Mississippi UCC1 Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi UCC1 Financing Statement?

Acquire a printable Mississippi UCC1 Financing Statement in just a few mouse clicks from the most extensive collection of legal e-forms.

Locate, download, and print professionally created and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of affordable legal and tax templates for US citizens and residents online since 1997.

After downloading your Mississippi UCC1 Financing Statement, you can fill it out in any online editor or print it and complete it by hand. Use US Legal Forms to gain access to 85,000 professionally drafted, state-specific forms.

- Customers who already possess a subscription must Log In to their US Legal Forms account, download the Mississippi UCC1 Financing Statement, and find it saved in the My documents tab.

- Clients without a subscription need to adhere to the instructions below.

- Verify that your template complies with your state’s criteria.

- If accessible, read the form’s description for additional information.

- If accessible, examine the form to see more details.

- Once you are certain the template is suitable for you, click on Buy Now.

- Set up a personal account.

- Select a plan.

- Make payment through PayPal or credit card.

- Download the template in Word or PDF format.

Form popularity

FAQ

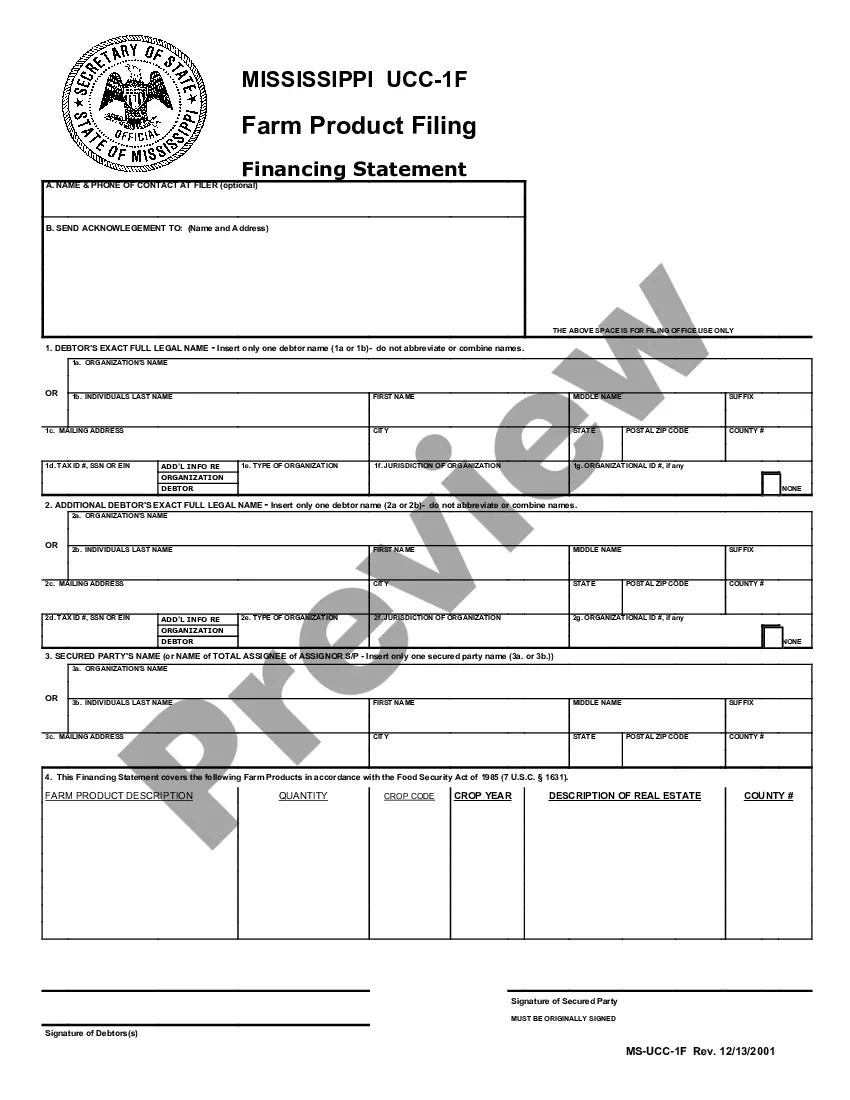

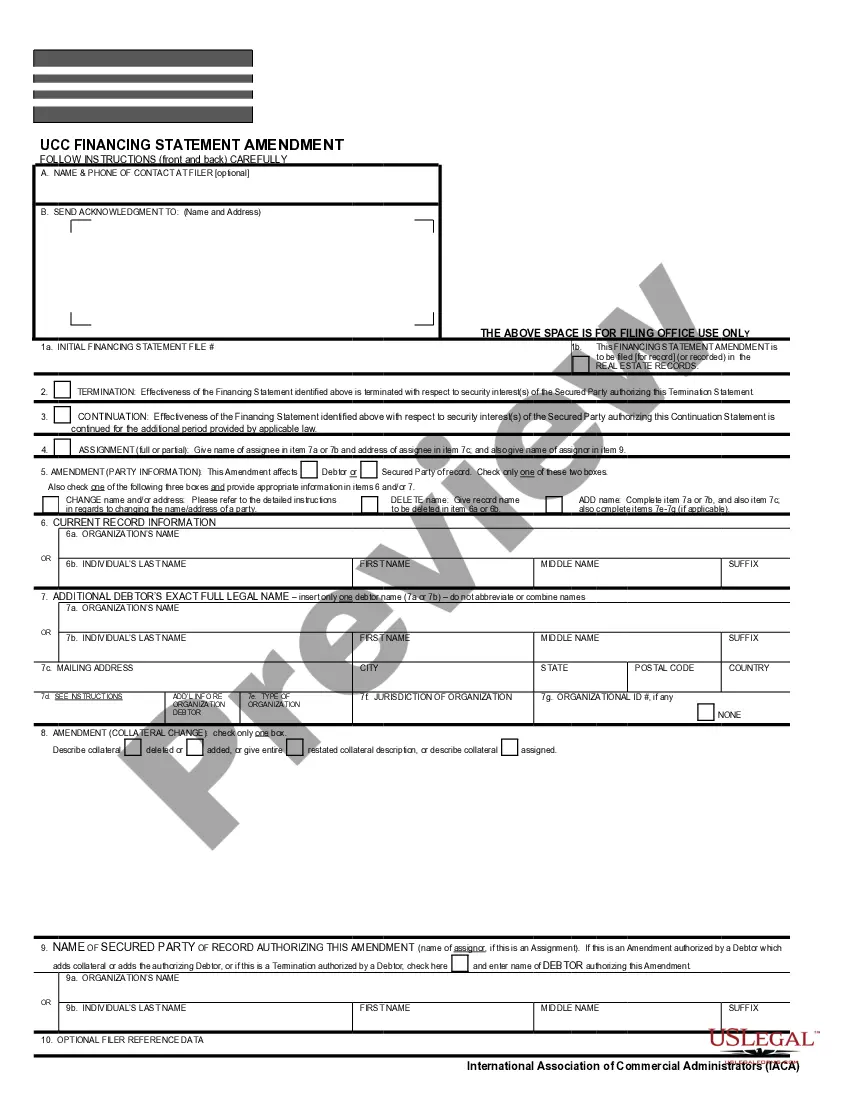

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

A UCC filing, also known as a UCC lien or a UCC-1, is a financing statement which lenders can file against your business with your secretary of state.This might be a piece of equipment, a vehicle, property, or even a blanket lien naming all your assets.

In Texas you can search for UCC-1 filings made against your company through a website provided by the Texas Secretary of State's office. There is a very small fee for conducting this search. Normally a UCC-1 Financing Statement expires five years from the date and time of filing as indicated on the UCC-1 form.

You can always check the status of UCC filings against your business through your business credit report or searching UCC lien public records.

A UCC-1 financing statementalso sometimes referred to as a 'UCC-1 filing,' a 'UCC lien,' or simply a 'UCC-1'is a form that creditors use to create a lien against a debtor's property.

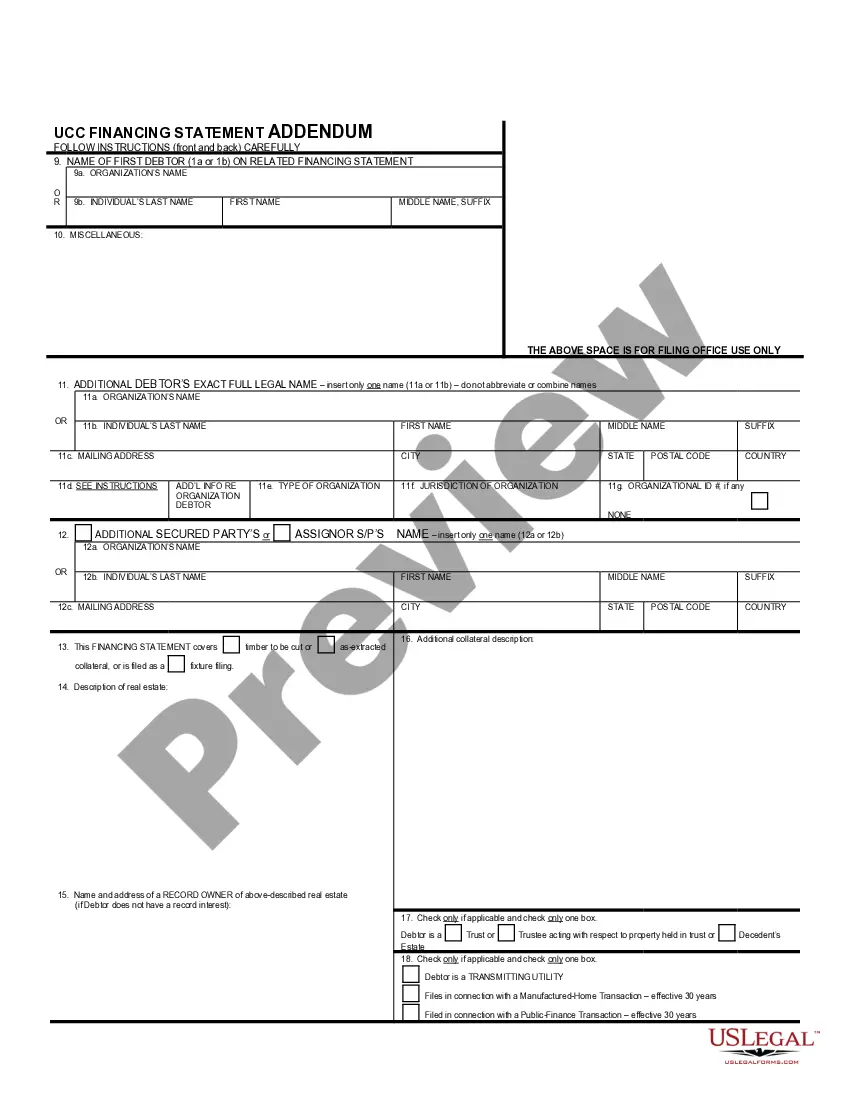

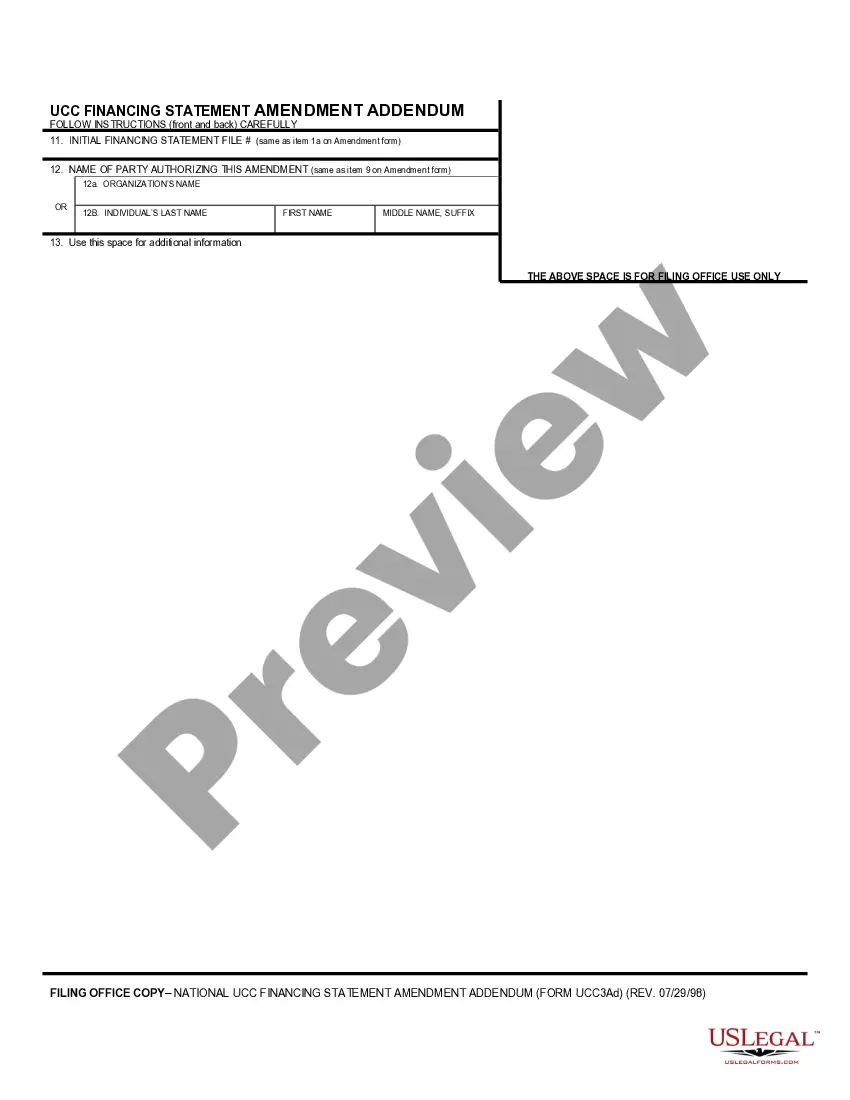

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

Searching Secretary of State Records Online. Locate the correct secretary of state's website. UCC financing statement forms must be filed in the state where the borrower is located. Most states have online directories of UCC filings available on the secretary of state's website.

UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

When is a UCC-1 Filed? UCC-1 filings typically happen when a loan is first originated. If the borrower has loans from more than one lender, the first lender to file the UCC-1 is first in line for the borrower's assets. This motivates lenders to file a UCC-1 as soon as a loan is made.