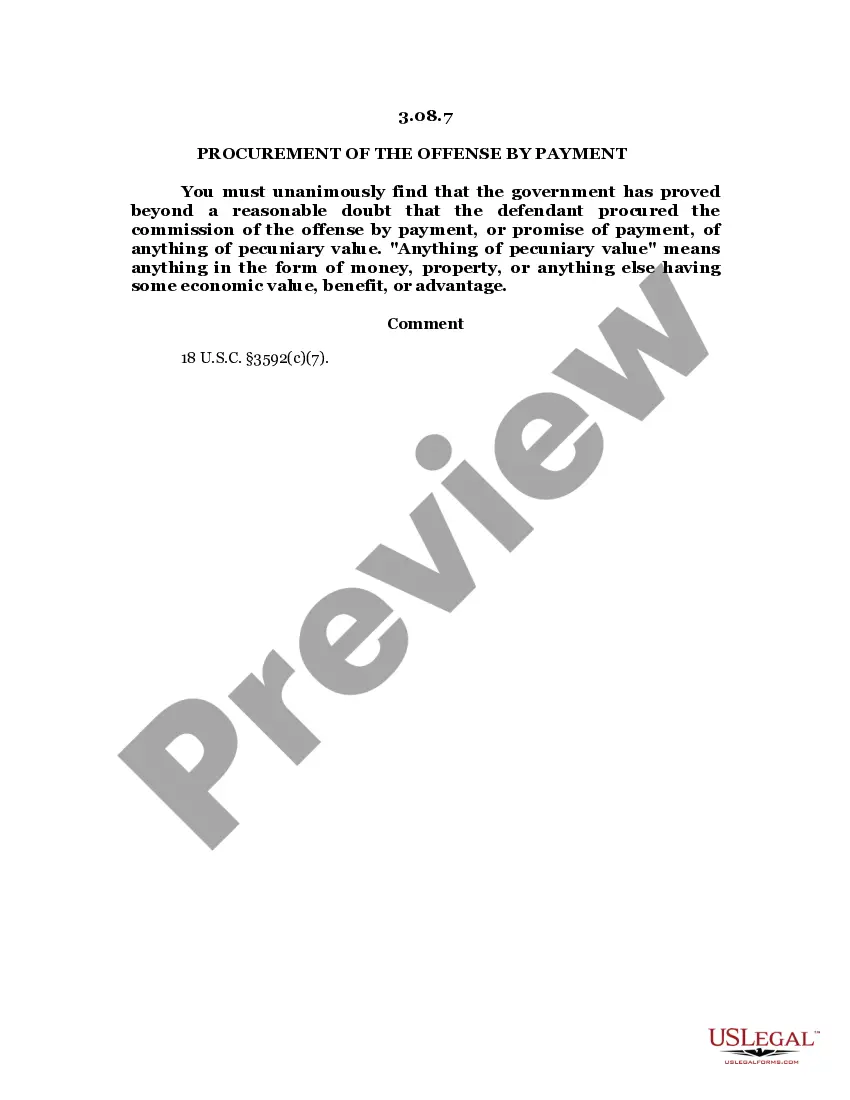

- Use the Preview button to review the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

What to include in your letter of explanationLay out the letter as you would any other, with your full street address and phone number at the top.Date the letter with the date on which you're writing it.Put in the recipient (the lender's) name and full address.More items...?

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Step 1: Set your refinance goals. The first step in the refinance process is to set a clear goal.Step 2: Get refinance rates from several lenders.Step 3: Compare rates and fees.Step 4: Submit your documents.Step 5: Appraisal and underwriting.Step 6: Closing day.

A letter of explanation is a document that's used to explain any circumstance or situation. There may be different types of situations wherein someone would ask you for such a letter. When composing your letter of explanation template, you have to be very careful when choosing your words.

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledgment. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.19-Apr-2022