Liability Parent Guardian Form Centrelink

Description

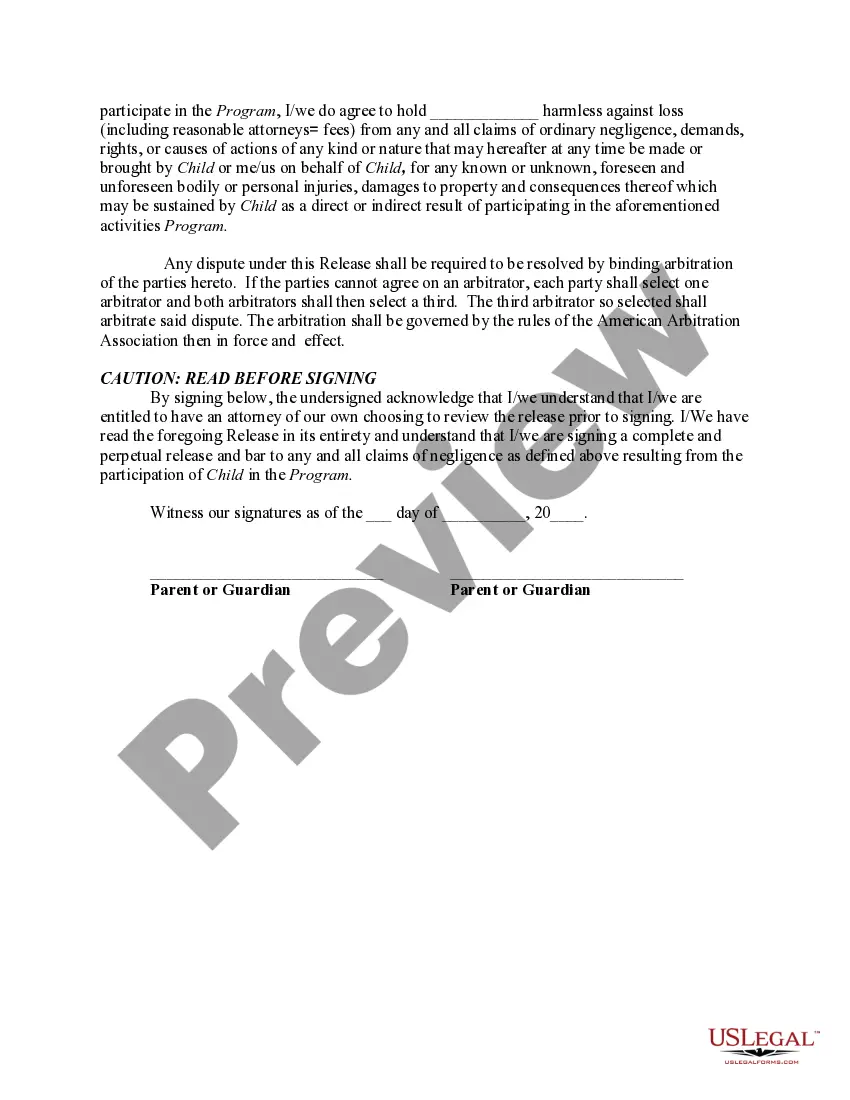

How to fill out Release From Liability By Parent Or Guardian For Students Under The Age Of 18 To Participate In On-Site Dance, Gymnastics And Yoga Classes?

Legal administration can be daunting, even for the most proficient professionals.

When you are looking for a Liability Parent Guardian Form Centrelink and lack the time to dedicate to finding the correct and current version, the experience can be overwhelming.

Access state- or county-specific legal and business documents. US Legal Forms addresses any requirements you may have, from personal to business paperwork, all in one location.

Utilize advanced tools to complete and manage your Liability Parent Guardian Form Centrelink.

Here are the steps to follow after accessing the form you need: Confirm this is the right form by previewing it and reading its description. Ensure that the sample is authorized in your state or county. Click Buy Now when you are ready. Select a subscription plan. Choose the format you prefer, and Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online directory, supported by 25 years of expertise and reliability. Transform your daily document management into a simple and user-friendly process today.

- Access a valuable resource library of articles, guides, and manuals pertinent to your situation and needs.

- Save time and effort searching for the documents you require, and leverage US Legal Forms’ sophisticated search and Review tool to locate Liability Parent Guardian Form Centrelink and obtain it.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check the My documents tab to view the documents you have previously downloaded and manage your folders as desired.

- If this is your first time using US Legal Forms, create an account and gain unrestricted access to all the advantages of the library.

- A comprehensive online form directory could be transformative for anyone looking to manage these matters efficiently.

- US Legal Forms is a frontrunner in online legal documents, with more than 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

Step 1: get started Sign in to myGov and select Centrelink. From your homepage, select MENU. Select Documents and appointments, then Documents and Request a document.

The base year is the tax year ending in the previous calendar year (that is, for the 2023 assessment period the base year is 2021-22). However in particular circumstances the tax year immediately following the base tax year may be used for assessing parental income.

The BASE tax year is the financial year ending before 1 January of the year of payment. A CURRENT tax year assessment If you are completing this form between September and December, you will need to provide information for both the BASE tax year and the CURRENT tax year.

What is a SY016 form? Unreasonable to live at home statement by parents or guardians form (SY016) Use this form if your child has applied as an independent person for Youth Allowance or ABSTUDY under the unreasonable to live at home guidelines.

Parent or Guardian details - for the BASE tax year and CURRENT tax year for dependent Youth Allowance or ABSTUDY customers form (MOD JY) Use this form to provide income details of a parent or guardian if you are a dependent claiming or receiving Youth Allowance or ABSTUDY.