Pennsylvania General Partnership For Foreign Workers

Description

How to fill out Pennsylvania General Partnership Package?

- Begin by logging into your US Legal Forms account. If you don't have an account, you will need to create one first.

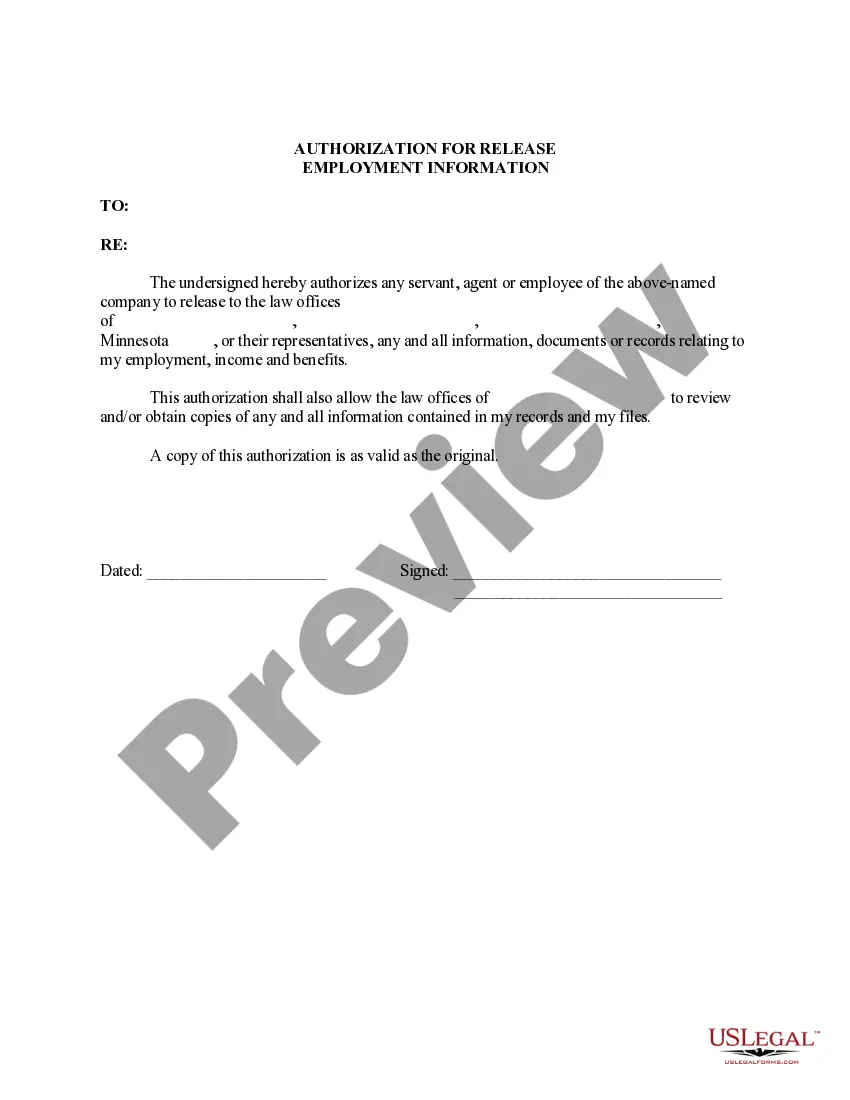

- Utilize the Preview mode to verify that you have selected the correct partnership form that meets your needs and adheres to your local laws.

- If the initially selected template isn't suitable, search for another one by using the Search tab to find the perfect match for your requirements.

- Select the desired document and proceed by clicking on the Buy Now button, where you can choose a subscription plan that works for you.

- Complete the payment process by entering your credit card or PayPal details, ensuring that your account is active and ready for access.

- After purchasing, download the form to your device so you can complete it at your convenience. You can revisit your downloaded forms anytime through the My Forms section of your account.

By utilizing US Legal Forms, you not only gain access to a comprehensive collection of over 85,000 legal documents but also benefit from support from premium experts to ensure accuracy in your paperwork.

Start your journey towards establishing a successful Pennsylvania general partnership by visiting US Legal Forms today!

Form popularity

FAQ

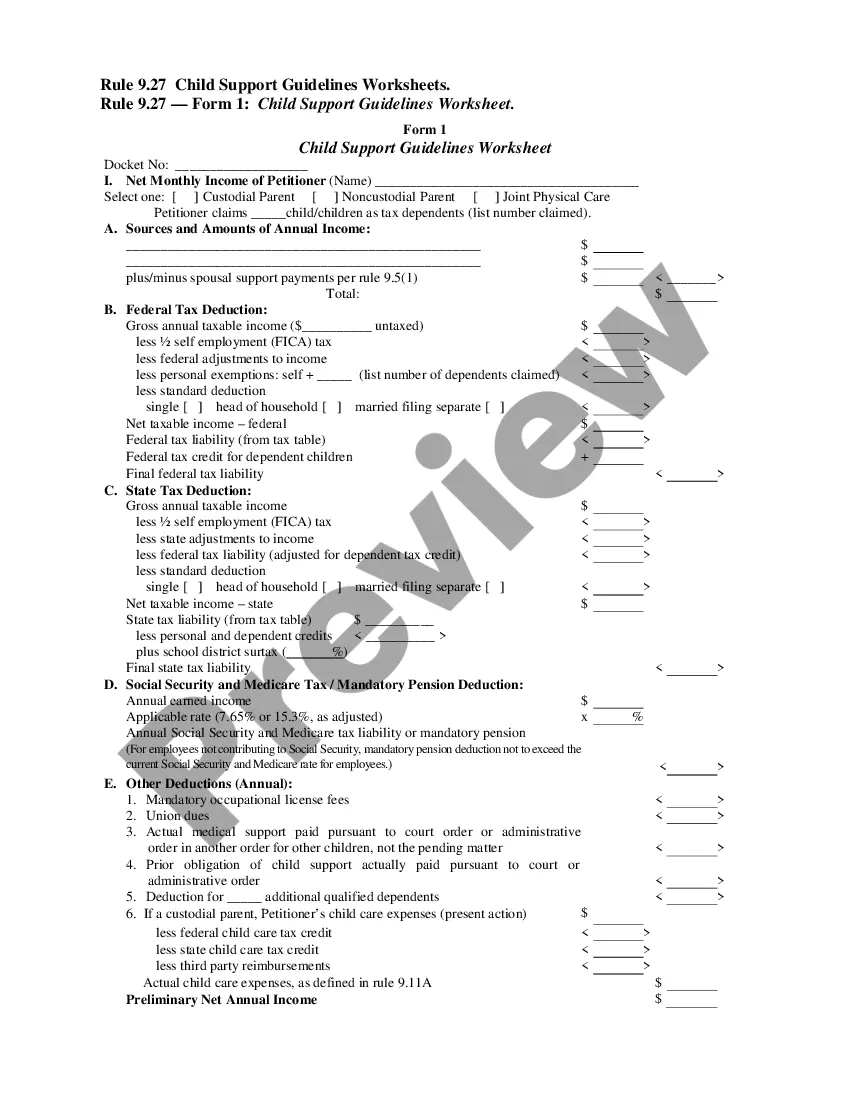

Yes, a general partnership in the United States must file Form 1065, which is an informational return to report income, deductions, and gains. This requirement holds true regardless of whether it has foreign partners. Partners then receive a Schedule K-1 showing their share of the partnership's income, which they must report on their individual tax returns. Keeping track of these filings can be easier with the guidance of US Legal Forms, particularly for Pennsylvania general partnerships involving foreign workers.

To register as a foreign entity in Pennsylvania, you must file the appropriate forms with the Pennsylvania Department of State. This process typically involves providing details about your business and its foreign status. Moreover, you might need to designate a registered agent in Pennsylvania. Leveraging platforms like US Legal Forms can streamline this registration process, ensuring you meet all requirements for your Pennsylvania general partnership for foreign workers.

Yes, a foreigner can indeed be a partner in a US business, including a Pennsylvania general partnership for foreign workers. Partnerships in the United States do not restrict the nationality of their partners, allowing diverse participation. Foreign partners can contribute capital and expertise, enhancing business opportunities. It's essential to consult legal resources or platforms like US Legal Forms to understand the specifics and ensure compliance with all regulations.

Yes, partnerships operating in Pennsylvania, including those involving foreign workers, generally have a filing requirement. Partnerships must register their business with the state, ensuring compliance with local regulations. Additionally, certain partnerships may need to file annual reports or tax forms to keep their status active. Utilizing a service like US Legal Forms can simplify the registration and filing process for your Pennsylvania general partnership.

If you are establishing a Pennsylvania general partnership for foreign workers and have an existing foreign LLC, you may need to register that entity with the Commonwealth of Pennsylvania. This ensures compliance with local laws and protects your business interests. It’s always prudent to consult with a legal expert or a service like USLegalForms to navigate these requirements smoothly.

Filing a Statement of Partnership Authority is the primary requirement for a partnership in Pennsylvania. This document ensures that the partnership is recognized in the state. Additionally, keep in mind that adhering to local regulations is just as important for running an efficient Pennsylvania general partnership for foreign workers.

Yes, Pennsylvania imposes a pass-through entity (PTE) tax on certain partnerships. This tax is designed for partnerships that generate income taxed to their partners, effectively allowing a more streamlined tax collection process. Understanding PTE tax can benefit your financial planning as a foreign worker in a Pennsylvania general partnership.

Yes, partnership income is subject to local taxes in Pennsylvania. These taxes vary by locality, so it’s vital to check the specific rates where your partnership operates. Staying informed about local tax regulations can benefit your Pennsylvania general partnership for foreign workers.

For a Pennsylvania general partnership for foreign workers, there must be at least two individuals or entities who agree to join together for a mutual business purpose. Each partner shares ownership and profits, which can be outlined in a partnership agreement. Clear communication between partners about roles and contributions is crucial.

In Pennsylvania, filing a Statement of Partnership Authority is necessary to clear the way for your general partnership for foreign workers. You must also check with local jurisdictions for additional permits or licenses. Remember, having the right documentation helps avoid operational hitches.