Ca Company Llc With Start

Description

How to fill out California Limited Liability Company LLC Formation Package?

Finding a reliable source to obtain the latest and pertinent legal templates is a significant part of managing bureaucracy.

Locating the appropriate legal documents requires accuracy and meticulousness, which is why it is essential to select samples of Ca Company Llc With Start only from trustworthy sources, such as US Legal Forms. An incorrect template will squander your time and delay your situation.

Once you have the form on your device, you can edit it using the editor or print it and fill it out manually. Eliminate the stress associated with your legal documentation. Browse the extensive US Legal Forms catalog to discover legal templates, assess their relevance to your situation, and download them immediately.

- Utilize the library navigation or search feature to locate your template.

- Review the form’s description to determine if it meets the requirements of your state and area.

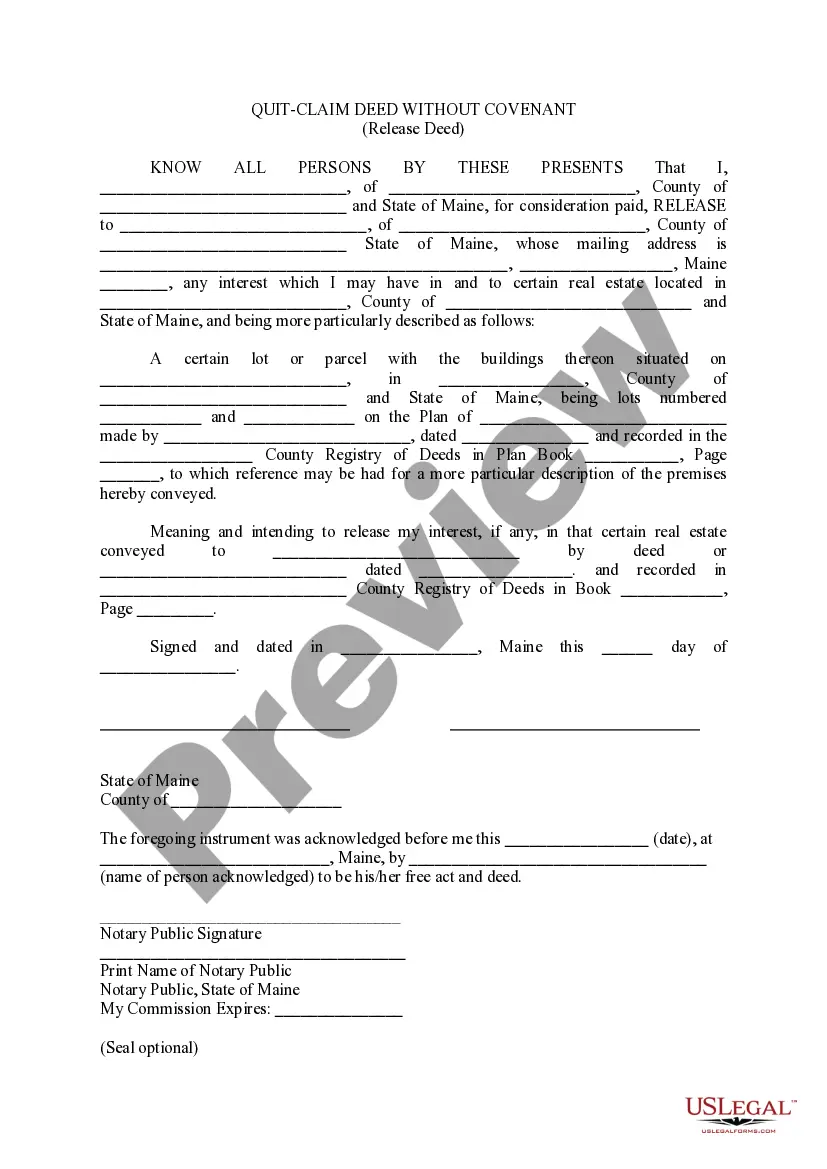

- Access the form preview, if available, to verify that the template is what you are looking for.

- Return to the search to find the correct template if the Ca Company Llc With Start does not meet your needs.

- Once you are confident about the form’s relevance, download it.

- If you are a registered customer, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing option that aligns with your preferences.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Ca Company Llc With Start.

Form popularity

FAQ

Starting an LLC in California will include the following steps: #1: Choose a Name for Your California LLC. #2: Select a Registered Agent. #3: File Your LLC Paperwork. #4: Draft an LLC Operating Agreement. #5: Obtain Tax Identification Numbers.

California LLC Fee The CA LLC fee is $85, payable to the secretary of state. In addition, a California LLC fee is also due for the statement of information, a document that must be submitted within 90 days of LLC formation and carries a filing cost of $20.

No, since your California LLC doesn't need to pay the $800 franchise tax for its 1st year, you don't need to file Form 3522. Form 3522 will need to be filed in the 2nd year.

Within 90 days of forming an LLC in California, the Secretary of State requires you to complete and file Form LLC-12 (Statement of Information). You'll need to pay a filing fee of $20. You must also complete and file a Form LLC-12 every two years after this initial filing.

Due Dates for First-Year Annual Tax Payment Domestic LLCs have until the 15th day of the 4th month after they file their Articles of Organization with the SOS to pay the first-year annual tax. For the LLC's first year, this is measured from the date the business files its Articles of Organization.