The New York State Parimutuel Betting Tax Return — Schedule I— - Simulcast Receiver's Betting Distribution is a form used by simulcast receivers to declare their gross revenue from parimutuel betting activities. This tax return includes two types of forms: Form PT-I-SR for simulcast receivers who receive wagers from simulcast sources or Form PT-I-SR-2 for simulcast receivers who receive wagers from an off-track betting corporation. This form requires the simulcast receivers to provide information on their gross revenue from parimutuel wagers, wager taxes withheld, and the total wager taxes due. Additionally, the simulcast receiver must provide the location of the simulcast facility, the simulcast source, and the total amount of wager taxes due. This form must be filed with the New York State Department of Taxation and Finance.

New York State Pari-Mutuel Betting Tax Return - Schedule II - Simulcast Receiver's Betting Distribution

Description

How to fill out New York State Pari-Mutuel Betting Tax Return - Schedule II - Simulcast Receiver's Betting Distribution?

US Legal Forms is the most straightforward and affordable way to locate appropriate legal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with federal and local laws - just like your New York State Pari-Mutuel Betting Tax Return - Schedule II - Simulcast Receiver's Betting Distribution.

Obtaining your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

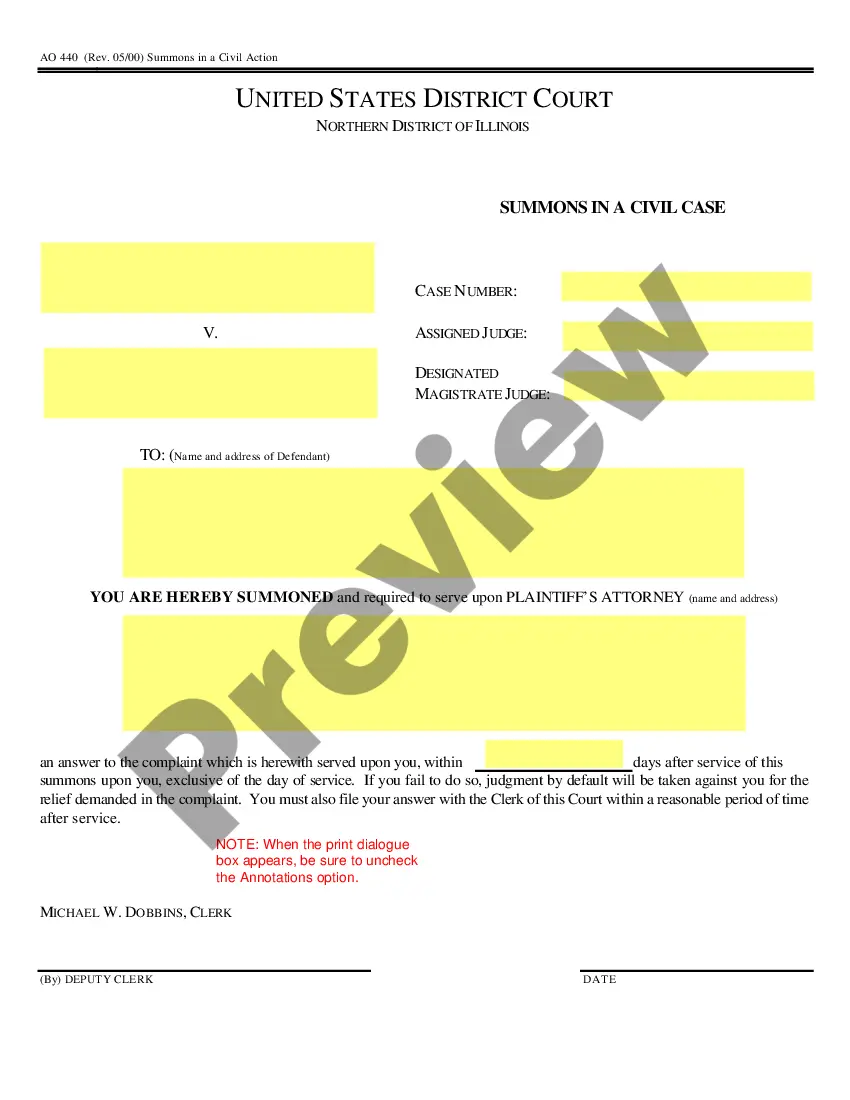

And here’s how you can obtain a professionally drafted New York State Pari-Mutuel Betting Tax Return - Schedule II - Simulcast Receiver's Betting Distribution if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your needs, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your New York State Pari-Mutuel Betting Tax Return - Schedule II - Simulcast Receiver's Betting Distribution and save it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your reliable assistant in obtaining the required official paperwork. Try it out!

Form popularity

FAQ

Is there any place I can go to get tax forms? A) Yes, you may visit a local IRS office or a post office or library that carries tax forms. You may also use computers that are often available for use in libraries to access IRS.gov to download needed forms.

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

The pari-mutuel tax is an ad valorem tax levied on gross receipts from wagers on horse and greyhound events.

Form IT-201, Resident Income Tax Return.

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

We accept forms that are consistent with the official printed versions and do not have an adverse impact on our processing. This policy includes forms printed from IRS.gov and output on high-quality devices such as laser or ink-jet printers, unless otherwise specified on the form itself.