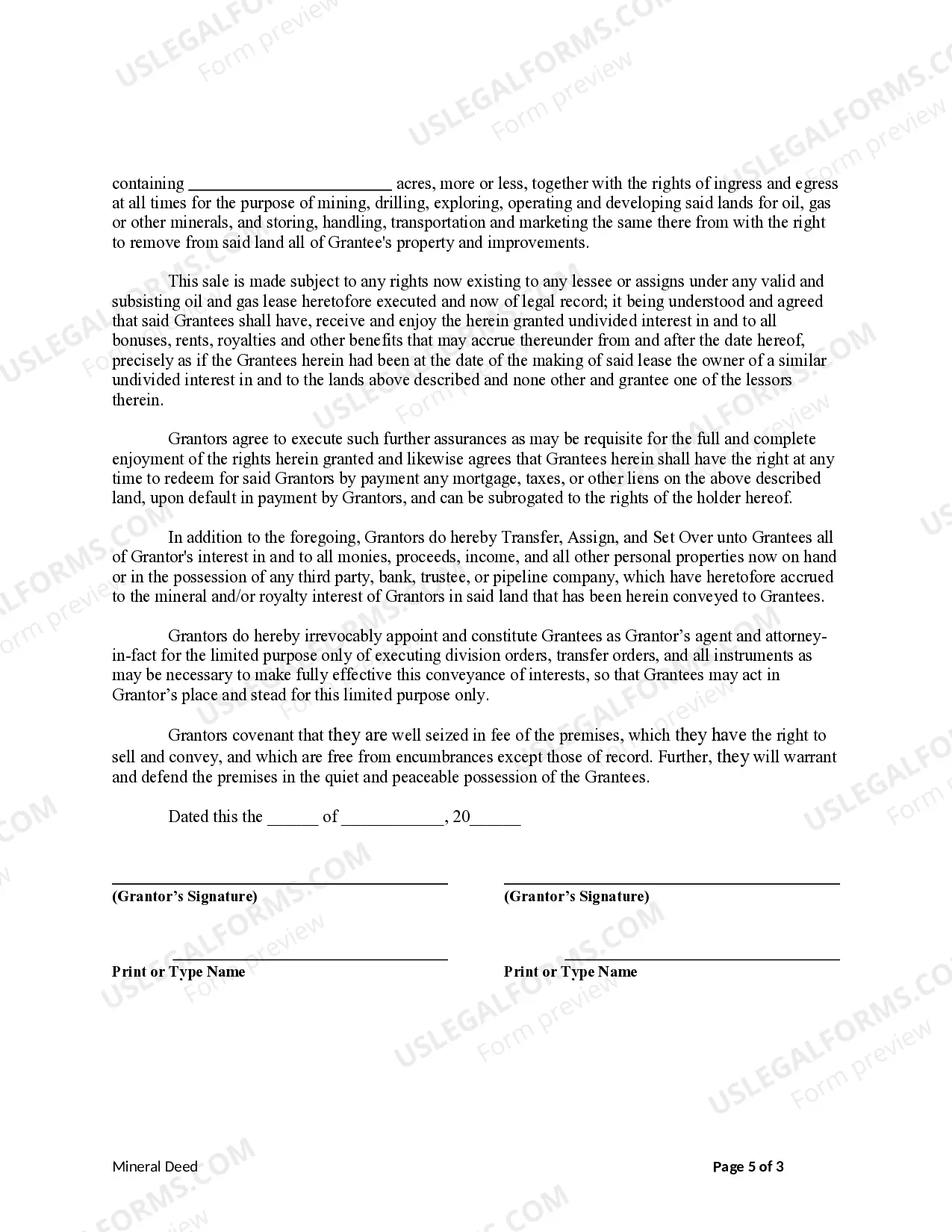

This form is a Mineral Deed where the Grantor(s) transfer all or part of the mineral rights to the described real property to name Grantee(s). Grantor(s) convey(s) the described property to the Grantee(s). This deed complies with all state statutory laws.

North Dakota Mineral Deed from Husband and Wife/Two Individuals to Husband and Wife/Two Individuals

Description

How to fill out North Dakota Mineral Deed From Husband And Wife/Two Individuals To Husband And Wife/Two Individuals?

Avoid expensive attorneys and find the North Dakota Mineral Deed from Husband and Wife/Two Individuals to Husband and Wife/Two Individuals you want at a reasonable price on the US Legal Forms site. Use our simple groups functionality to look for and obtain legal and tax files. Go through their descriptions and preview them just before downloading. In addition, US Legal Forms enables customers with step-by-step tips on how to download and complete every template.

US Legal Forms subscribers simply have to log in and get the specific document they need to their My Forms tab. Those, who have not got a subscription yet must follow the guidelines below:

- Ensure the North Dakota Mineral Deed from Husband and Wife/Two Individuals to Husband and Wife/Two Individuals is eligible for use in your state.

- If available, read the description and use the Preview option well before downloading the sample.

- If you are confident the template fits your needs, click Buy Now.

- If the template is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select obtain the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you may fill out the North Dakota Mineral Deed from Husband and Wife/Two Individuals to Husband and Wife/Two Individuals by hand or by using an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Like land, mineral rights are conveyed through a deed transferring ownership to the buyer. While the property deed will reference the mineral rights transfer at the time of the separation of land and mineral rights, subsequent sales of the land will not.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

How can I find out who owns the oil rights on property in North Dakota? To determine mineral rights on a parcel of land, you need to go to the County Recorder's Office in the county of that parcel and request any recorded deed documents for the parcel.

Mineral rights must be transferred to heirs before any transactions related to them can take place. Unlike a home, which can be sold by an estate, mineral rights must be transferred before any sale. Mineral rights can be transferred to rightful heir(s) or to a trust through a mineral deed.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Are inherited mineral rights taxable? The federal government does not consider inherited mineral rights taxable. Still, any income you accumulate from those rights does have to be reported on your tax return.