Assignment Of Existing Promissory Note Form

Description

How to fill out Assignment Of Promissory Note And Liens?

Individuals typically link legal documentation with something intricate that only an expert can manage.

In a sense, this is accurate, as creating an Assignment Of Existing Promissory Note Form requires considerable knowledge in subject matter, including state and county laws.

Nevertheless, with US Legal Forms, processes have become simpler: pre-prepared legal templates for various personal and business situations tailored to state regulations are compiled in a single online repository and are now accessible to everyone.

Once purchased, all templates remain stored in your profile for reuse: you can access them anytime needed through the My documents tab. Discover all advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and area of application, enabling a search for the Assignment Of Existing Promissory Note Form or any specific template to only take a few minutes.

- Previously registered users with an active subscription should Log In to their account and select Download to acquire the form.

- New users to the platform will need to create an account and subscribe prior to downloading any paperwork.

- Here is a detailed guideline on how to get the Assignment Of Existing Promissory Note Form.

- Review the page content thoroughly to ensure it aligns with your requirements.

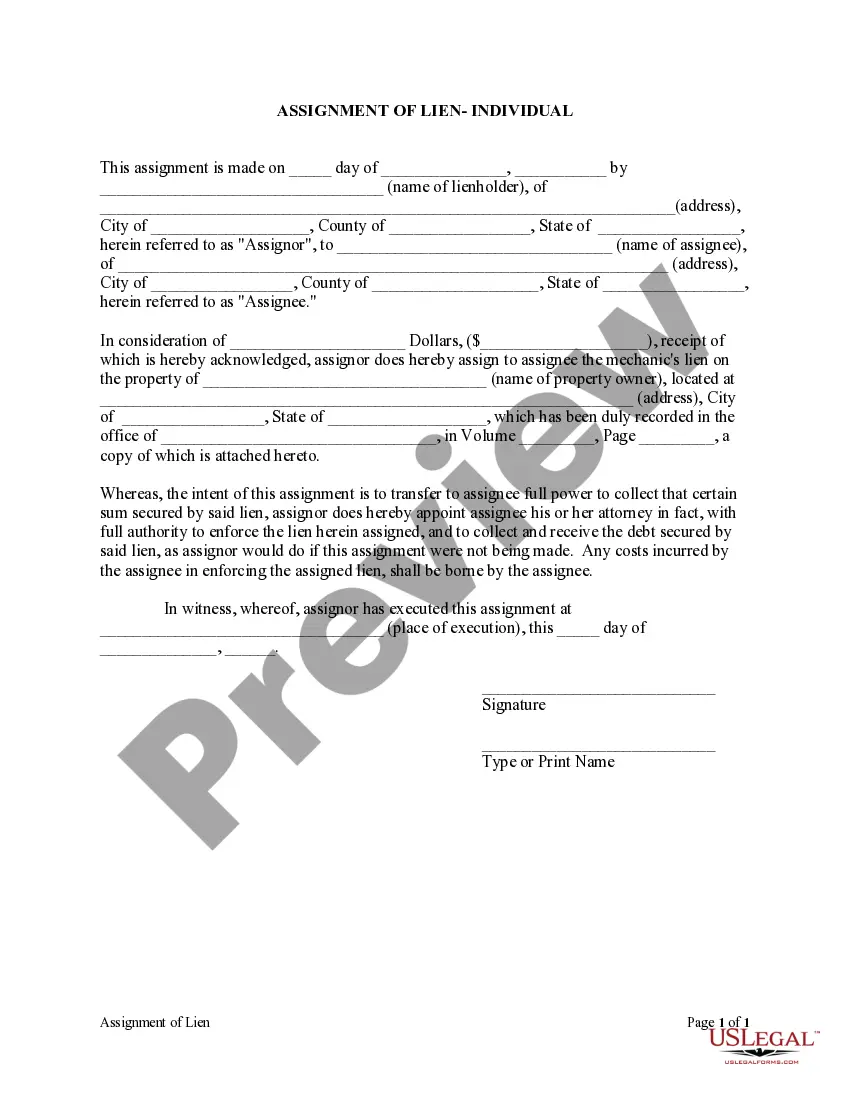

- Read the form description or check it through the Preview option.

- If the previous option does not satisfy you, find another sample via the Search bar in the header.

- Click Buy Now once you locate the suitable Assignment Of Existing Promissory Note Form.

Form popularity

FAQ

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

A promissory note can be transferred to a revocable living trust by assignment. An assignment is accomplished by the payee signing over the note to the trustee or trustees of the revocable living trust. The assignment should be in writing and a copy of the promissory note should be attached.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

You can create a Promissory Note as a lender or borrower by following these steps:Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.