Lien Partial Release Withdrawal Vs

Description

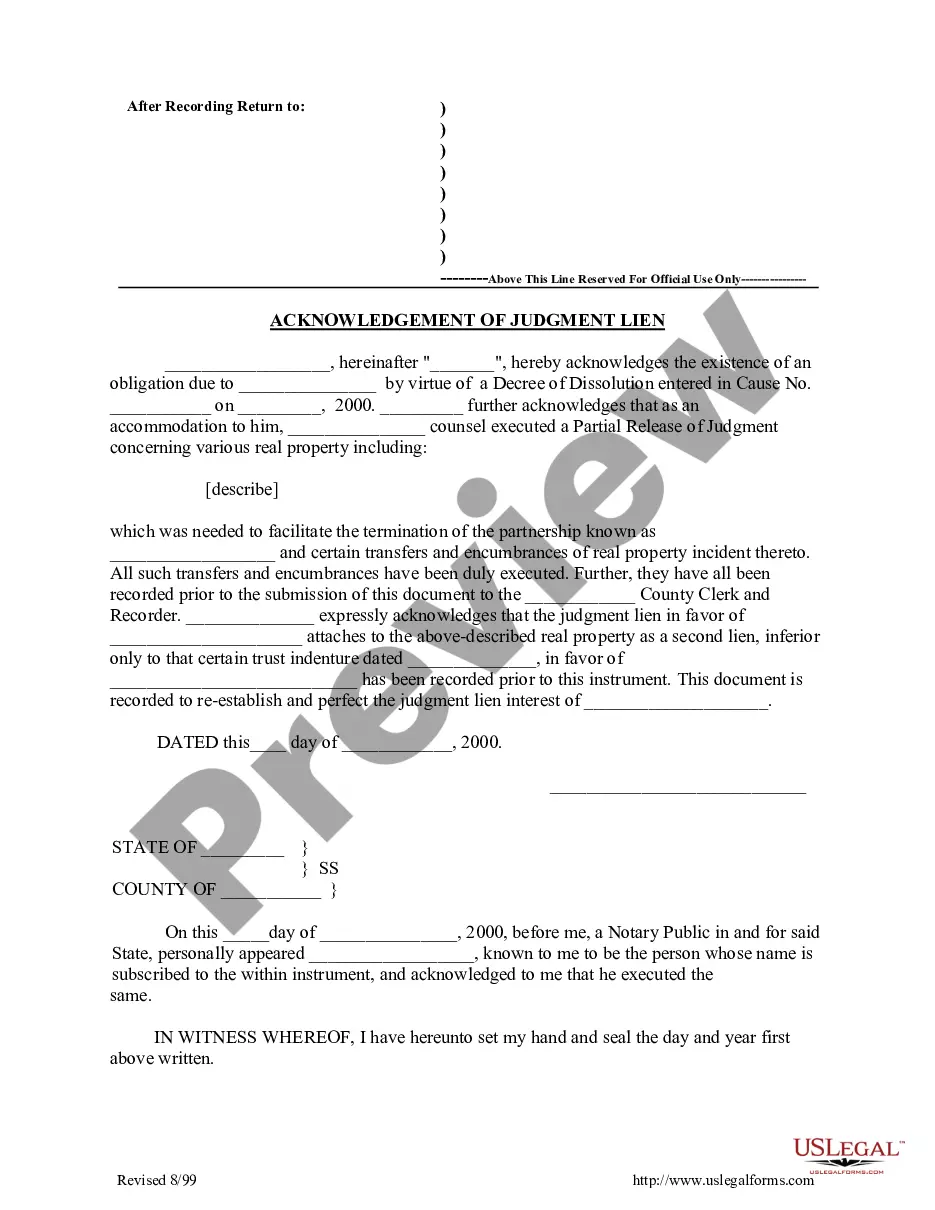

How to fill out Montana Acknowledgment Of Judgment Lien And Partial Release?

Individuals frequently link legal documents with a level of difficulty that only an expert can handle.

In a sense, this is correct, as formulating Lien Partial Release Withdrawal Vs demands comprehensive understanding of subject requirements, including regional and local laws.

Nonetheless, with US Legal Forms, the process has become simpler: pre-made legal documents for any personal and business circumstance pertinent to state regulations are compiled in a centralized online directory and are now accessible to everyone.

Establish your account or Log In to advance to the billing page. Complete payment for your subscription using PayPal or a credit card. Select the format for your template and click Download. You can print your document or upload it to an online editor for faster completion. All templates in our collection are reusable: once obtained, they remain saved in your profile. You can access them whenever necessary via the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents categorized by state and area of use, making it easy to search for Lien Partial Release Withdrawal Vs or any specific template in just a few minutes.

- Returning users with a valid subscription are required to Log In to their account and click Download to access the document.

- New users must first create an account and subscribe before being able to download any official paperwork.

- Here’s a detailed guide on how to acquire the Lien Partial Release Withdrawal Vs.

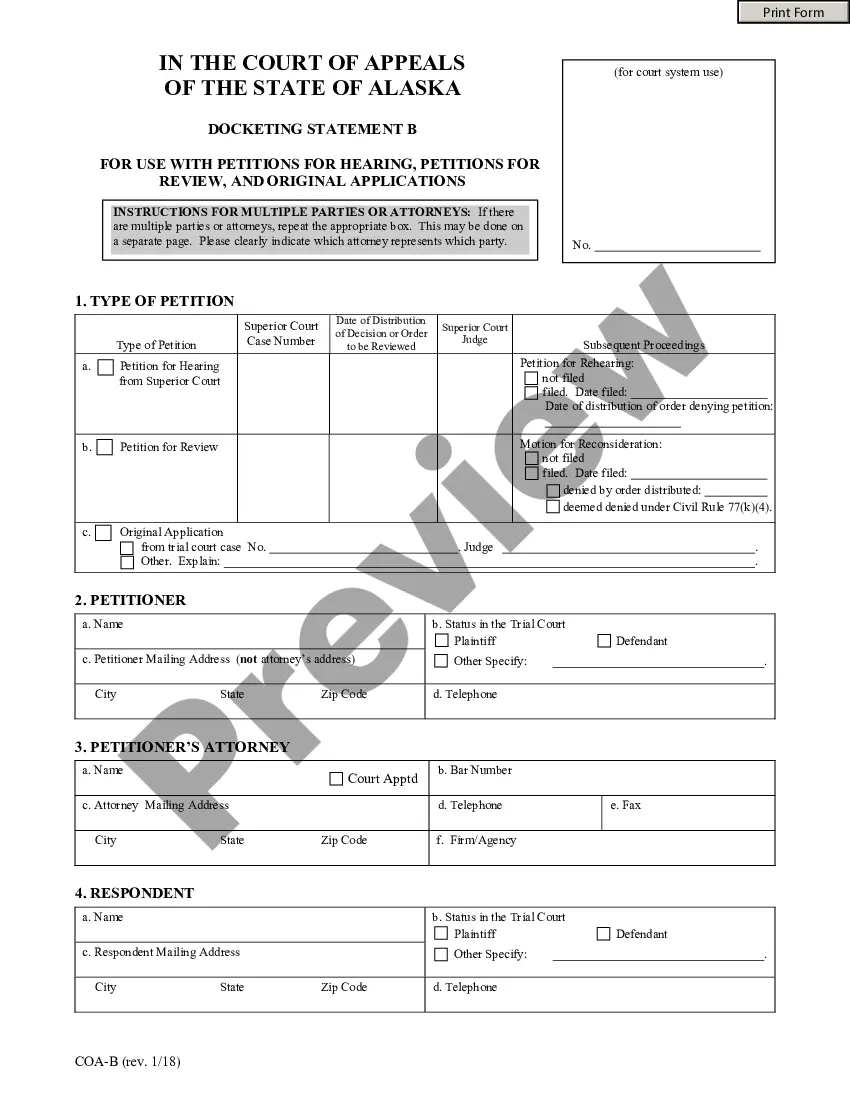

- Examine the content of the page thoroughly to ensure it aligns with your requirements.

- Review the form description or confirm it through the Preview option.

- If the previous sample does not meet your needs, find another one using the Search field in the header.

- Upon identifying the correct Lien Partial Release Withdrawal Vs, click Buy Now.

- Select a subscription plan that suits your requirements and financial situation.

Form popularity

FAQ

Withdrawal. A "withdrawal" removes the public Notice of Federal Tax Lien and assures that the IRS is not competing with other creditors for your property; however, you are still liable for the amount due.

A partial tax lien release will only apply to a certain piece of property, but it can be useful to help prevent the encumbrance of an asset. One common example of where a partial release of lien is helpful is when the taxpayer is short-selling their residence in order to free up financial flexibility.

A "withdrawal" removes the public Notice of Federal Tax Lien and assures that the IRS is not competing with other creditors for your property; however, you are still liable for the amount due.

Once the tax debt is paid in full, the tax lien will be released within 30 days. However, the IRS does allow other options for a taxpayer to have a lien subordinated, removed or released, if conditions exist that are in the best interests of both the government and the taxpayer.

A lien withdrawal removes your tax lien from public record. You can request lien withdrawal: After you've paid your tax balance, or.