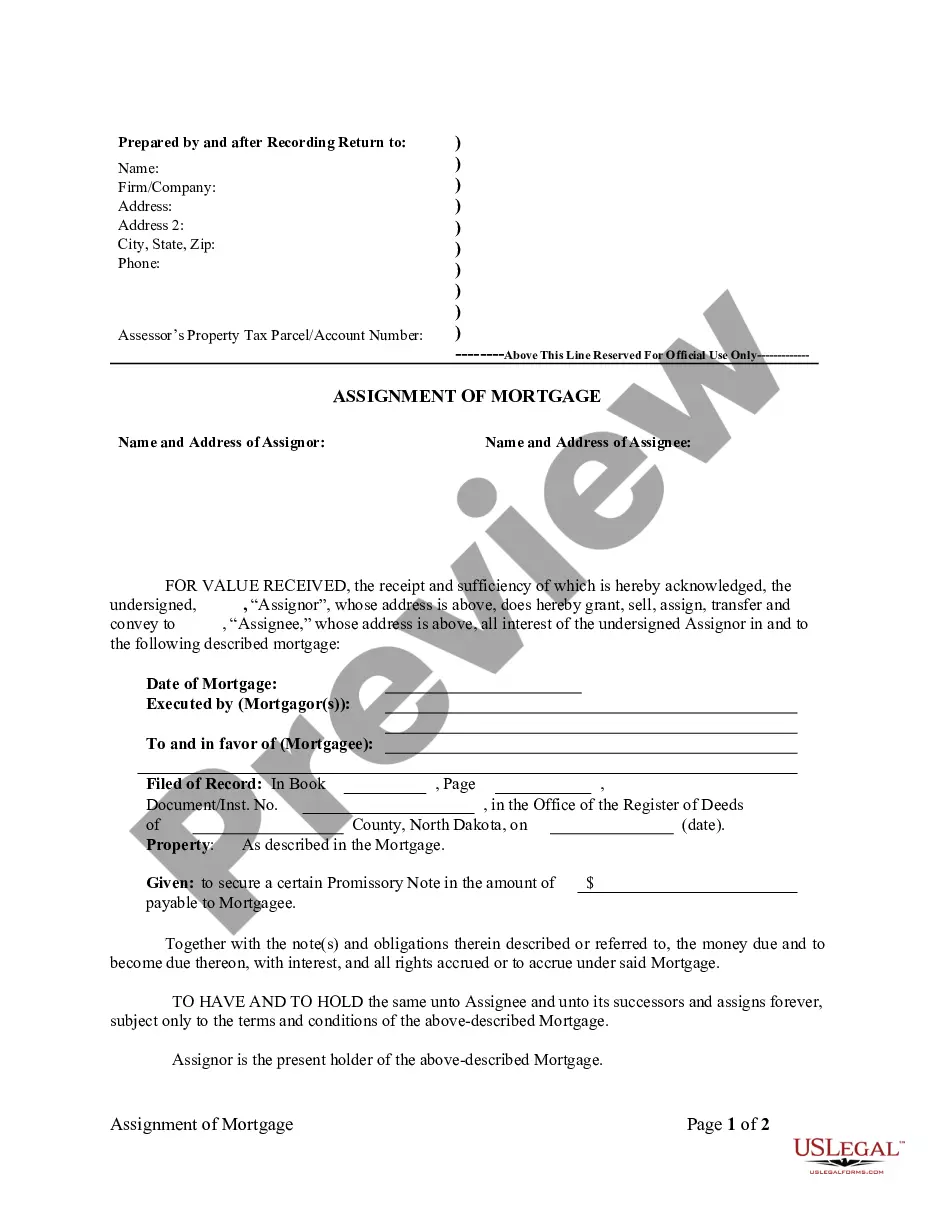

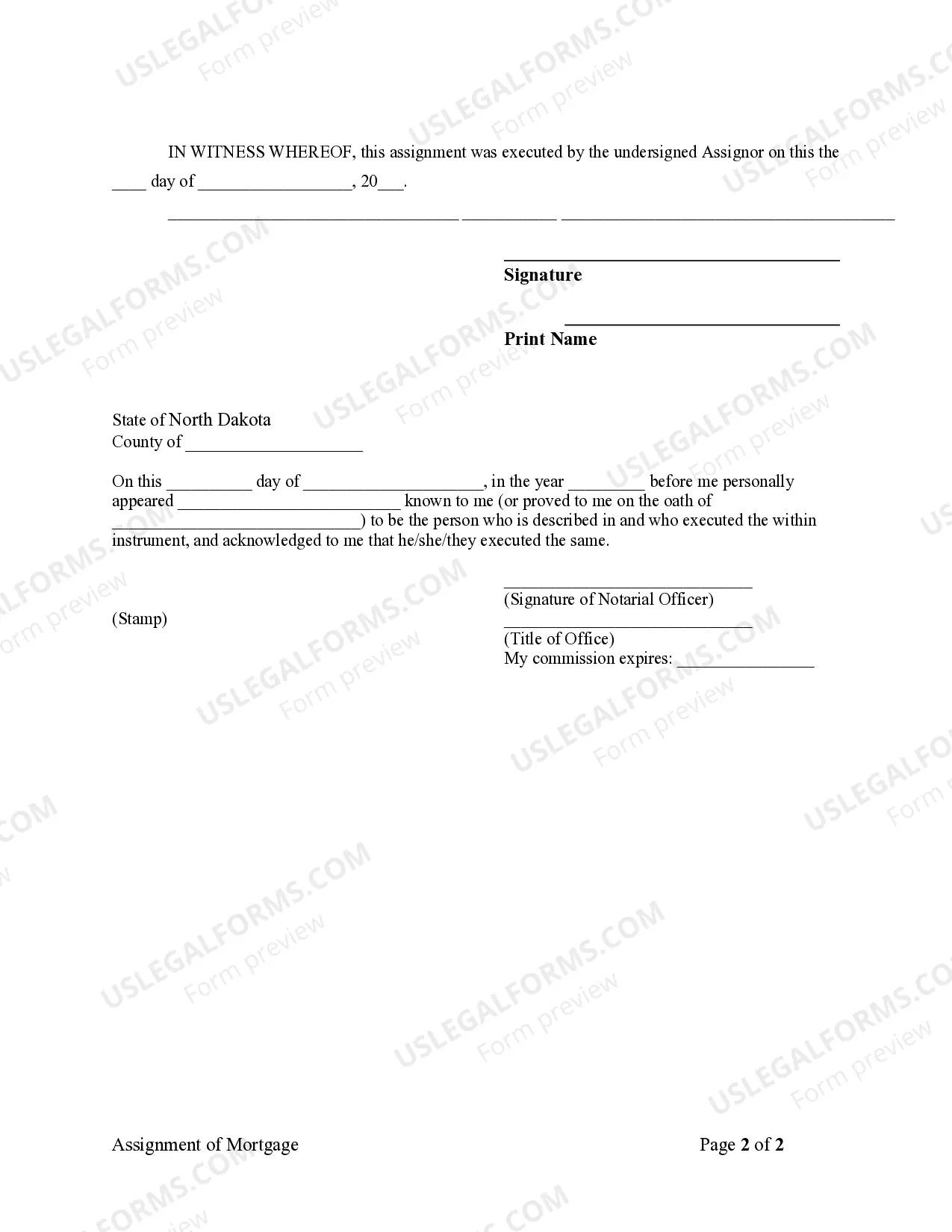

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

North Dakota Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out North Dakota Assignment Of Mortgage By Individual Mortgage Holder?

Avoid expensive lawyers and find the North Dakota Assignment of Mortgage by Individual Mortgage Holder you need at a affordable price on the US Legal Forms site. Use our simple groups function to find and obtain legal and tax forms. Go through their descriptions and preview them just before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to obtain and complete each template.

US Legal Forms clients simply need to log in and obtain the specific document they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the tips listed below:

- Ensure the North Dakota Assignment of Mortgage by Individual Mortgage Holder is eligible for use where you live.

- If available, look through the description and use the Preview option well before downloading the sample.

- If you are confident the template meets your needs, click on Buy Now.

- If the form is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, it is possible to fill out the North Dakota Assignment of Mortgage by Individual Mortgage Holder by hand or an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.

Mortgages and deeds of trust both grant the title for your property to your lender until the loan is paid. A mortgage is an agreement made between you and the lender. A mortgage grants ownership of your home to the lender which will transfer the title back to you after the loan is paid.

When a borrower prepays their mortgage or makes the final mortgage payment, a satisfaction of mortgage document must be prepared, signed, and filed by the financial institution in ownership of the mortgage. The satisfaction of mortgage document is created by a lending institution and their legal counsel.

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

In title theory states, a lender holds the actual legal title to a piece of real estate for the life of the loan while the borrower/mortgagor holds the equitable title.

The Mortgage or Deed of Trust is a legal document in which the borrower transfers the title to a third party (trustee) to hold as security for the lender.If the borrower defaults on the loan, the property can be sold to pay off the mortgage debt.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.