What is Deed?

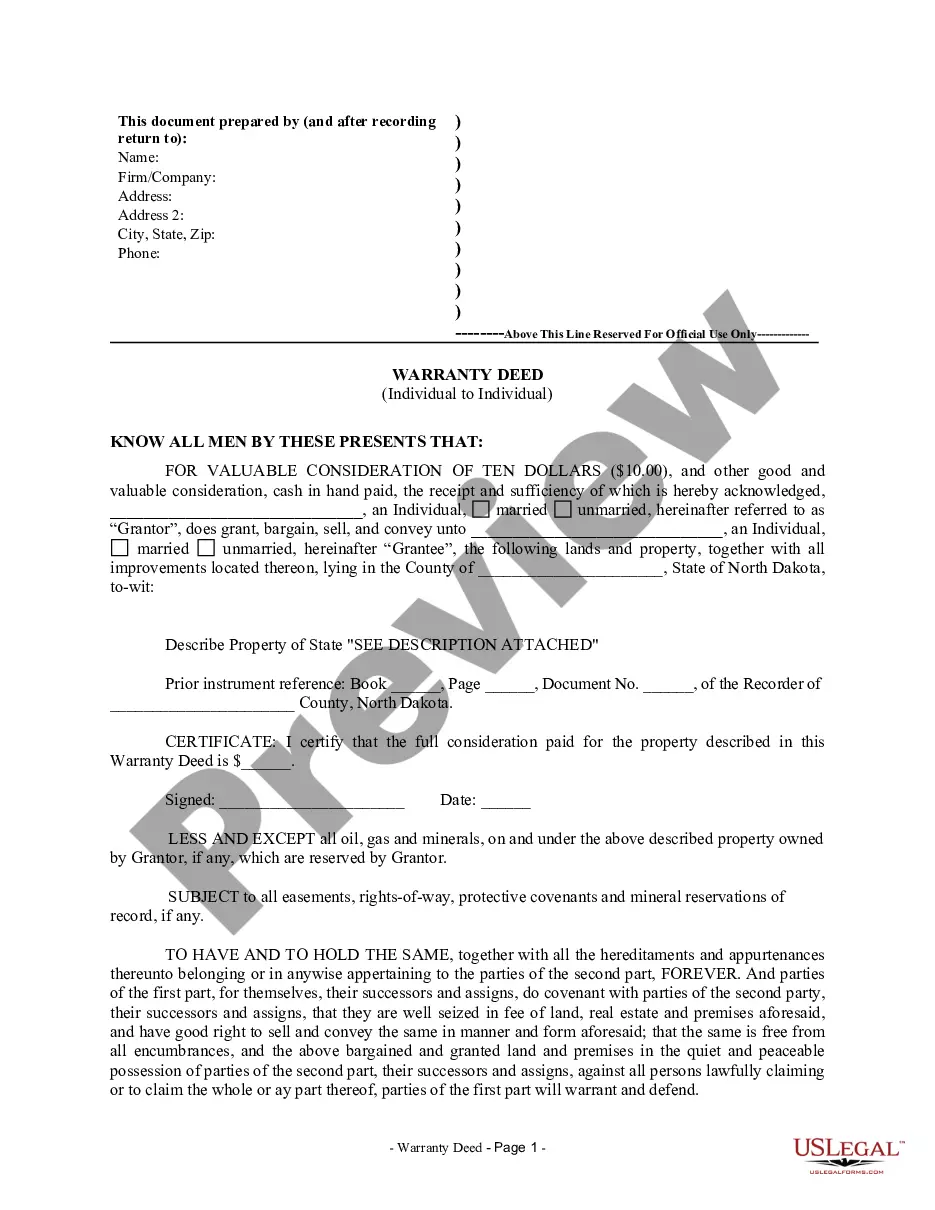

Deeds are legal documents that convey ownership of real property. They are used during sales, transfers, and other transactions. Explore state-specific templates for accurate documentation.

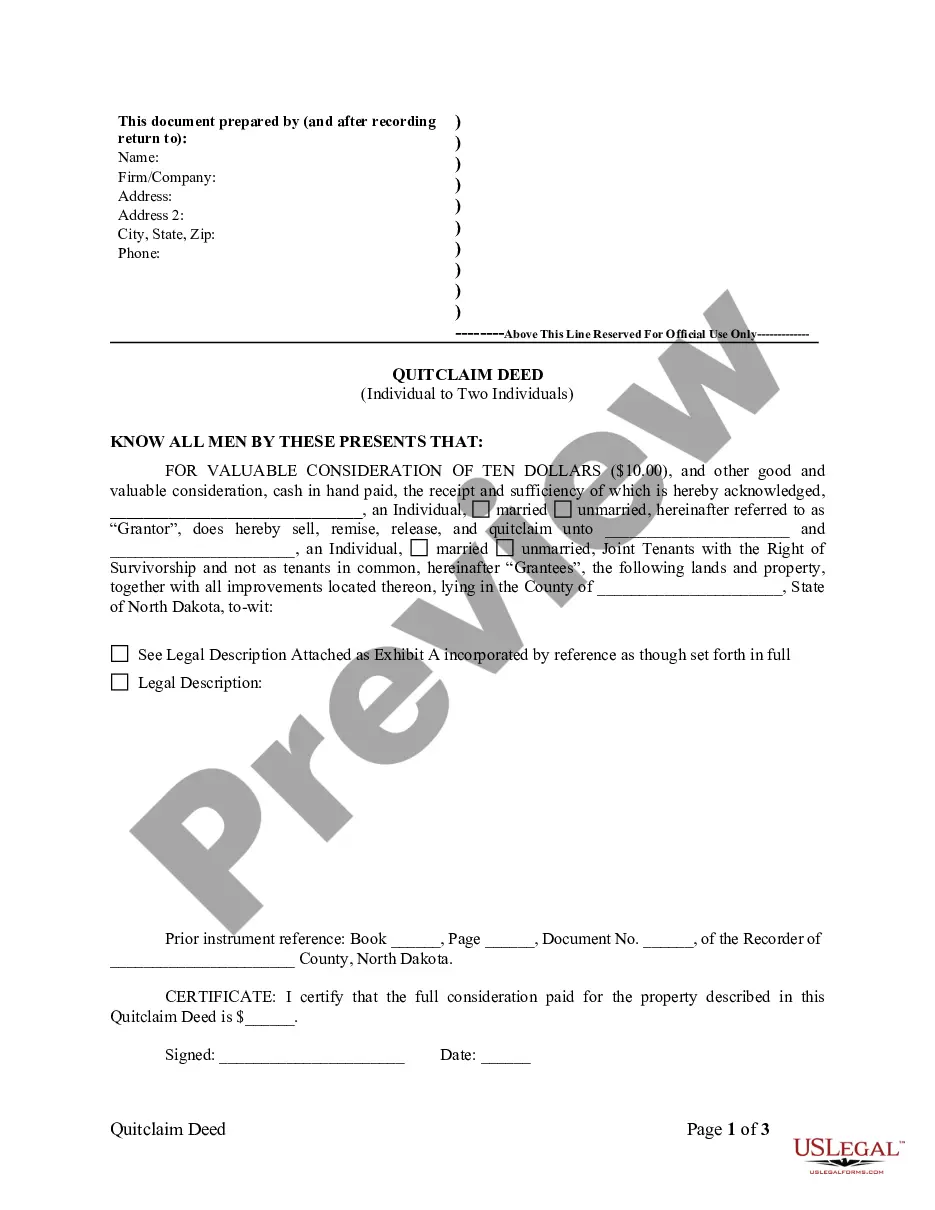

Deeds are essential documents for transferring property ownership. Attorney-drafted templates are quick and easy to complete.

Get everything you need for owner-financed real estate transactions in one package, with multiple related legal forms for effective management.

Get everything needed to release a mortgage in one package, including necessary forms for both individuals and corporations.

Get everything you need for owner-financed real estate transactions in one package, with multiple related legal forms for effective management.

Simplify property transfers between partners with a straightforward method that does not require extensive legal documentation.

Use this agreement for purchasing real estate, allowing buyers to make payments over time while securing the property until full payment is made.

Transfer property ownership easily between individuals without the need for complicated legal proceedings.

Used to transfer mineral rights between individuals, ensuring clear ownership and management of valuable property interests.

Secure your property transfer with a legally binding document that protects both parties' interests.

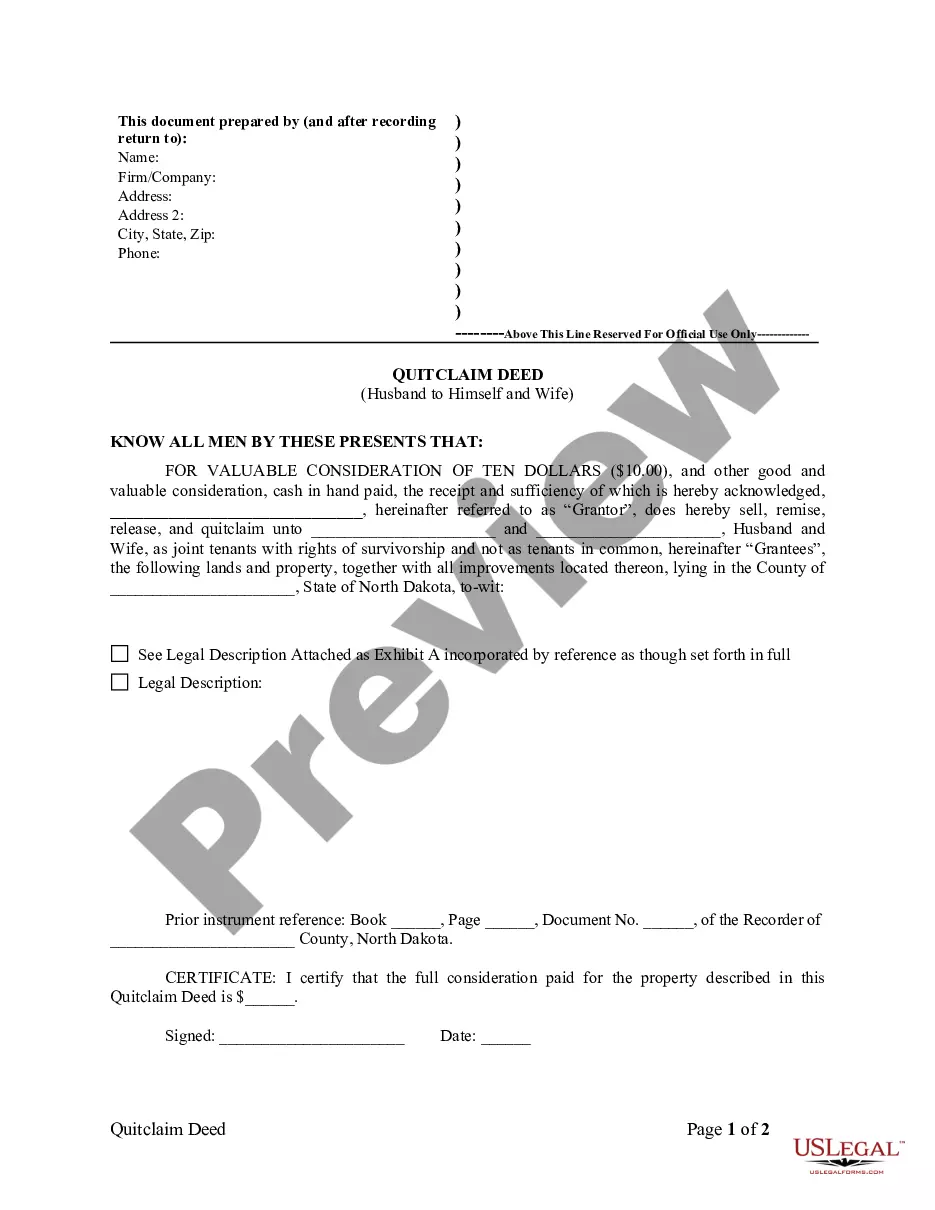

Transfer property ownership to yourself and your partner while excluding specific rights.

Transfer property ownership to a trust effectively and simply, ensuring the trust holds the title without complications.

Transfer property to your child while retaining a life estate, ensuring you can live in the home for the rest of your life.

Transfer property ownership to two individuals as joint tenants, ensuring rights of survivorship.

A deed must be executed and delivered to be effective.

Most deeds require notarization to be valid.

Deeds can be revoked or modified under certain conditions.

Different types of deeds serve various legal purposes.

Recording a deed with the county protects ownership rights.

Begin quickly with these simple steps.

A trust can help manage assets during your lifetime, while a will handles distribution after death.

If you do not create a plan, your assets may be distributed according to state law.

It's wise to review your plan regularly, especially after major life events.

Beneficiary designations typically override wills, so ensure they are up-to-date.

Yes, you can designate separate individuals for financial and healthcare decisions.