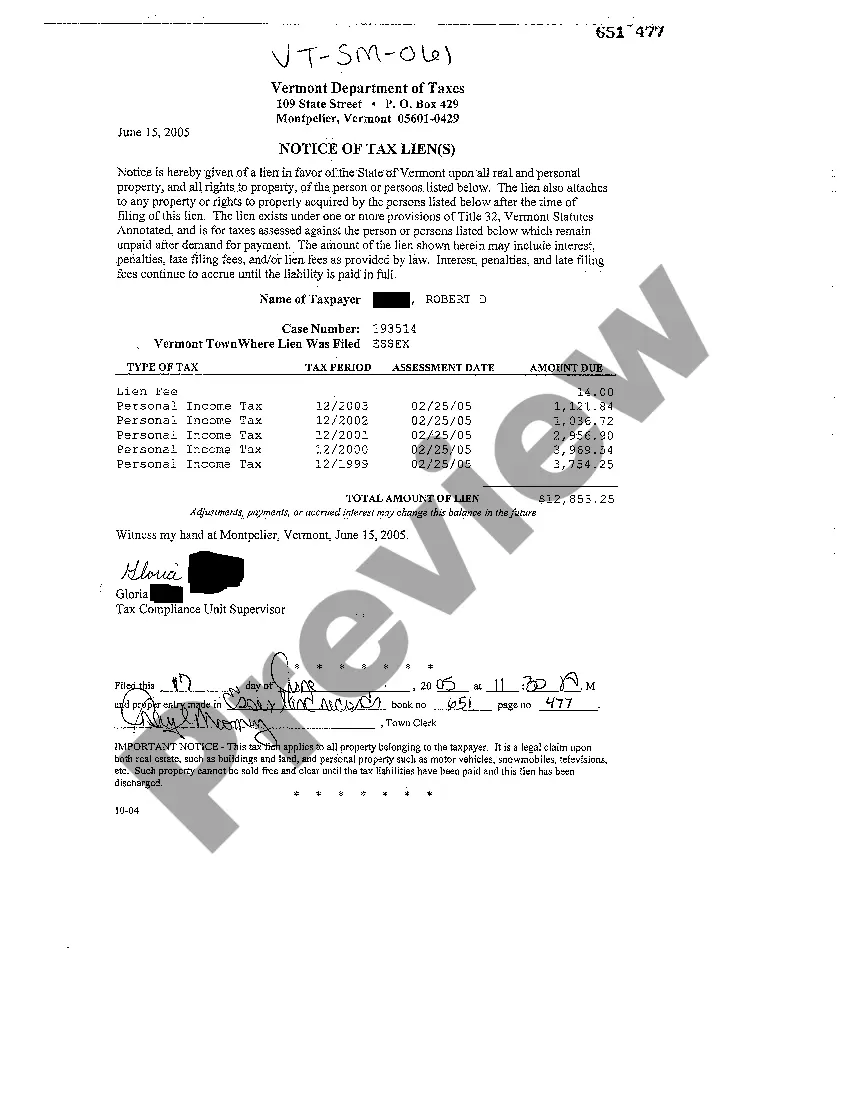

Vermont Notice of Tax Lien

Description

How to fill out Vermont Notice Of Tax Lien?

Searching for a Vermont Notice of Tax Lien on the internet can be stressful. All too often, you find files that you believe are alright to use, but find out later they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Have any form you are looking for in minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be included in your My Forms section. In case you do not have an account, you need to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations below to download Vermont Notice of Tax Lien from our website:

- Read the document description and click Preview (if available) to check whether the form meets your requirements or not.

- If the form is not what you need, find others using the Search field or the listed recommendations.

- If it’s right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- Right after getting it, you may fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted templates, users are also supported with step-by-step instructions on how to get, download, and complete templates.

Form popularity

FAQ

A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt.When filed, the Notice of Federal Tax Lien is a public document that alerts other creditors that the IRS is asserting a secured claim against your assets.

The Process of a Tax Lien The process begins when a taxpayer gets a letter that details how much is owed. This is known as a notice and demand for payment. If the taxpayer fails to pay the debt or attempt to resolve it with the IRS, the agency can place a lien on the person's assets.

Tax liens put your assets at risk. To remove them you'll need to work with the IRS to pay your back taxes.Tax liens (and their cousins, tax levies) are serious business if you owe back taxes.

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

If you owe the IRS taxes, and you haven't made other arrangements to deal with the debt, it might be worth checking to see if you are subject to a federal tax lien. You can find out by calling the IRS's Centralized Lien Unit at 1-800-913-6050 or authorizing your tax professional to call on your behalf.

When you buy a tax lien, you're responsible for paying the outstanding lien amount, plus interest or penalties due. Then, the state or municipality pays you principal and interest when the property owner makes their property tax paymentthis is how you earn money with tax lien investing.

If a creditor gets a judgment against you, it can then place a lien on your property. The lien gives the creditor an interest in your property so that it can get paid for the debt you owe.And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

We may file a Notice of Federal Tax Lien in the public record to notify your creditors of your tax debt.The federal tax lien arises automatically when the IRS sends the first notice demanding payment of the tax debt assessed against you and you fail to pay the amount in full.

For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.