Sub Lease In Tagalog

Description

How to fill out California Application For Sublease?

Legal documents handling can be daunting, even for experienced experts.

When you are looking for a Sub Lease In Tagalog and cannot find the time to search for the correct and updated version, the procedures may be challenging.

US Legal Forms caters to any needs you may possess, from personal to corporate documents, all in a single platform.

Employ sophisticated tools to accomplish and oversee your Sub Lease In Tagalog.

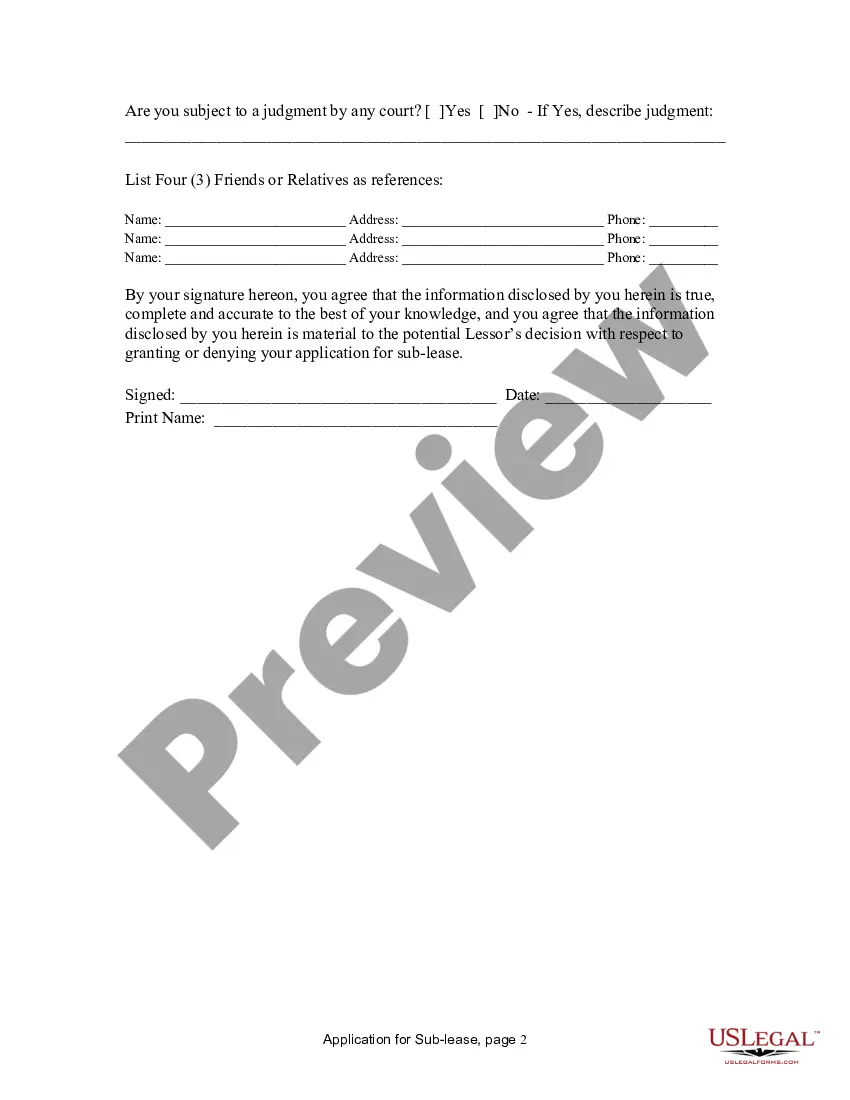

Here are the steps to take after downloading the document you require: Confirm this is the appropriate form by previewing it and reviewing its description.

- Access a valuable resource hub of articles, guides, and materials relevant to your situation and requirements.

- Conserve time and effort in locating the documents you require, and leverage US Legal Forms’ advanced search and Preview feature to find Sub Lease In Tagalog and obtain it.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you’ve saved earlier and manage your folders as you prefer.

- If it is your first time using US Legal Forms, create a complimentary account and gain unlimited access to all the library's benefits.

- Utilize a robust web form library to alter the way you address these challenges.

- US Legal Forms stands as a frontrunner in online legal documents, offering over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you are able to access location-specific legal and organizational forms.

Form popularity

FAQ

?Calculating KY Limited Liability Entity Tax (LLET) Kentucky imposes a tax on every business that is protected from liability by the laws of the state. This includes corporations, LLCs, S-Corporations, limited partnerships, and other types of businesses.

These are the simple steps to follow in filing an Article of Organization in Kentucky. Step 1: Find Forms Online. Go to the Kentucky Secretary of State to download the articles of organization form for your LLC or to log into the online service. Step 2: Fill Out Form. ... Step 3: File Formation Certificates.

To obtain your valid Kentucky Corporation/LLET account number, please contact the Department of Revenue at (502) 564-3306. To submit payment online, visit .

To request court records from the KDLA, email kdla.archives@ky.gov or call 502-564-1787.

In Kentucky, you may file in small claims court on your own for anything that is $2,500 or less. If you want to sue for more, you will have to file in regular district court and may need the help of a lawyer. You may talk to the clerk of court for help in filing a lawsuit in small claims court.

Kentucky Form 20A100 "Declaration of Representative" is used for this purpose. IRS Form 2848, "Power of Attorney and Declaration of Representative", is also acceptable for income tax purposes.

Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while in Kentucky, as well as any other income from Kentucky sources.

Purpose of Form 20A100. Use the Declaration of Representative (Form 20A100) to authorize the individual(s) to represent you before the Kentucky Department of Revenue. You may grant the individual(s) authorization to act on your behalf with regard to any tax administered by the Kentucky Department of Revenue.