Form Remove Member Llc With Ein

Description

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

Legally overseeing operations can be daunting, even for the most proficient professionals.

When you are looking for a Form Remove Member Llc With Ein and lack the time to search for the accurate and up-to-date version, the process can be overwhelming.

US Legal Forms addresses any needs you may have, covering everything from personal to business documentation, all in one centralized location.

Employ advanced tools to complete and manage your Form Remove Member Llc With Ein.

Here are the steps to follow once you acquire the form you require: Validate that this is the correct document by reviewing it and examining its details. Ensure that the sample is recognized in your state or county. Select Buy Now when you are prepared. Choose a subscription option. Locate your preferred format, and Download, fill out, eSign, print, and send your document. Leverage the US Legal Forms online directory, backed by 25 years of expertise and reliability. Streamline your everyday document management into a seamless and user-friendly experience today.

- Access a valuable resource hub of articles, tutorials, and manuals related to your situation and needs.

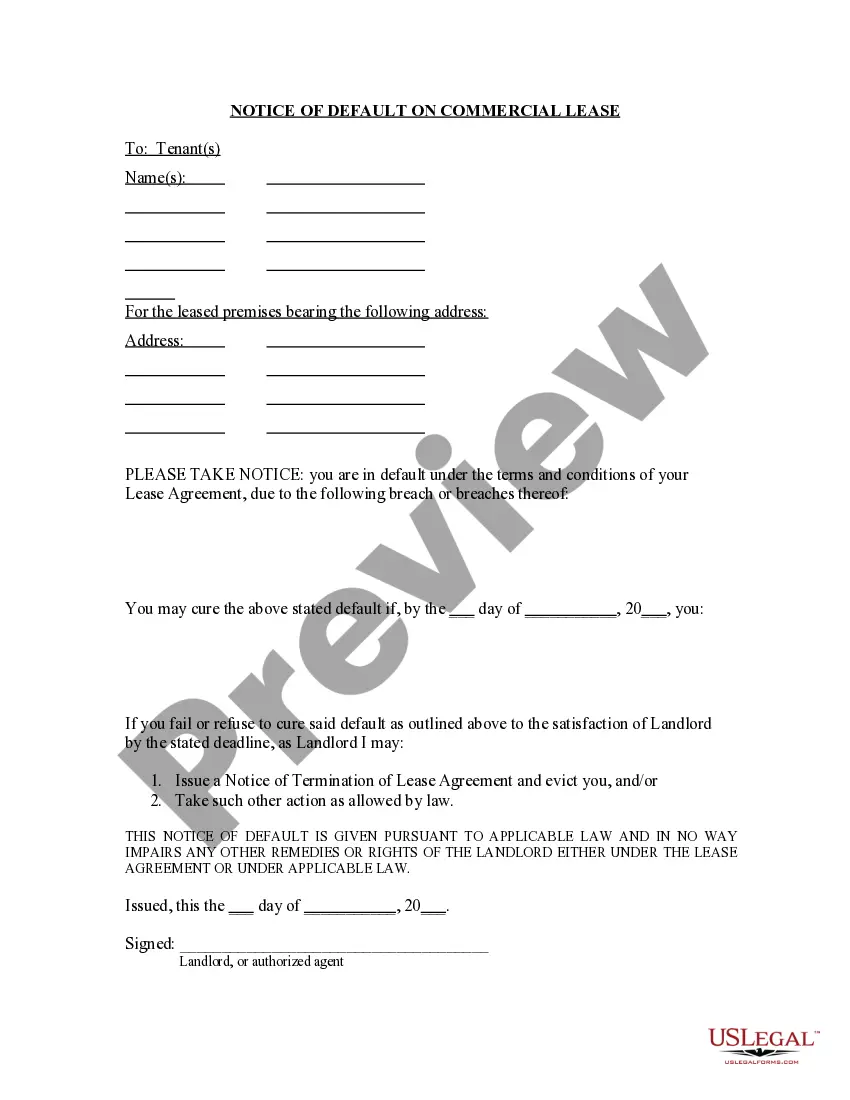

- Save time and effort locating the necessary documents, utilizing US Legal Forms' sophisticated search and Preview feature to find Form Remove Member Llc With Ein and download it.

- If you hold a subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Visit the My documents tab to review the documents you have downloaded previously and manage your folders as desired.

- If it's your first interaction with US Legal Forms, establish an account to gain unlimited access to all platform benefits.

- Utilize a comprehensive online form directory that can significantly change the game for anyone wishing to handle these matters efficiently.

- US Legal Forms is a market leader in online legal documents, offering over 85,000 state-specific legal forms accessible at any time.

- Access state- or county-specific legal and business documents.

Form popularity

FAQ

If you reported your EIN incorrectly, please file a W-3c to correct it. Make sure you use the Employer Identification Number (EIN) issued by IRS on all Forms W-2c/W-3c. Note: The same EIN number should be used on the Form 941-x, Supporting Statement to Correction Information, when applicable.

You need to complete Form 8822-B and send it to the IRS to change the EIN Responsible Party for your LLC. If the Responsible Party for your LLC has changed, you'll need to update the IRS as soon as possible, as per their requirements. Note: Form 8822-B can also be used to change your LLC address with the IRS.

Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership representative where no partnership representative is in effect.

The usual method of involuntary removal is a vote by the other members followed by a buyout based on the departing member's interest or share in the company. Member buyouts may be addressed in a buy-sell agreement or another internal governing document.

If there is more than one responsible party, the entity may list whichever party the entity wants the IRS to recognize as the responsible party. Additionally, entities must report any changes to the responsible party to the IRS within 60 days by using Form 8822-B, Change of Address or Responsible Party ? BusinessPDF.