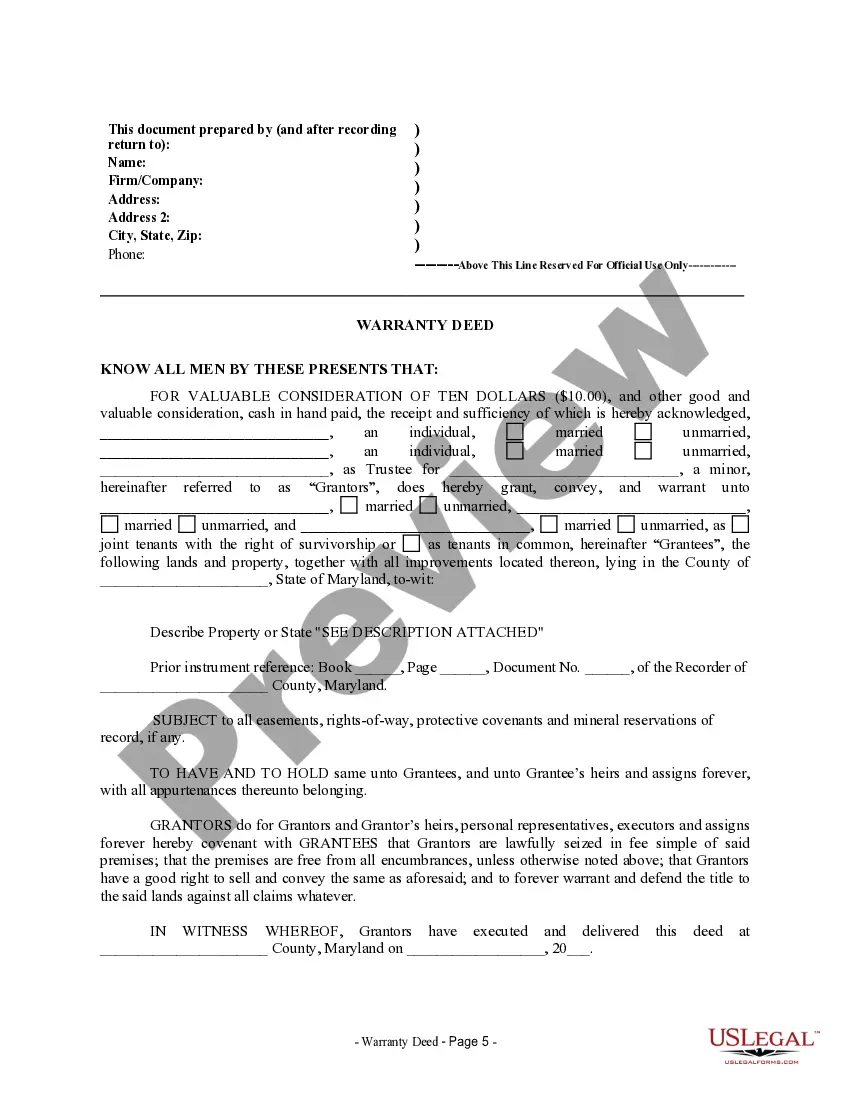

Maryland Warranty Deed from two Individuals and Trustee to Three Individuals

Description

How to fill out Maryland Warranty Deed From Two Individuals And Trustee To Three Individuals?

Among numerous complimentary and paid examples available online, you cannot be certain of their trustworthiness.

For instance, who developed them or if they’re sufficiently qualified to manage the requirements you need these individuals to address.

Stay calm and use US Legal Forms! Find Maryland Warranty Deed from two People and Trustee to Three People samples created by expert attorneys and avoid the costly and time-intensive process of searching for a lawyer and then paying them to draft a document for you that you can easily access by yourself.

Select a pricing plan and create an account. Remit for the subscription using your credit/debit card or PayPal. Download the document in the required format. Once you’ve registered and paid for your subscription, you can utilize your Maryland Warranty Deed from two Individuals and Trustee to Three Individuals as frequently as you wish or for as long as it remains valid in your state. Modify it in your preferred editor, complete it, endorse it, and print it. Achieve more for less with US Legal Forms!

- If you have a membership, Log In to your account and click the Download button adjacent to the file you wish to acquire.

- You'll also gain access to all of your past downloaded files in the My documents section.

- If you’re utilizing our platform for the first time, follow the directions provided below to obtain your Maryland Warranty Deed from two People and Trustee to Three People effortlessly.

- Verify that the document you locate is applicable in the state where you reside.

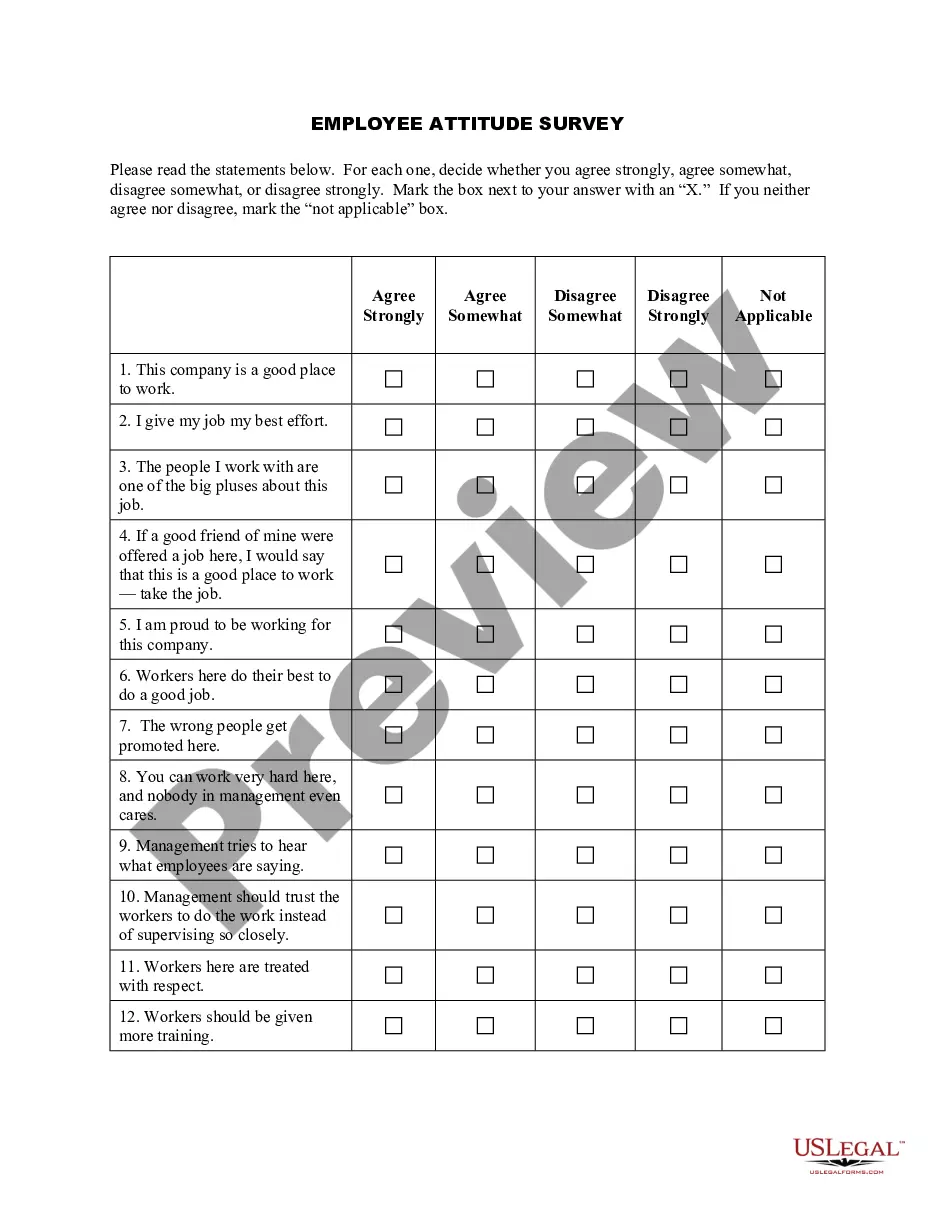

- Examine the template by reading the overview using the Preview feature.

- Click Buy Now to initiate the purchasing process or find another example using the Search bar found in the header.

Form popularity

FAQ

Your executor and successor trustee can usually be the same person, and it's actually a quite common arrangement.It helps to understand the roles of the executor and the successor trustee in your estate plan as you make a decision because some of the factors can be personal.

Trustee: a person or persons designated by a trust document to hold and manage the property in the trust. Beneficiary: a person or entity for whom the trust was established, most often the trustor, a child or other relative of the trustor, or a charitable organization.

When you are creating a will and a trust as part of your estate planning, you need to name an executor as well as a trustee, which can both be the same person, if you wish.

Generally, the individual that develops the trust appoints the trustees. You can have up to four trustees. Many grantors appoint their executors to also act as trustees. Similar to an executor, you can request professionals to act as trustees, such as an accountant or lawyer.

Executor v. If you have a trust and funded it with most of your assets during your lifetime, your successor Trustee will have comparatively more power than your Executor.

The role of a trustee is different than the role of an estate executor. An executor manages a deceased person's estate to distribute his or her assets according to the will. A trustee, on the other hand, is responsible for administering a trust.The beneficiaries are the recipients of the trust's assets.

An all-in fee will start between 1% and 2%, and usually covers the trust's investment manager, fiduciary and trust administration, and record-keeping and disbursements, but typically not asset-management fees. So, you might pay $30,000 to $50,000 a year on a $3 million trust.

The role of Executor is to administer the deceased's Estate, but the Trustees are there to manage any ongoing Trusts which arise from the Will.

Most corporate Trustees will receive between 1% to 2%of the Trust assets. For example, a Trust that is valued at $10 million, will pay $100,000 to $200,000 annually as Trustee fees. This is routine in the industry and accepted practice in the view of most California courts.