Oklahoma Assignment of Mortgage by Corporate Mortgage Holder

Description

Key Concepts & Definitions

Assignment of Mortgage by Corporate Mortgage refers to the transfer of a mortgage from one corporate entity to another. It involves the conveyance of the rights and responsibilities associated with the mortgage, including the right to receive payments and the duty to manage the mortgage under the original terms.

Step-by-Step Guide to an Assignment of Mortgage by a Corporation

- Initiate the Assignment: The assigning corporation (current mortgage holder) decides to transfer the mortgage to another corporate entity.

- Financial Assessment: Both parties use financial assessment tools to evaluate the financial stability associated with the transfer.

- Documentation: Prepare legal documents that comply with corporate assignment law to formalize the transfer.

- Approval Process: Submission of the agreement for review under real estate investment and credit management guidelines.

- Record the Assignment: Officially record the assignment with local authorities to maintain the legal validity of the transfer.

Risk Analysis

- Credit Risk: Involves assessing the creditworthiness of the acquiring corporation which is often supported by a free credit report.

- Legal Compliance: Each state has differing corporate assignment laws which could pose legal risks if not properly adhered to.

- Financial Impact: Understand how this assignment could affect both entities financial status and the wider implications for stakeholders such as increased risk of bankruptcy.

Best Practices

- Quality Assurance: Implement a quality control process for documentation and legal compliance to avoid potential disputes or legal challenges.

- Professional Consultation: Engage with legal experts familiar with income tax solutions and corporate law to optimize financial benefits and compliance.

- Transparent Communication: Maintain clear and consistent communication between all parties involved to ensure the transition is smooth and all stakeholders are informed.

FAQ

- What is an assignment of mortgage? Its the transfer of rights and responsibilities of a mortgage from one party to another.

- Why would a corporation assign a mortgage? Reasons may include restructuring, real estate portfolio management, or exiting the investment.

- Is it necessary to get a loan approval in an assignment process? Yes, as the receiving partys ability to manage the mortgage must be assured.

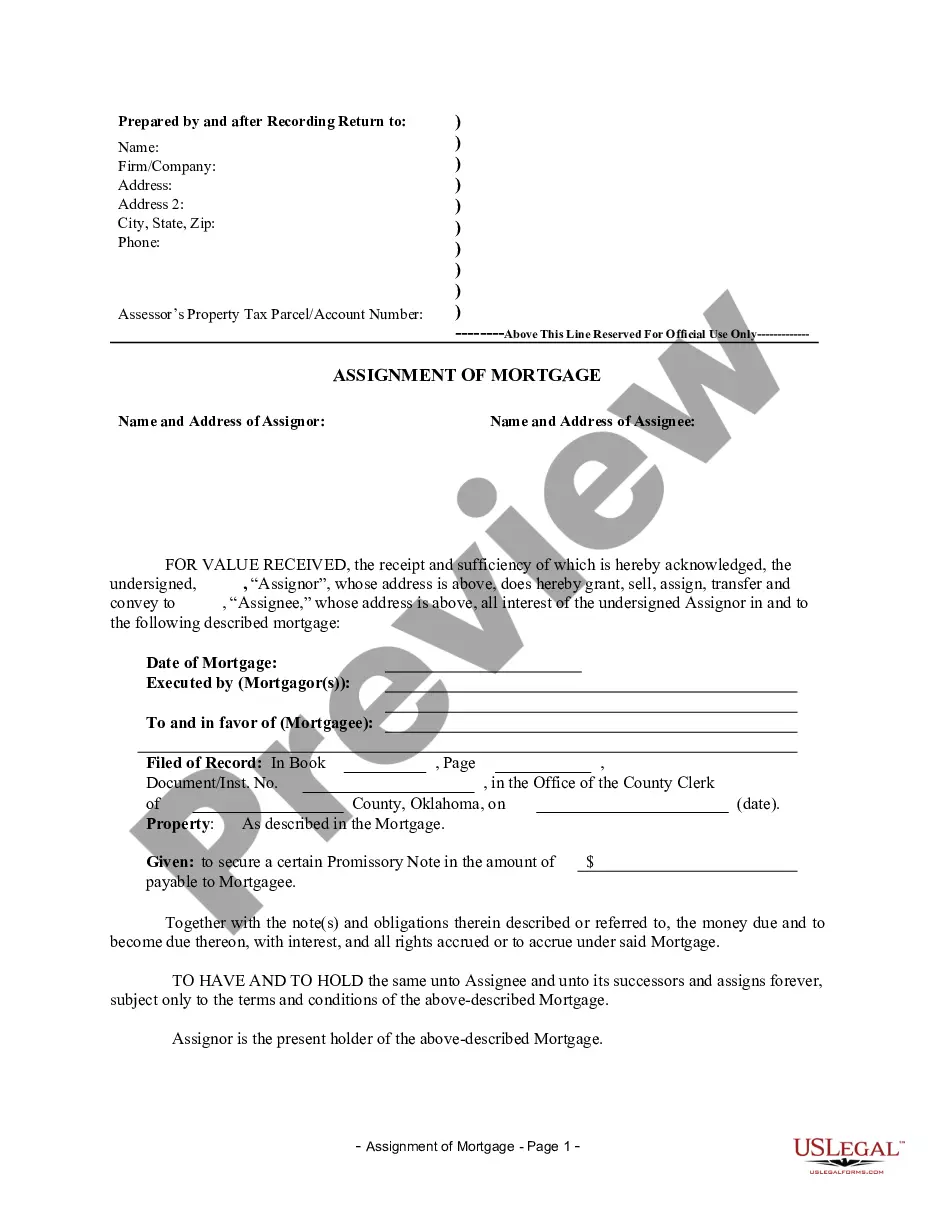

How to fill out Oklahoma Assignment Of Mortgage By Corporate Mortgage Holder?

When it comes to submitting Oklahoma Assignment of Mortgage by Corporate Mortgage Holder, you most likely imagine a long procedure that involves choosing a appropriate sample among hundreds of similar ones after which being forced to pay a lawyer to fill it out for you. In general, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific form in a matter of clicks.

For those who have a subscription, just log in and then click Download to get the Oklahoma Assignment of Mortgage by Corporate Mortgage Holder form.

If you don’t have an account yet but want one, keep to the step-by-step guide below:

- Make sure the file you’re getting applies in your state (or the state it’s needed in).

- Do so by looking at the form’s description and by clicking on the Preview function (if offered) to find out the form’s information.

- Click on Buy Now button.

- Pick the appropriate plan for your budget.

- Sign up to an account and choose how you want to pay out: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

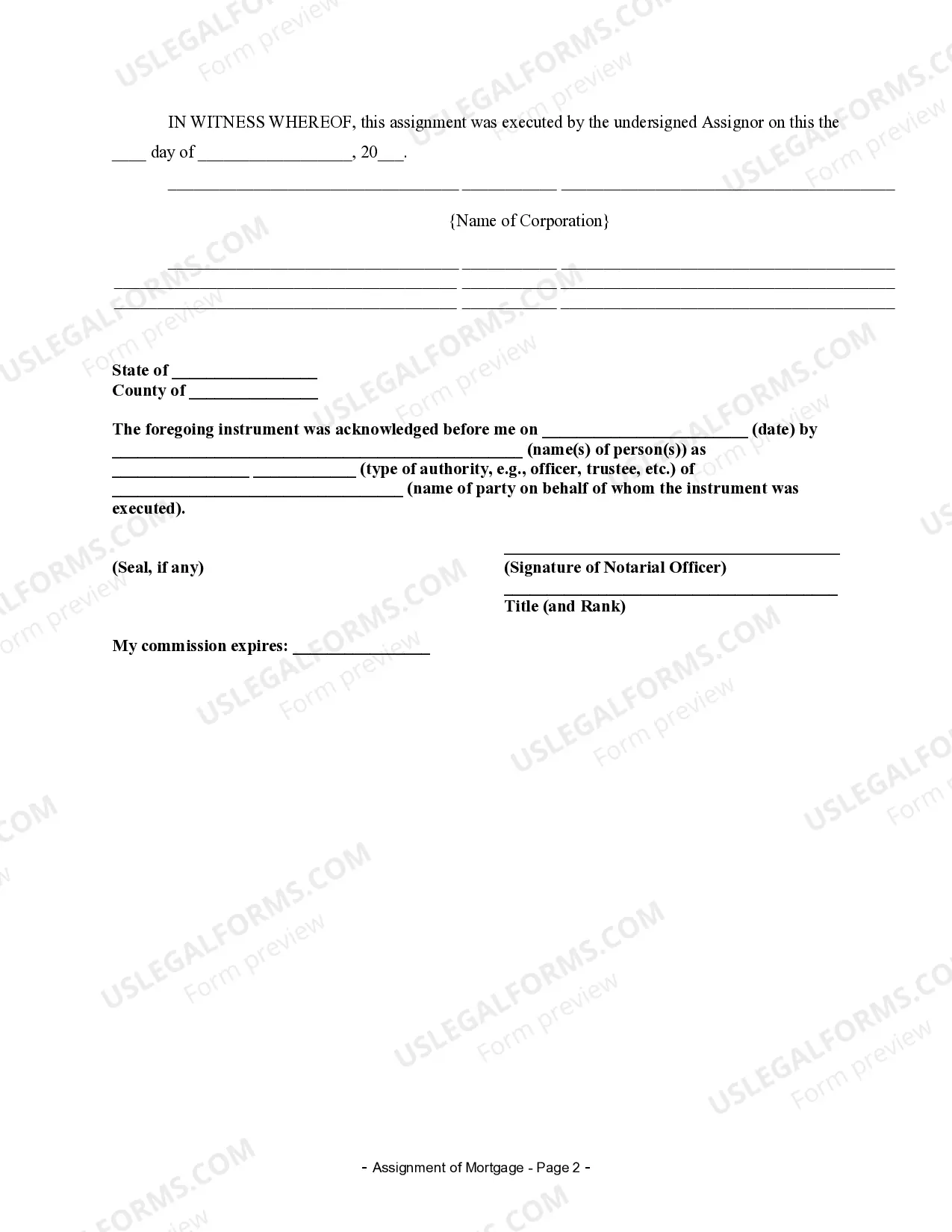

Professional attorneys work on drawing up our samples to ensure after saving, you don't need to worry about editing content material outside of your individual information or your business’s details. Join US Legal Forms and receive your Oklahoma Assignment of Mortgage by Corporate Mortgage Holder document now.

Form popularity

FAQ

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.

An assignment is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded and the promissory note is endorsed (signed over) to the new bank.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

An assignment of mortgage is a document which indicates that a mortgage has been transferred from the original lender or borrower to a third party. Assignments of mortgage are more commonly seen when lenders sell mortgages to other lenders.This document indicates that the loan obligation has been transferred.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.