What is Deed?

Deeds are legal documents that convey property ownership from one party to another. They are commonly used in real estate transactions. Explore state-specific templates for your needs.

Deeds are essential documents for transferring property ownership. Our attorney-drafted templates are quick and easy to complete.

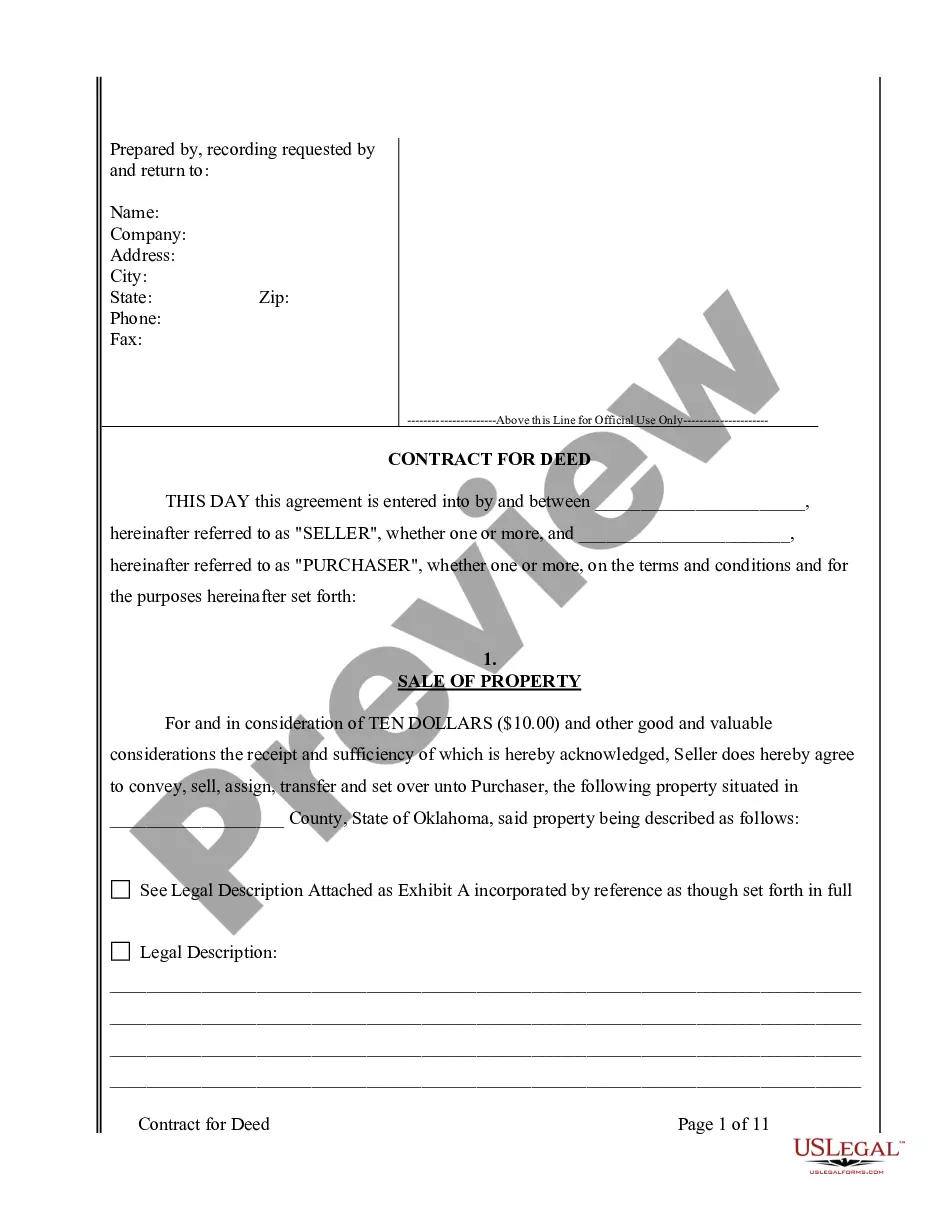

Everything you need for owner financing in real estate, including essential related legal documents.

Everything needed to release a mortgage in one place, providing peace of mind during your transaction.

Everything you need for owner financing in real estate, including essential related legal documents.

Ideal for buyers and sellers, this form outlines the terms for purchasing real estate through an installment plan.

Transfer property quickly and easily between individuals without the complexities of a traditional deed.

Essential for transferring mineral rights from an individual to a trust, ensuring clear ownership and legal protection.

Transfer property from a corporation to an individual with this comprehensive document that ensures limited liability for past claims.

Use this document to legally transfer property ownership from one individual to another, ensuring clear title and protection from claims.

Transfer property ownership between partners while reserving mineral rights. Perfect for simplifying property agreements without involving third parties.

Secure property for your child while retaining the right to live on it, making estate planning simpler and more effective.

Use this document to transfer property ownership from trustees to a couple, establishing joint tenancy with survivorship rights.

Easily transfer mineral rights to multiple individuals, ensuring all parties understand their ownership options.

Deeds must be signed, often requiring notarization.

Property deeds are public records once filed.

Different types of deeds suit various ownership scenarios.

A deed's validity can affect property title transfers.

Understanding deed types is crucial for real estate transactions.

Begin your process in a few simple steps.

A trust can help manage assets and avoid probate; it depends on your goals.

Without action, your assets may be distributed according to state laws.

Review your plan regularly, especially after major life events.

Beneficiary designations can override your will, so keep them updated.

Yes, you can designate separate individuals for financial and health-related decisions.