Unsecured Loan Form For Car

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

Working with legal documents and operations might be a time-consuming addition to the day. Unsecured Loan Form For Car and forms like it often require you to search for them and navigate the best way to complete them effectively. For that reason, whether you are taking care of economic, legal, or personal matters, using a extensive and hassle-free online library of forms at your fingertips will greatly assist.

US Legal Forms is the top online platform of legal templates, featuring more than 85,000 state-specific forms and numerous resources to assist you to complete your documents effortlessly. Discover the library of appropriate papers available to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Protect your document management operations by using a top-notch services that allows you to prepare any form within minutes without additional or hidden cost. Just log in to your profile, identify Unsecured Loan Form For Car and acquire it right away from the My Forms tab. You can also access formerly downloaded forms.

Would it be the first time utilizing US Legal Forms? Sign up and set up an account in a few minutes and you will gain access to the form library and Unsecured Loan Form For Car. Then, follow the steps listed below to complete your form:

- Ensure you have the correct form using the Review feature and looking at the form description.

- Pick Buy Now as soon as ready, and choose the monthly subscription plan that is right for you.

- Press Download then complete, sign, and print out the form.

US Legal Forms has 25 years of expertise supporting consumers manage their legal documents. Discover the form you require today and streamline any operation without having to break a sweat.

Form popularity

FAQ

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates.

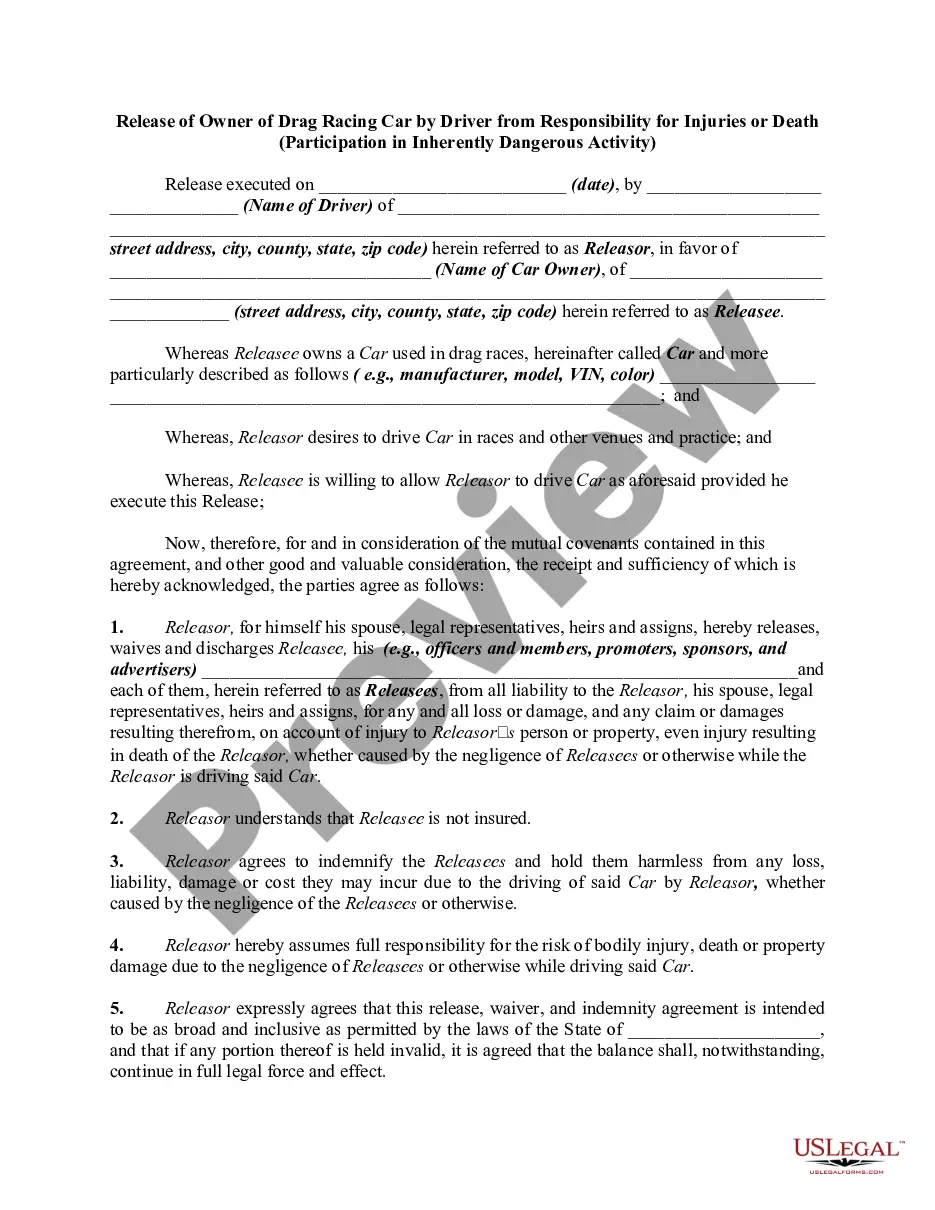

A personal loan can be secured with an asset, but it is more commonly unsecured. A car loan is secured with the vehicle you purchase, so it can be repossessed in the event of a default. Both car loans and personal loans are generally fixed-rate installment loans that have set terms and regular monthly payments.

A traditional car loan is secured by the financed vehicle, while an unsecured car loan is either a or personal loan without collateral used for the purpose of buying a car. If you need financing to buy a car, most auto loans require collateral.

An unsecured car loan is a personal loan used to purchase a new or used car. Since the loan is unsecured, the lender cannot repossess your car if you stop making payments. Instead, the lender can report the default to the credit bureaus and sue you. Unsecured Auto Loans: Should You Get One? | Bankrate.com Bankrate ? Loans ? Auto Loans Bankrate ? Loans ? Auto Loans

Most car loans are secured, but the possibility for an unsecured personal loan to pay for a car is out there. Saving a lot on interest and taking advantage of promotional financing can make secured loans a much better deal, saving you money over the life of the loan.