Liability Pllc Foreclosures

Description

How to fill out Florida Professional Limited Liability Company PLLC Formation Package?

Whether for commercial purposes or for personal matters, everyone must confront legal issues at some time in their life.

Completing legal documents requires meticulous attention, starting from choosing the correct form template. For example, if you select an incorrect version of a Liability Pllc Foreclosures, it will be rejected upon submission.

Choose the file format you desire and download the Liability Pllc Foreclosures. Once it is saved, you can fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms catalog available, you won’t have to waste time searching for the appropriate sample online. Utilize the library’s simple navigation to find the correct template for any circumstance.

- It is thus essential to obtain a reliable source of legal documents like US Legal Forms.

- If you need to acquire a Liability Pllc Foreclosures template, follow these straightforward steps.

- Locate the sample you require by using the search bar or catalog browsing.

- Review the form’s details to ensure it aligns with your case, state, and area.

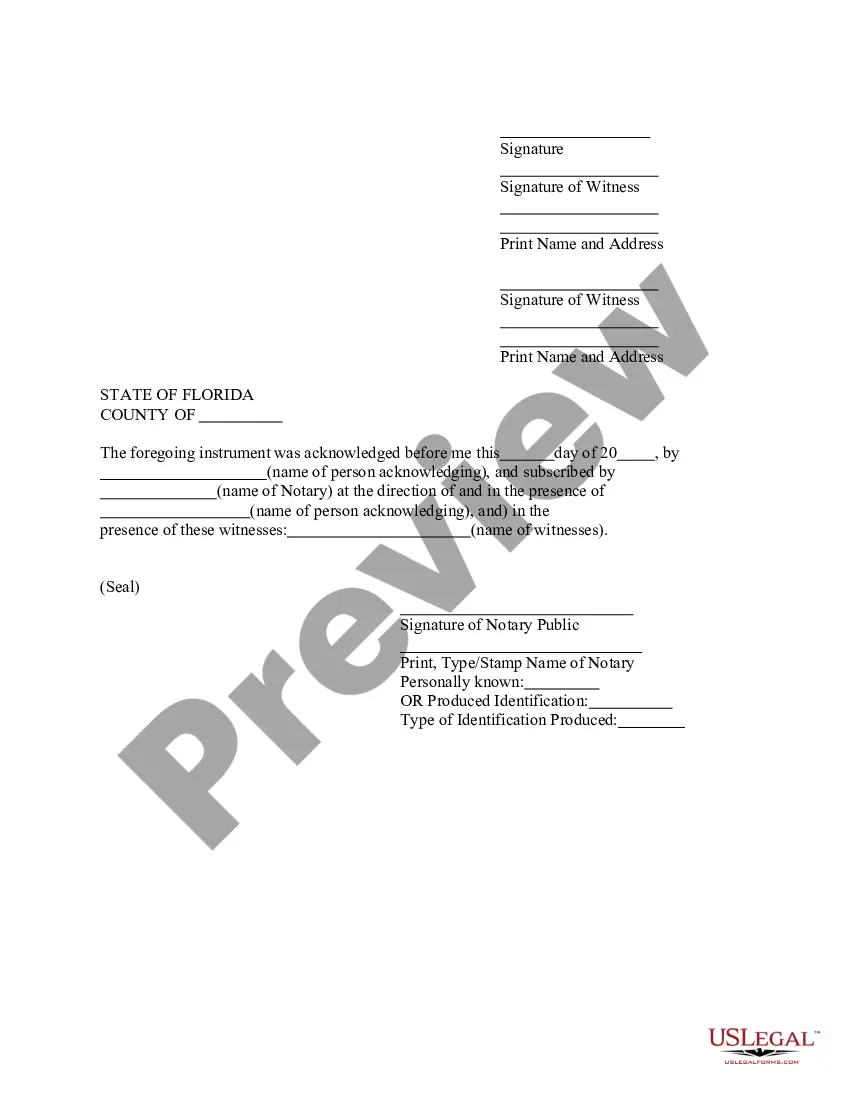

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to find the Liability Pllc Foreclosures template you require.

- Obtain the template if it satisfies your needs.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

Form popularity

FAQ

Hear this out loud PauseA PLLC is an LLC formed by a person or group of people who provide professional services. (PLLC stands for ?professional limited liability company.?) Unlike the members of a regular Washington LLC, the members of a Washington PLLC are required to maintain licenses with the state ing to their profession.

A professional limited liability company, or PLLC, is a specialized type of LLC used by certain licensed professionals in many states. A limited liability company, or LLC, is a particular way of organizing the structure of a business.

Hear this out loud PauseThe extent of liability protection is the main difference between a PLLC and an LLC in Florida. In most cases, you'll also need to provide your licensing credentials to the state before you can form a PLLC.

Hear this out loud PauseA PLLC that is classified as an S Corporation must file a Form 1120S, which is an annual corporate income tax return. This Form 1120S is used to report profits or losses from the S Corporation, and these then pass through to the member's own income tax return, which allows them to avoid the self-employment tax.

Hear this out loud PauseDeed of Trust and Foreclosure by Power of Sale In the instance of foreclosure, the trustee, not the mortgage holder, conducts the sale or foreclosure auction of the mortgaged property.