What is Probate?

Probate refers to the legal process of administering a deceased person's estate. It includes validating wills and distributing assets. Explore Tennessee-specific templates to simplify this process.

Probate involves managing an estate after someone passes. With our attorney-drafted templates, completing necessary documents is quick and straightforward.

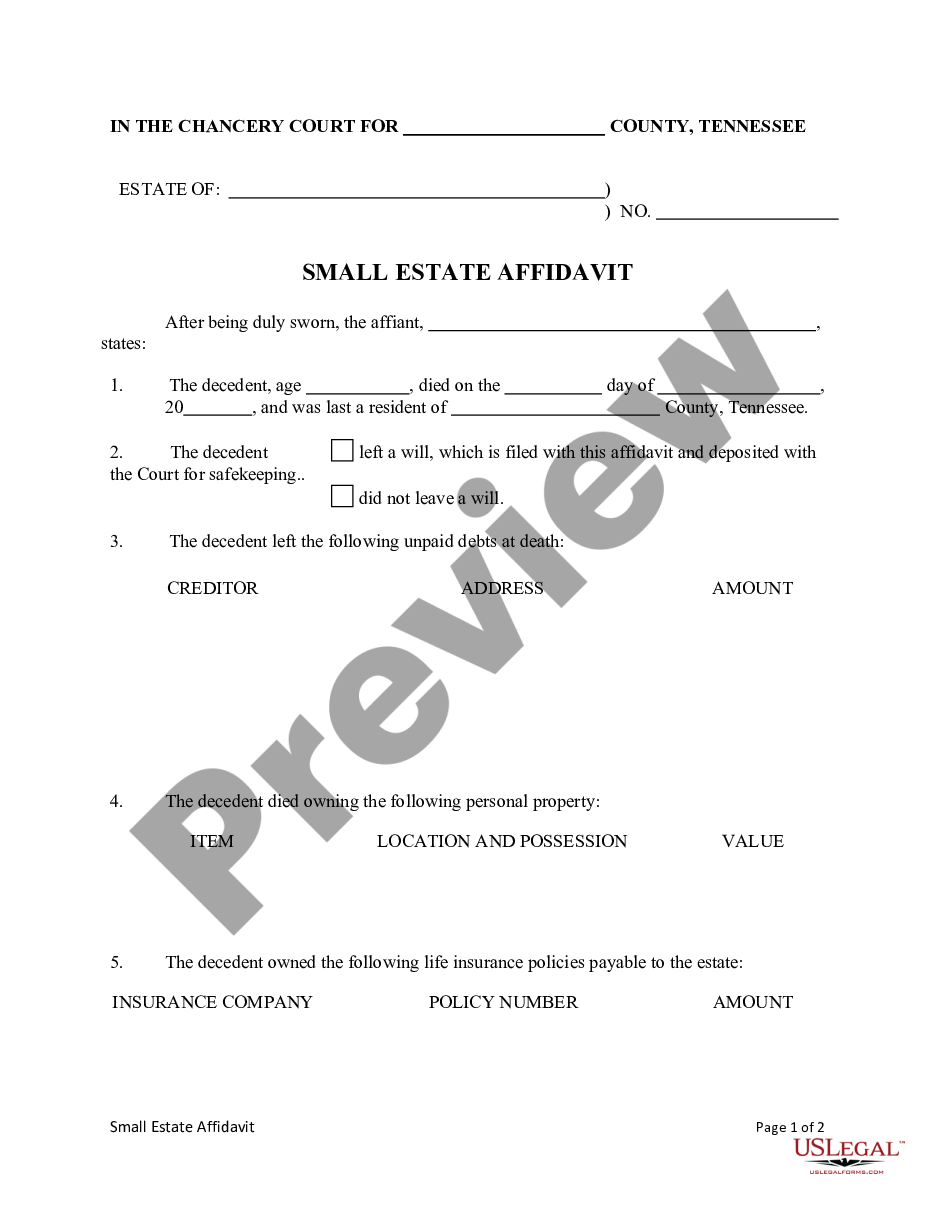

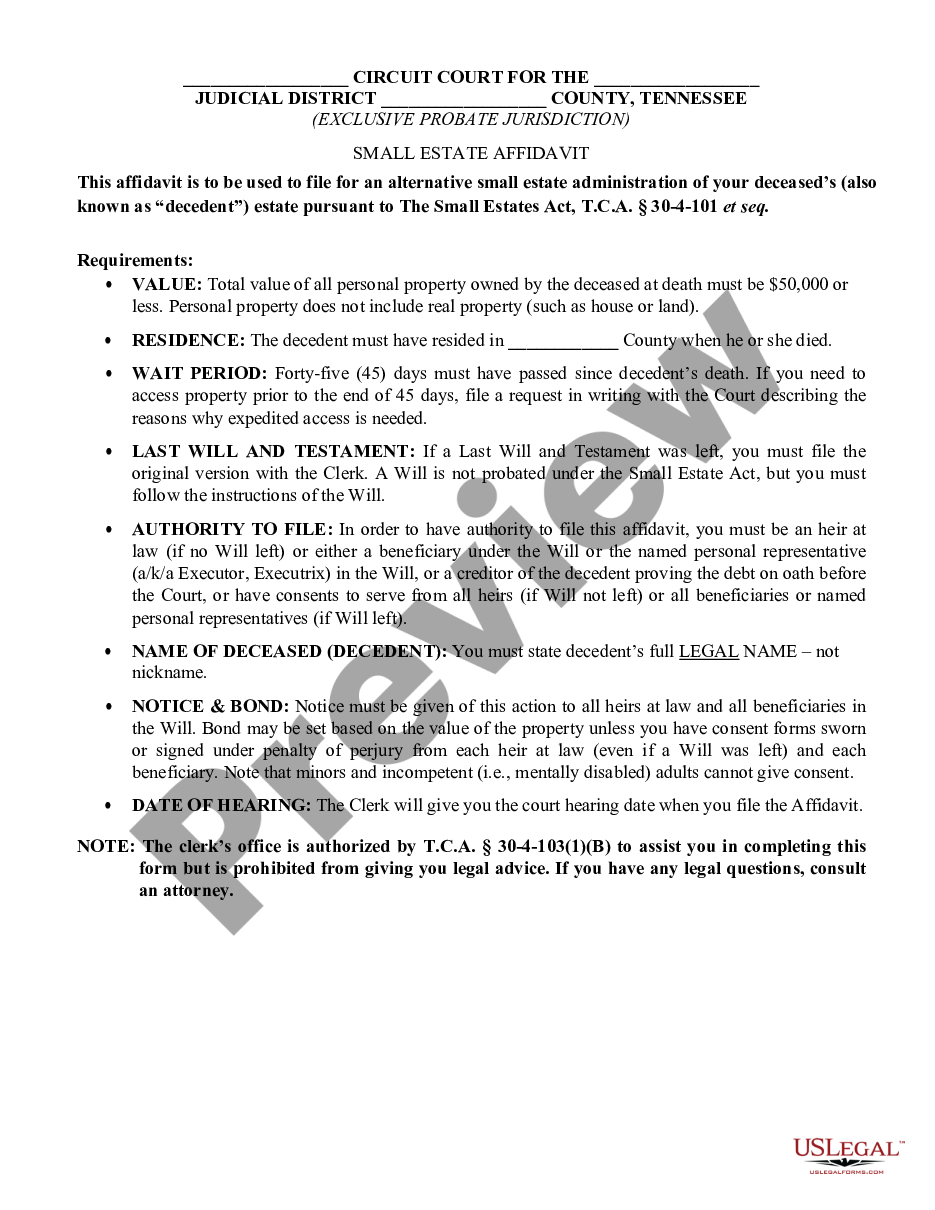

Use this affidavit to settle an estate valued under $50,000 without going through probate, simplifying the process for heirs.

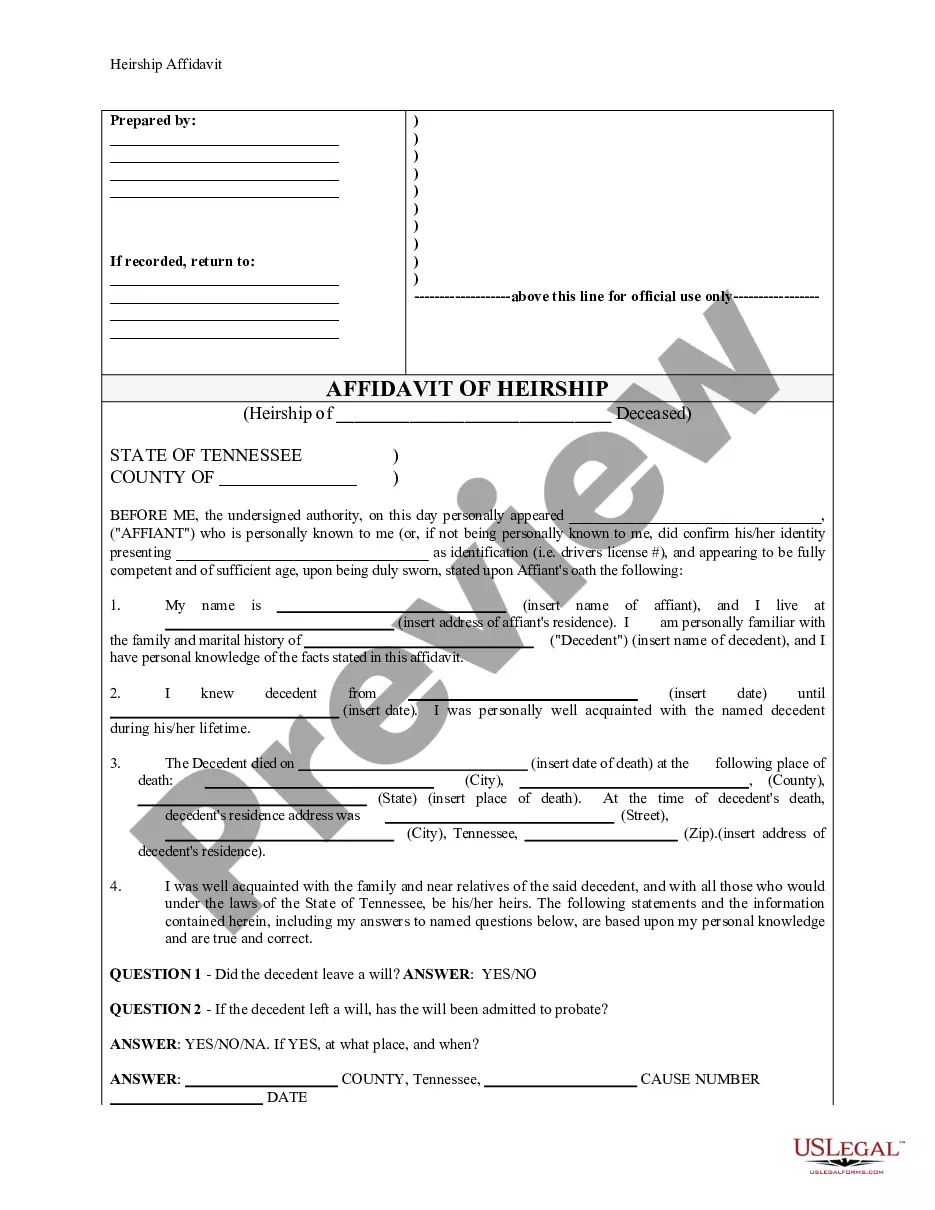

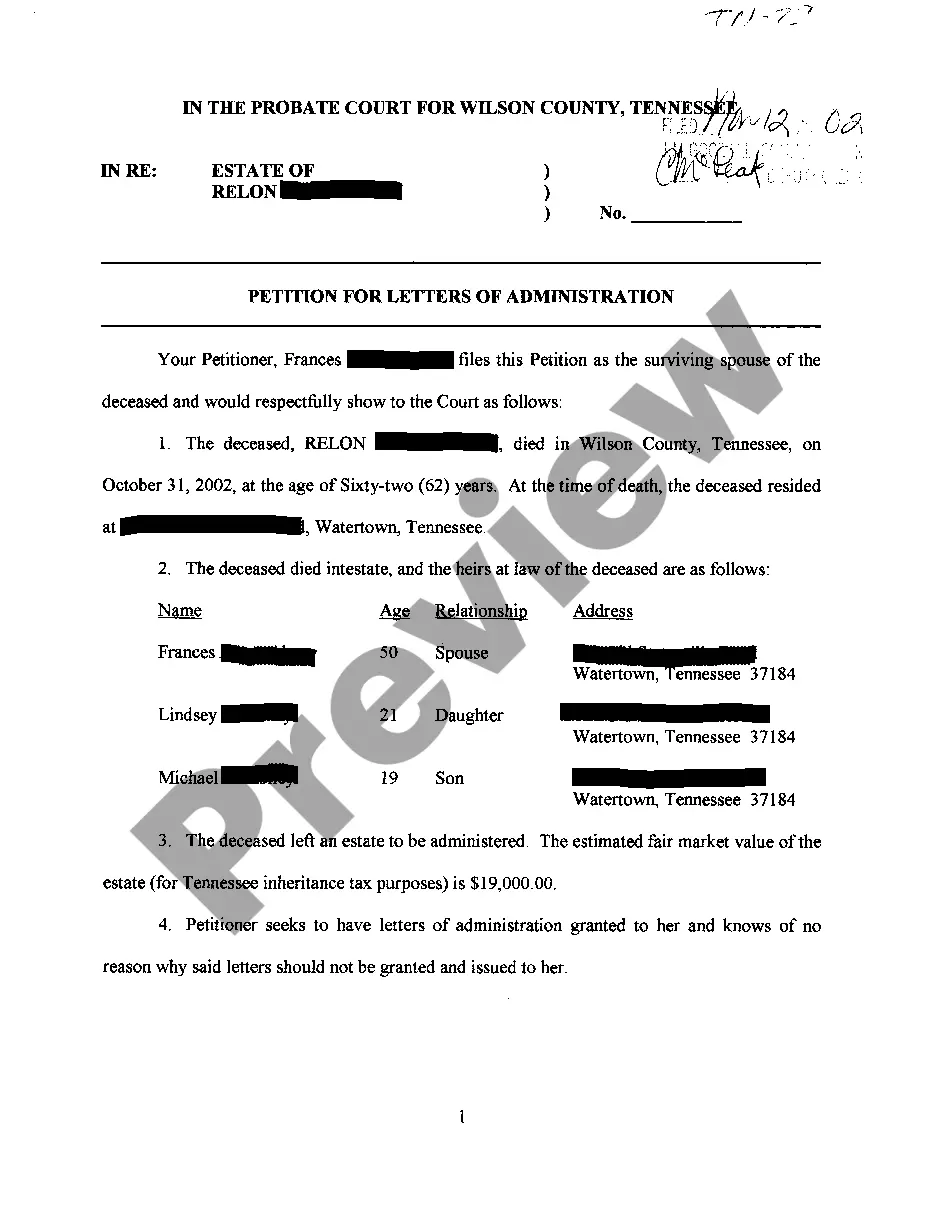

Establishes legal heirs of a deceased person, crucial for probate and estate proceedings.

Ensure compliance with surety requirements when securing bonds in corporate transactions and protect your interests.

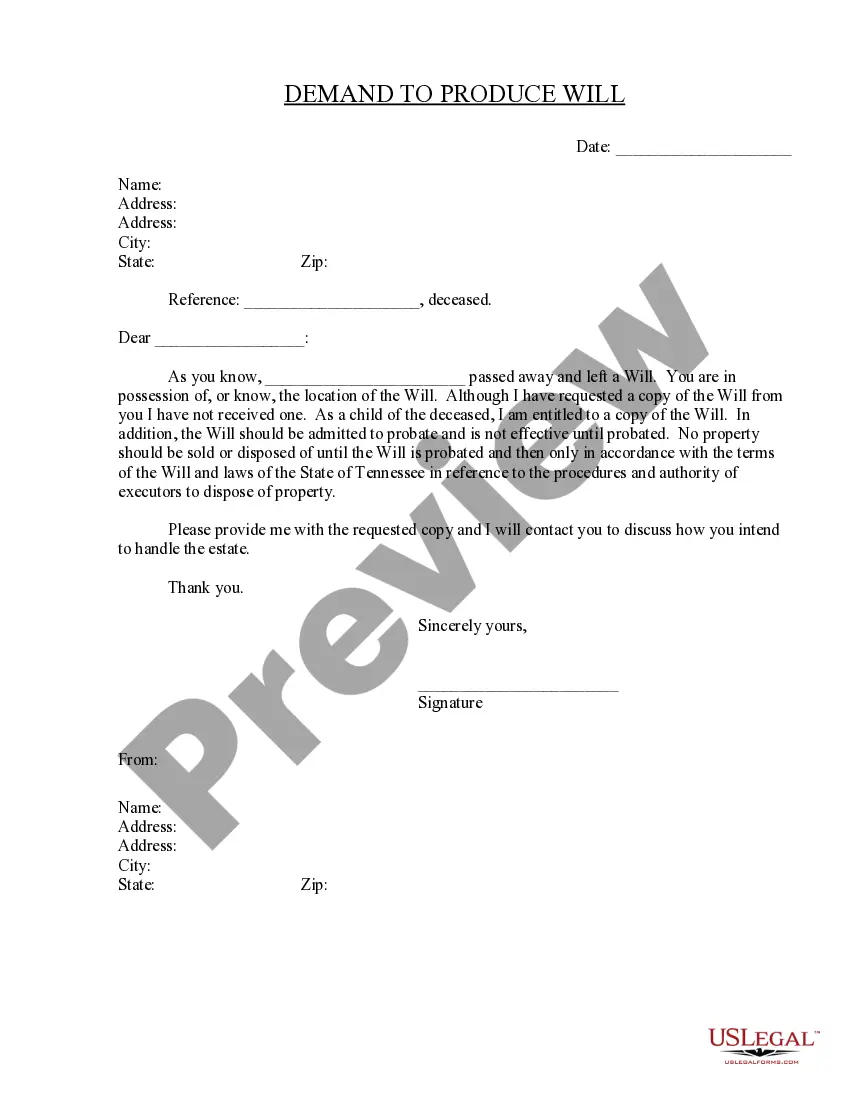

Request a copy of a deceased's Will from the executor or person who has it, ensuring your legal rights to the estate are protected.

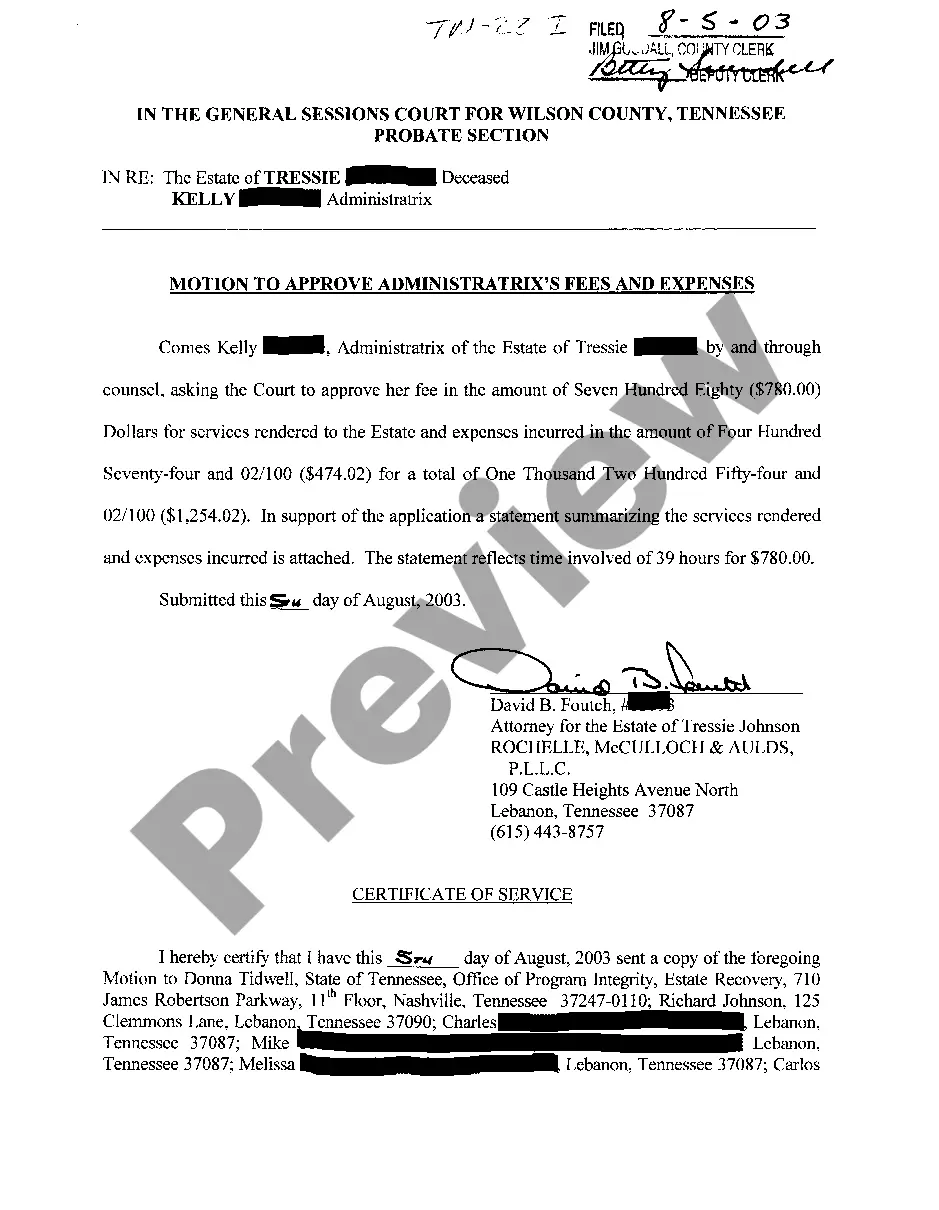

Prove that copies of important estate documents were delivered to distributees, ensuring legal notification.

Use this affidavit when settling a small estate, allowing heirs to bypass regular probate procedures.

Confirm receipt of an inheritance from an estate, essential for legal documentation.

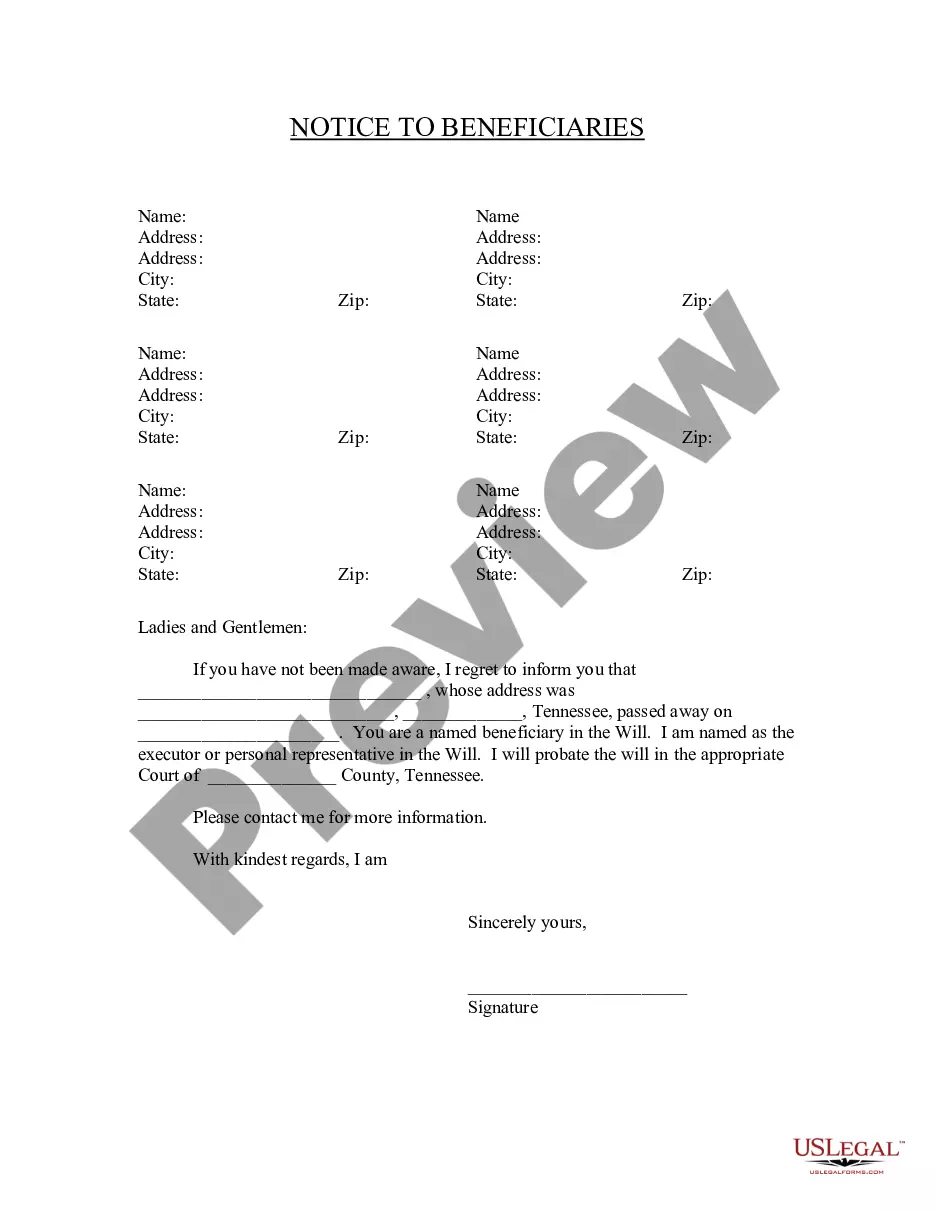

Notify beneficiaries about their status in a will, ensuring they are aware of their inheritance rights during estate administration.

Probate is generally required for estates with assets exceeding a certain value.

Wills must be validated in probate court for executor authority.

Assets can include real estate, bank accounts, and personal property.

Creditors may make claims against the estate during probate.

Heirs are typically notified of the probate proceedings.

Begin your probate process with these simple steps.

Not necessarily. A will covers asset distribution, while a trust can offer additional management and privacy.

If no action is taken, the estate may go through intestacy laws, distributing assets according to state rules.

Review your plan regularly or after major life events like marriage or the birth of a child.

Beneficiary designations typically override wills, directing assets directly to named individuals.

Yes, you can designate separate individuals for financial and healthcare decisions in your plan.