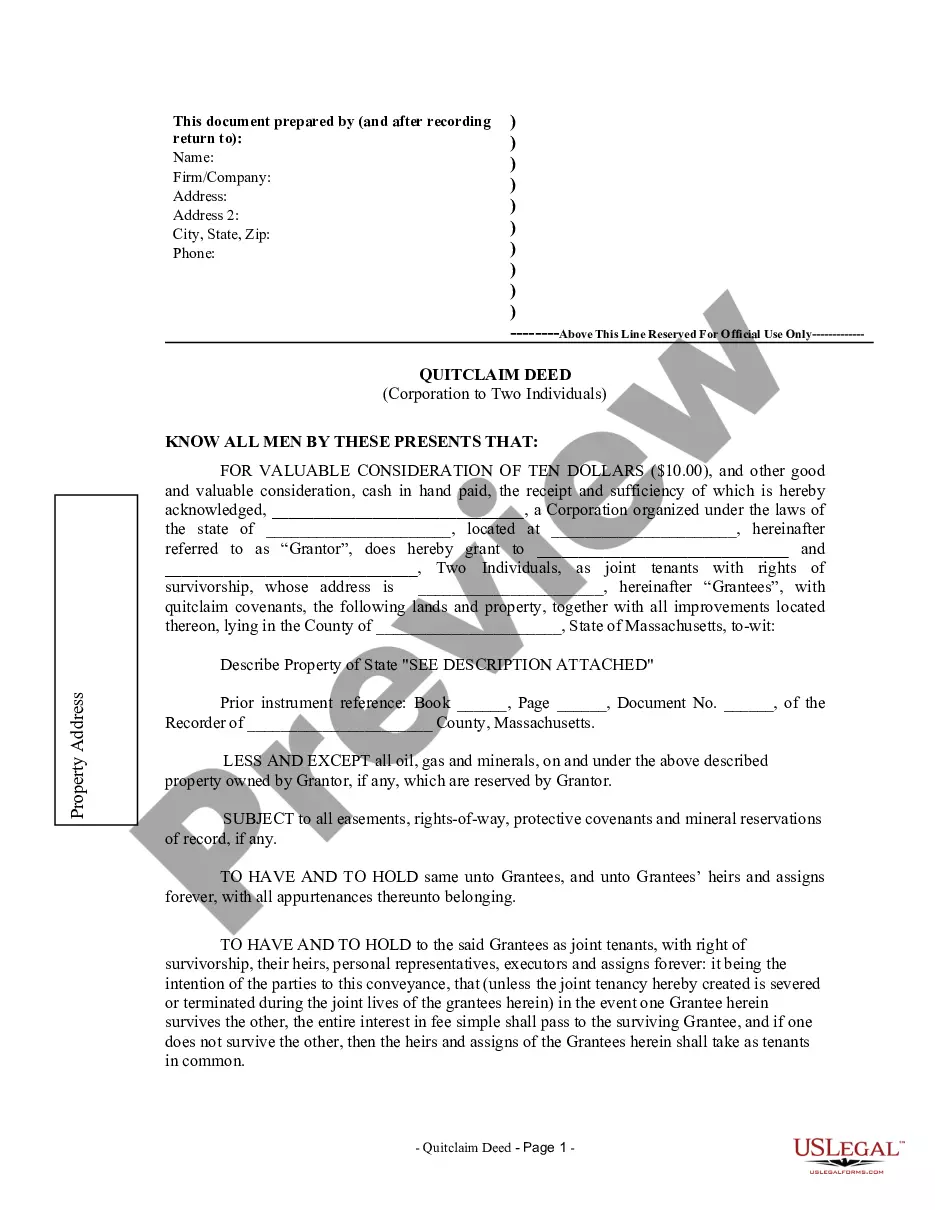

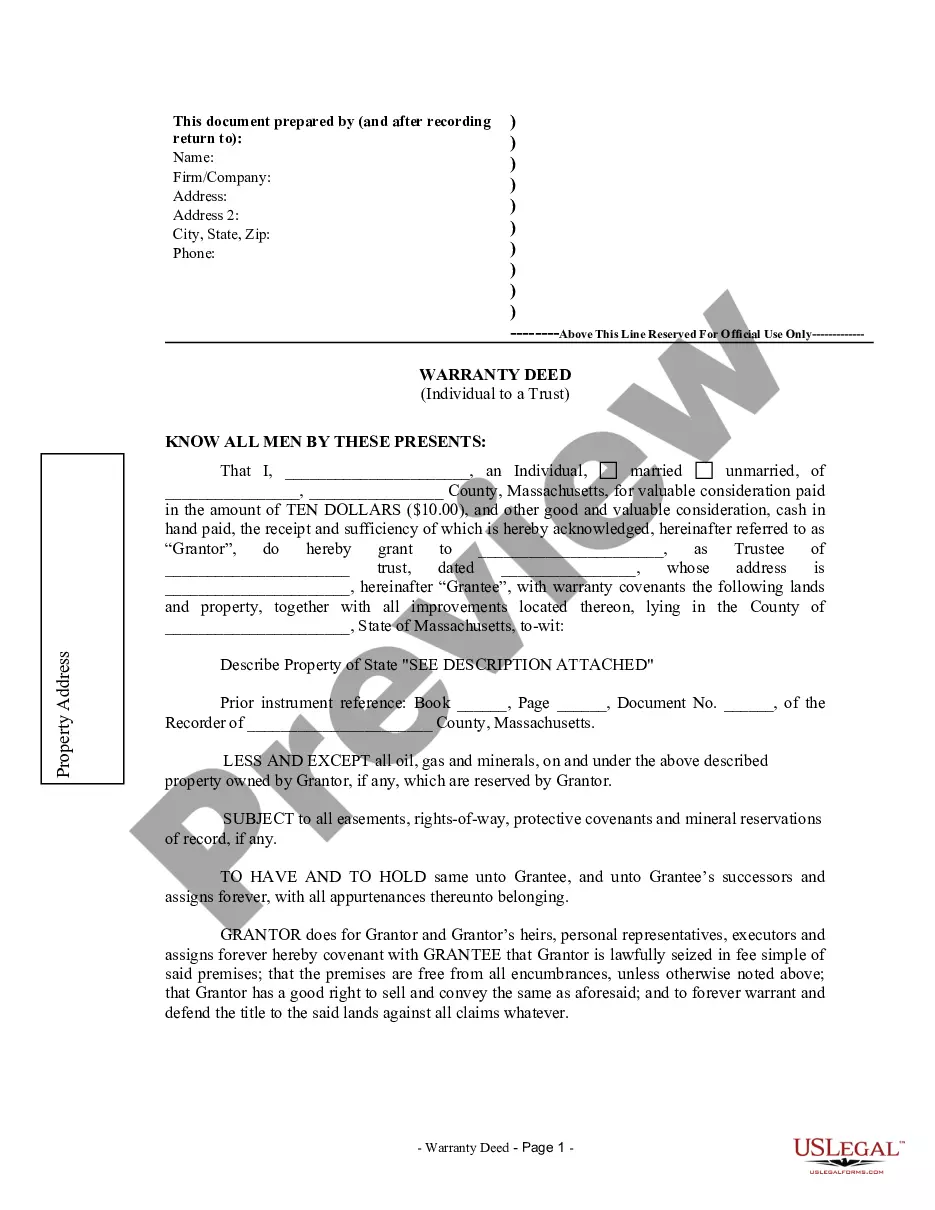

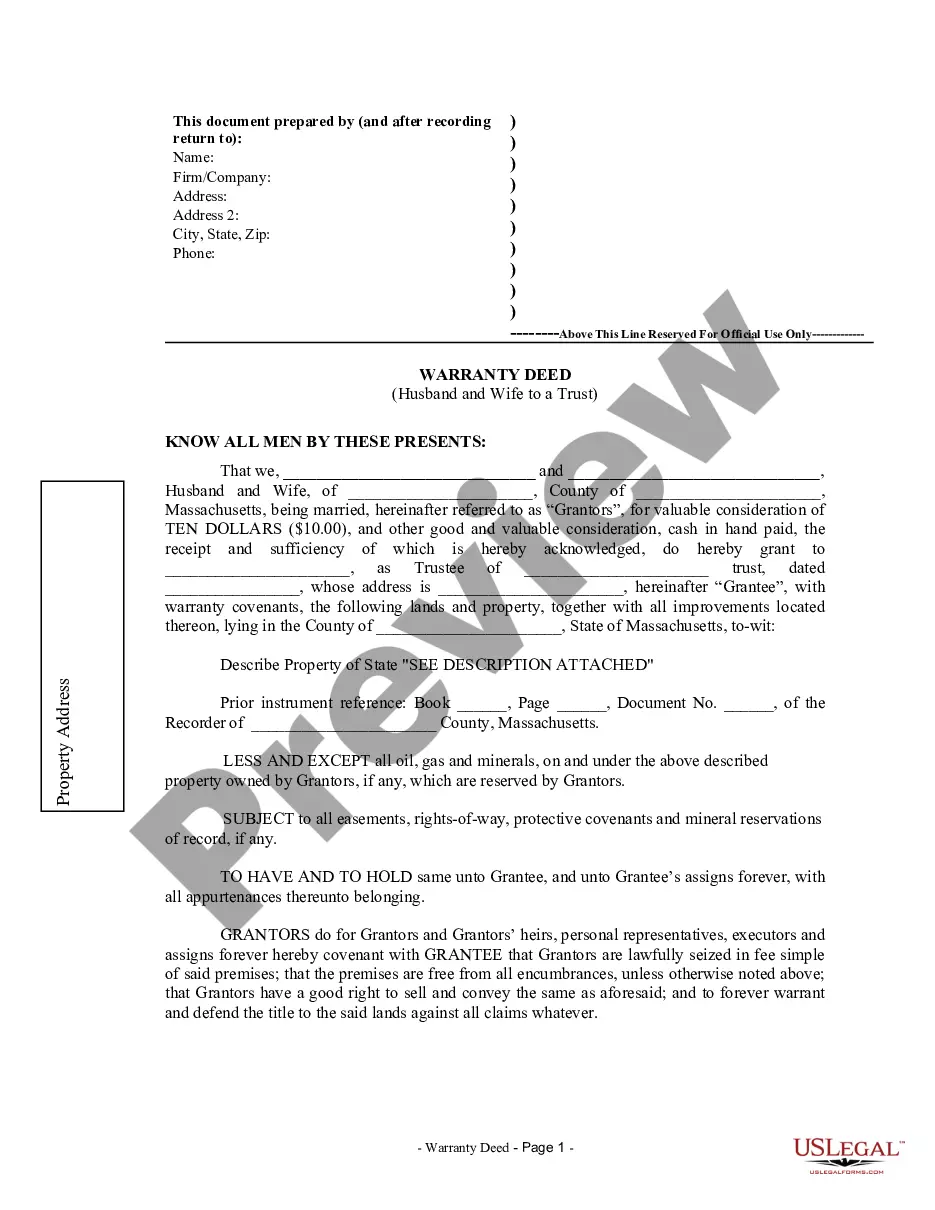

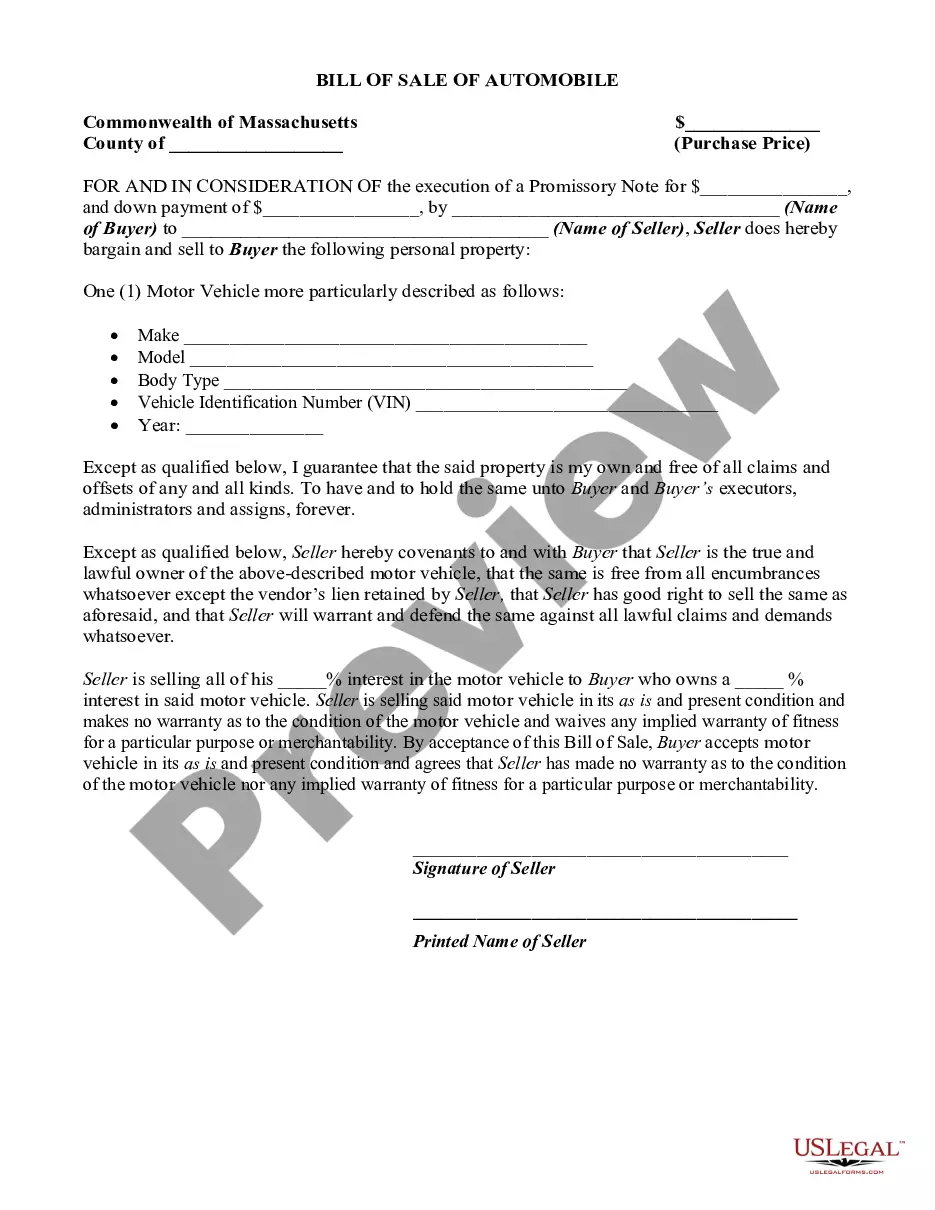

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are three individuals. Grantor conveys and quitclaims all interest in the the described property including, but not limited to, any reserved life estate. This deed complies with all state statutory laws.

Pennsylvania Quitclaim Deed from Individual Grantor to Three Individual Grantees with Release of Life Estate

Description

How to fill out Pennsylvania Quitclaim Deed From Individual Grantor To Three Individual Grantees With Release Of Life Estate?

The work with papers isn't the most straightforward job, especially for people who almost never deal with legal papers. That's why we recommend using correct Pennsylvania Quitclaim Deed from Individual Grantor to Three Individual Grantees with Release of Life Estate templates created by professional attorneys. It allows you to stay away from problems when in court or handling formal organizations. Find the templates you require on our site for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the template page. After downloading the sample, it’ll be saved in the My Forms menu.

Users without an active subscription can quickly get an account. Follow this brief step-by-step guide to get the Pennsylvania Quitclaim Deed from Individual Grantor to Three Individual Grantees with Release of Life Estate:

- Be sure that the document you found is eligible for use in the state it’s required in.

- Verify the file. Use the Preview feature or read its description (if readily available).

- Buy Now if this sample is what you need or use the Search field to find a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after doing these simple actions, you can complete the form in your favorite editor. Recheck filled in info and consider asking a legal representative to examine your Pennsylvania Quitclaim Deed from Individual Grantor to Three Individual Grantees with Release of Life Estate for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Form popularity

FAQ

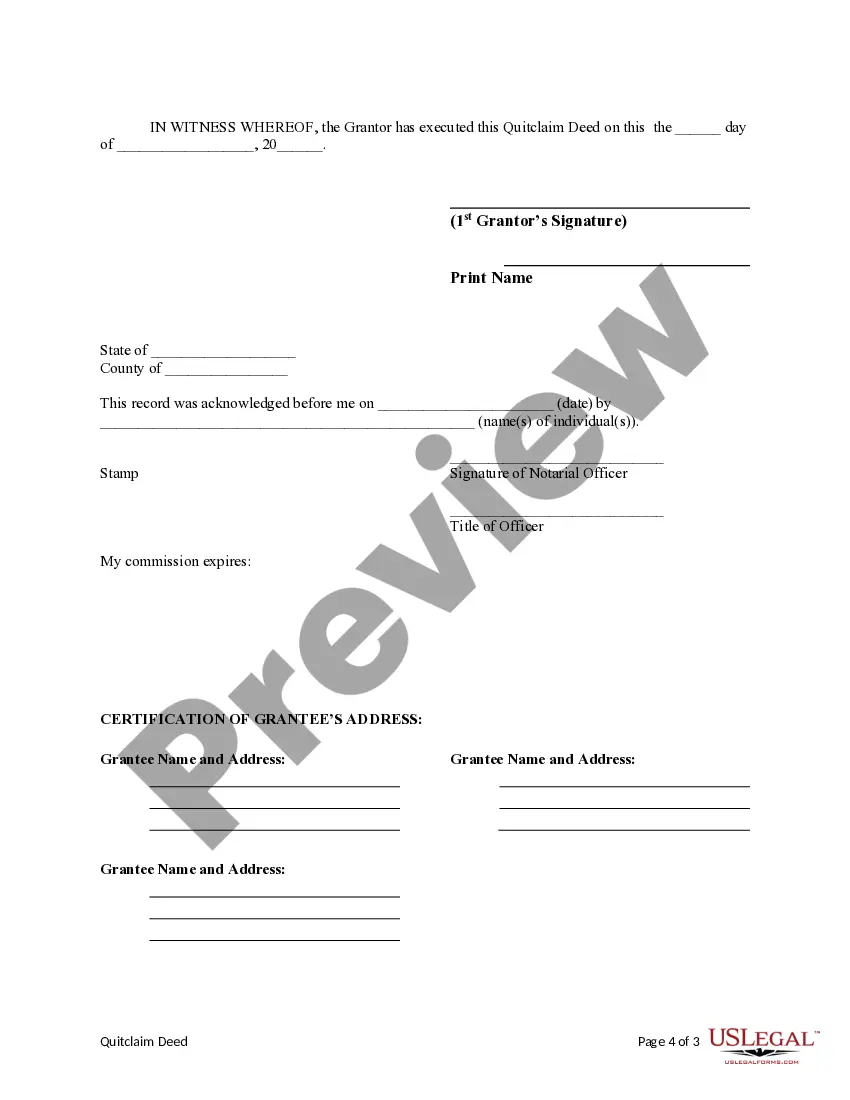

You'll need to pay a fee, which varies from county to county. For example, in Montgomery County, near Philadelphia, the fee for recording a deed is $86.75 for up to four pages and up to four names, and $1 per additional name and $4 per additional page.

Filing a quitclaim deed is a right of any property owner. You can file a quitclaim deed without refinancing your mortgage, but you are still responsible for the payments. Transferring the mortgage without refinancing is possible through an assumption of the loan, which requires lender approval.

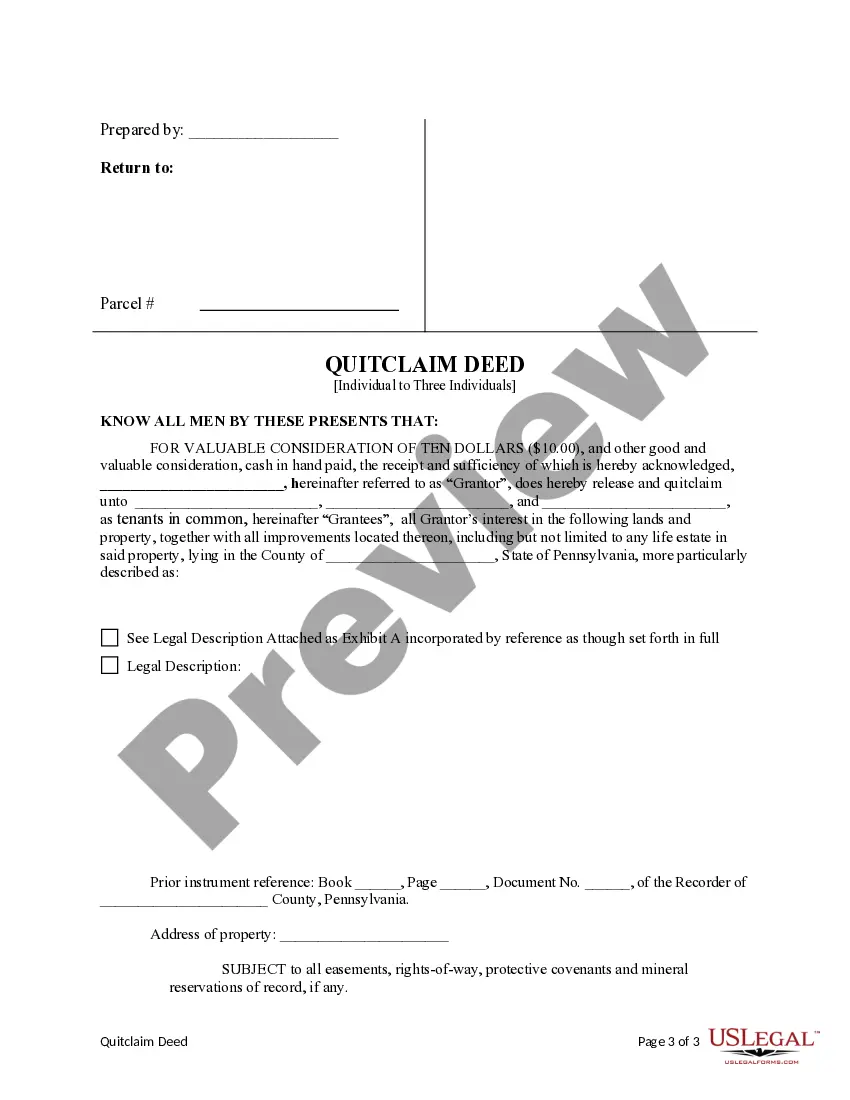

Fill in the deed form. Print it out. Have the grantor(s) and grantee(s) sign and get the signature(s) notarized. Fill out a Statement of Value form, if necessary. Get the Uniform Parcel Number (UPI) on the deed certified, if required by your county.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Even if you sign a quitclaim deed, the mortgage balance will continue to show up on your credit report. This will hurt what is called your debt utilization ratio. This may mean you have too much debt to be qualified for your next mortgage when you want to buy a new home.

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.