Kentucky Dissolution Package to Dissolve Corporation

Understanding this form

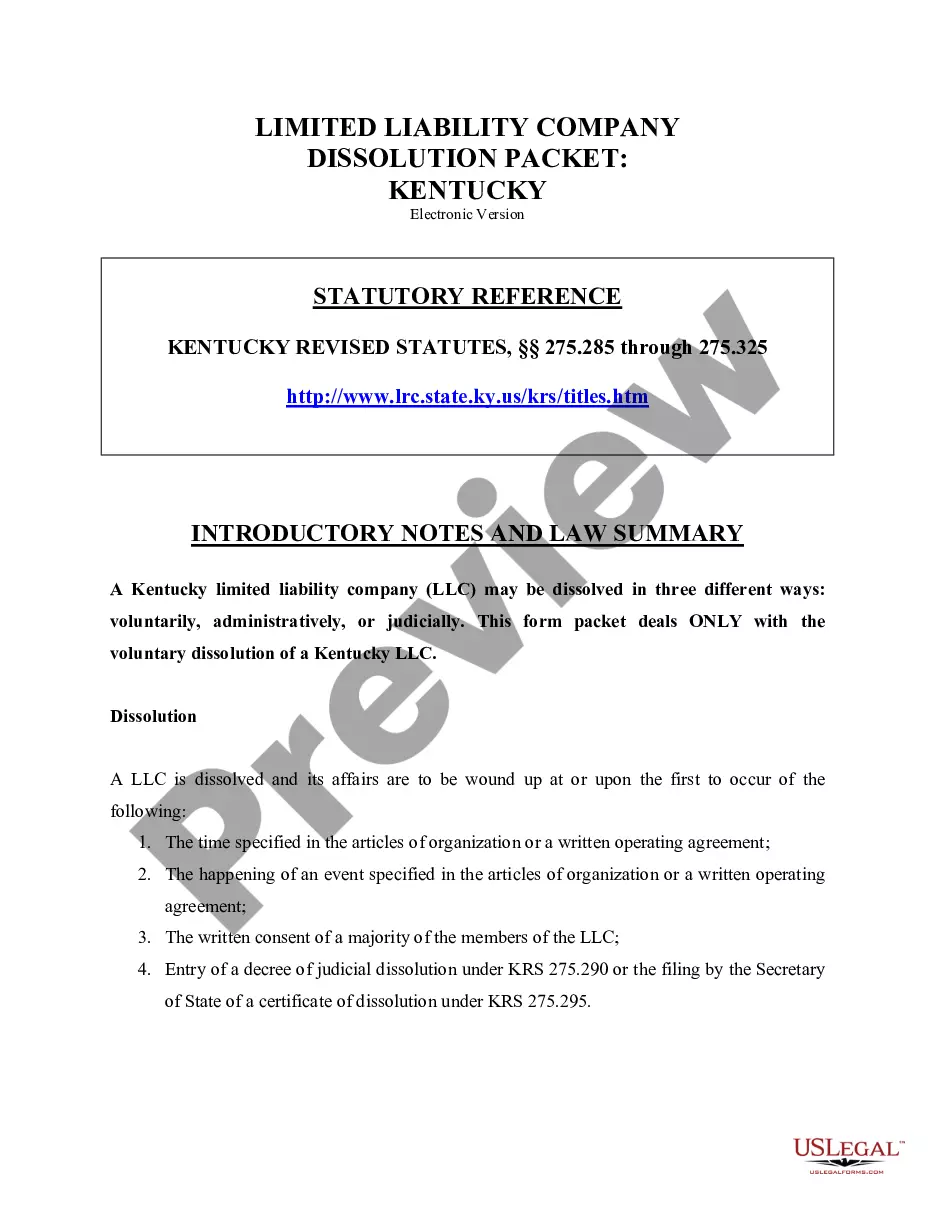

The Kentucky Dissolution Package to Dissolve Corporation provides all necessary legal forms and guidelines for voluntarily dissolving a corporation in Kentucky. This package includes step-by-step instructions, required documents, and sample letters. Unlike administrative or judicial dissolutions, this package specifically addresses voluntary dissolution, ensuring that all legal requirements are met effectively.

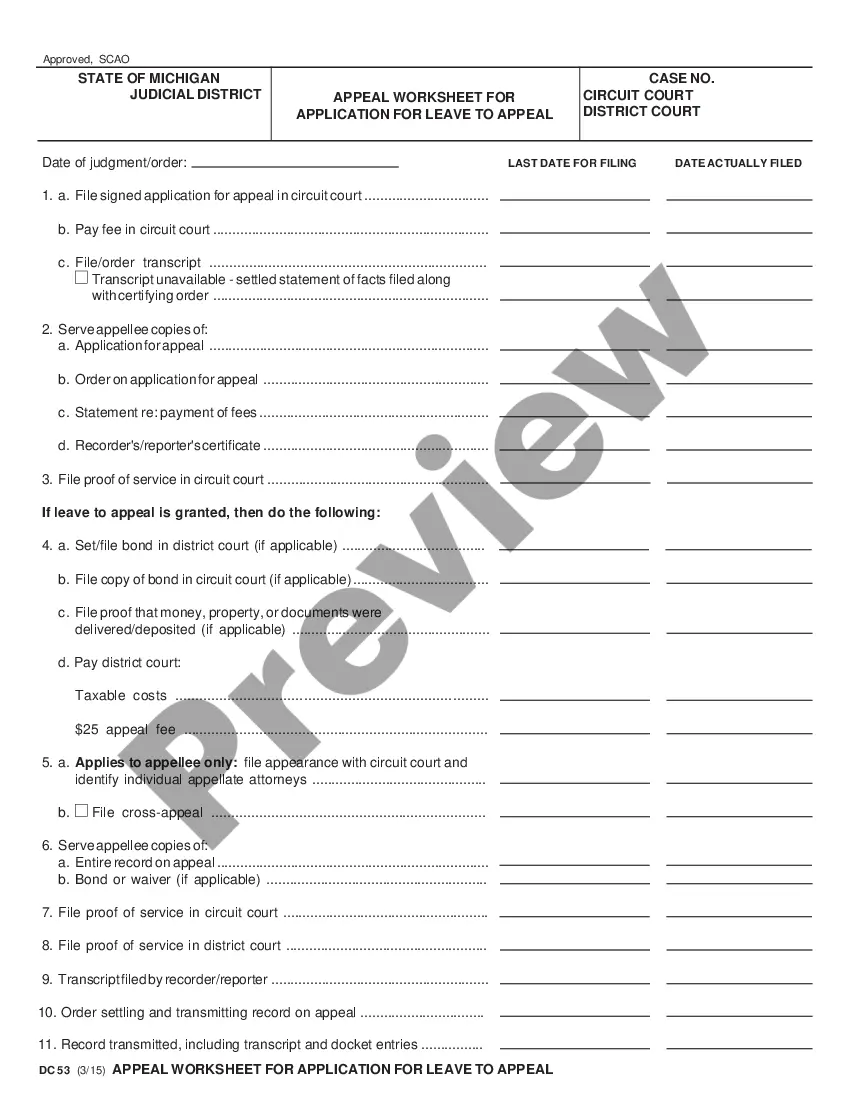

Main sections of this form

- Articles of Dissolution for corporations that have not issued shares or commenced business.

- Resolution of the Board of Directors recommending dissolution to shareholders.

- Notice of Special Meeting for shareholder approval.

- Articles of Dissolution for corporations that have issued shares or commenced business.

- Notices to claimants and for publication regarding the dissolution.

Common use cases

This form is needed when a corporation in Kentucky decides to voluntarily dissolve its business operations. It is suitable in situations such as a business slowing down, bankruptcy considerations, a lack of business activity, or when the owners wish to close the company and distribute any remaining assets among shareholders.

Who should use this form

This package is intended for:

- Corporation owners and shareholders wishing to dissolve their business.

- Board of Directors seeking to recommend voluntary dissolution.

- Incorporators or initial directors of a corporation that has not issued shares or commenced business.

Steps to complete this form

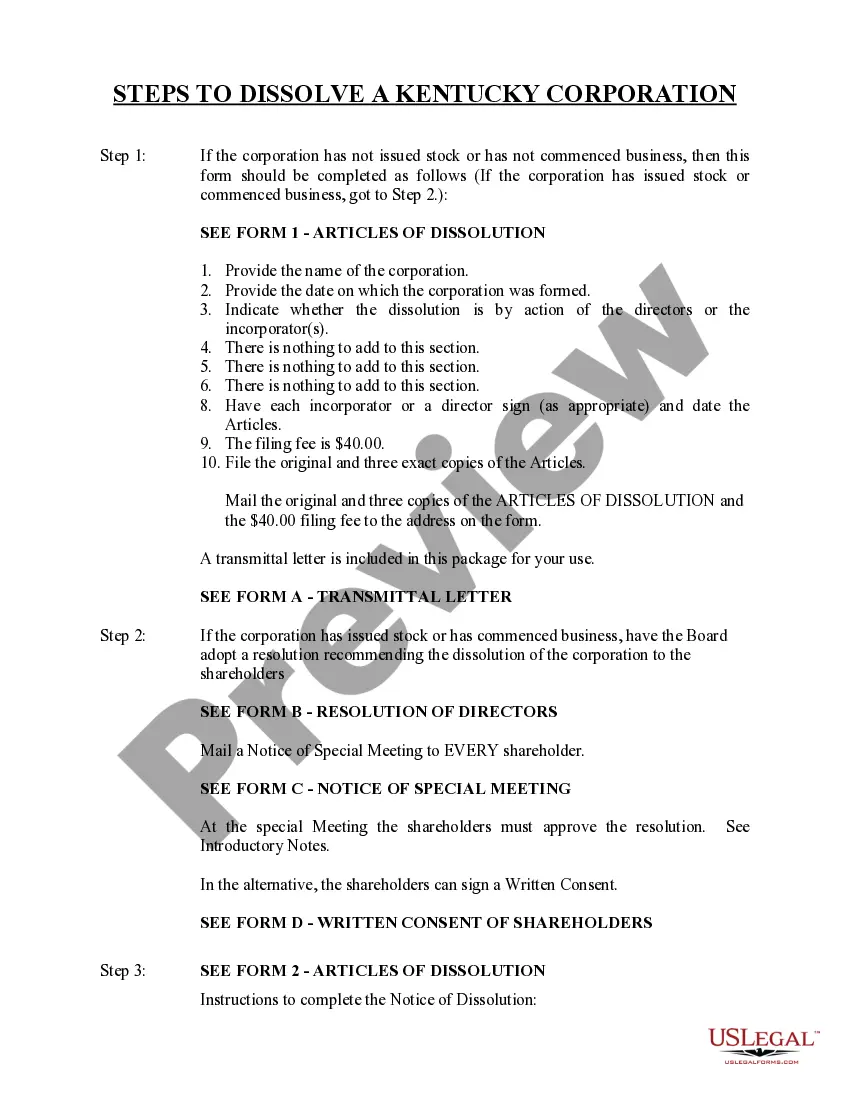

- If no shares have been issued or business has not commenced, complete the Articles of Dissolution (Form 1).

- For corporations that have issued shares or commenced business, the Board must adopt a resolution and notify shareholders (use Form B for resolution and Form C for notice).

- Compile Articles of Dissolution (Form 2) with details about the corporationâs formation, dissolution approval, and asset distribution status.

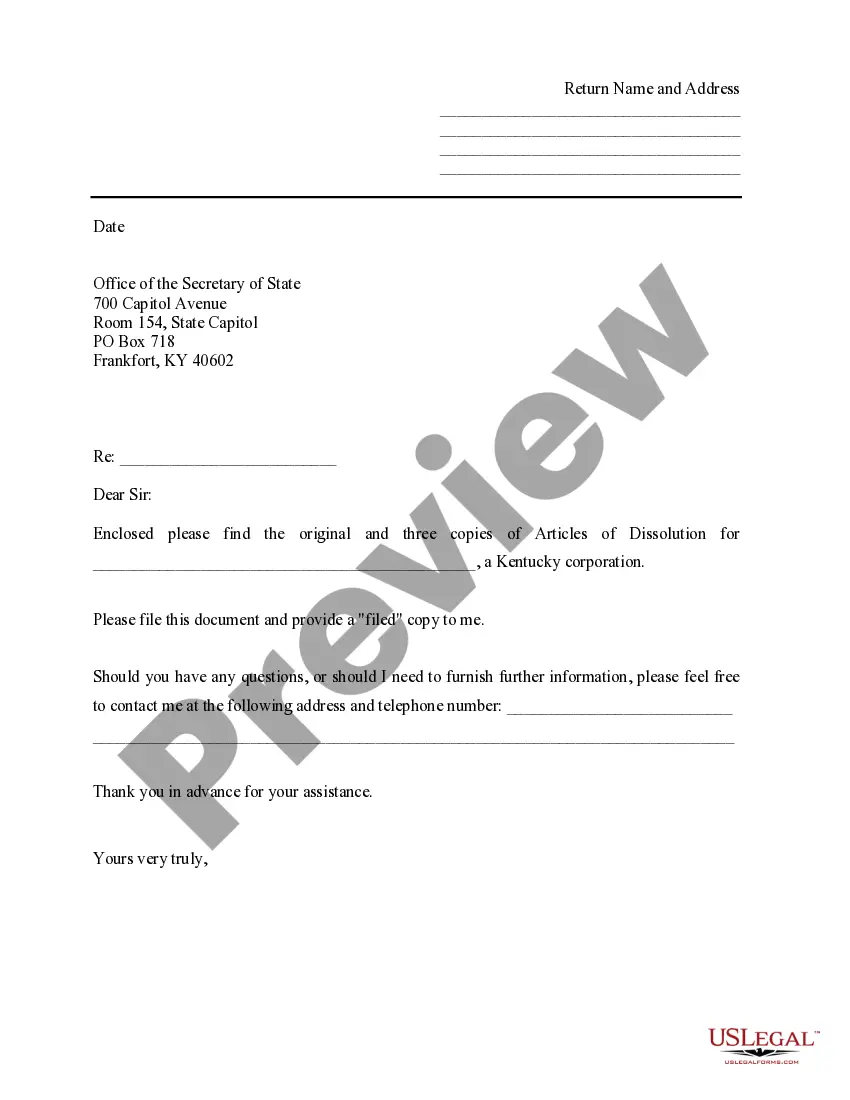

- After completion, send the original and copies of the Articles along with the filing fee to the Kentucky Secretary of State.

- Complete the winding up process by notifying known claimants (Form 3) and publishing notice in a local newspaper (Form 4).

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to notify all shareholders about the proposed dissolution meeting.

- Not providing all required information in the Articles of Dissolution.

- Missing deadlines for notifying claimants or for filing Articles.

Why use this form online

- Easy access to up-to-date legal documents tailored for Kentucky.

- Convenient step-by-step instructions to guide users through the dissolution process.

- Downloadable forms that can be filled out and filed at your convenience.

Looking for another form?

Form popularity

FAQ

Hold a Board of Directors meeting and record a resolution to Dissolve the Kentucky Corporation. Hold a Shareholder meeting to approve Dissolution of the Kentucky Corporation. File all required Annual Reports with the Kentucky Secretary of State. Clear up any business debts.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

In Kentucky, business entities are required by law to formally dissolve. In order to properly close, a domestic entity must file articles of dissolution, and a foreign entity must file a certificate of withdrawal. These forms are available for download on this website.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.