What is Probate?

Probate is the legal process of settling an estate after someone passes away. It includes validating wills and distributing assets. Explore state-specific templates to help guide you through this process.

Probate involves managing a deceased person's estate. Attorney-drafted templates are quick and easy to complete.

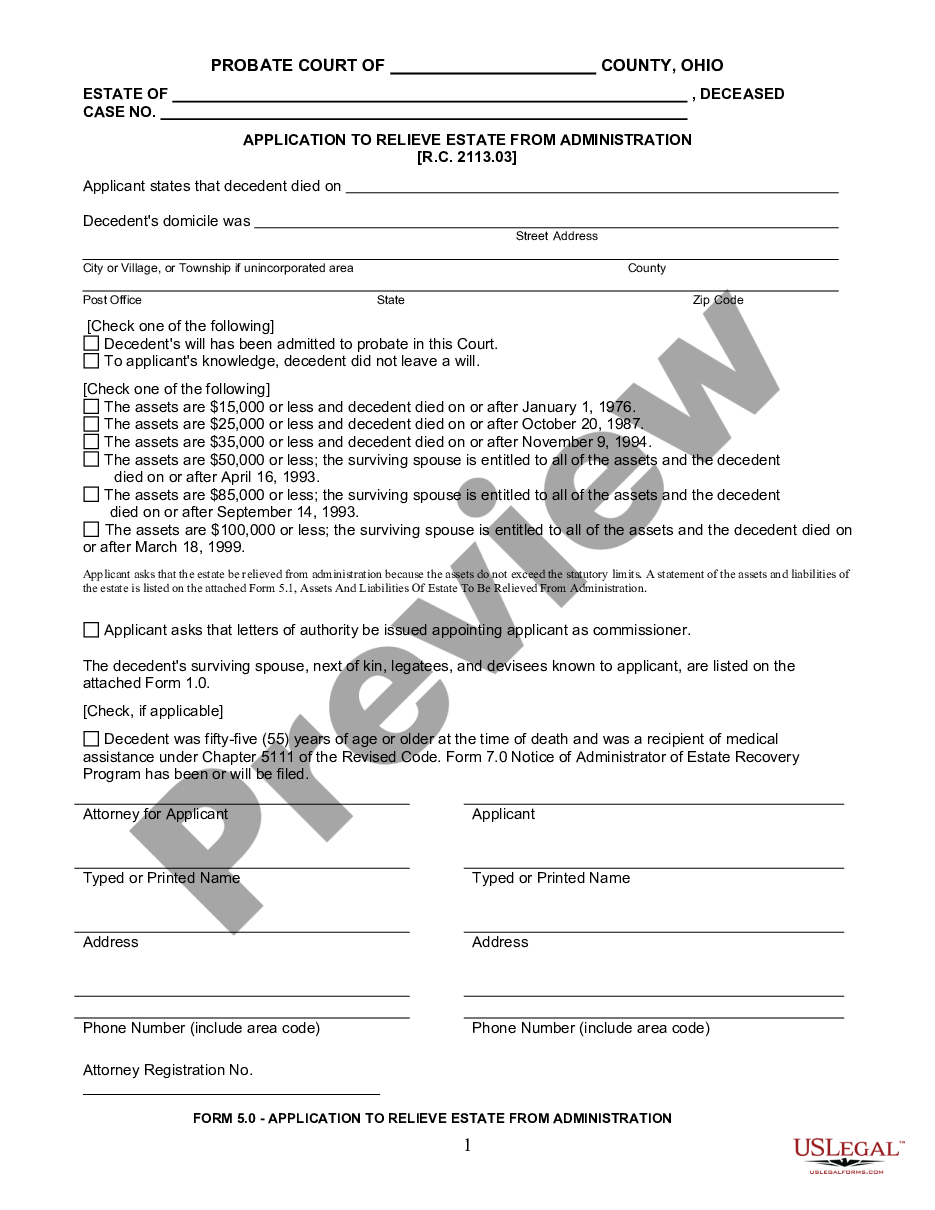

Utilize this to administer a small estate without full probate, simplifying the process for surviving spouses with limited assets.

Confirming heirs of a deceased individual can smooth estate transitions, especially in the absence of a will.

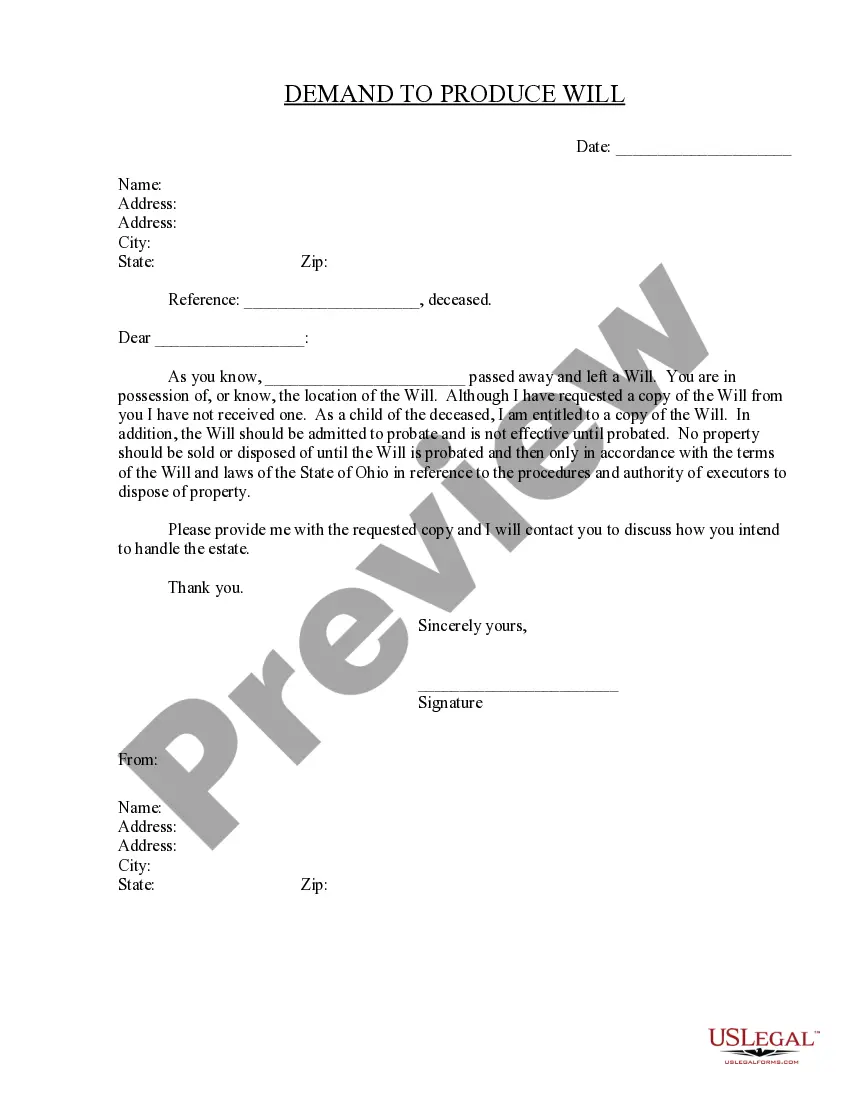

Request a copy of a deceased person's will to ensure proper estate management and probate procedures.

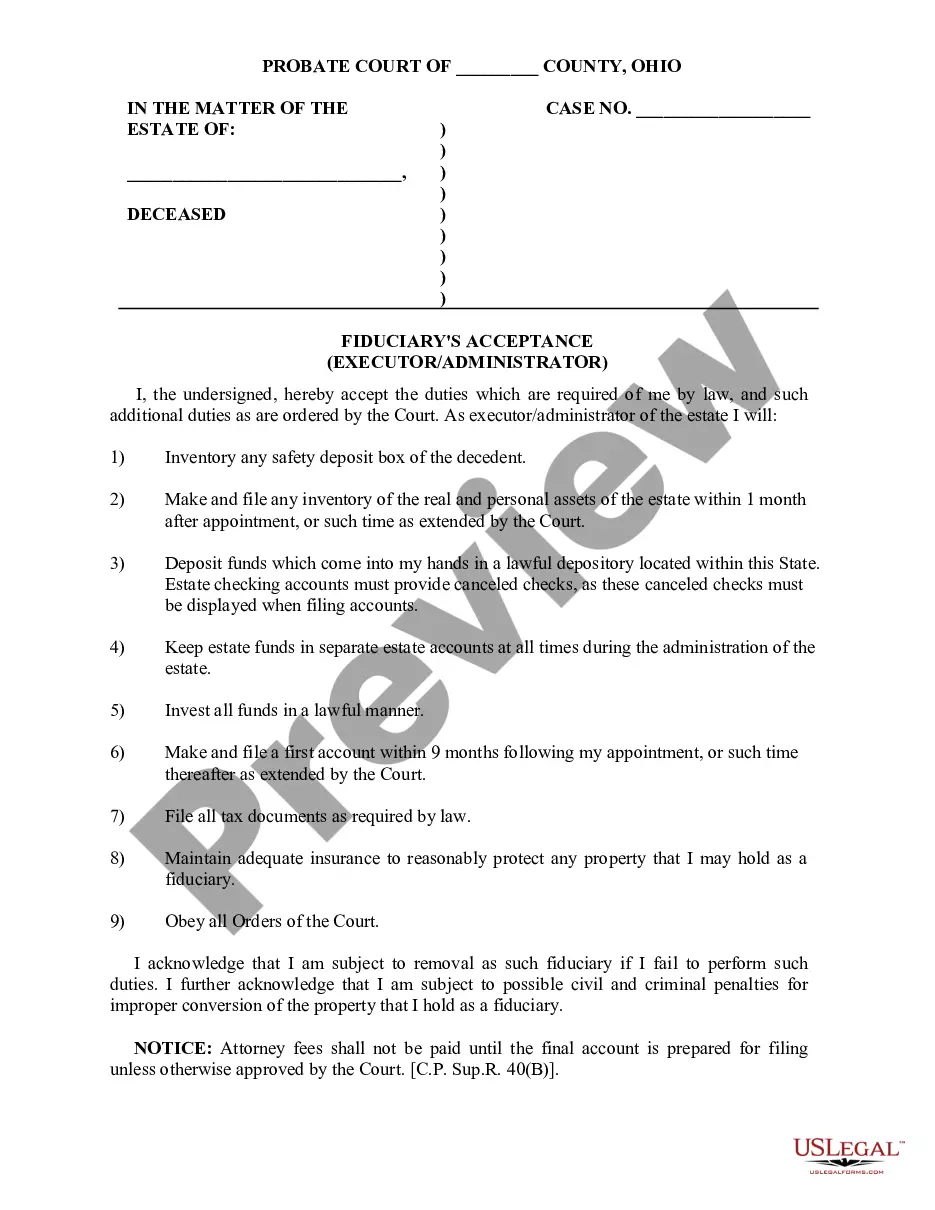

Accept your legal responsibilities as executor or administrator of an estate with this essential document.

Order a home study to determine your suitability for adopting a minor child. Essential for adoption cases.

Streamline the handling of small estates valued up to $35,000, making it easier for heirs to transfer assets without formal probate.

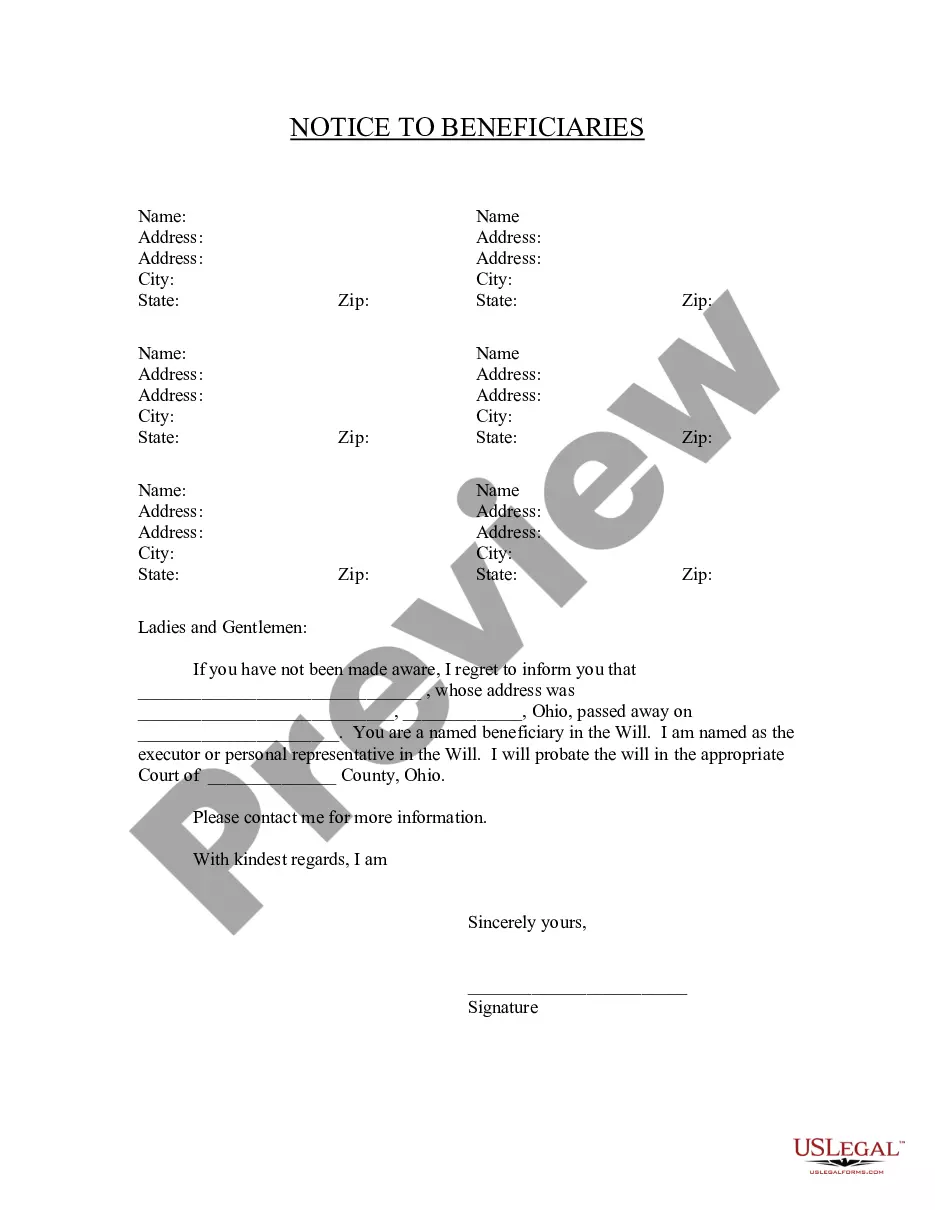

Notify beneficiaries that they're included in a will and provide essential information about the deceased and probate process.

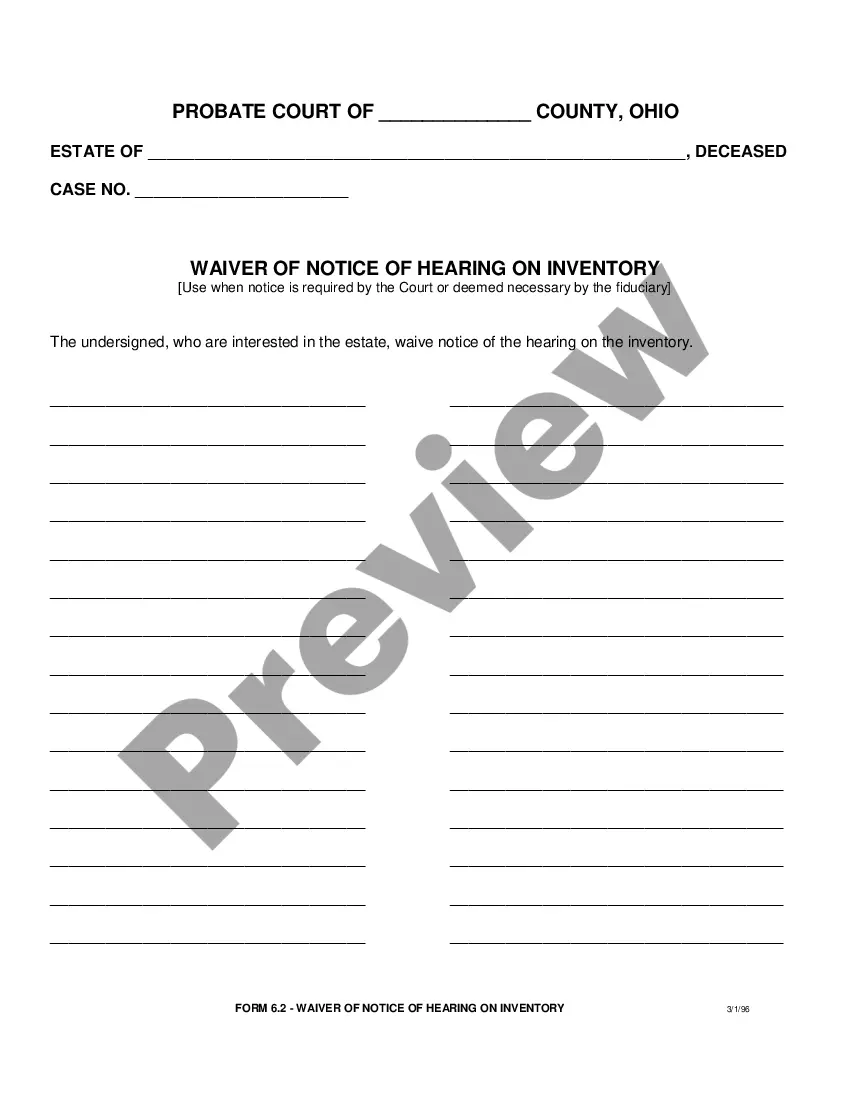

Waive your right to receive notice of an inventory hearing, allowing the process to move forward without delay.

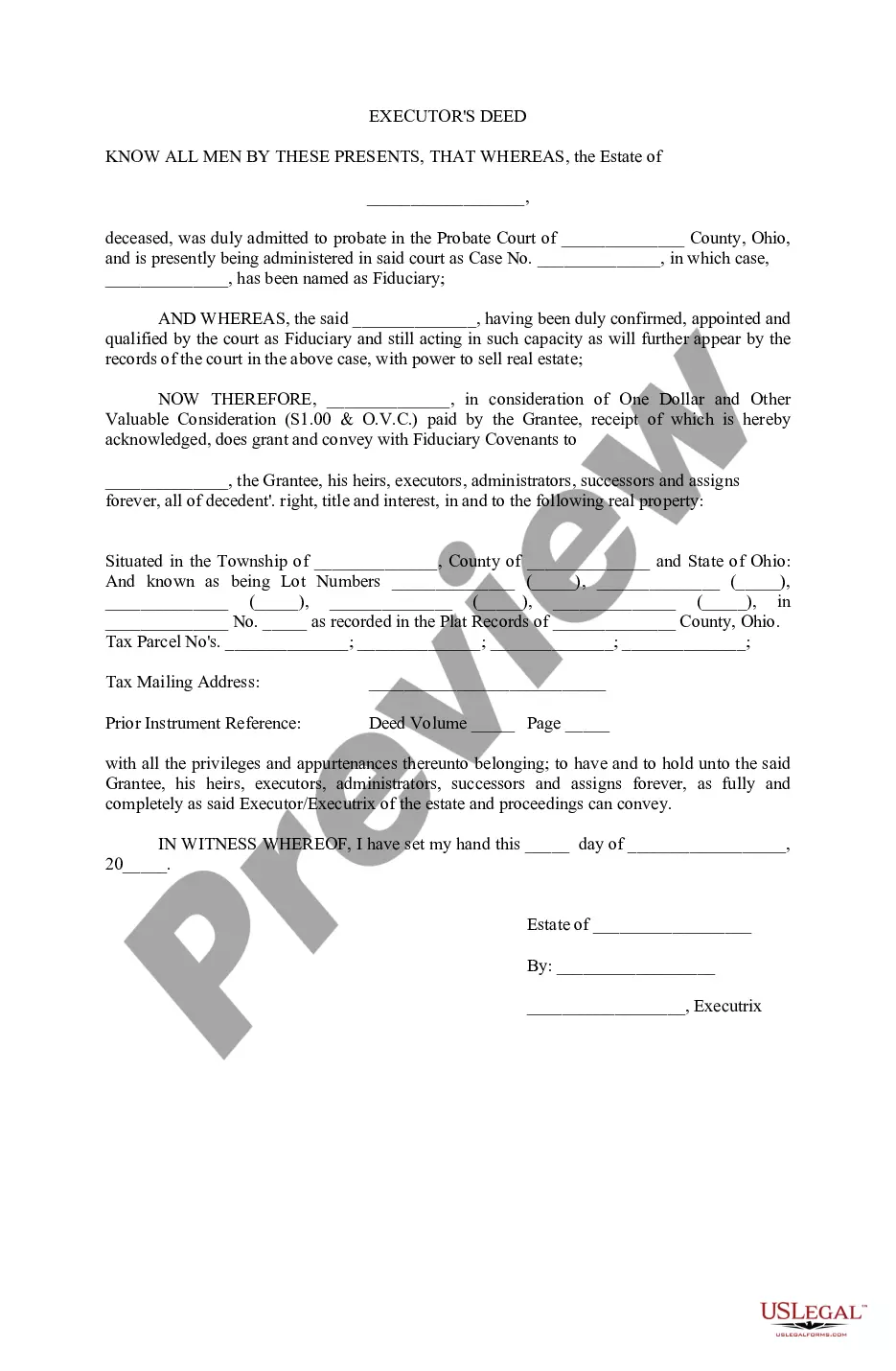

Utilized by estate executors to transfer property ownership under court authority, ensuring legal compliance and clarity in transactions.

Use this petition to legally adopt an adult, especially in cases involving disabilities or established caregiver relationships.

Probate is necessary to validate a will in court.

Not all assets go through probate, such as joint accounts.

The probate process can vary by state.

Beneficiaries may need to wait for the probate to finalize distributions.

Probate can involve paying debts and taxes before distributing assets.

Begin quickly with these steps.

A trust can help manage assets during life and avoid probate, but it's not necessary with a will.

If no action is taken, the estate may go through probate, often leading to delays and potential disputes.

It's advisable to review your estate plan every few years or after significant life changes.

Beneficiary designations can override wills, so it's important to keep them updated.

Yes, you can appoint separate individuals for financial and healthcare decisions through legal documents.