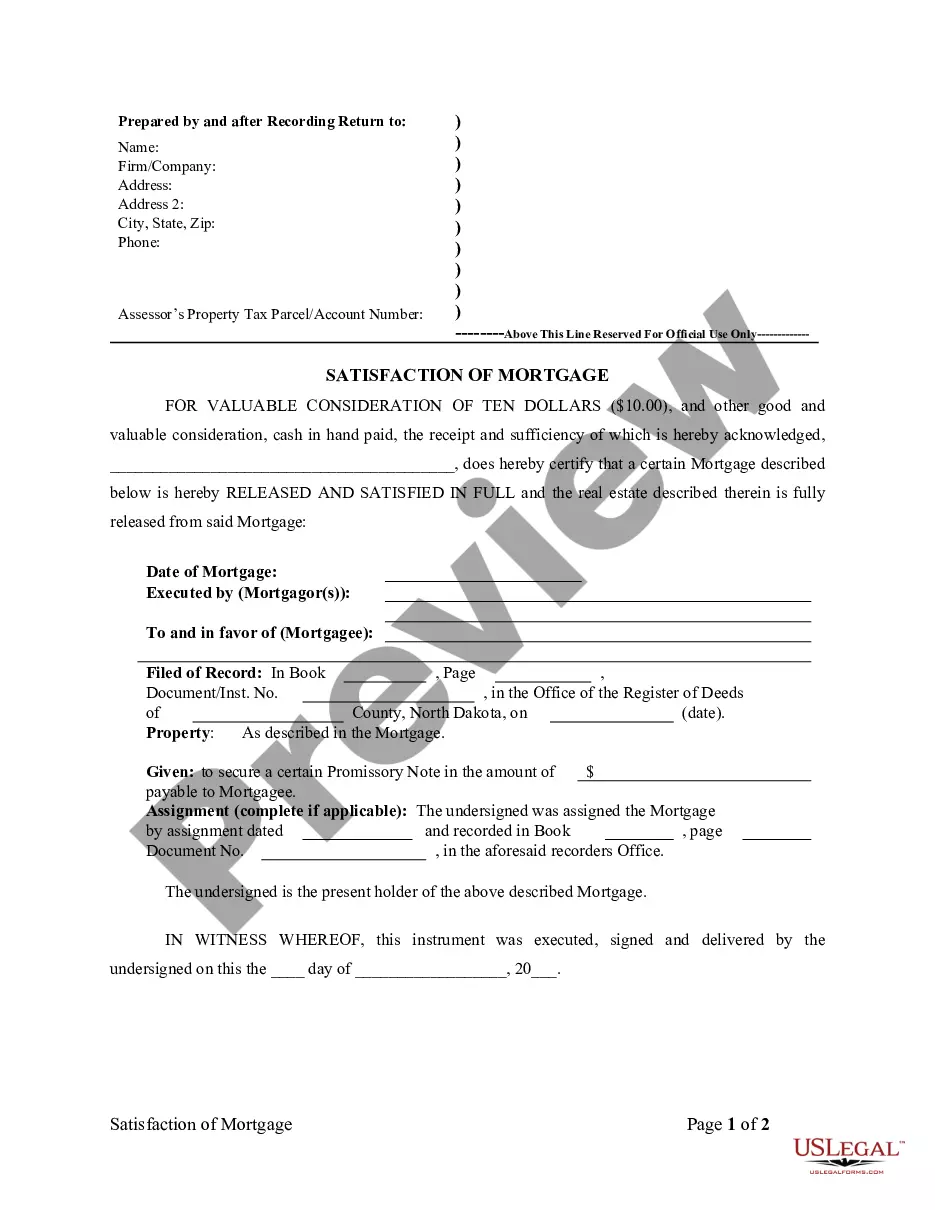

North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out North Dakota Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Avoid pricey attorneys and find the North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual you need at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax files. Read their descriptions and preview them well before downloading. Moreover, US Legal Forms provides customers with step-by-step tips on how to obtain and complete each and every form.

US Legal Forms customers basically have to log in and download the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the tips below:

- Ensure the North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual is eligible for use in your state.

- If available, read the description and use the Preview option just before downloading the templates.

- If you are confident the document is right for you, click Buy Now.

- In case the template is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to your gadget or print it out.

After downloading, you are able to fill out the North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual manually or by using an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

Register the discharge of mortgage Once you return the Discharge Authority form, your bank would prepare a Discharge of Mortgage document. This document must be registered at the Land Titles office.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.

A Satisfaction of Mortgage is used to acknowledge the same of a Mortgage agreement.In essence, the Deed of Reconveyance and Satisfaction of Mortgage both serve the same function, which is to show that the borrower has repaid the loan fully and that the lender has no further interest in the property.