What is Probate?

Probate documents help settle an estate after someone passes away. They are essential for transferring assets and addressing debts. Explore state-specific templates for New York.

Probate involves managing a deceased person’s estate. Our attorney-drafted templates are quick and easy to complete.

Ideal for settling small estates under $50,000 without complex probate. Enables heirs to claim assets swiftly and efficiently.

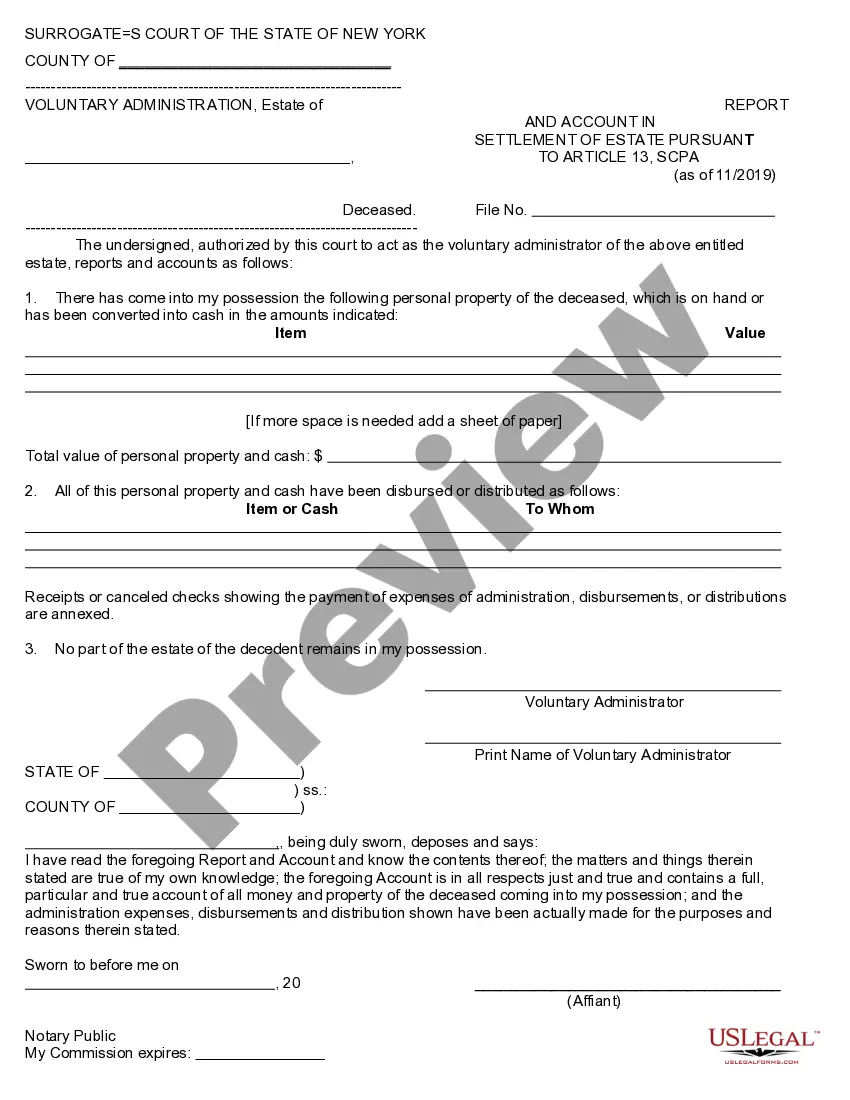

Submit a comprehensive report to conclude a small estate, detailing assets and distributions to beneficiaries.

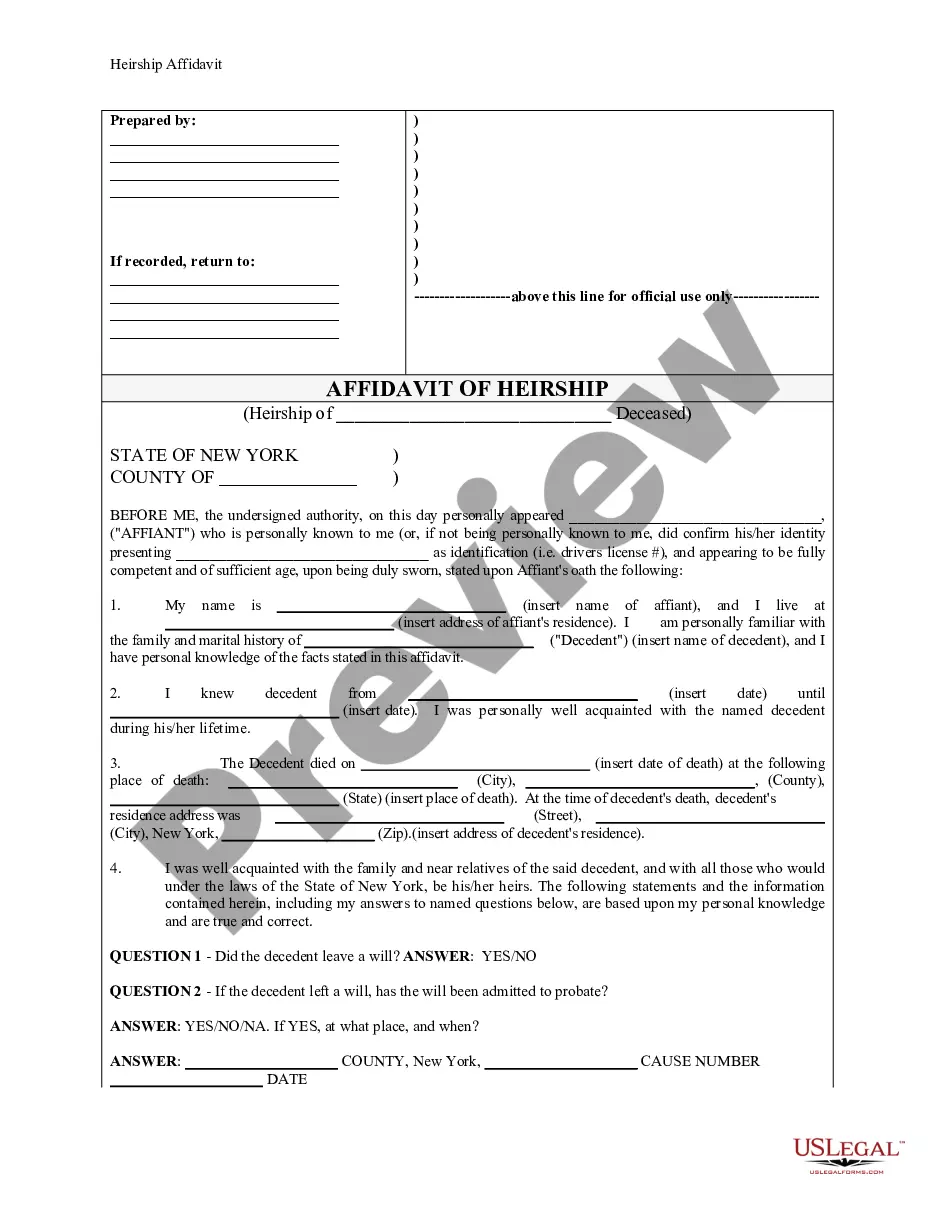

Establishes legal heirship for a deceased person, crucial for settling estates without a formal will.

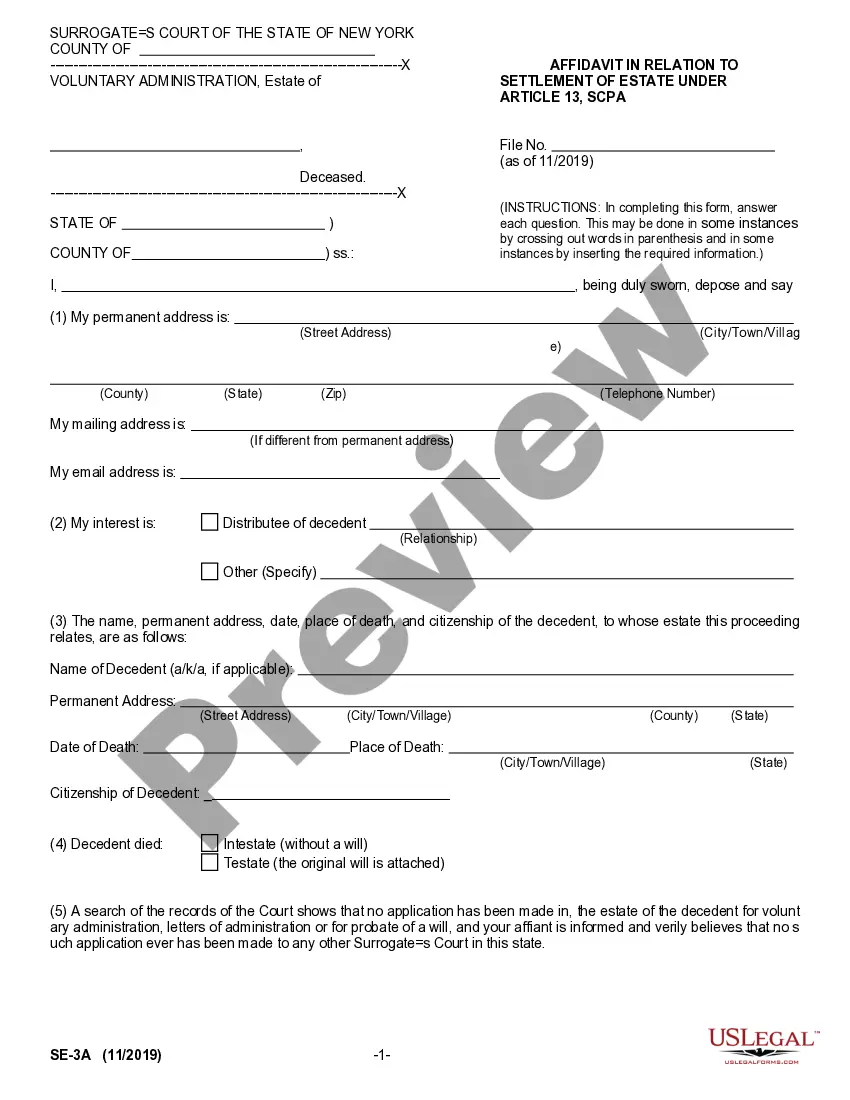

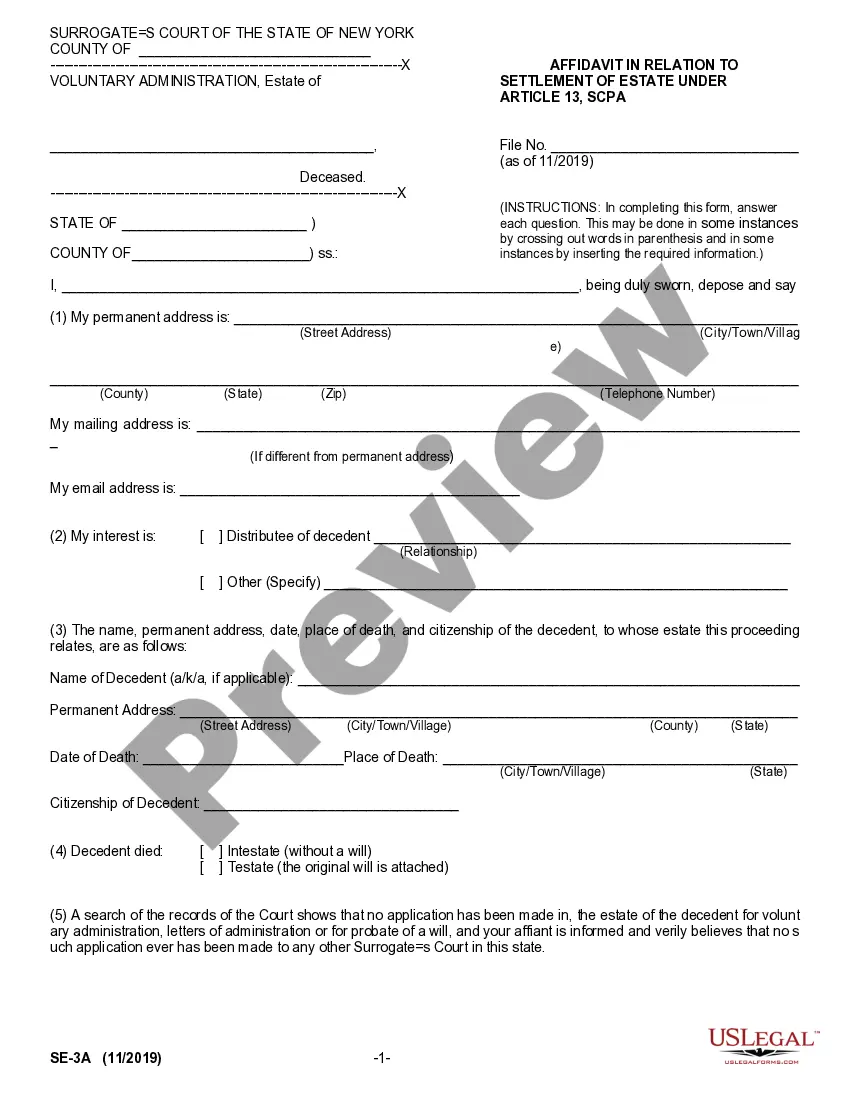

Use this affidavit to settle an estate when there’s no will or when no application for administration has been made.

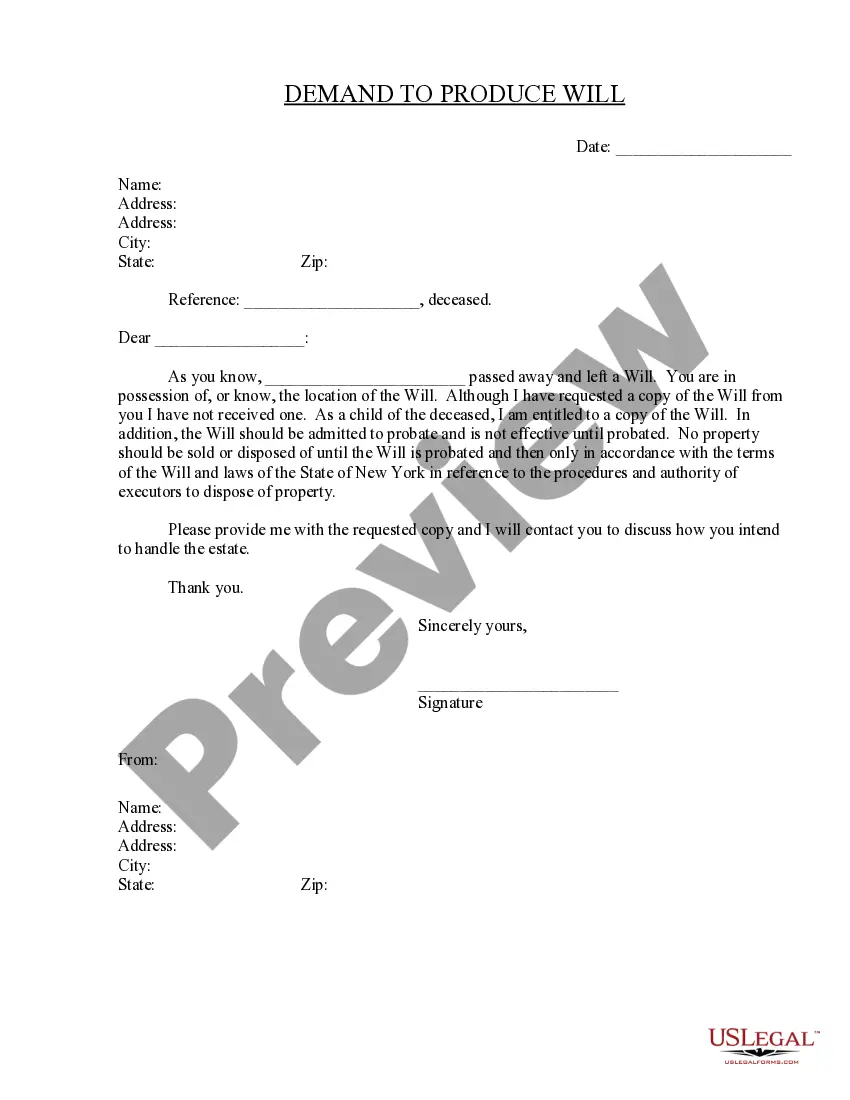

Request a copy of a deceased person's Will to ensure proper estate handling and your legal rights as an heir.

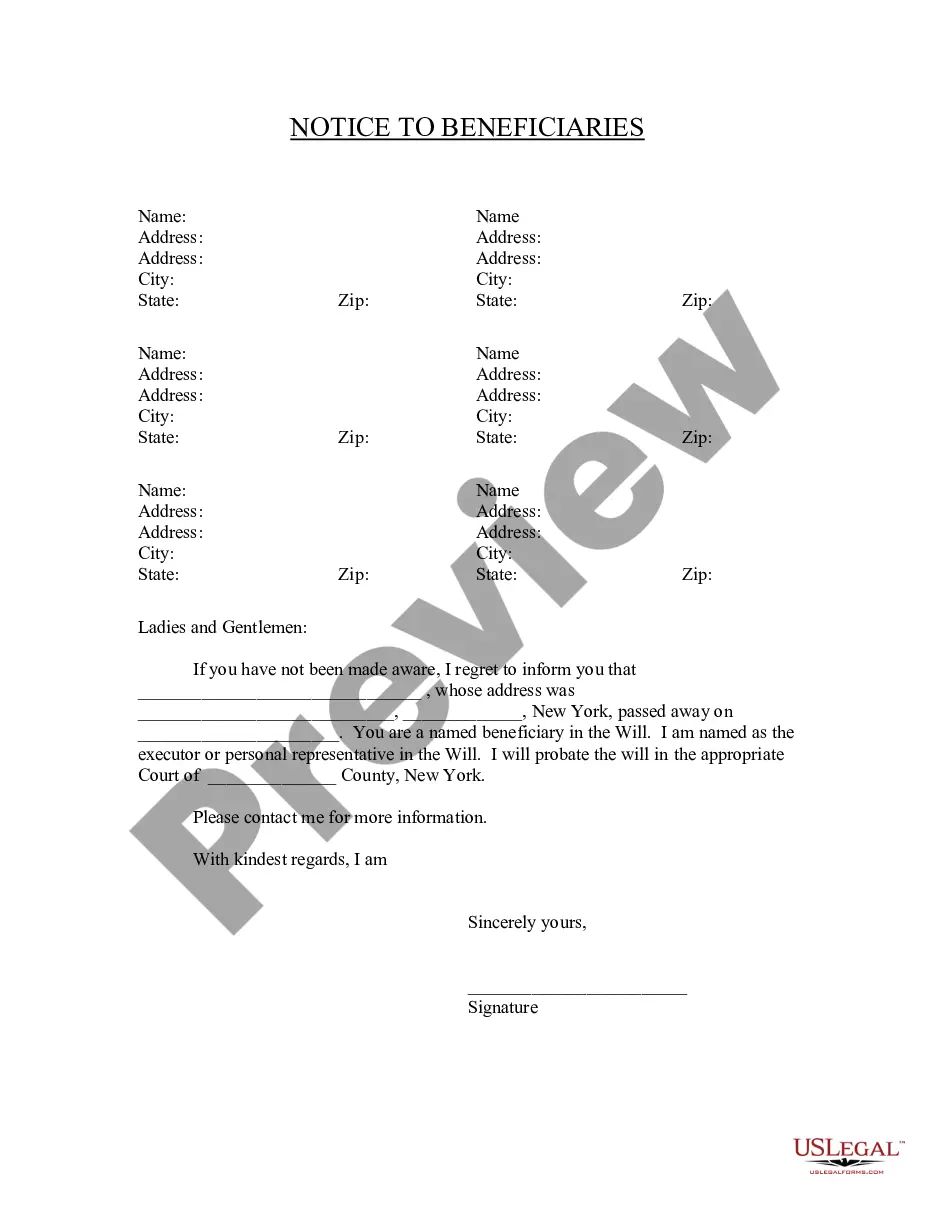

Notify beneficiaries of their status in a will, ensuring they are informed about the probate process and their rights.

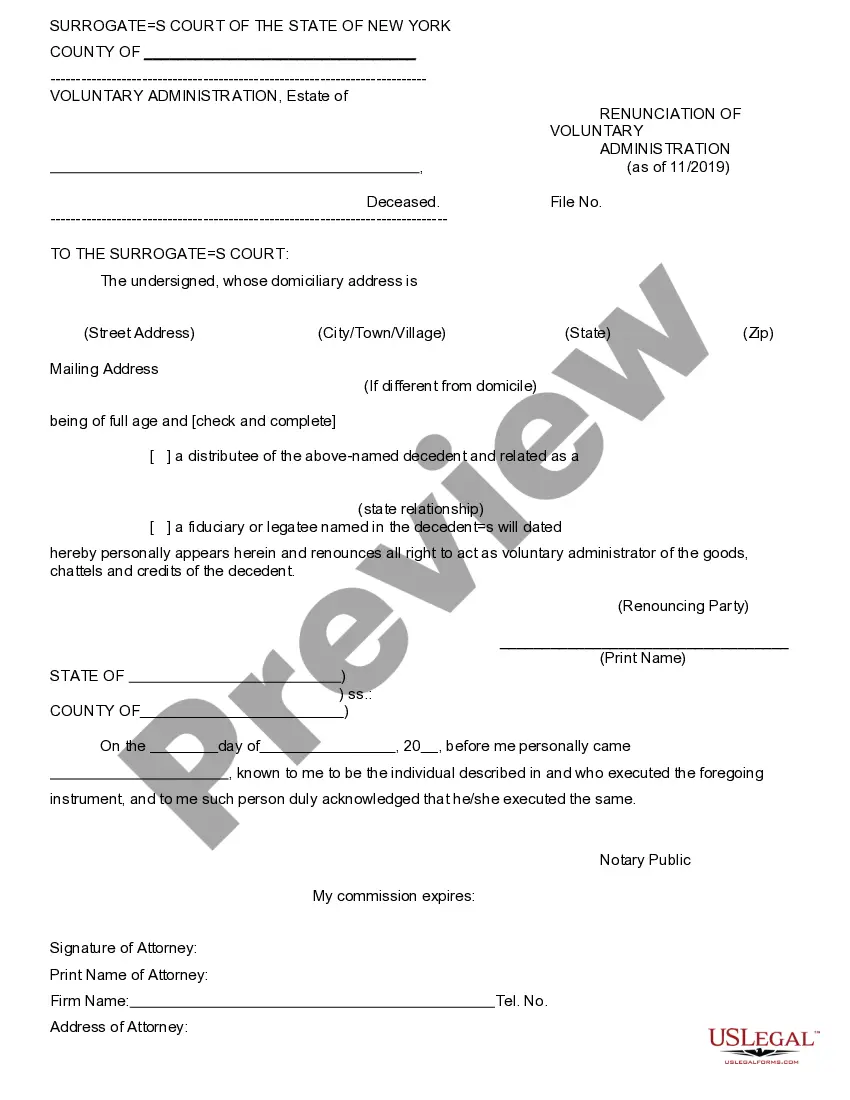

Use this document to formally renounce your participation in voluntary administration, safeguarding your rights in the process.

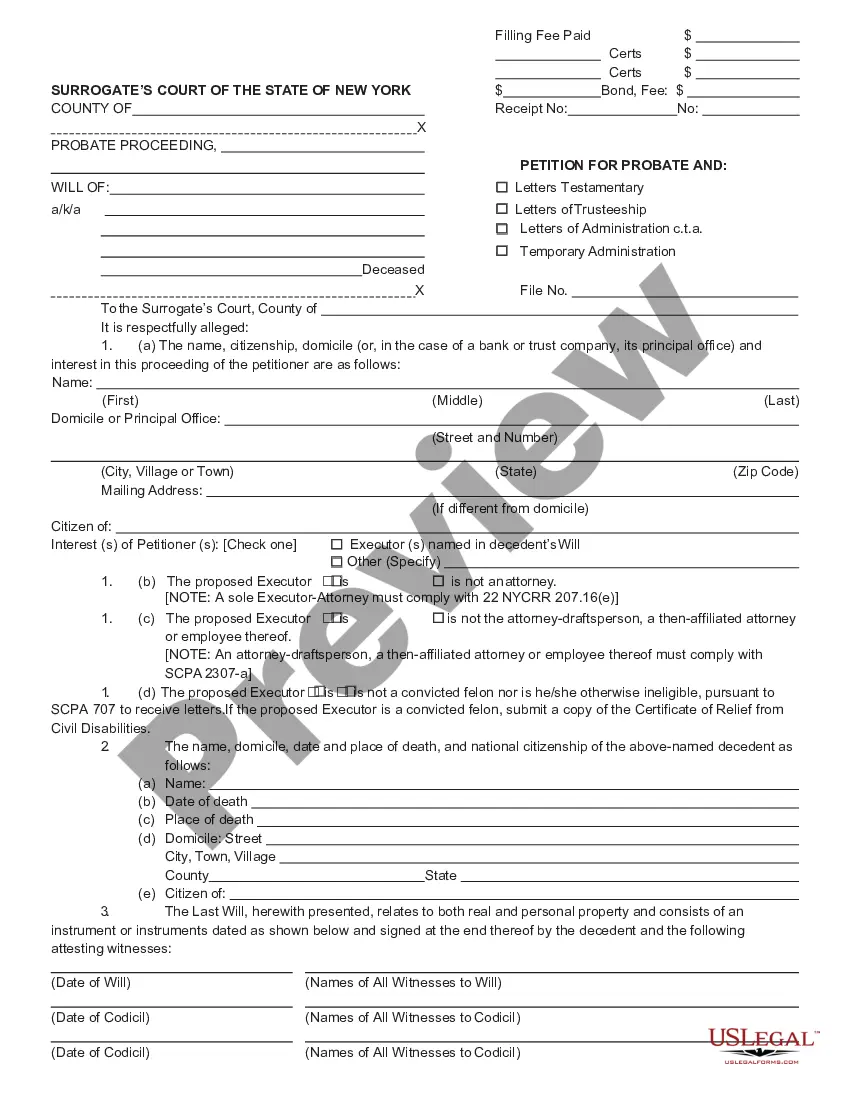

Initiate the probate process for a deceased person's estate and validate their will in court.

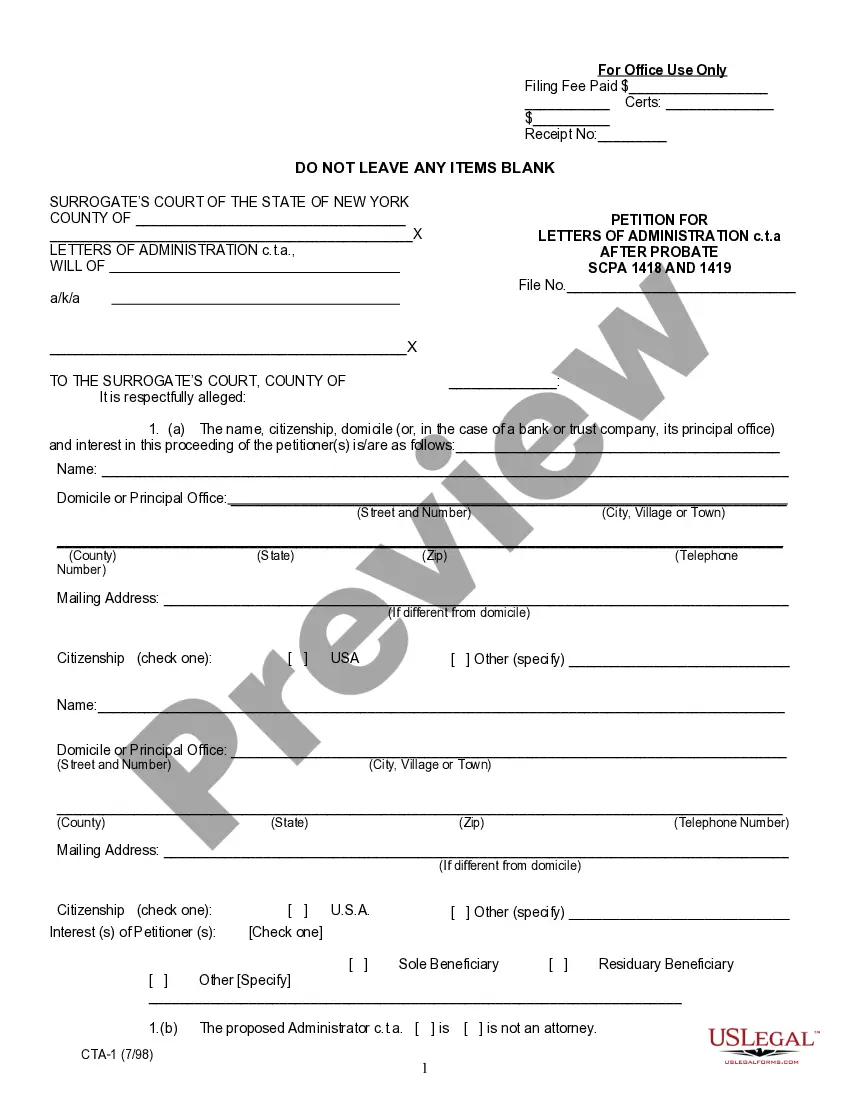

Use this form to request letters of administration for a probate estate after the initial probate process ends.

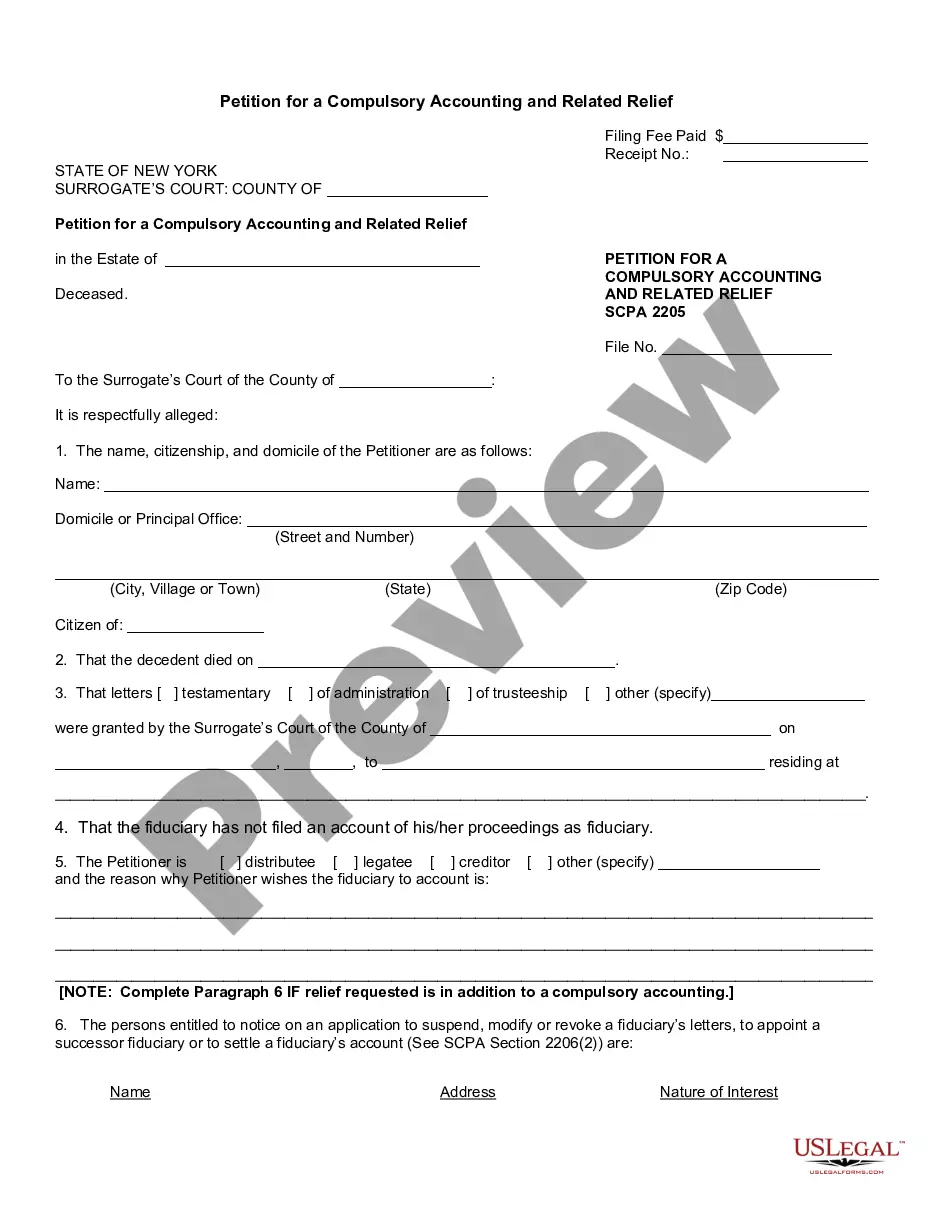

Request a court-ordered accounting from a fiduciary managing an estate when no account has been filed.

Probate is necessary to legally transfer assets after death.

Every estate must settle debts before distributing assets.

Some assets may bypass probate through joint ownership or beneficiary designations.

Probate processes can vary significantly from state to state.

An executor or administrator manages the estate's affairs.

Begin your probate journey with these easy steps.

A trust can offer additional benefits, such as avoiding probate, but is not mandatory.

If you take no action, your estate may go through probate, and assets may be distributed according to state law.

It's wise to review your estate plan every few years or after major life changes.

Beneficiary designations typically override wills, so ensure they align with your overall plan.

Yes, you can designate separate individuals for financial and health care decisions in your planning.