Oklahoma Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What is this form?

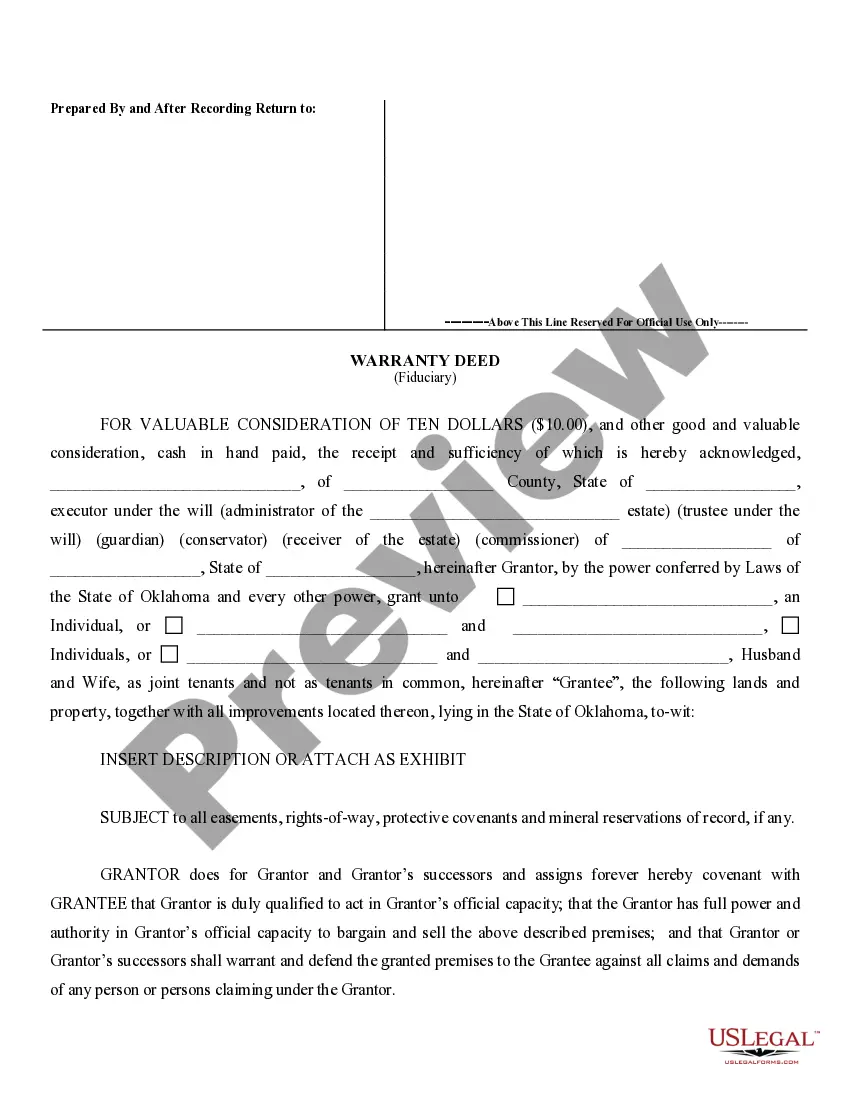

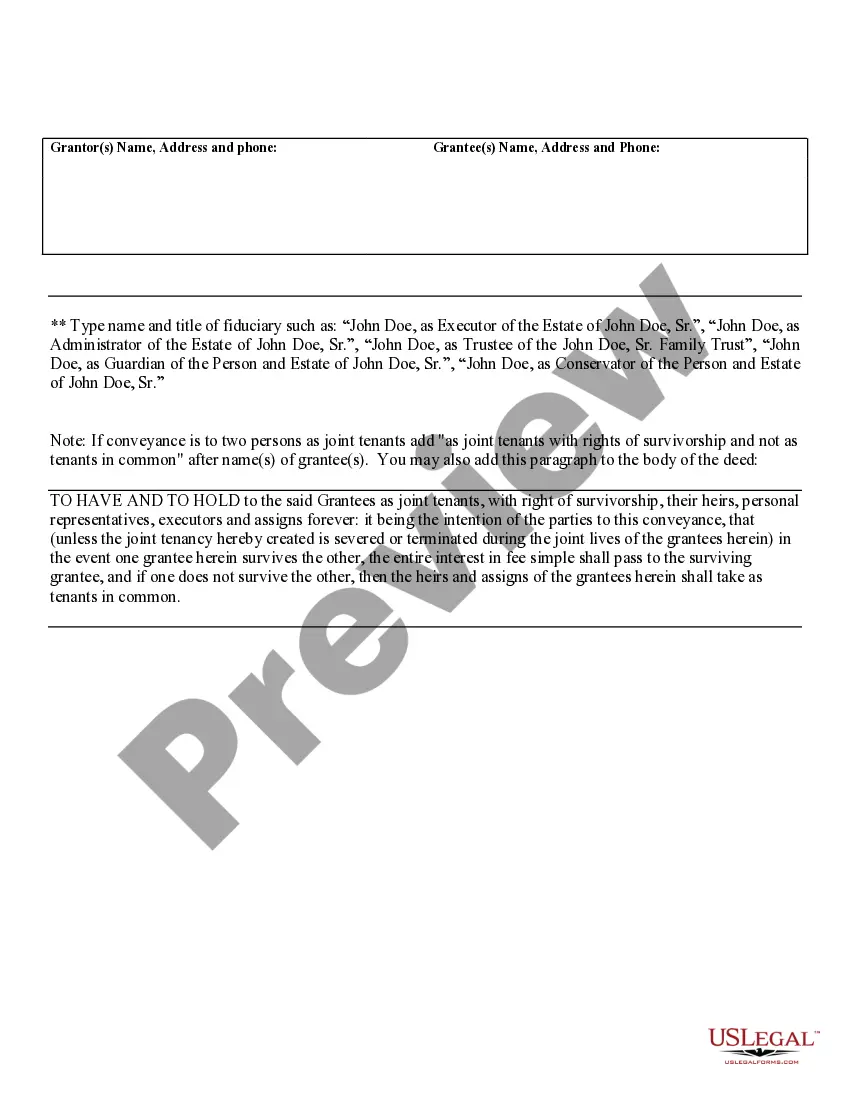

The Fiduciary Deed is a legal document used by executors, trustees, trustors, administrators, and other fiduciaries to transfer property. This form facilitates the transfer of real estate from a grantor acting in an official capacity to a grantee, while providing the necessary legal acknowledgment and protection. Unlike standard deeds, the Fiduciary Deed acknowledges the authority of the acting fiduciary to conduct such transactions on behalf of an estate or trust.

What’s included in this form

- Identifies the grantor and grantee, along with their roles.

- Specifies the property being conveyed.

- Includes a warranty clause guaranteeing the grantor's authority to act.

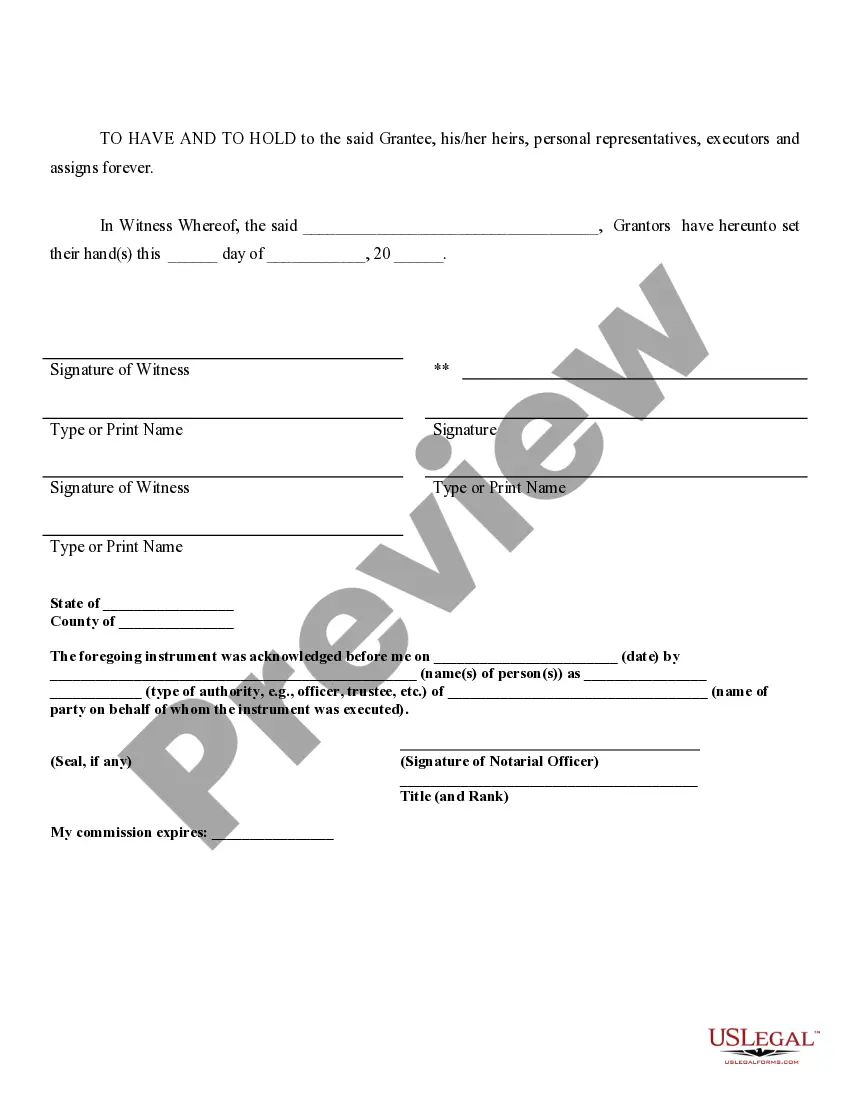

- Requires acknowledgment by a notary public.

- Allows for provisions regarding joint tenancies and rights of survivorship.

Situations where this form applies

This form is needed when a fiduciary is authorized to manage and transfer property as part of their responsibilities, such as after a person has passed away or when a trust is established. Common situations include transferring real estate as part of a decedent's estate management or executing property transfers under the authority granted by a trust.

Intended users of this form

This form is intended for:

- Executors managing an estate under a will.

- Trustees overseeing a trust and its assets.

- Administrators appointed to handle an estate without a will.

- Guardians or conservators acting on behalf of another individual.

How to complete this form

- Identify the parties involved: list the grantor's and grantee's names and roles.

- Specify the property details: include a clear description of the real estate being transferred.

- Enter the date of the transaction.

- Obtain the necessary signatures from the grantor and a notary public.

- Ensure that all information is reviewed and locked before final submission.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to properly identify the grantor and grantee.

- Not accurately describing the property to be transferred.

- Neglecting to have the form notarized, if required.

- Entering information after the document has been locked, leading to data loss.

Why use this form online

- Easy access: download the form anytime, anywhere.

- Editability: fill in form fields using a computer for accuracy.

- Guidance provided: clear instructions on how to complete the document.

- Cost-effective: eliminates the need for legal consultations for routine property transfers.

Looking for another form?

Form popularity

FAQ

An Oklahoma (OK) quitclaim deed is the type of deed used when people who trust one another need to transfer ownership or interest in real estate property from one person to the next.If the buyer (grantee) wants a warranty on the title and ownership, the proper form to use is a warranty deed.

In Oklahoma, if the will does not specify the executor fee (or you have renounced your claim to that fee), default executor fees are calculated as a percentage of the net value of the estate: 5.0% on the first $1K. 4.0% on the next $5K. 2.5% on anything more.

Personal representative's deeds are used to transfer real property from both testate (with a will) and intestate (without a will) estates. These documents provide essential information about the specific probate estate and related property transfer in one document.

The Will must be filed in the District Court in the county where the decedent lived. A Petition for Probate must be filed as well. This requests the appointment of an executor. If there is no Will, the Court will appoint someone to serve as the Personal Representative of the estate.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

Many executors are able to wrap up an estate themselves, without hiring a probate lawyer.Many executors decide, sometime during the process of winding up an estate, that they could use some legal advice from a lawyer who's familiar with local probate procedure .

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

If an estate doesn't go through probate and it is a necessary process to transfer ownership of assets, the heirs could sue the executor for failing to do their job. The heirs may not receive what they are entitled to. They may be legally allowed to file a lawsuit to get what they are owed.