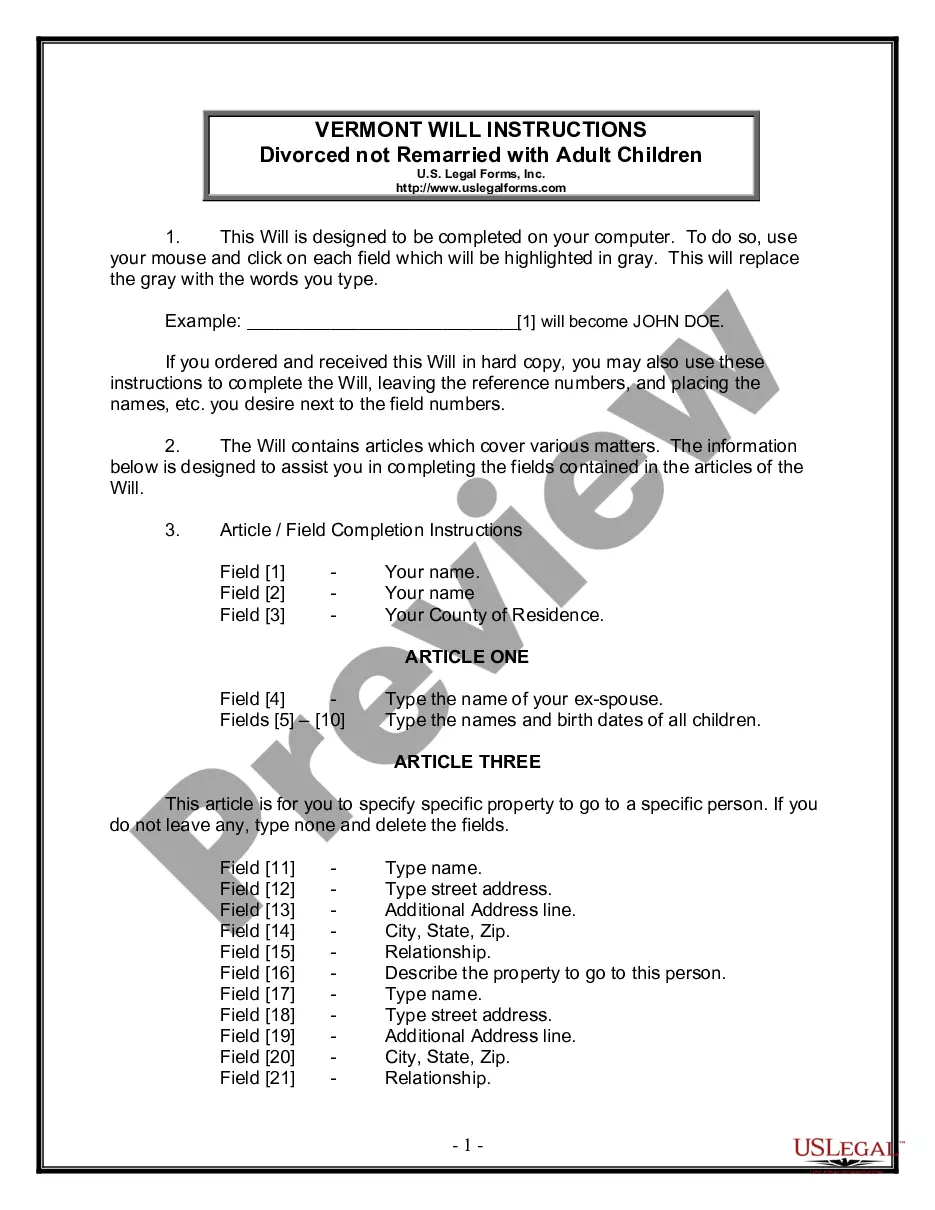

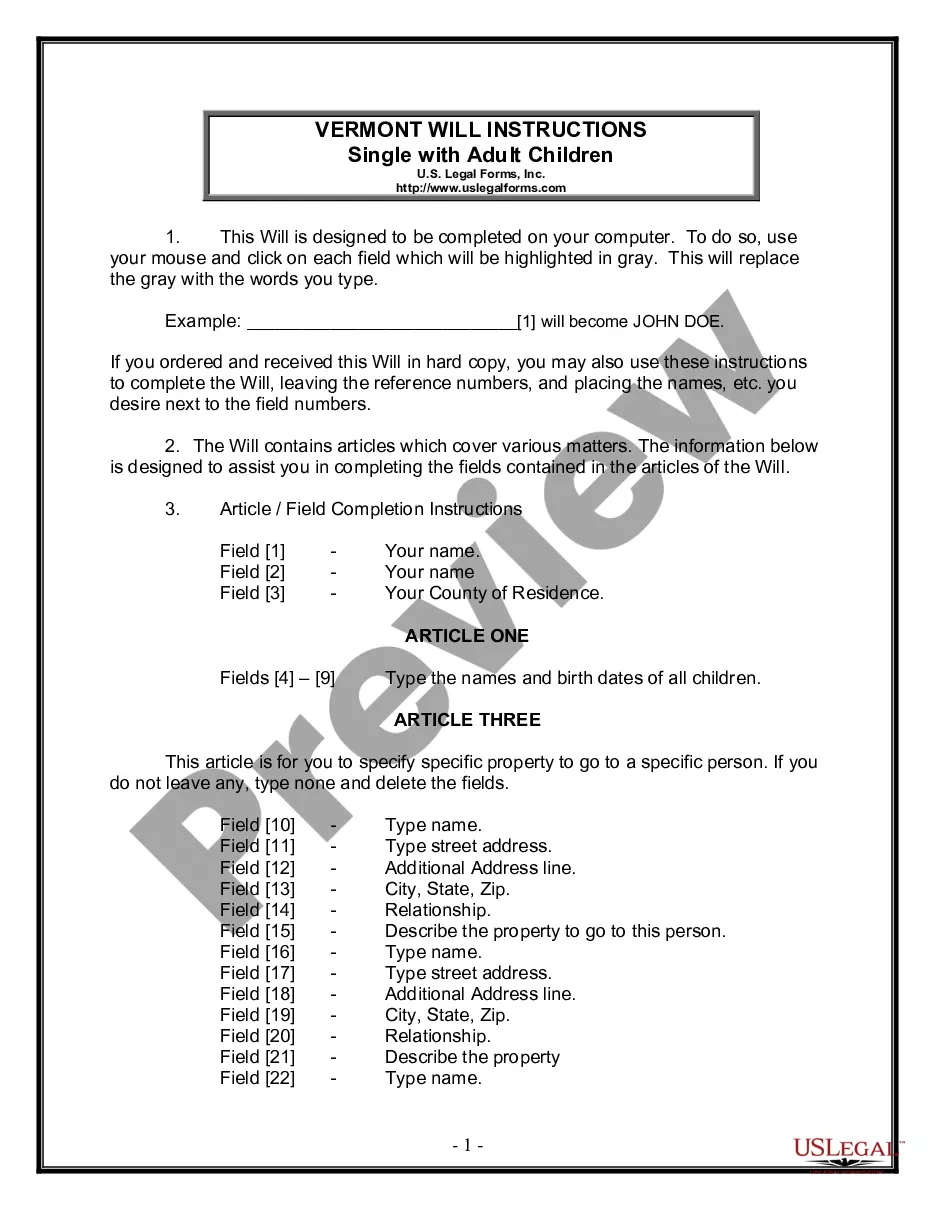

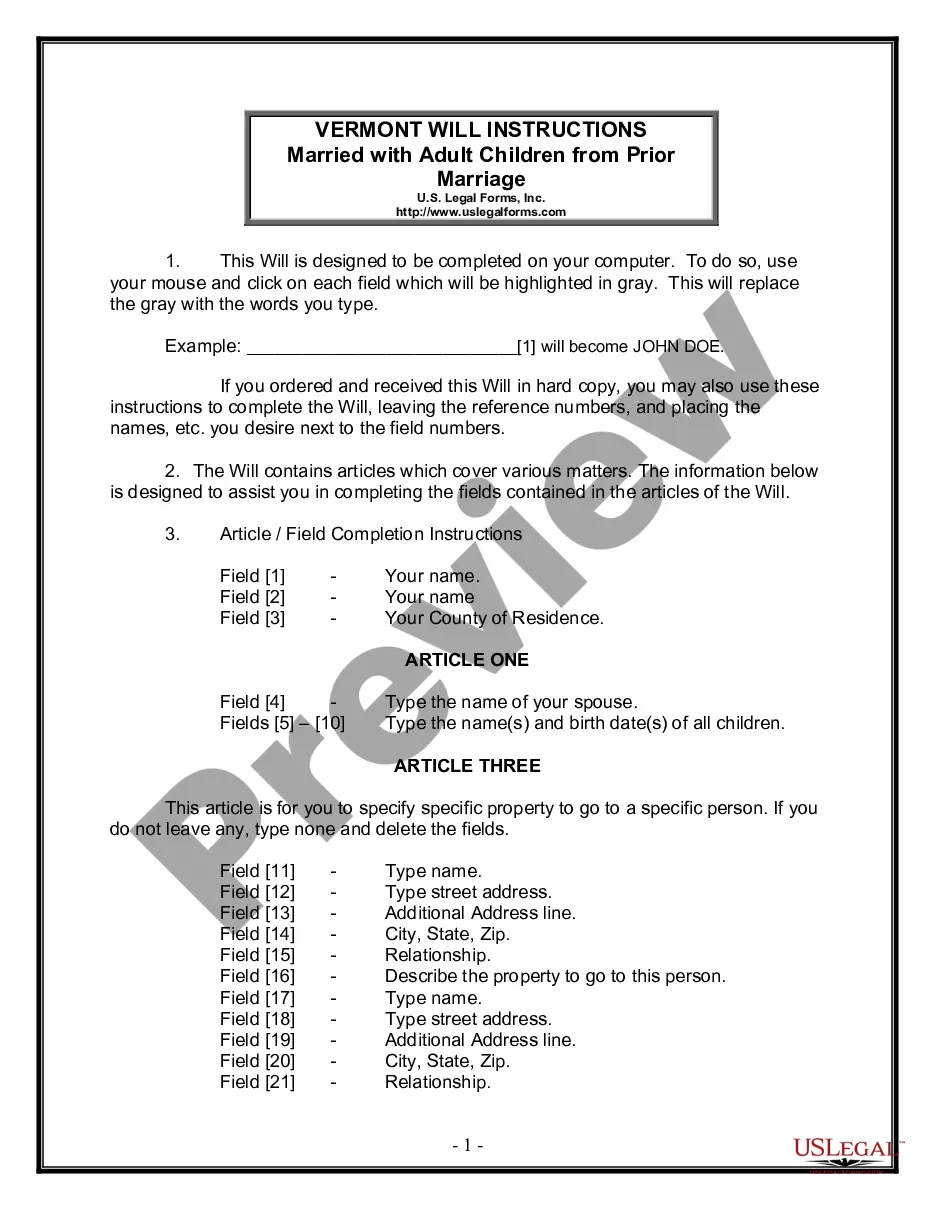

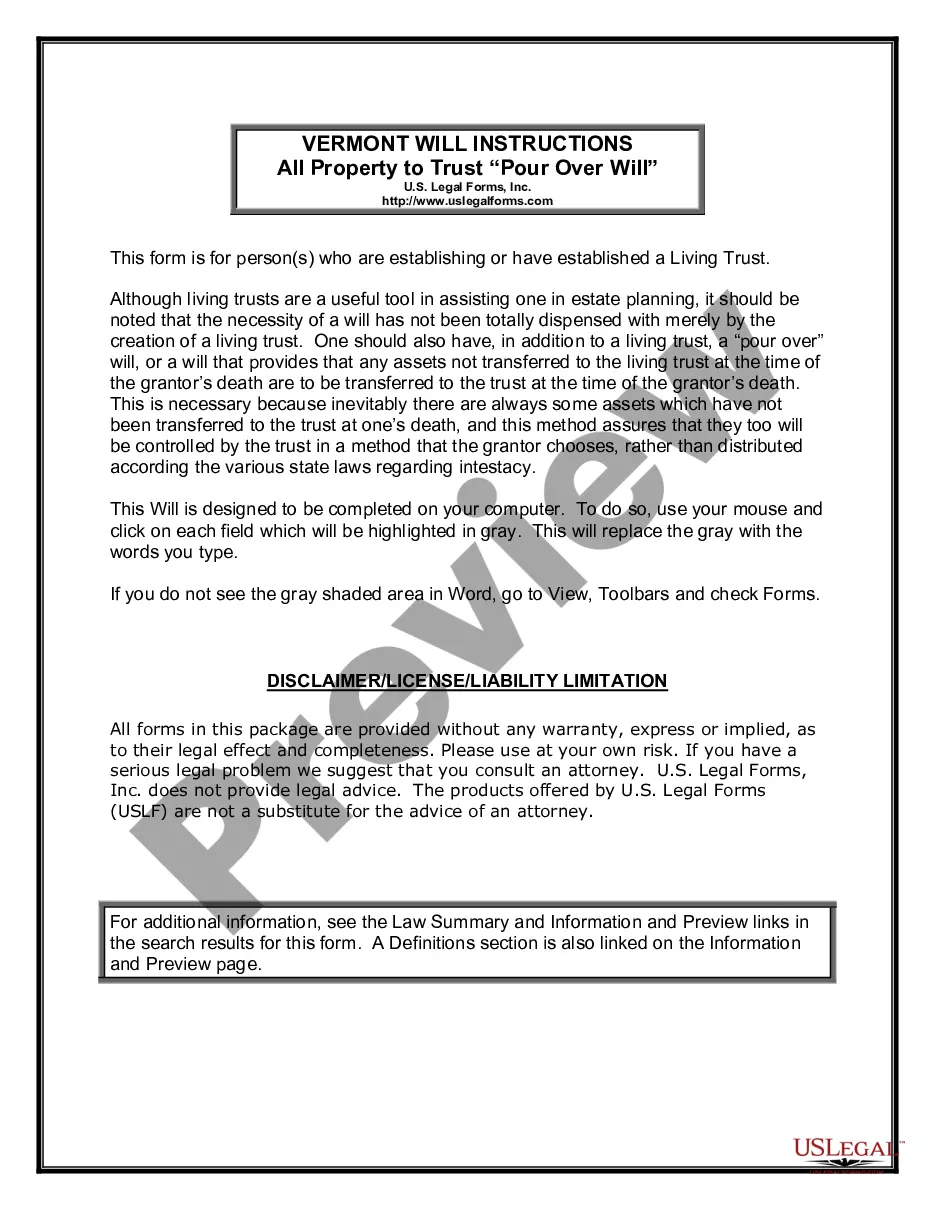

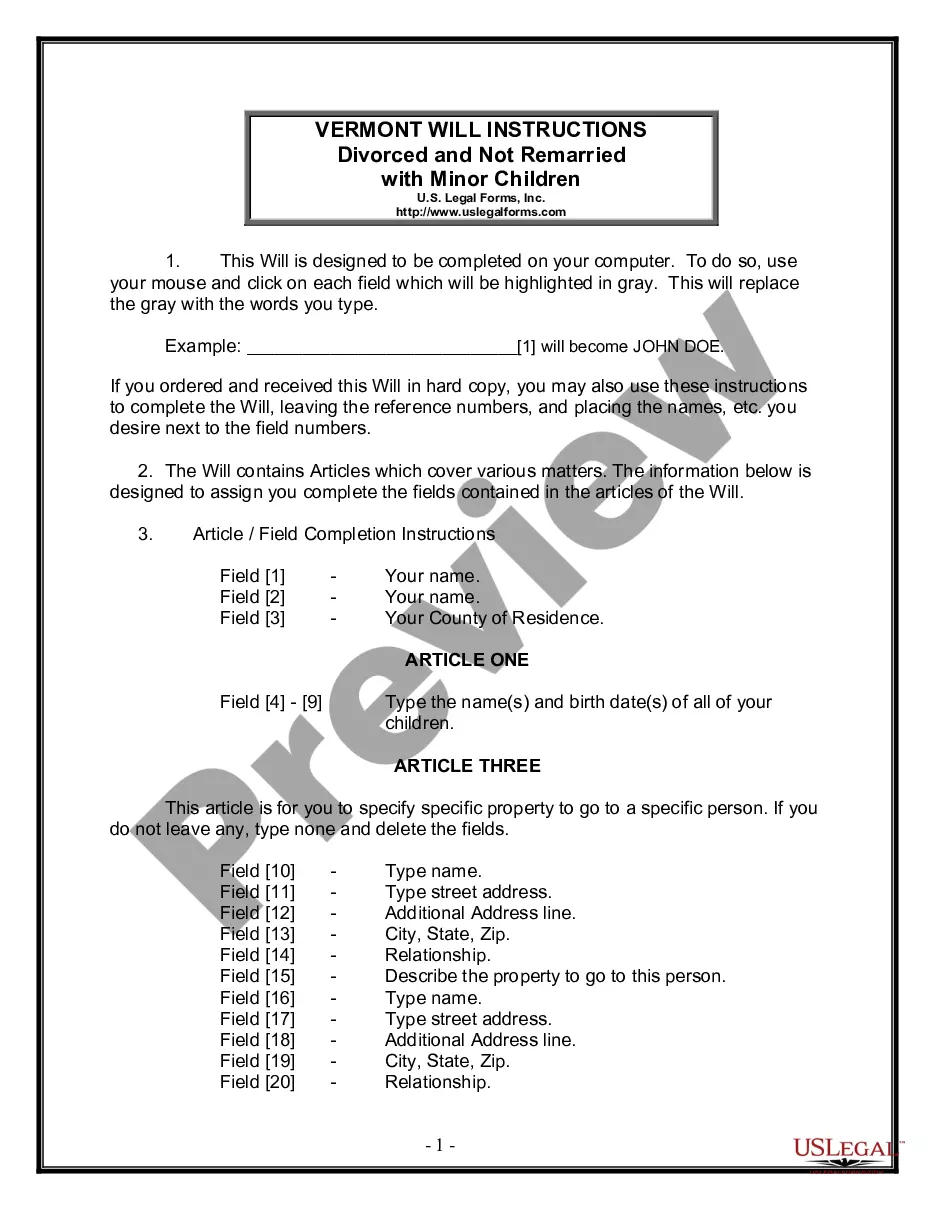

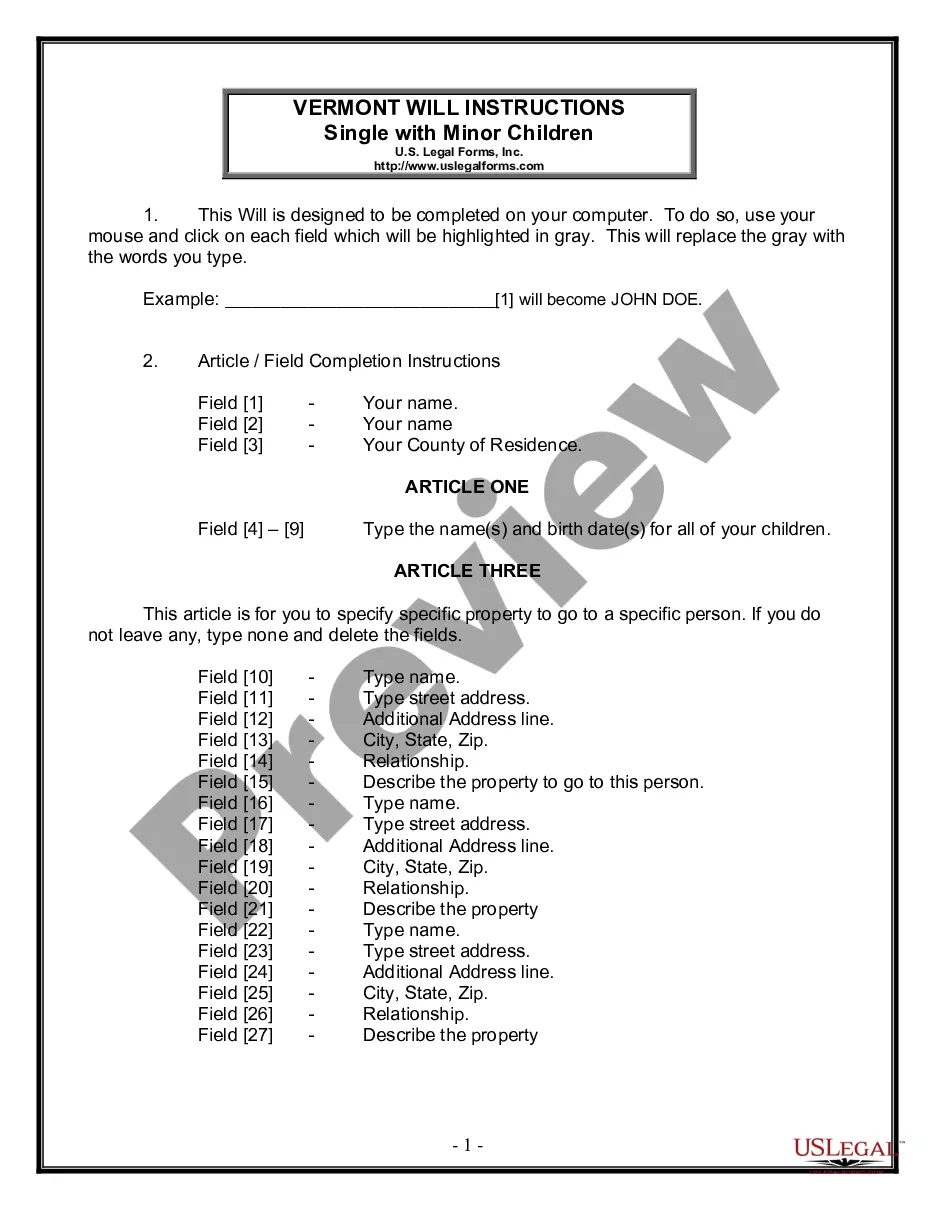

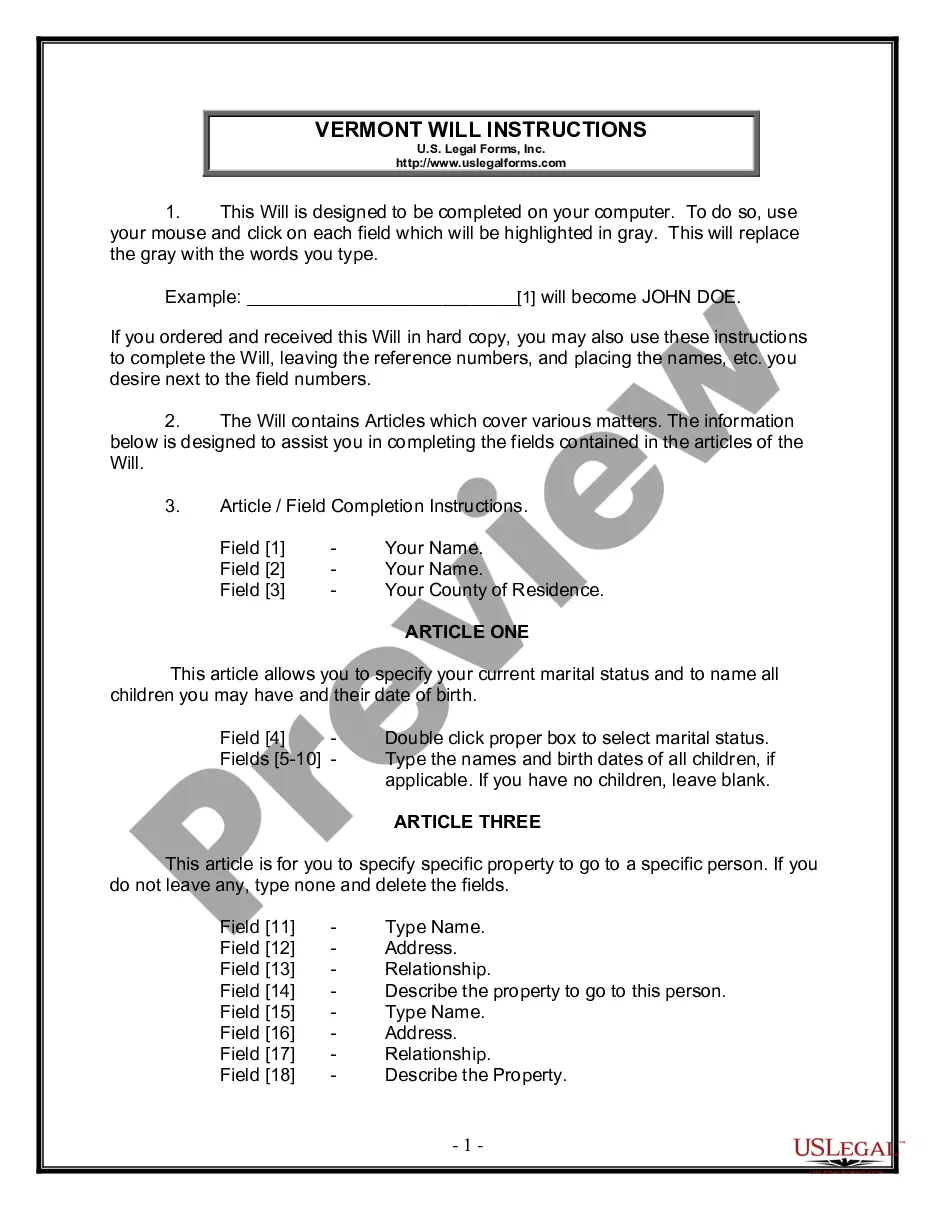

What is Last Will and Testament?

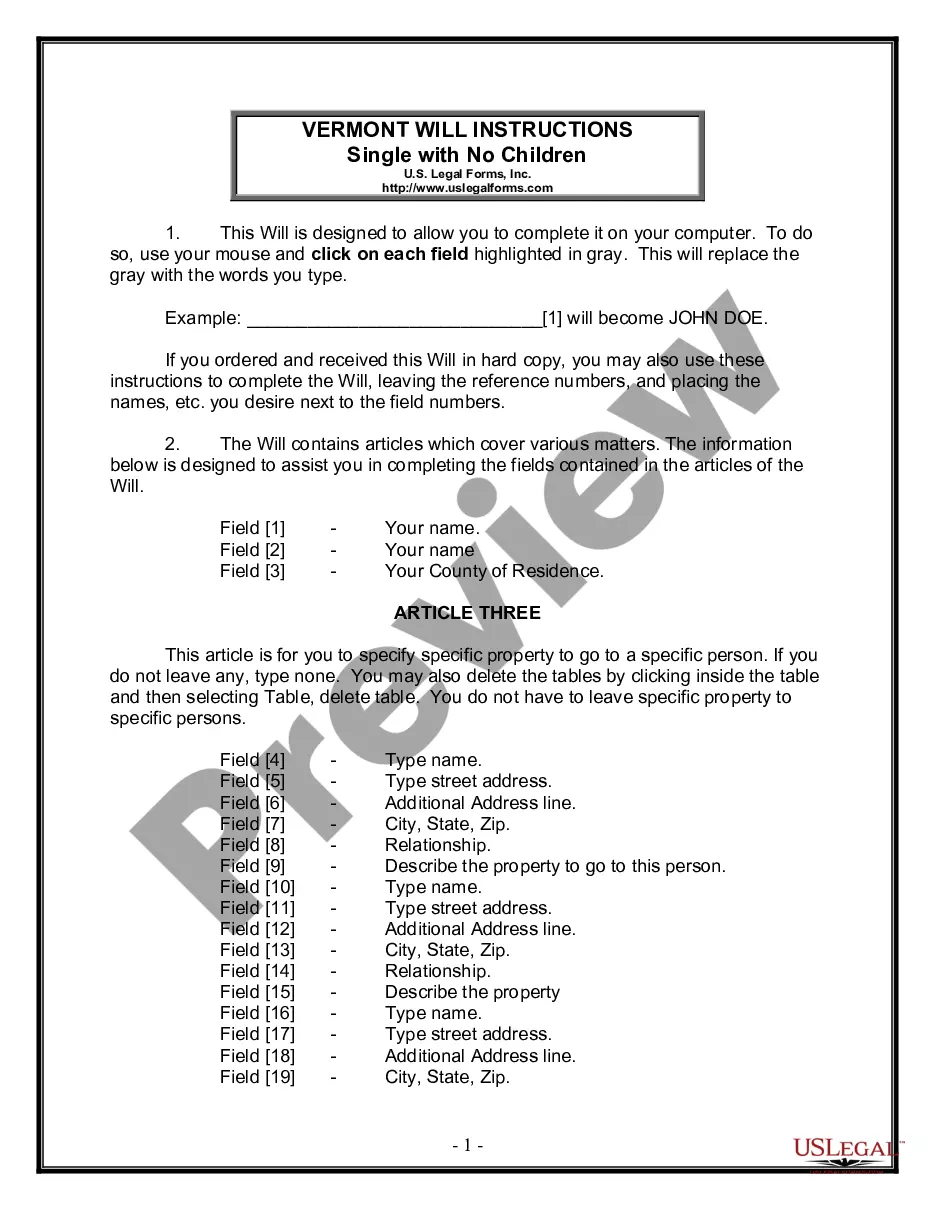

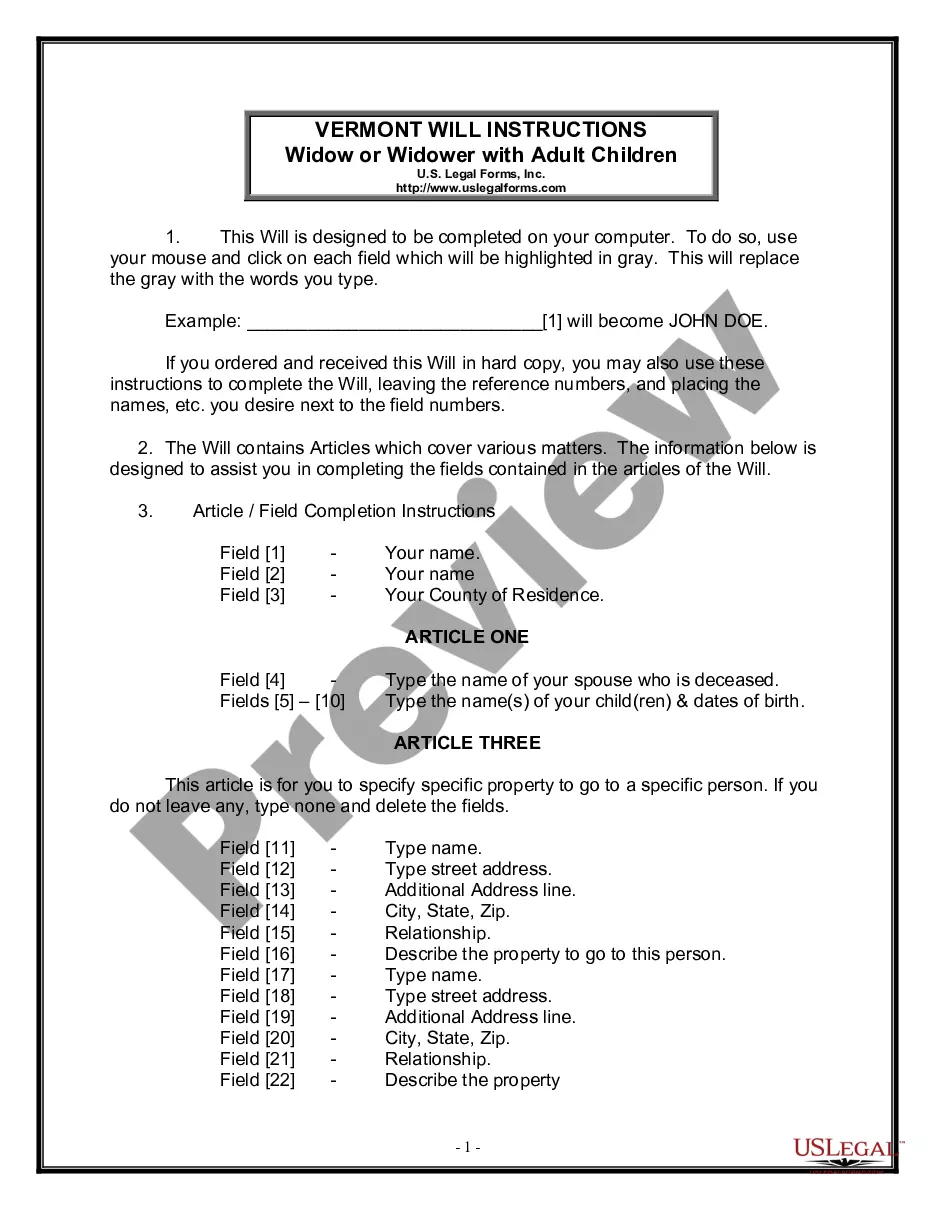

A Last Will and Testament is a legal document that specifies how your assets should be distributed after your death. It can also appoint guardians for minor children. Explore our state-specific templates to create a will that fits your needs.