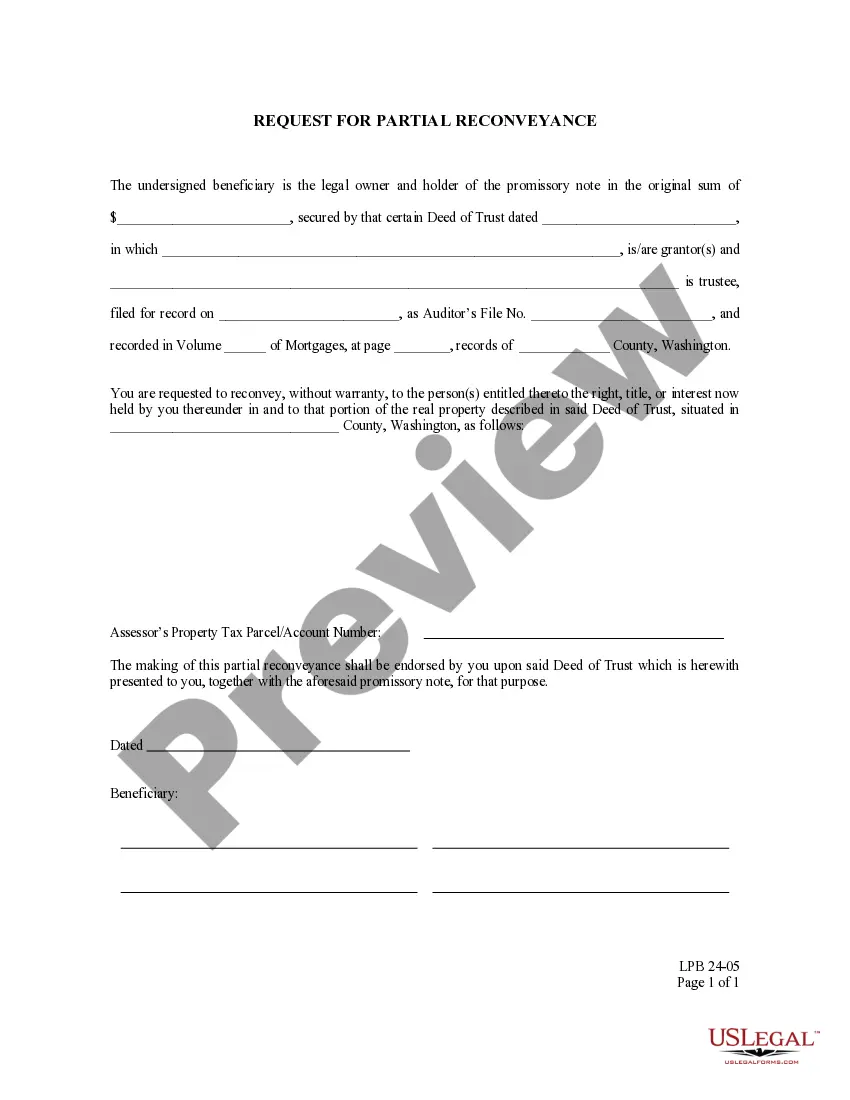

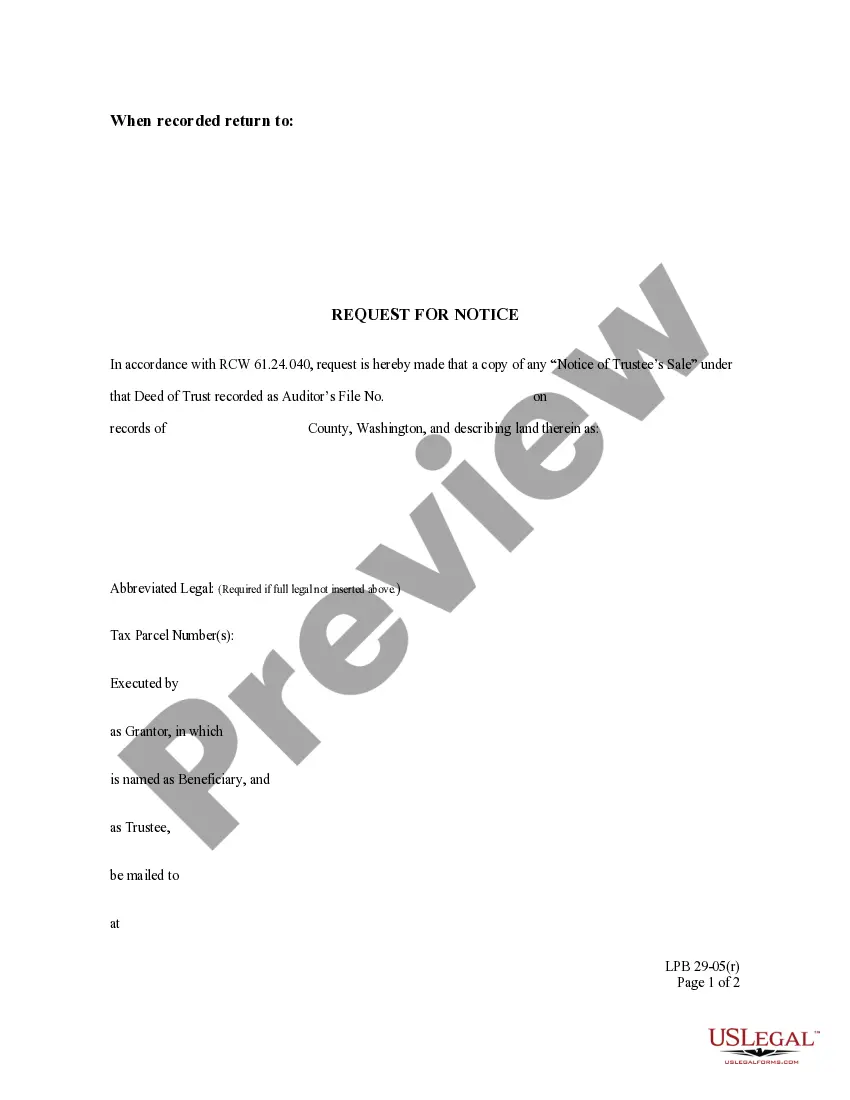

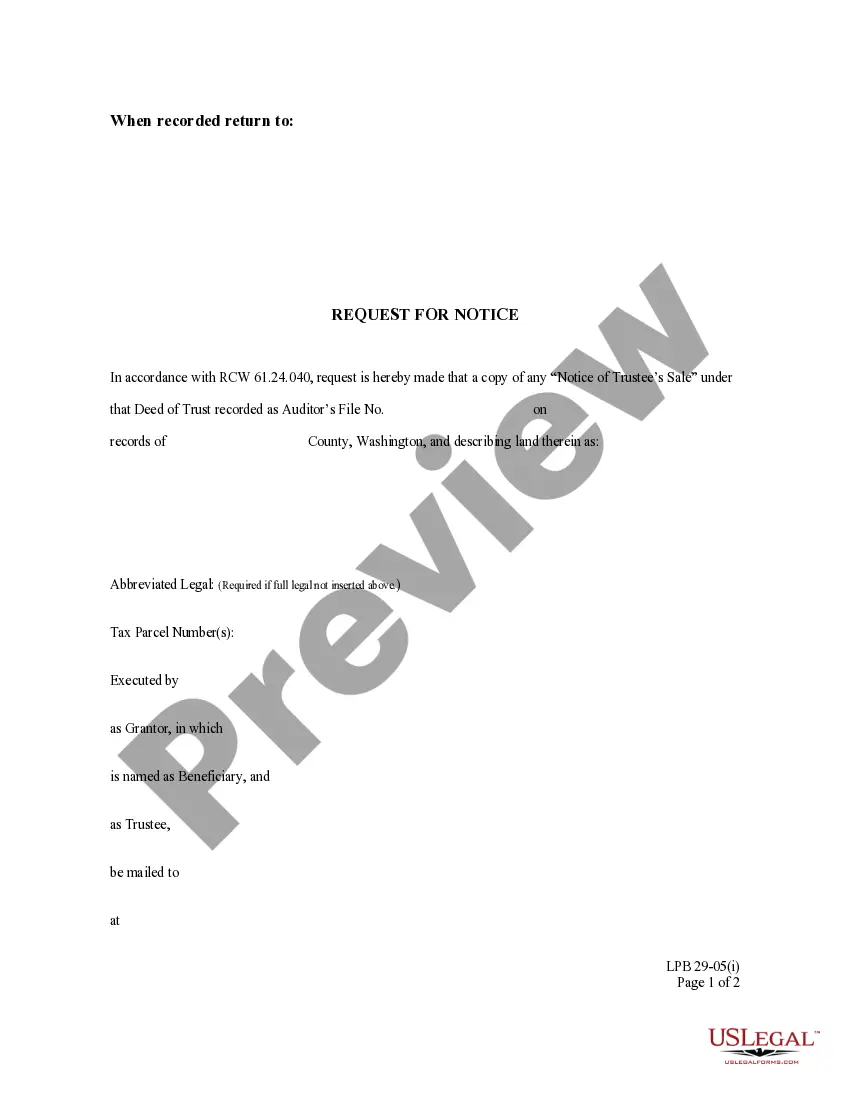

This is an official Washington form for use in land transactions, a Request for Full Reconveyance.

Washington Request for Full Reconveyance

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Request For Full Reconveyance?

Out of the large number of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms prior to buying them. Its extensive catalogue of 85,000 templates is categorized by state and use for simplicity. All the documents available on the platform have already been drafted to meet individual state requirements by qualified lawyers.

If you have a US Legal Forms subscription, just log in, look for the form, press Download and access your Form name from the My Forms; the My Forms tab holds your downloaded documents.

Stick to the guidelines below to get the form:

- Once you see a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the template.

- Look for a new template using the Search engine if the one you’ve already found isn’t appropriate.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

When you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it with an online editor of your choice. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains the most up-to-date version in your state. Our platform offers fast and easy access to samples that suit both lawyers as well as their clients.

Form popularity

FAQ

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

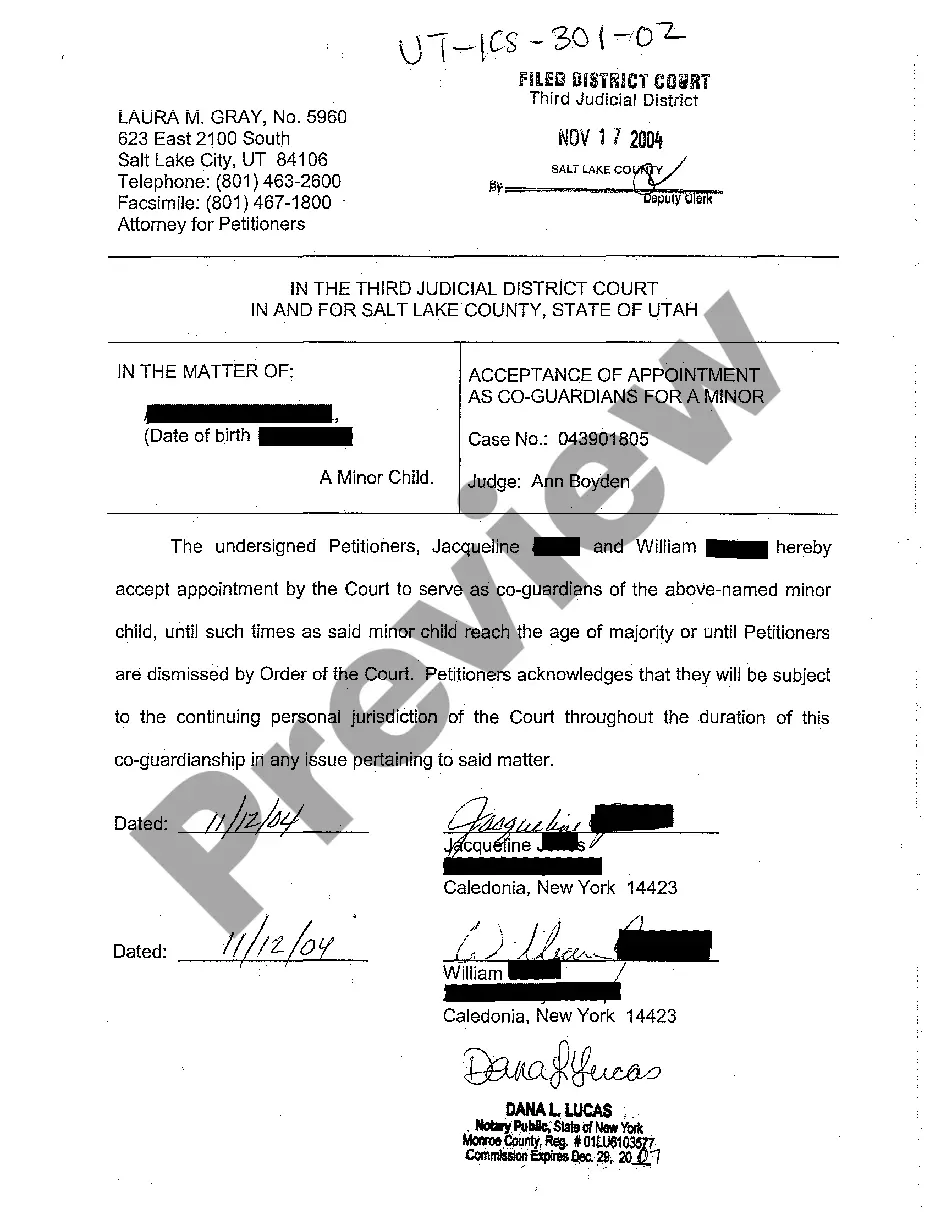

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien.Once the document is registered, it establishes the borrower as the sole owner of the property, which is now free and clear of the previous mortgage.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form. is completed and signed by the trustee, whose signature must be notarized.

An action for reconveyance, on the other hand, is a legal and equitable remedy granted to the rightful owner of land which has been wrongfully or erroneously registered in the name of another for the purpose of compelling the latter to transfer or reconvey the land to him.

Upon the return receipt of the Address Verification Letter, the property reconveyance process will begin. Once all the paperwork has been received by the Administrative Office, it may take up to thirty (30) calendar days to process. The deeds of trust are processed in the sequence received.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

Complete the top area of the reconveyance deed. Enter the name of and address of the person who executed the deed of trust, the borrower or debtor. Refer to the original deed of trust for the name spelling. Complete the middle section, the trustee's name and address.

A reconveyance fee is a charge that comes from the title company of a property or from an attorney in some states. This fee is what covers the cost of taking away any lien that a lender has on an owner's property title when the owner wants to refinance the property. The fee is taken at closing.