Affidavit or Proof of No Income - Unemployed - Assets and Liabilities

About this form

The Affidavit of No Income is a legal document used by individuals who are unemployed and need to declare their financial status. This form outlines the affiant's lack of income and details regarding any dependents, liabilities, and sources of funds. It differs from other income declaration forms by focusing specifically on individuals without any income, making it essential for various legal and financial situations where proof of no income is required.

What’s included in this form

- Affiant's personal information, including name and address.

- Marital status and details about any dependents.

- Declaration of unemployment status and date of last employment.

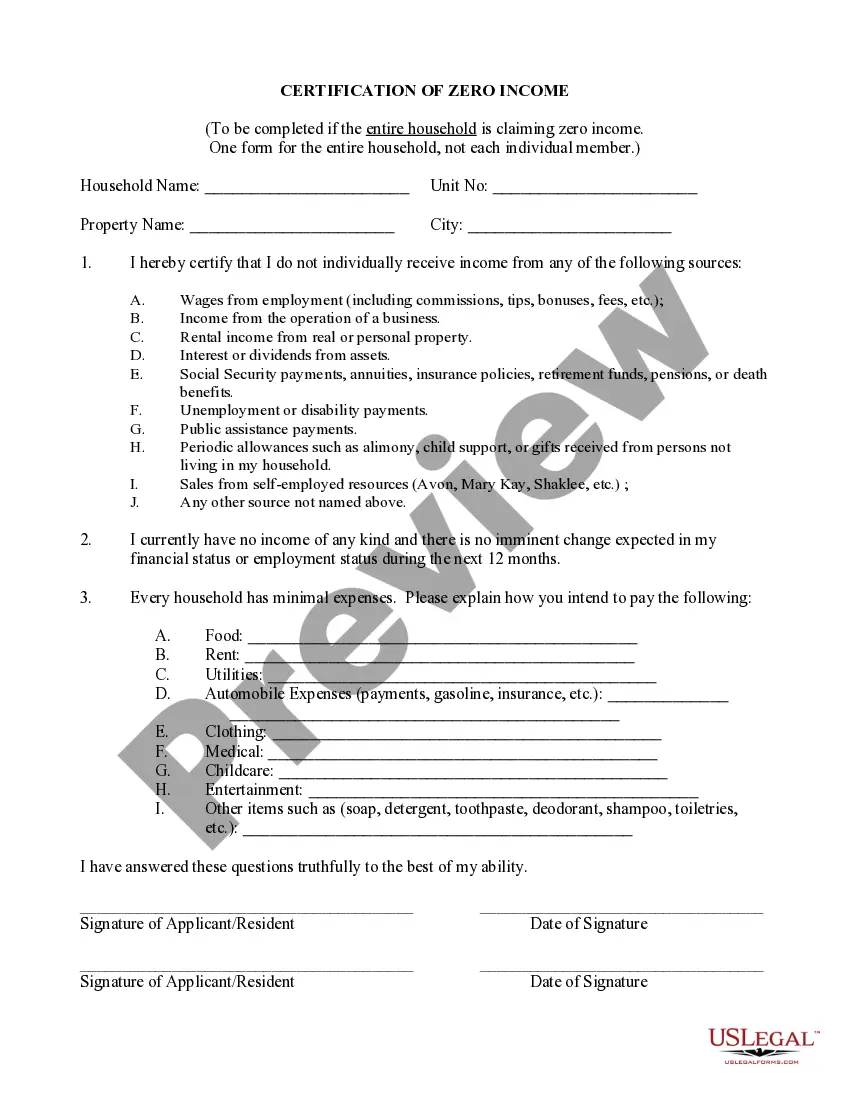

- Certification of no income sources, including employment, social security, and other benefits.

- Details on how basic needs will be funded.

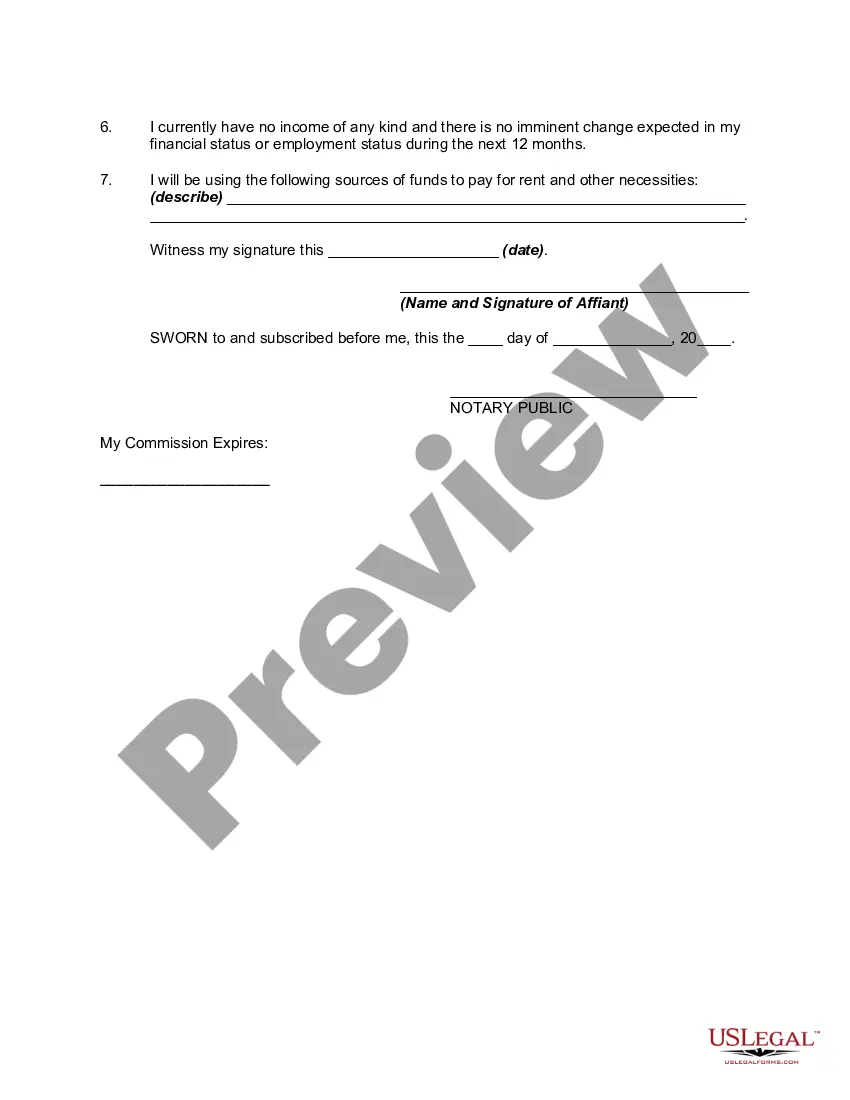

- Signature requirements for the affiant and notarization details.

When to use this document

This form is typically used when an individual needs to demonstrate their financial situation to a court, government agency, or landlord. It is often required for applications for public assistance, housing programs, or to negotiate payment plans where proving lack of income is necessary.

Who this form is for

- Unemployed individuals seeking financial assistance.

- Persons applying for government programs requiring income verification.

- Those negotiating rent or payment plans due to financial hardship.

- Individuals without any sources of income needing to formally declare their status.

Steps to complete this form

- Fill in your personal information, including your name and residence address.

- Specify your marital status and provide details regarding any dependents.

- Indicate your unemployment status and the date you last worked.

- Certify that you do not receive income from any specified sources.

- Describe your plans for funding your basic needs.

- Sign the document in the presence of a notary public for validation.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes

- Failing to provide accurate personal information, including the correct address.

- Neglecting to declare any potential sources of funding.

- Inaccurately stating marital status or dependents.

- Not ensuring the form is notarized properly, if required.

Benefits of using this form online

- Convenience of instantaneous access to legal forms.

- Editable formats allow for customization based on personal circumstances.

- Form templates are drafted by licensed attorneys, ensuring legal reliability.

- Quick download options to use immediately, without waiting for physical copies.

Quick recap

- The Affidavit of No Income is essential for proving unemployment status.

- It includes personal details and a declaration of no income sources.

- Proper completion and notarization of the form are crucial for its validity.

- This form helps in accessing various assistance programs and negotiating financial terms.

Form popularity

FAQ

The main purpose of a financial affidavit is to provide the court with an explanation of a party's financial circumstances. Without this information, the court would be unable to make financial orders or orders concerning property distribution.

A single-step income statement presents the revenue, expenses and ultimately the profit or loss generated by a business, but it reports on this information by using just one equation to calculate profits. The equation used in a single-step income statement is: Net Income = (Revenues + Gains) (Expenses + Losses)

The basic format for an income statement states revenues first, followed by expenses. The expenses are subtracted from the revenue to calculate the net income of the business.

Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.

Statement of Cash Flows. A cash flow statement is one of the most important planning tools you have available. Income Statement. Like a cash flow statement, an income statement is one of the most important and valuable financial statements at your disposal. Balance Sheet. Statement of Changes in Equity.

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time.

In all contested (and some uncontested) divorces, the Courts require each spouse to file what's called a Financial Affidavit, a formal document that details the typical financial factors that play a role in every marriage: how much you earn (income), how much you spend (expenses), how much you own (assets), how much

The income statement consists of revenues and expenses along with the resulting net income or loss over a period of time due to earning activities.The operating section of an income statement includes revenue and expenses.

Your previous years' tax return. Pay stubs for the past two months and the last pay stub for the previous year. Your credit card statements for the year. A copy or information about your bills for the year.