Certificate Of Assumed Name Mn For Sole Proprietorship New York

Description

How to fill out Minnesota Certificate Of Assumed Name Renewal?

Locating a reliable venue to obtain the latest and most pertinent legal templates is a significant portion of the challenge involved in dealing with bureaucracy.

Identifying the correct legal documents demands precision and carefulness, which is why it is vital to source samples of Certificate Of Assumed Name Mn For Sole Proprietorship New York exclusively from reputable providers, such as US Legal Forms. An inaccurate template will squander your time and delay the predicament you are facing. With US Legal Forms, you have minimal cause for concern. You can access and review all details concerning the document’s applicability and pertinence for your situation and within your state or county.

Eliminate the stress that comes with your legal paperwork. Explore the extensive US Legal Forms inventory to discover legal templates, verify their relevance to your circumstances, and download them immediately.

- Utilize the library navigation or search functionality to find your template.

- Examine the form’s description to verify if it meets the criteria of your state and locality.

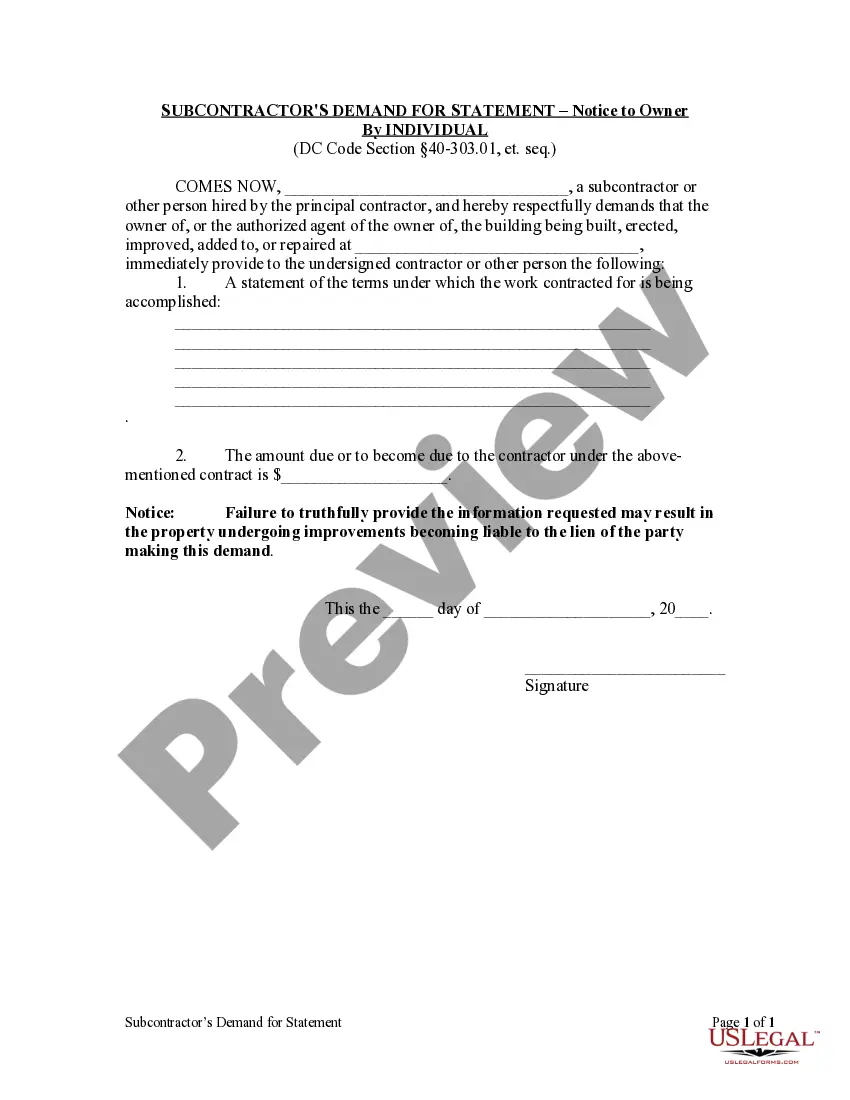

- Review the form preview, if available, to confirm the form is suitable for your needs.

- Continue your search and locate the appropriate document if the Certificate Of Assumed Name Mn For Sole Proprietorship New York does not meet your standards.

- Once you are certain about the form’s suitability, download it.

- If you are an authorized user, click Log in to verify your identity and obtain your chosen templates in My documents.

- If you do not yet possess an account, click Buy now to acquire the template.

- Select the pricing plan that aligns with your needs.

- Proceed to the registration to complete your order.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Certificate Of Assumed Name Mn For Sole Proprietorship New York.

- Once you have the form on your device, you may edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

In Minnesota, a DBA registration is indeed required for any business that operates under a name different from its legal name. This includes sole proprietorships, which must file for a certificate of assumed name mn for sole proprietorship new york to legally use the name they choose. Registering a DBA not only helps to establish your brand in Minnesota but also protects you against the use of similar business names. Therefore, it is essential for business owners to understand and fulfill this requirement.

A DBA, or 'doing business as,' is essentially a name that a sole proprietor can use that differs from their legal name. On the other hand, a sole proprietorship is a type of business structure where an individual operates the business without forming a separate legal entity. While all sole proprietors can function without a DBA, using a certificate of assumed name mn for sole proprietorship new york enables them to brand their business more effectively. Thus, understanding this distinction can help you choose the right approach for your business.

In New York, a DBA, or 'doing business as,' is not required for every business, but it is recommended for sole proprietorships operating under a name other than the owner's legal name. Filing for a certificate of assumed name mn for sole proprietorship new york allows you to legally operate under that name while providing transparency to customers. This process helps protect your brand and can improve your business’s credibility. Therefore, while it may not be mandatory, obtaining a DBA is a wise step for many sole proprietors.

Yes, a DBA, or 'Doing Business As', is commonly referred to as an assumed name. When you file for an assumed name certificate, you are essentially registering your DBA. This certification is vital in safeguarding your business identity and is part of acquiring your Certificate of assumed name mn for sole proprietorship new york. Using this proactive approach builds your business credibility.

Typically, it takes around 2 to 4 weeks to receive a New York State certificate of authority. This timeline can vary based on the volume of applications being processed. It's advisable to keep track of your application after submitting it, as the Certificate of assumed name mn for sole proprietorship new york requires official validation to begin operating under your assumed name.

No, an assumed business name is not the same as a sole proprietorship. The assumed name, often referred to as a DBA, is simply a name under which a sole proprietor can conduct business. A sole proprietorship is a type of business structure where the owner is fully responsible for all debts and obligations. However, having a Certificate of assumed name mn for sole proprietorship new york clarifies the business identity under which the sole proprietor operates.

Yes, a sole proprietor in New York may need to register a DBA if they are operating under a name different from their own. This helps eliminate confusion and legally associates the business name with the owner. Obtaining a Certificate of assumed name mn for sole proprietorship new york provides you with the legal permissions necessary to operate under that name effectively.

Yes, if you are using a name other than your legal business name, registering a DBA, or 'Doing Business As', in New York is necessary. This registration helps maintain transparency and protects your business identity. The Certificate of assumed name mn for sole proprietorship new york will ensure that your chosen name is legally recognized. You can easily file this with your county clerk's office.

An assumed name in New York refers to a business name that differs from the owner's legal name. Sole proprietors often use assumed names to conduct business under a more recognizable title. To operate legally, it's important to file a Certificate of Assumed Name. This process secures your Certificate of assumed name mn for sole proprietorship new york, ensuring your business name is officially recognized.