Rent Control Form No. Iii

Description

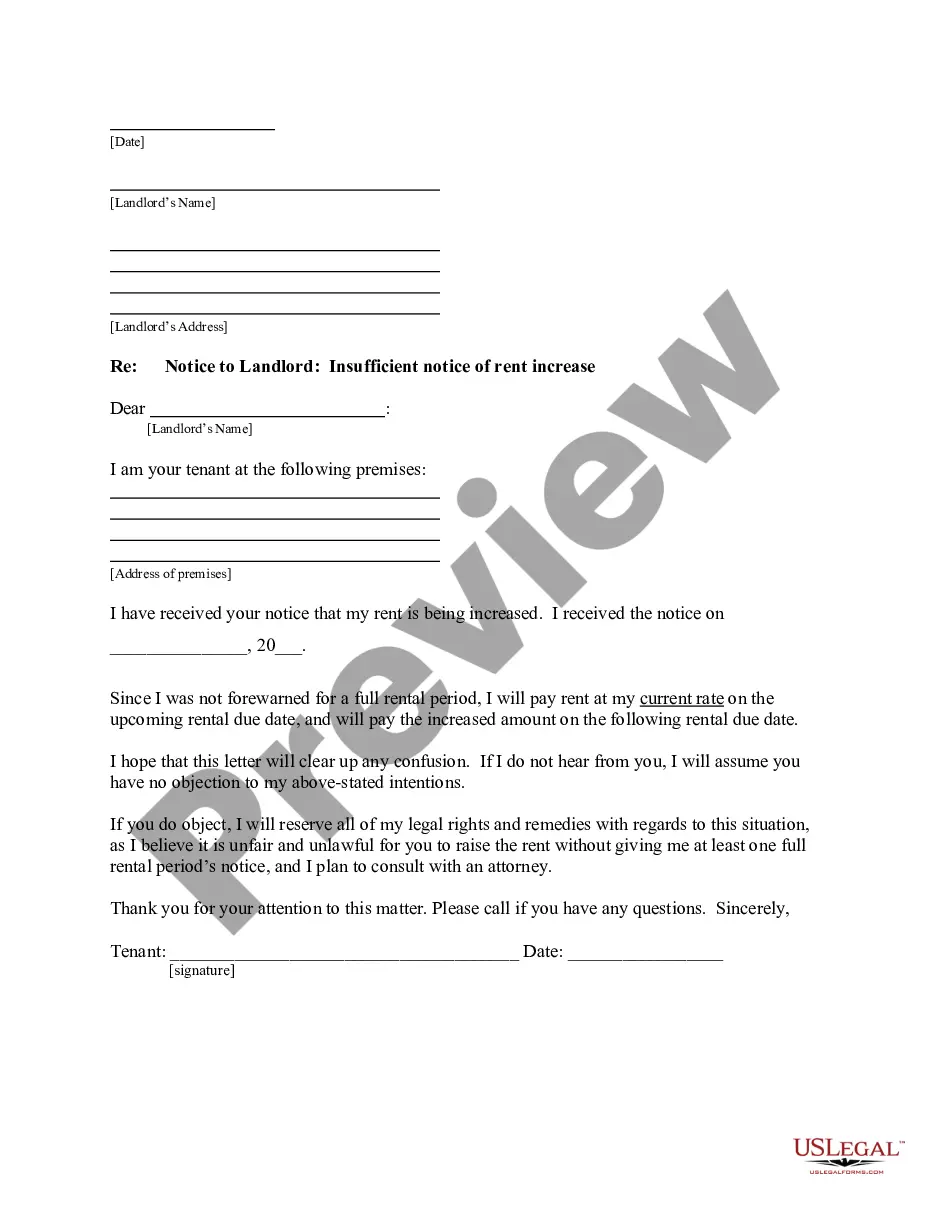

How to fill out California Letter From Tenant To Landlord Containing Notice To Landlord To Withdraw Improper Rent Increase Due To Violation Of Rent Control Ordinance?

Whether for corporate reasons or personal matters, everyone must confront legal issues at some moment in their lives.

Filling out legal documents demands meticulous care, beginning with choosing the correct form template.

With an expansive US Legal Forms catalog available, you do not have to waste time searching for the suitable template online. Use the library’s straightforward navigation to locate the right form for any circumstance.

- Acquire the template you require by utilizing the search bar or catalog browsing.

- Review the details of the form to ensure it corresponds to your circumstances, state, and locale.

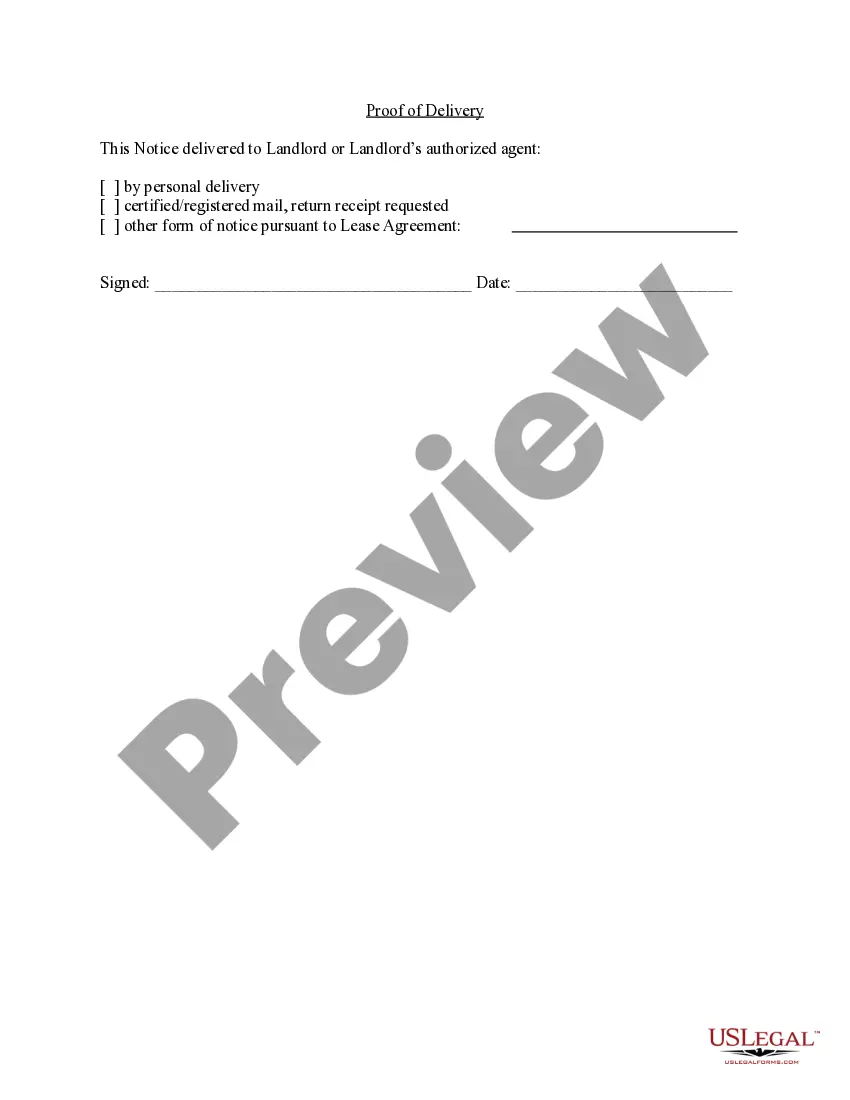

- Click on the form’s preview to examine it.

- If it is not the right form, return to the search feature to find the Rent Control Form No. Iii template that you need.

- Download the document if it aligns with your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access files you have saved in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the registration form for your account.

- Choose your payment method: credit card or PayPal account.

- Select the file format you prefer and download the Rent Control Form No. Iii.

- Once it is stored, you can complete the form using editing software or print it and finish it by hand.

Form popularity

FAQ

South Carolina Annual Report Fee: $0 However, on the off chance you choose to have your LLC taxed as a C-corp or an S-corp, you'll need to file an Initial Annual Report of Corporations (Form CL-1) and pay a $25 fee within 60 days of forming your LLC.

State: City: ZIP: Mailing address: Street: Street: Section C: Number of shares Pay the $25 minimum License Fee when you file your CL-1. Submit your CL-1 and the $25 fee online at sos.sc.gov/online-filings when registering your business with the South Carolina Secretary of State (SCSOS).

Mail filings: In total, mail filing approvals for South Carolina LLCs take 3-4 weeks. This accounts for the 5-1o business days (1-2 weeks) processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for South Carolina LLCs take 1-2 business days.

1 Form must be included with the Articles of Incorporation. You must submit a total payment of $135 which includes the $25 fee for the CL1 Form. $110.00. CL1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue.

If you are a nonresident of South Carolina, use your 2022 SC1040 and Schedule NR as a basis to calculate the modified South Carolina taxable income to enter on line 3 of the worksheet. Forms are available at dor.sc.gov/forms.

Does a bill of sale have to be notarized in South Carolina? No. A vehicle bill of sale for a private party transfer does not need to be notarized.

To dissolve a South Carolina LLC, file Articles of Termination, in duplicate, with the South Carolina Secretary of State, Division of Business Filings (SOS). The form is available on the SOS website (see link below).

Yes! All businesses that are taxed as an S or C corporation must include an initial report (Form CL-1) along with their Articles of Formation, Articles of Organization, or Certificate of Authority to Transact Business in South Carolina.