What is Probate?

Probate is the legal process of settling a deceased person's estate. It involves validating wills, paying debts, and distributing assets. Explore state-specific templates for your needs.

Probate involves managing a deceased person's assets. Attorney-drafted templates make the process quick and straightforward.

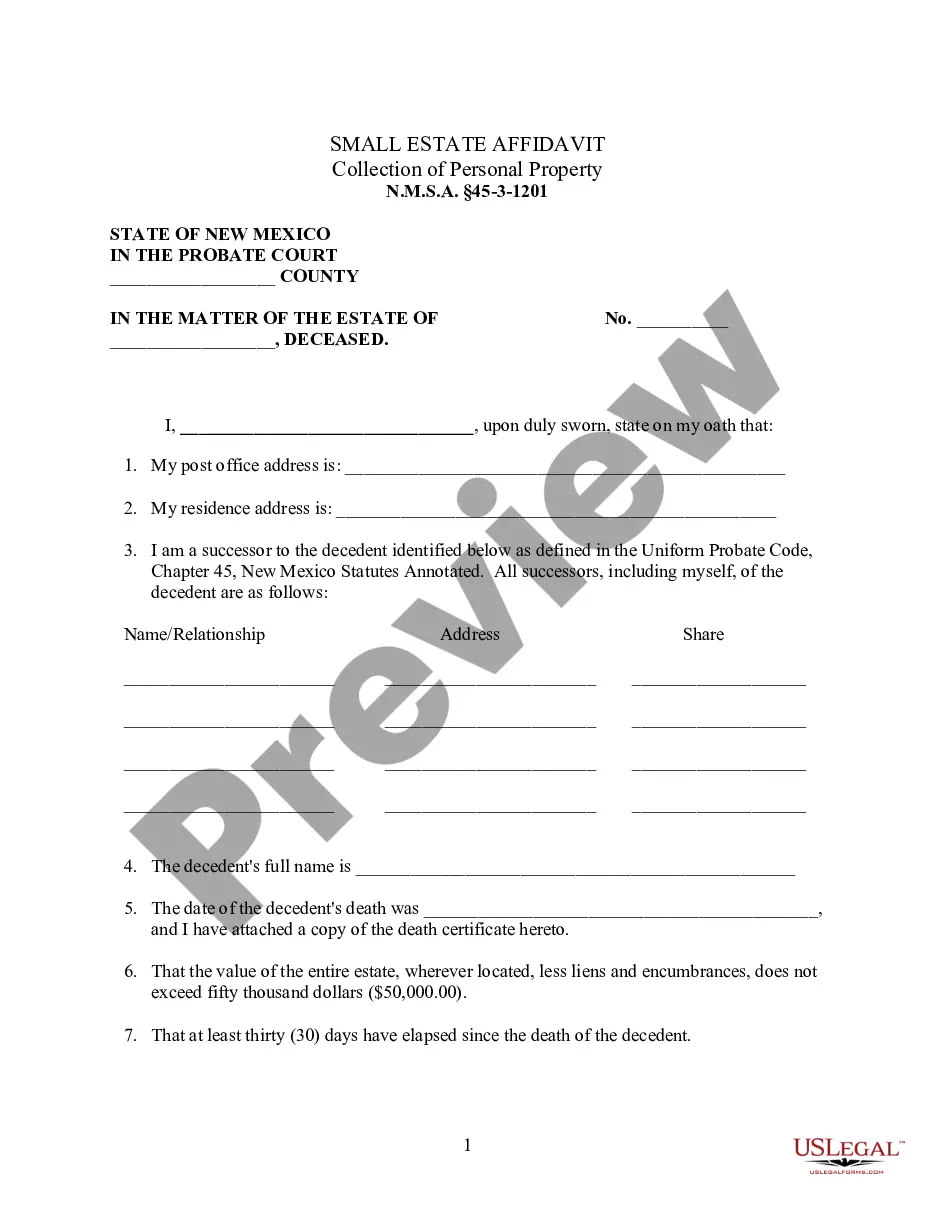

Collect personal property from an estate valued under fifty thousand dollars, without going through lengthy probate processes.

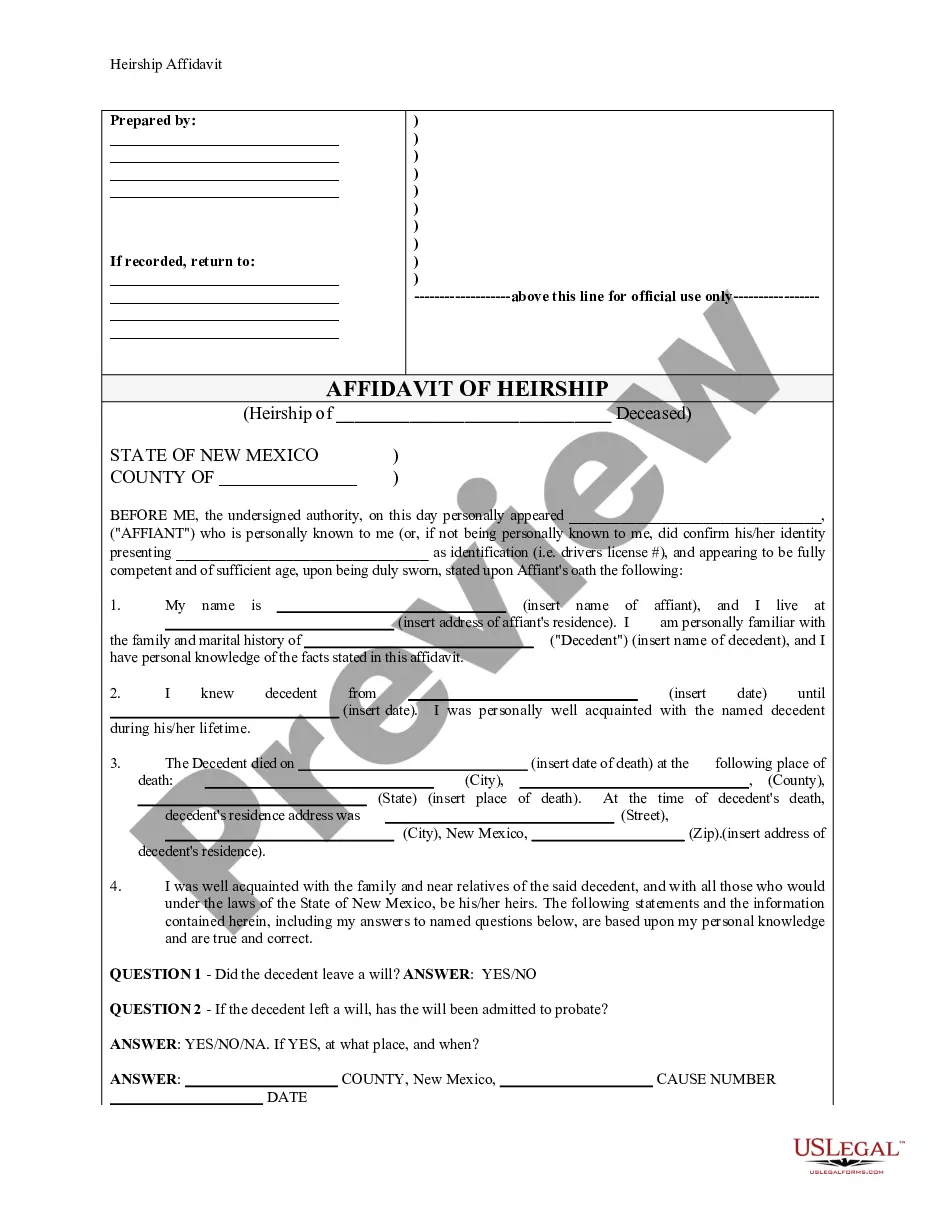

Use this affidavit to establish the legal heirs of a deceased person, crucial for estate distribution without a will.

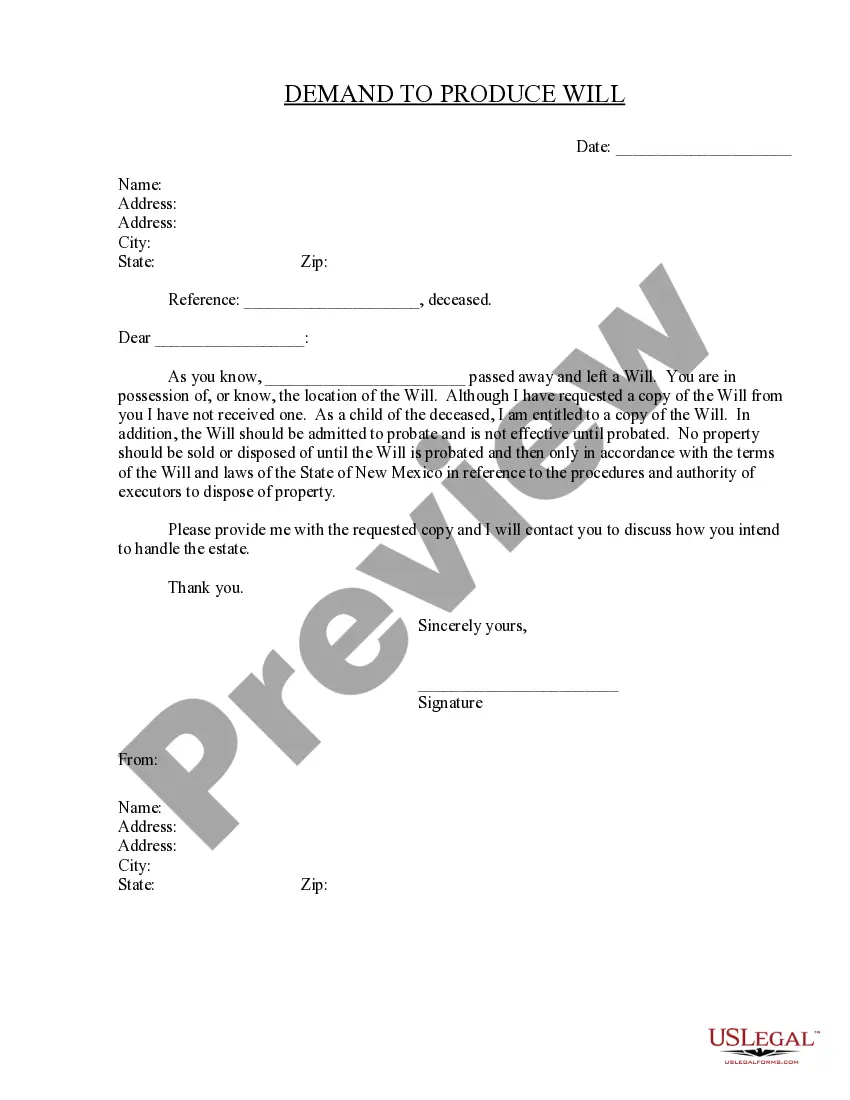

Request a copy of a deceased person's will to understand estate distribution rights and responsibilities.

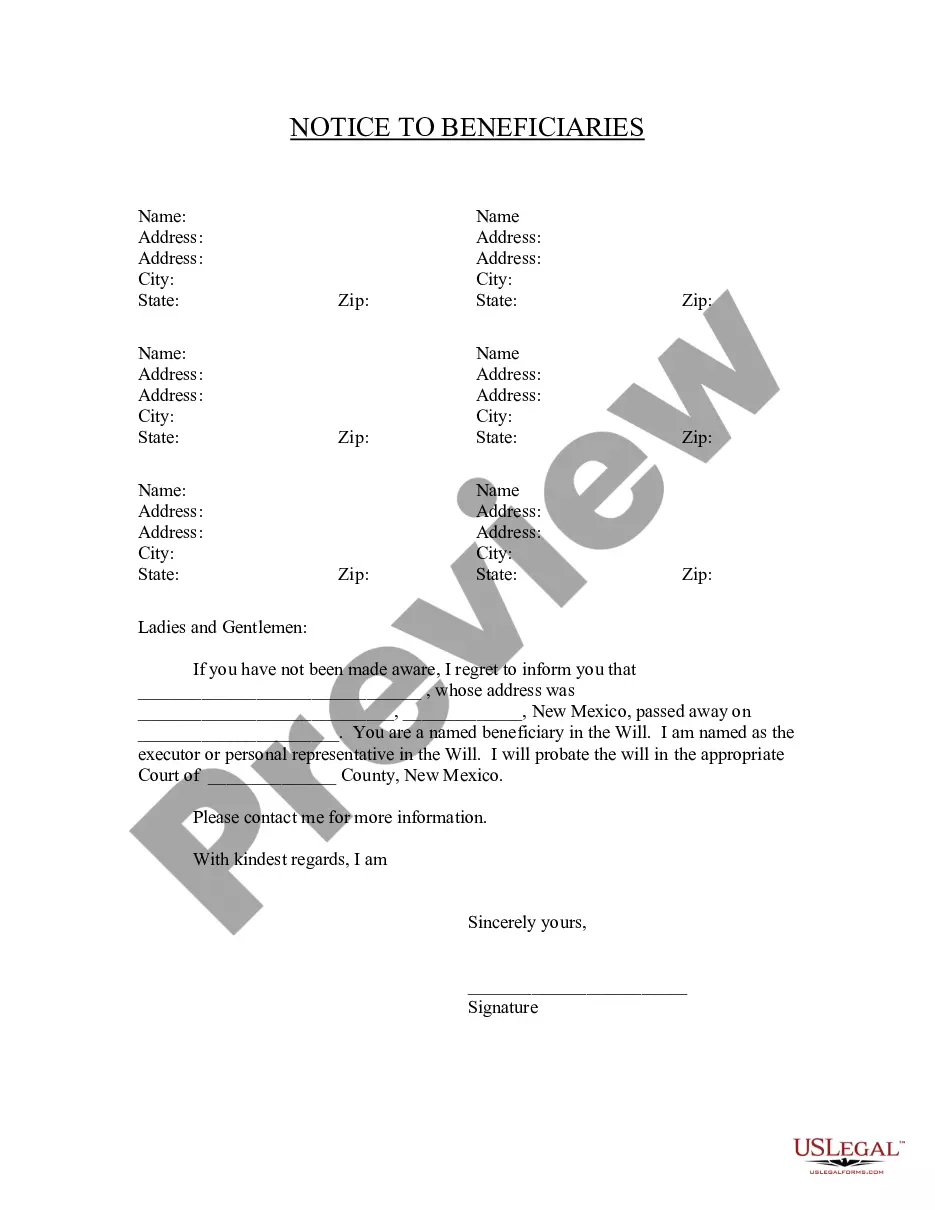

Notify beneficiaries that they are named in a will and provide essential details about the deceased and probate process.

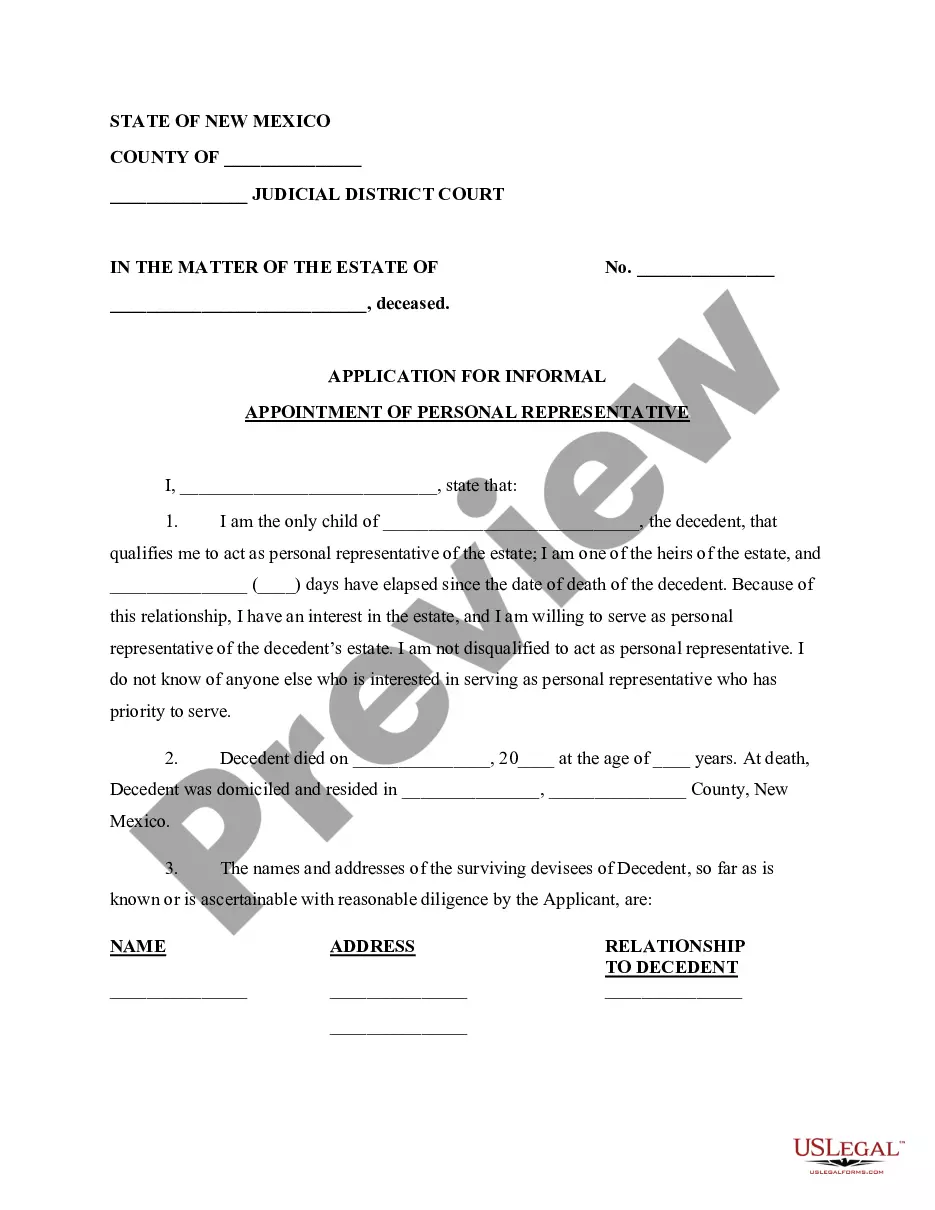

Use this application to request informal appointment as a personal representative for an estate without a will, streamlining the probate process.

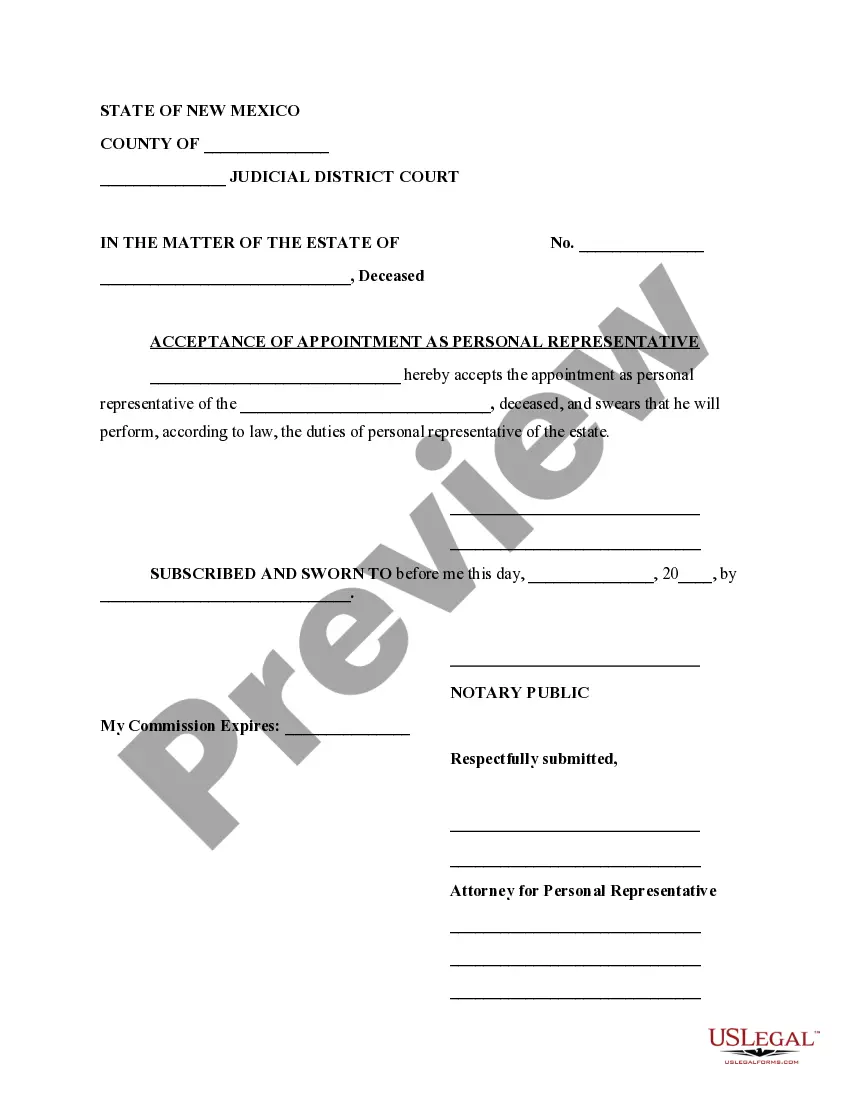

Confirm your role as a personal representative for an estate to fulfill legal obligations and responsibilities.

Disclaim any rights to inherit property from an estate or trust, allowing for clear distribution according to your wishes.

Clarify estate divisions among heirs to avoid disputes over inheritance.

Challenge a will's validity by citing mental incompetence or undue influence.

Clarify joint ownership of property, addressing common misconceptions and explaining rights and responsibilities in shared ownership scenarios.

Probate is not always required, depending on asset types.

Wills must be original to be valid in most cases.

Not all assets go through probate, like joint accounts.

Probate can take several months to years to complete.

Heirs may need to be notified of probate proceedings.

Debts of the deceased must be settled before distribution.

Probate laws can vary significantly by state.

Begin your probate process with these simple steps.

A trust can help manage assets during your lifetime and avoid probate.

If no plan is in place, state laws will determine asset distribution.

Review your estate plan every few years or after major life changes.

Beneficiary designations can override a will, directing assets outside probate.

Yes, you can designate separate agents for financial and healthcare matters.