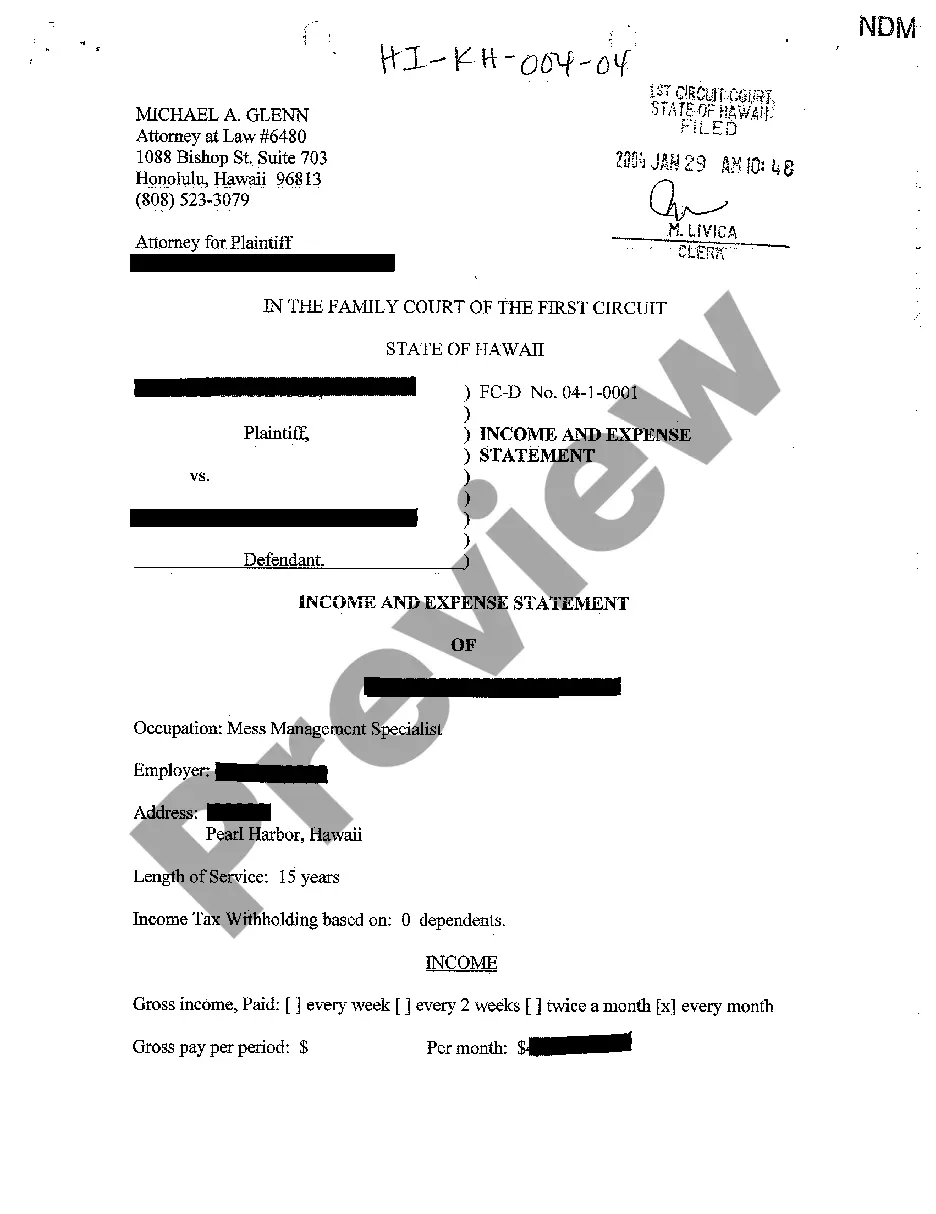

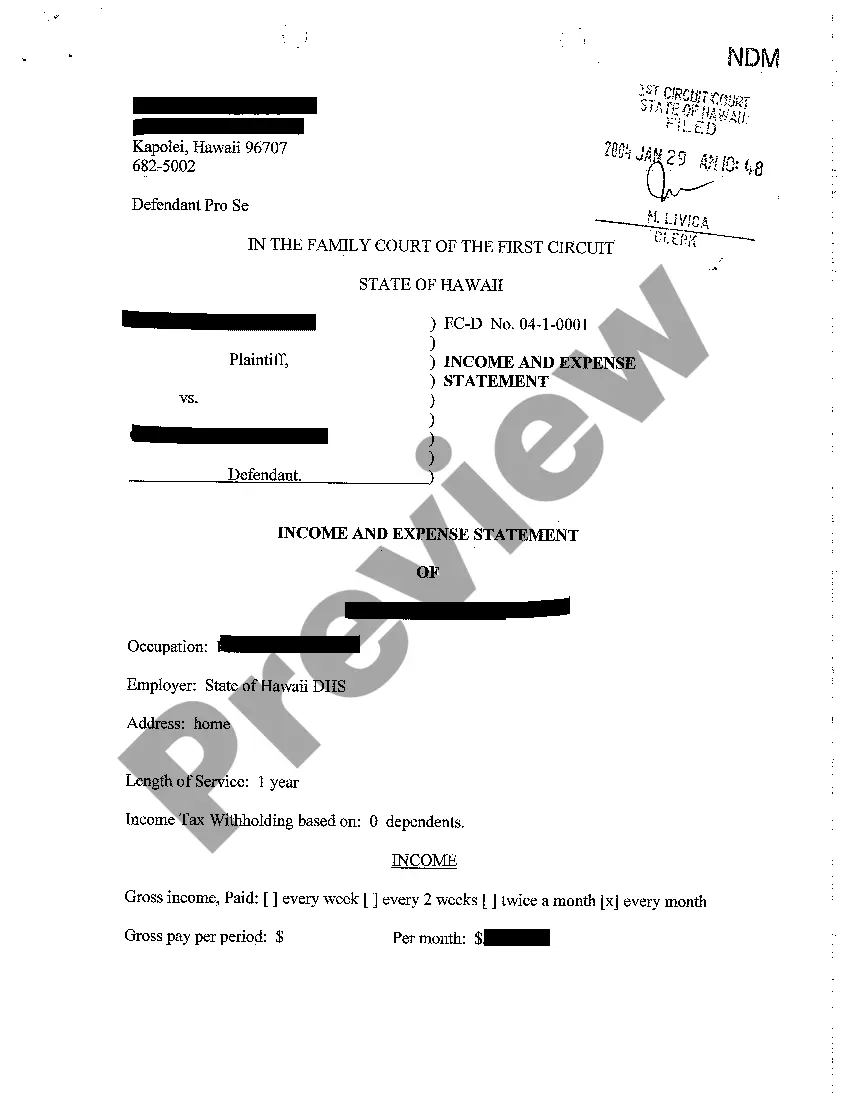

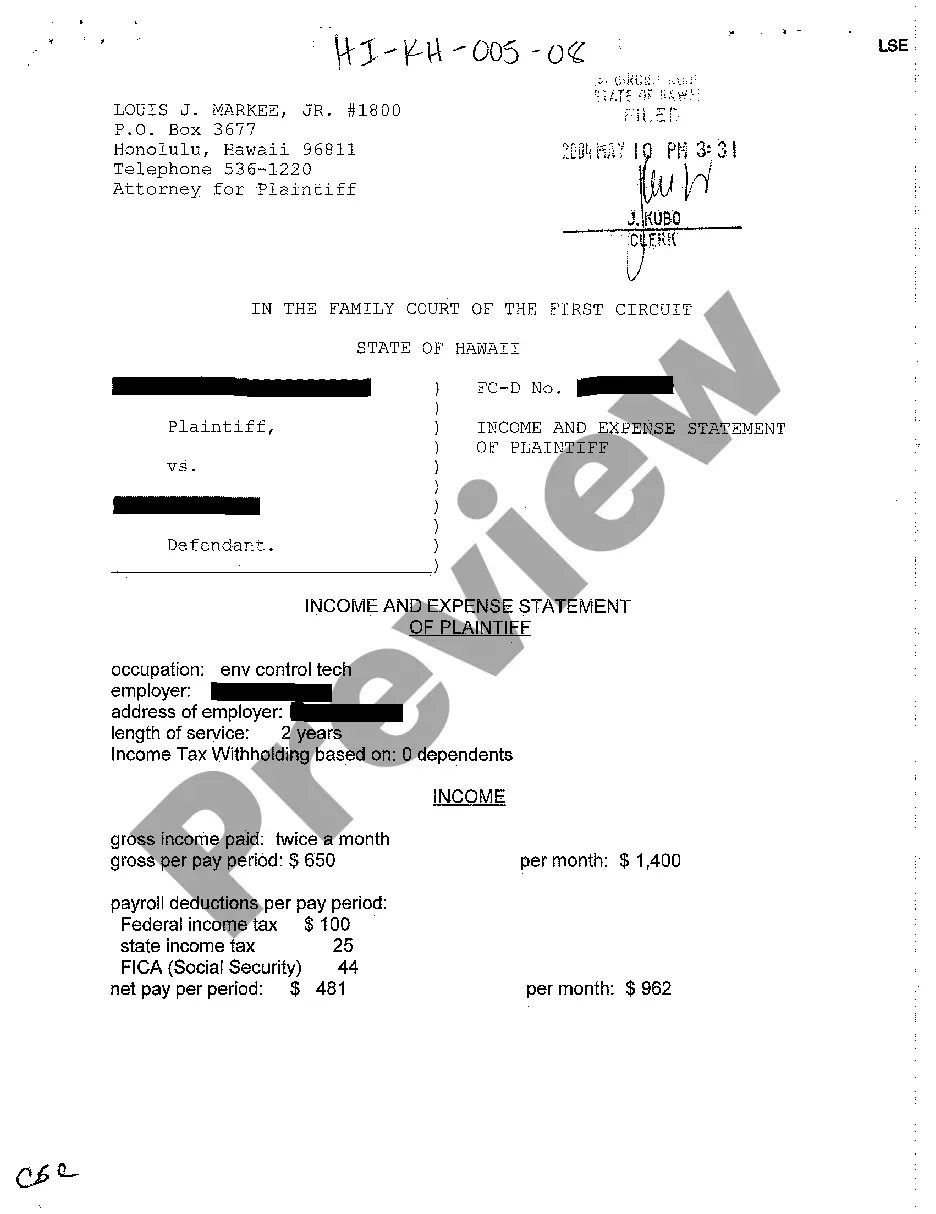

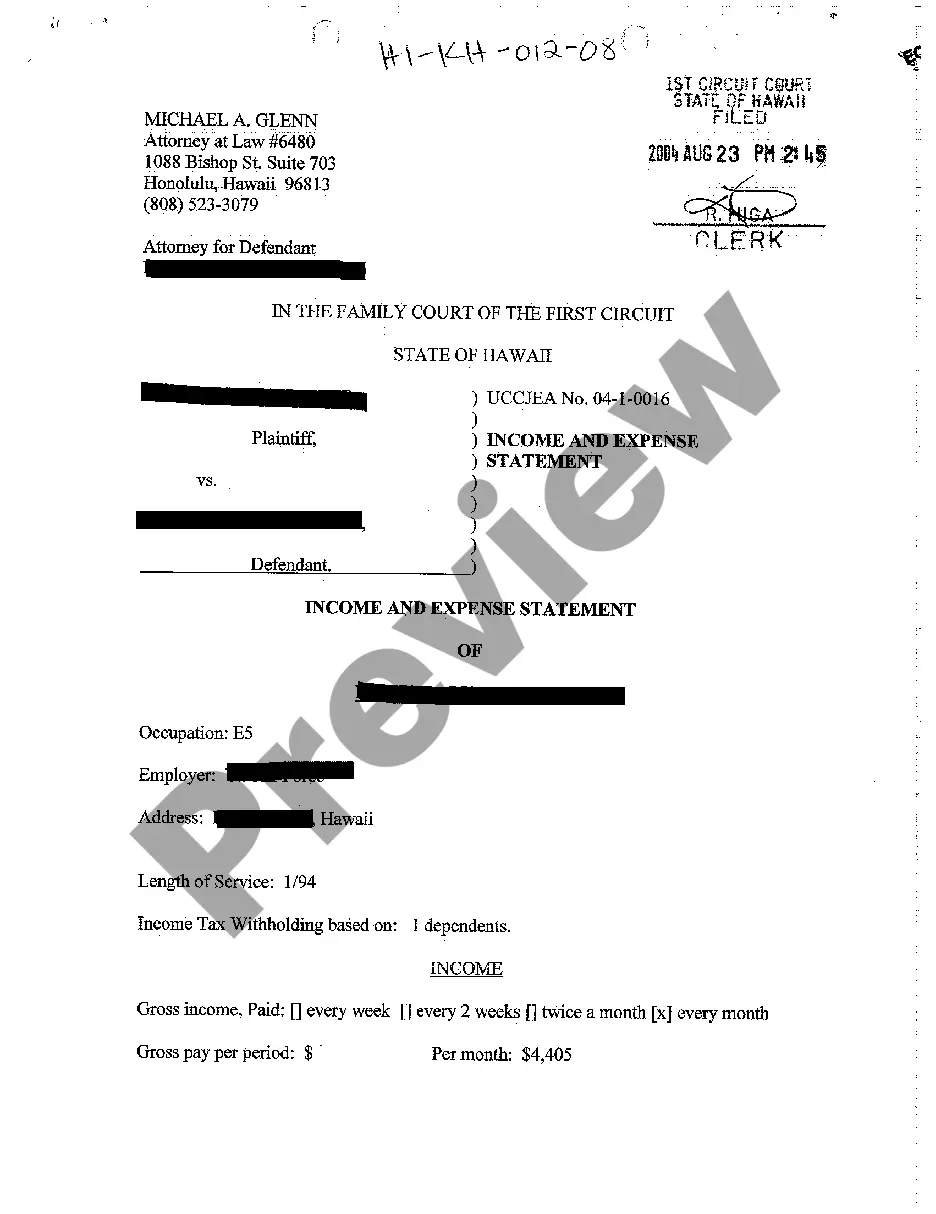

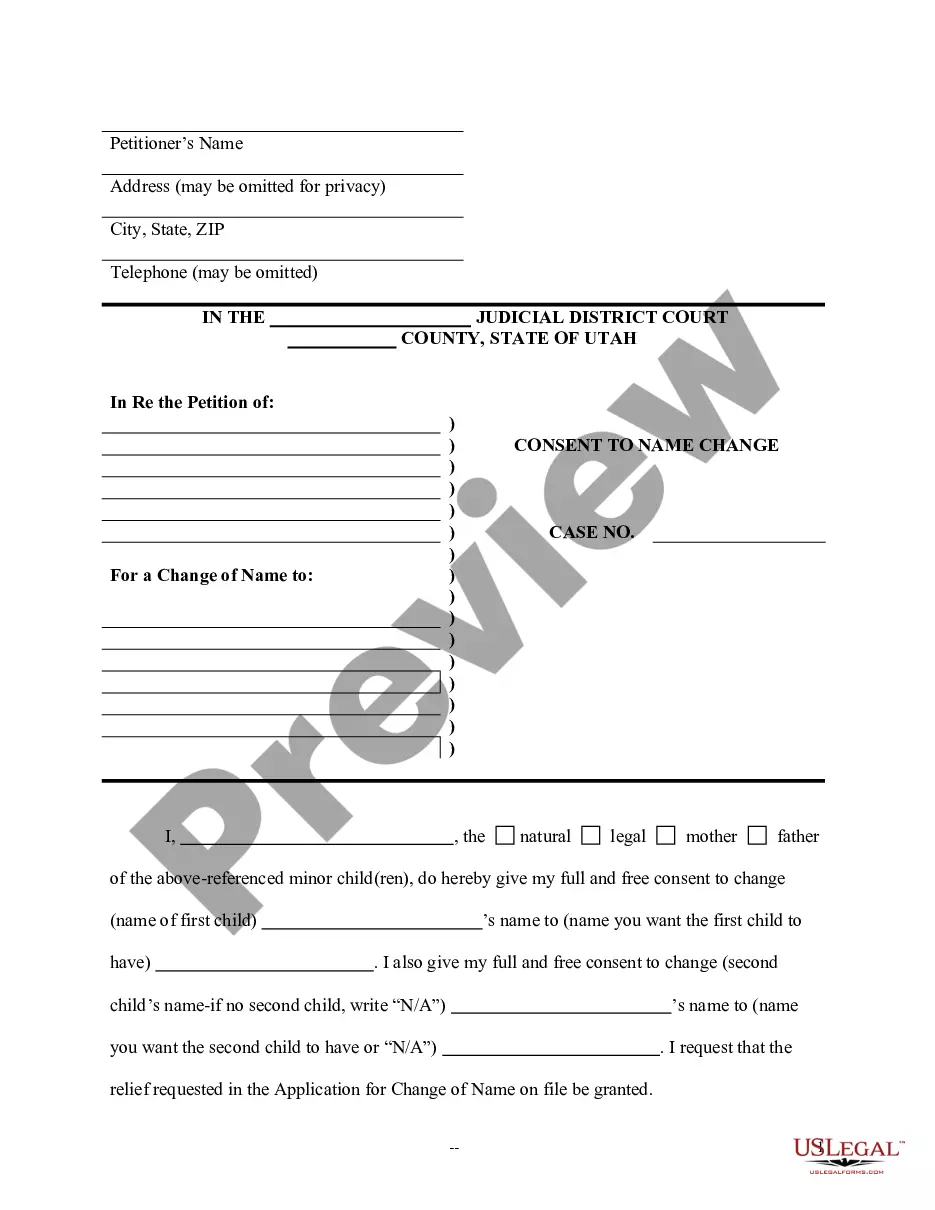

Hawaii Income and Expense Statement of Both Parties

Description

How to fill out Hawaii Income And Expense Statement Of Both Parties?

Among countless complimentary and paid templates available online, you cannot guarantee their dependability.

For instance, who created them or whether they possess the expertise to handle your specific needs.

Always stay calm and utilize US Legal Forms!

Review the document by utilizing the Preview function. Click Buy Now to initiate the purchasing process or search for another example using the Search field located in the header. Select a pricing option and set up an account. Complete the payment for the subscription using your credit or debit card or through PayPal. Download the document in your preferred format. Once you’ve registered and purchased your subscription, you can access your Hawaii Income and Expense Statement of Both Parties as many times as you wish or for as long as it remains valid in your state. Edit it with your preferred offline or online editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- Find Hawaii Income and Expense Statement of Both Parties samples crafted by experienced legal professionals.

- Avoid the costly and time-intensive process of seeking out a lawyer and subsequently paying them to draft a document for you that you can easily obtain.

- If you already maintain a subscription, Log In to your account and locate the Download button near the form you are looking for.

- You will also have access to all of your previously saved documents in the My documents section.

- If you’re using our service for the first time, follow the steps outlined below to quickly acquire your Hawaii Income and Expense Statement of Both Parties.

- Ensure that the document you see is relevant to your jurisdiction.

Form popularity

FAQ

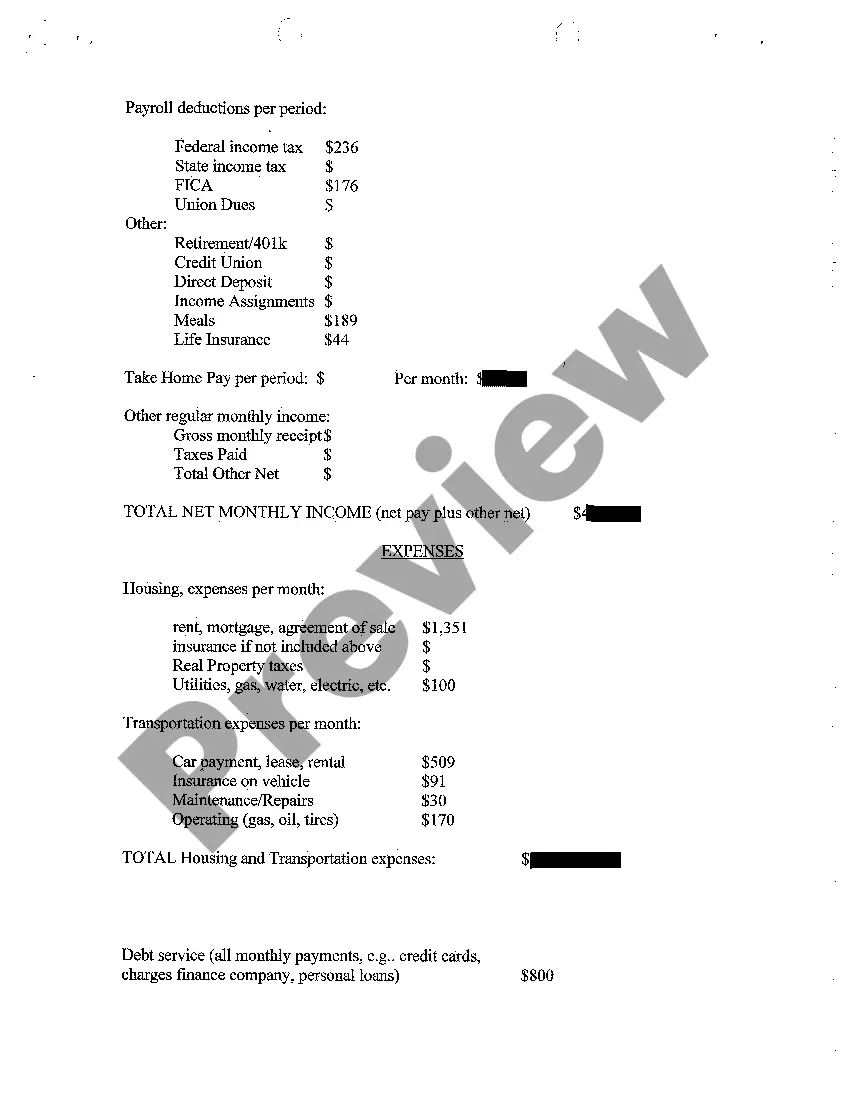

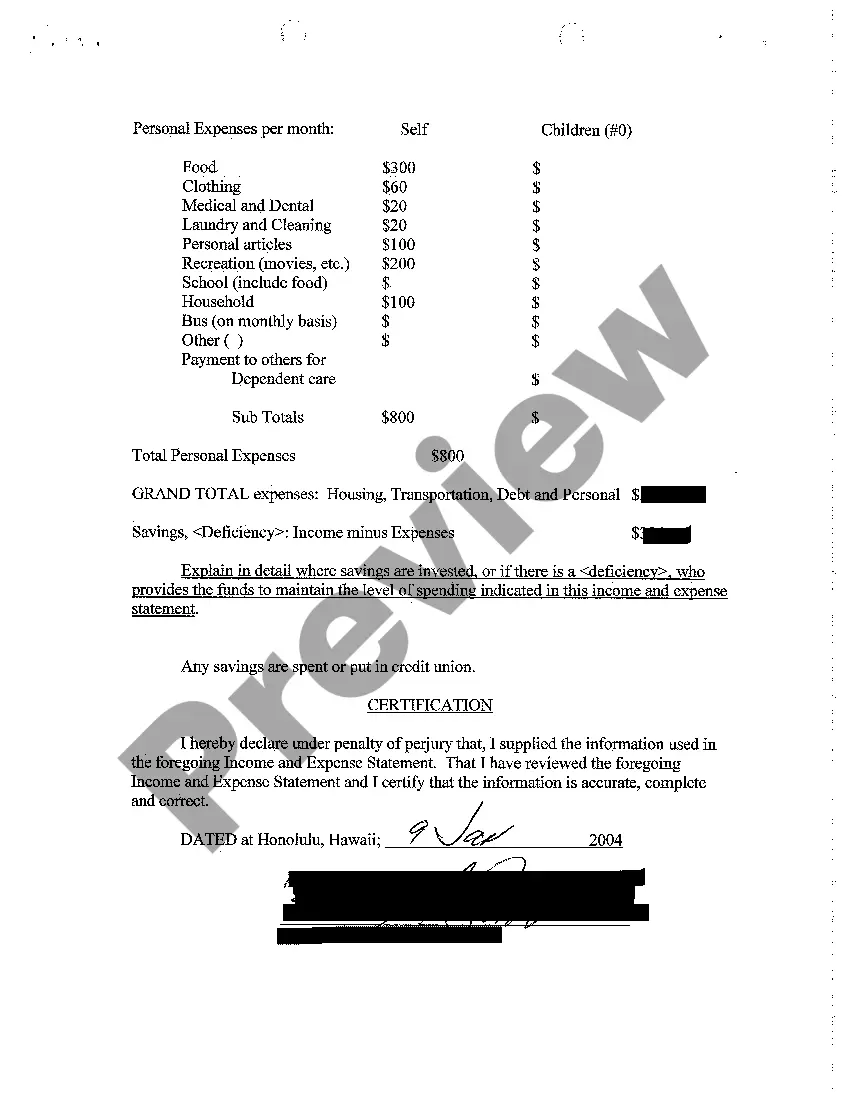

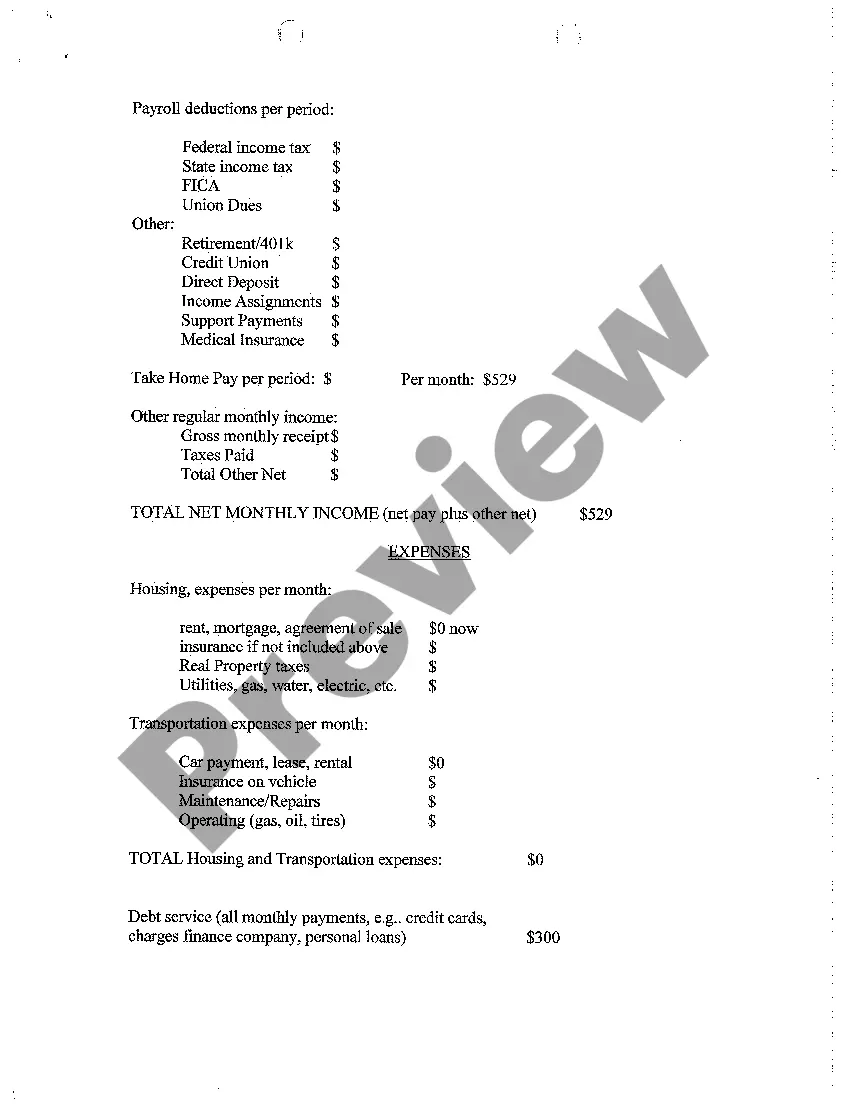

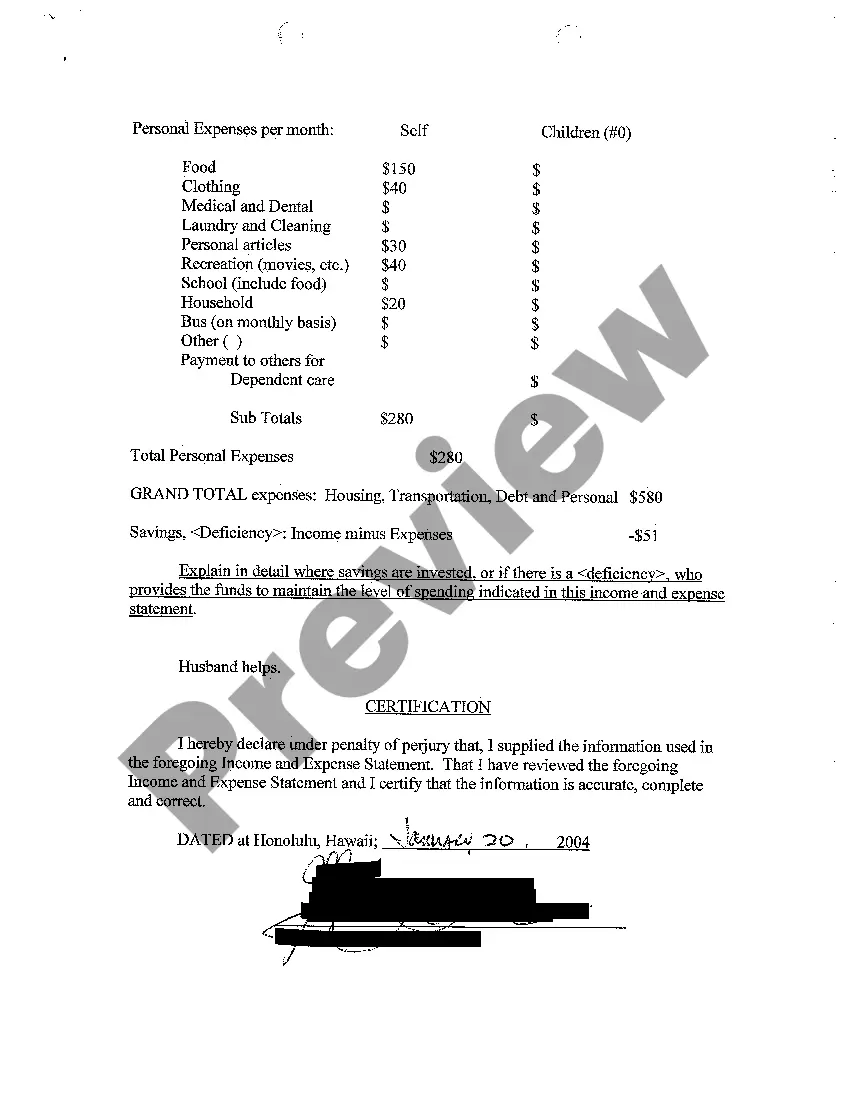

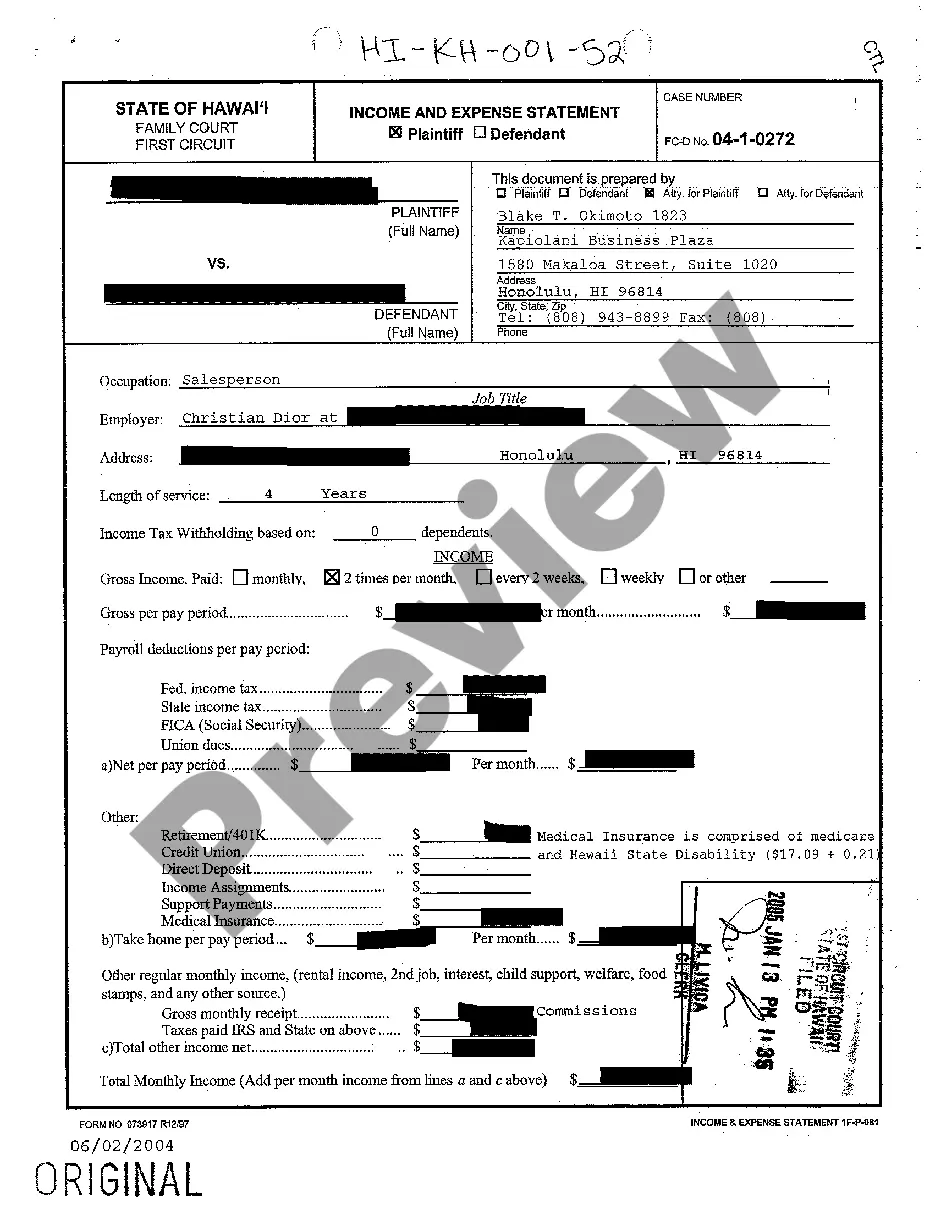

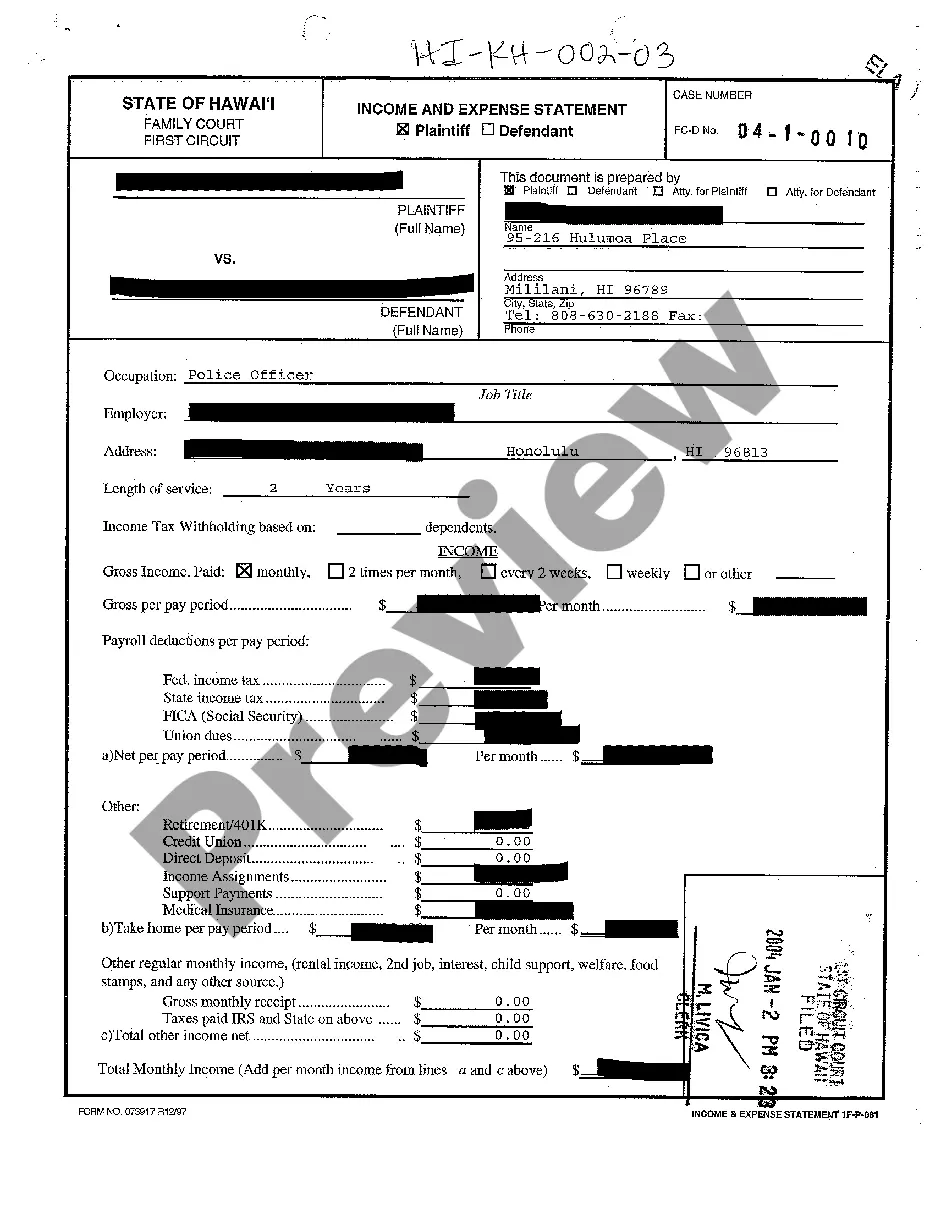

Creating an income and expense report involves listing your income sources and tracking your expenditures over a specified time period. Begin with your monthly earnings, then outline all necessary expenses to compile the Hawaii Income and Expense Statement of Both Parties. Be detailed and precise to provide a clear picture of your financial standing. You can find helpful tools and templates on uslegalforms that simplify the reporting process and ensure accuracy.

Yes, you need to fill out an income and expense declaration when required by the court. The Hawaii Income and Expense Statement of Both Parties serves as an essential document in legal proceedings, providing a complete overview of your financial situation. This information helps the court make informed decisions regarding child support, spousal support, and other financial considerations. If you need assistance, uslegalforms offers user-friendly templates to simplify this process.

In Hawaii, there is no specific age at which a child can definitively decide which parent to live with. However, as children mature, their preferences may be considered by the court, typically around the age of 14. Courts will take into account various factors, including the child's wishes and the Hawaii Income and Expense Statement of Both Parties, to make an informed decision. Ultimately, the child's best interests remain the primary focus in custody determinations.

During a custody battle, avoid making negative remarks about the other parent, as this can reflect poorly on you. Focus on factual information regarding the child's needs, rather than emotionally charged statements. Keep discussions centered on the facts, such as the Hawaii Income and Expense Statement of Both Parties, which outlines financial aspects that may affect custody. Maintaining a calm and respectful tone helps strengthen your position.

An example of a custody modification could be a change in the living arrangements of the child due to a parent's relocation for a job. Such a change may require you to submit the Hawaii Income and Expense Statement of Both Parties to help evaluate the financial implications. The court will consider the child's best interests in any modification request before making a decision. It’s essential to provide compelling evidence supporting the need for change.

Yes, you can modify child custody without a lawyer in Hawaii. However, it's vital to prepare the necessary documentation, including the Hawaii Income and Expense Statement of Both Parties, to support your request. You must file your modification request with the court and provide a solid reason for the change. Keep in mind that having legal advice can help navigate this process more effectively.

To file for separation in Hawaii, you need to fill out a few important forms, including the Hawaii Income and Expense Statement of Both Parties. This statement helps determine financial responsibilities during the separation process. After completing the required paperwork, you file it at your local court. Be sure to meet the specific state requirements to ensure a smooth process.

A statement of income and expense is a financial document that outlines a person’s or business’s income and expenditures over a specific period. This document provides insights into financial health by comparing income against expenses. Creating a detailed statement helps individuals meet their financial obligations and is an essential aspect of the Hawaii Income and Expense Statement of Both Parties that US Legal Forms can assist you with.

Three critical content items on an income statement are gross revenue, operating expenses, and net income. Gross revenue reflects total income from sales, while operating expenses include costs necessary to run the business. Lastly, net income indicates the profitability after all expenses are accounted for, crucial for preparing a Hawaii Income and Expense Statement of Both Parties.

An income and expense statement has three key components: total income, total expenses, and net income. Total income includes all income sources, while total expenses capture all costs incurred. Net income is calculated by subtracting total expenses from total income. This provides a comprehensive view in line with the Hawaii Income and Expense Statement of Both Parties.