The Illinois Non-Wage Garnishment Notice is a legal notice issued by the State of Illinois to an employer or creditor regarding the withholding of money from an employee or debtor's wages. This notice requires the employer or creditor to withhold a portion of the employee or debtor's wages and remit the funds to the State of Illinois under the authority of the court. There are two types of Illinois Non-Wage Garnishment Notice: one for non-tax debts and one for tax debts. The non-tax debt notice is used to collect monies for judgments obtained in civil court proceedings, including but not limited to: child support payments, alimony, overdue rent, repossessions, or other unpaid debts. The tax debt notice is used to collect unpaid taxes from an employee or debtor.

Illinois Non-Wage Garnishment Notice

Description

Key Concepts & Definitions

Non Wage Garnishment Notice: This is a legal document informing an individual that a garnishment has been ordered against their assets, excluding wages. This might include bank accounts, rental income, or other financial assets. The notice usually provides details about the debt, the amount to be garnished, and the rights of the debtor.

Step-by-Step Guide to Responding to a Non Wage Garnishment Notice

- Review the Notice: Carefully read the garnishment notice to understand the details of the debt and the amount being garnished.

- Verify the Debt: Confirm that the debt is legitimate and that the details in the notice match your records.

- Seek Legal Advice: Consider consulting with an attorney who specializes in debt collection and financial law to explore your legal options.

- Respond Legally: File any necessary legal responses or objections within the time frame specified in the notice.

- Attend Hearings: If required, attend court hearings to present your case.

- Settle or Arrange Payments: If the garnishment is valid, arrange for payment plans or settlement as necessary.

Risk Analysis of Ignoring a Non Wage Garnishment Notice

Ignoring a non wage garnishment notice can lead to severe financial penalties and legal consequences. If the debt is valid and the garnishment proceeds without your response, additional costs and interest may accumulate, potentially increasing the total amount owed. Non-compliance might also result in court actions, further legal expenses, and potential seizure of assets.

Common Mistakes & How to Avoid Them

- Ignoring the Notice: Always respond promptly to avoid escalation of the situation.

- Lack of Legal Representation: Failing to seek legal advice can result in unfavorable outcomes. Hiring an attorney can provide guidance and protect your interests.

- Inaccurate Record Keeping: Maintain accurate and up-to-date financial records to dispute any inaccuracies in the garnishment notice effectively.

FAQ

What is non wage garnishment? Non wage garnishment is a legal process where a creditor seeks to recover debts from a debtor's non-wage assets.

Can I challenge a non wage garnishment? Yes, debtors have the right to contest the garnishment through the court system, provided they respond within the stipulated time frame.

Does bankruptcy affect non wage garnishment? Filing for bankruptcy can potentially stop or alter the process of garnishment depending on the type of bankruptcy and the nature of the debts.

Key Takeaways

Understanding your legal rights and responding appropriately to a non wage garnishment notice is crucial. Seeking professional advice and promptly addressing the notice can prevent significant financial and legal repercussions.

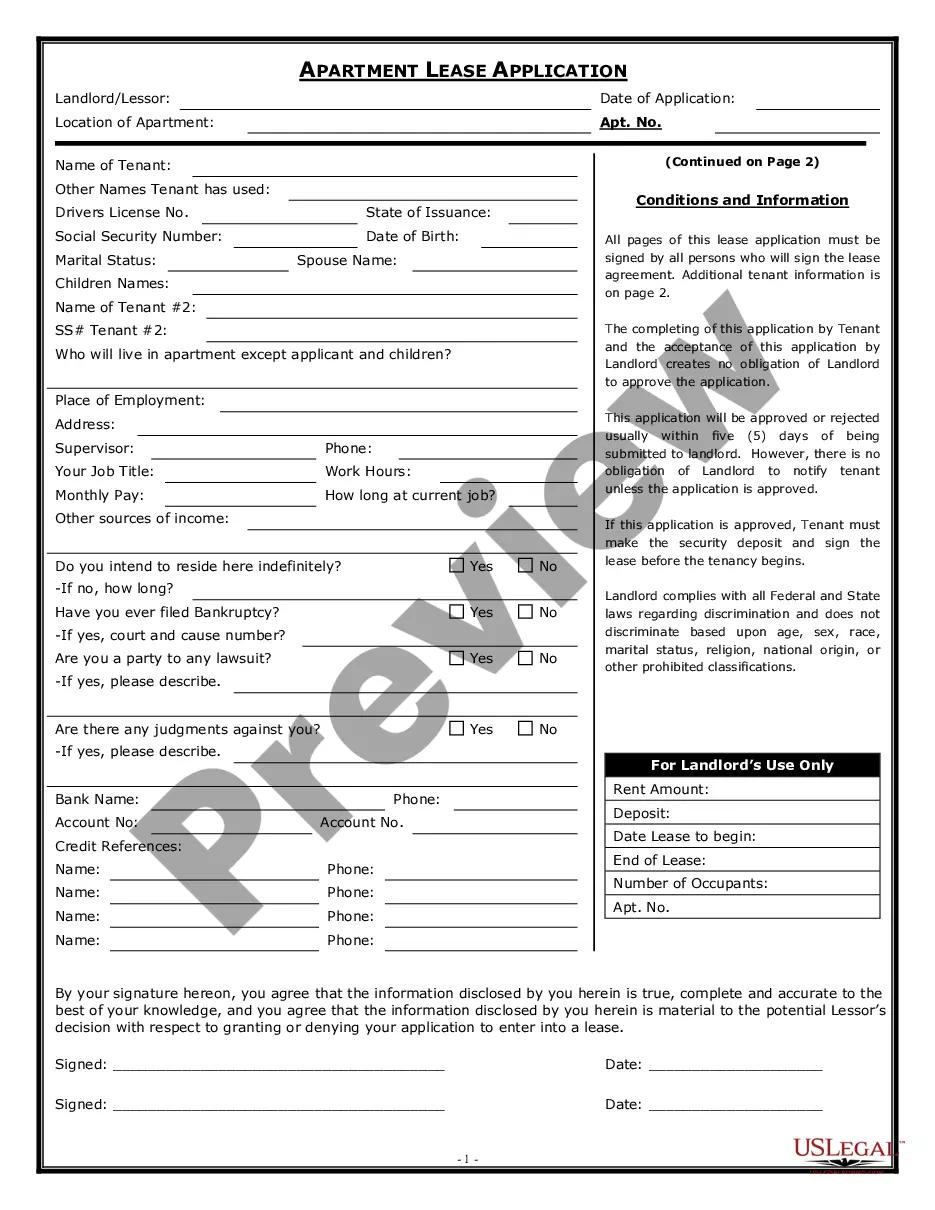

How to fill out Illinois Non-Wage Garnishment Notice?

Preparing formal documentation can be quite a challenge unless you possess ready-to-use customizable templates. With the US Legal Forms online collection of official records, you can be assured that the forms you encounter match federal and state laws and have been evaluated by our experts.

Thus, if you are looking to complete the Illinois Non-Wage Garnishment Notice, our platform is the ideal location to obtain it.

Document compliance assessment. You should carefully review the content of the form you wish to use and ensure that it meets your requirements and complies with your state's laws. Previewing your document and checking its general overview will assist you in doing so.

- Acquiring your Illinois Non-Wage Garnishment Notice from our library is as straightforward as ABC.

- Previously registered individuals with an active subscription need only Log In and click the Download button once they locate the correct template.

- Afterwards, if necessary, users can access the same document from the My documents section of their account.

- Nonetheless, even if you are new to our service, registering with a valid subscription will require only a few minutes. Here’s a quick guide for you.

Form popularity

FAQ

Wage Garnishment in Illinois In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.

Non-wage garnishment is the judgment creditor's attachment, after judgment, of the judgment debtor's property, other than wages, which is in the possession, custody or control of third parties. Example: A creditor files a non-wage garnishment to attach funds your client has deposited in the local bank.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

Wage Garnishment in Illinois In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

Employment income is usually not exempt under Illinois law, but other kinds of income are exempt from wage deductions. Some examples of exempt income include Social Security and other income from the federal government, workers' compensation benefits, unemployment benefits, and government assistance, to name a few.